A tale of two soft drinks

Two new soft drinks were released on the market. Only one survived. This sounds dramatic, but it’s unfortunately not uncommon.

In its first year on shelves, Soft Drink A sold $30MM and had above-average distribution. Soft Drink B sold only $10MM with lower distribution. Soft Drink A was designed for mass appeal, and Soft Drink B catered to a narrow, premium audience. Both had below-average velocities. Which one succeeded?

If you guessed Soft Drink B, you’d be correct. But why?

Understanding the reason Soft Drink B survived Year 1 requires understanding velocities.

Product velocity and brand success

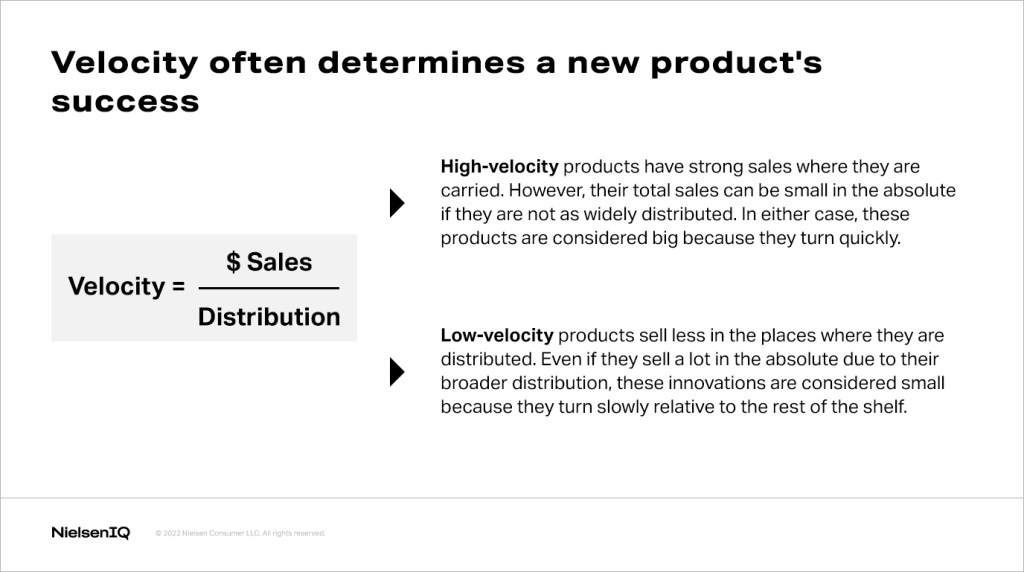

Typically, a new product’s ability to succeed is determined by its velocity. Velocities are a reliable indicator for success because they are an objective, quantifiable metric to assess demand—and retailers are focused on growth.

High-velocity products have strong sales where they are carried. However, total sales can be small in the absolute if the products are not as widely distributed. In either case, these products are considered “big” because they turn quickly.

Low-velocity products, on the other hand, sell less in the places where they are carried. These products may sell a lot in the absolute due to their broader distribution. Still, these innovations are considered small because they turn slowly relative to the rest of the shelf.

Delisting slower-moving SKUs for faster-moving products is one way that retailers focus on growth. In fact, according to NielsenIQ retail measurement and BASES research, a product is 3x more likely to succeed if its velocity is in the top 40% of the category. Yet, some slow-turning SKUs—like Soft Drink B in our opening example—are still able to sustain. This type of scenario frequently elicits questions from clients who partner with us on building successful product innovations. Why would retailers keep these products around?

Online market testing for emerging & growth brands

Studio by BASES gives you access to easy, expertly designed, quick-turn market research surveys to make informed decisions based on consumer feedback.

There are more paths to growth than absolute size

Big or small, most launches start with a goal of producing incremental sales for retailers. This provides a path for new revenue without cannibalizing growth. Crucially, big innovations are not always the most incremental. NielsenIQ BASES uncovered that two-thirds of the time, the slowest moving SKUs within a line are more incremental than some faster moving SKUs. That’s why retailers might choose to keep some small innovations on shelves.

That said, without the support of strong velocities, smaller launches need to differentiate themselves to drive incremental sales in deliberate ways.

Common pathways to growth

To better understand how small brands differentiate themselves, we reviewed more than 4,000 new product SKUs within the last five years, across 20 categories. We analyzed the number and types of SKUs with low-ranking velocities in Year 1 that survived long term. And for an even deeper understanding, we investigated the characteristics of these SKUs, concept testing approximately 20 of them in primary research. Ultimately, we found some common pathways to growth that help to explain why the small can—sometimes—still succeed.

Here are three common pathways:

How else can you set up your small launch for success?

Let’s return to our opening example. What enabled Soft Drink B to succeed despite its face-value indicators to the contrary? Pricing was one key factor. The beverage was premium to the category and sold in glass bottle four-packs. Additionally, its narrow appeal and high-quality taste targeted a niche group of consumers, which increased its word-of-mouth endorsements and its repeat rate. These factors combined to generate the incremental growth Soft Drink B needed to survive its first year.

Incrementality, whether generated through targeted benefits, trade-ups, size extensions or new usage occasions, is key to success for any slow-turning SKU, particularly those not associated with established brands. But equally essential is the ability to provide a superior experience and solve unmet needs for consumers. When a new product does its job to overcome compensating behaviors—providing exactly the right size, packaging or consumption experience consumers have been looking for—it often can command a premium and achieve a high repeat rate, driving even more growth.

There is little room for error in small launches. Nailing your activation requires advance planning and strategic execution. Whatever your differentiation—hitting your target, justifying your premium or communicating a new usage occasion—it must land, and land well.

Finally, early identification of potential slow-velocity SKUs is critical. Ensure that your internal stakeholders have the appetite for a smaller launch and understand the product’s fit within the entire portfolio. Likewise, make it clear to retailers—who have low tolerance for slower-turning initiatives without clear justification—exactly what value this initiative will bring.

Ultimately, the odds of success are slim for slow-turning SKUs. But manufacturers who identify them early, set reachable targets, generate incrementality and delight their customers with an exceptional product experience—all while aligning the expectations of retailers and stakeholders—can increase their chance of long-term sustainability.

The IQ Brief: NIQ intelligence, straight to your inbox

Keep up with our latest data and insights on consumer behavior, category performance, innovation, manufacturing, and more by signing up for The IQ Brief. This twice-monthly roundup of our latest intelligence will keep you briefed on the topics that matter most to your business—and help you tackle tomorrow’s challenges, today.