7 new consumer segments

To get an in-depth understanding of these internal decisions and what consumers are looking to purchase, NielsenIQ has created seven new consumer segments across five major markets in Europe:

- The Trendies

- The Body Conscious

- The Close to Nature

- Conscience Driven

- The Pragmatists

- The Actively Engaged

- The Unconcerned

These consumer groups are designed to help manufacturers and retailers understand the behaviors and trigger points that impact consumers and the impact on shelf strategy. Lets take a closer look at each below.

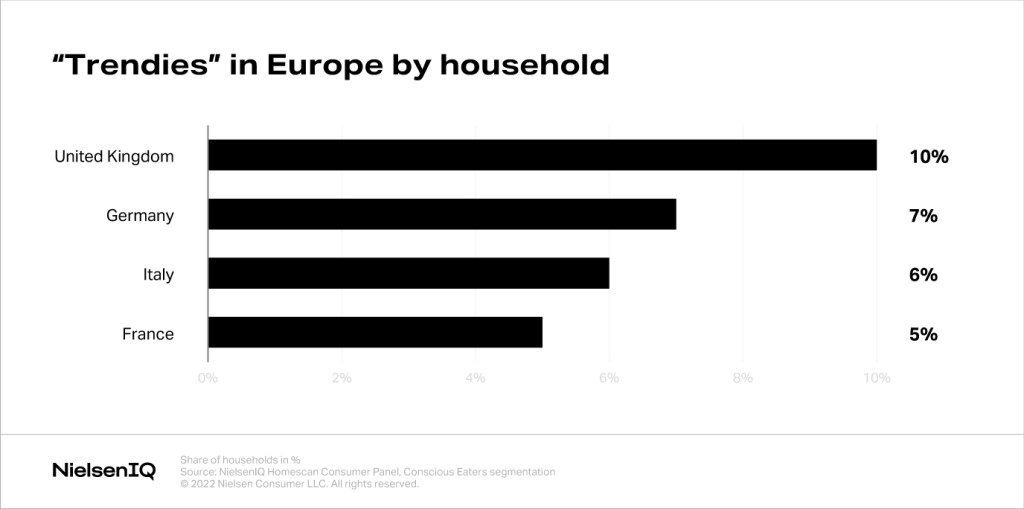

The Trendies

Let’s start with the Trendies, a group with very precise dietary needs who often follows niche diets. In the U.K., 10% of households are classed as Trendies while, Germany represents 7%, Italy has 6%, and France 5%. They avoid specific foods, ingredients, and allergens from their menu, driven by choice or by necessity. This is a community that conducts research on food nutrition and are often influenced by others.

Health is their top concern. When entering the store and scanning the shelf, they will be focused on pure health products placed among hundreds of other offerings.

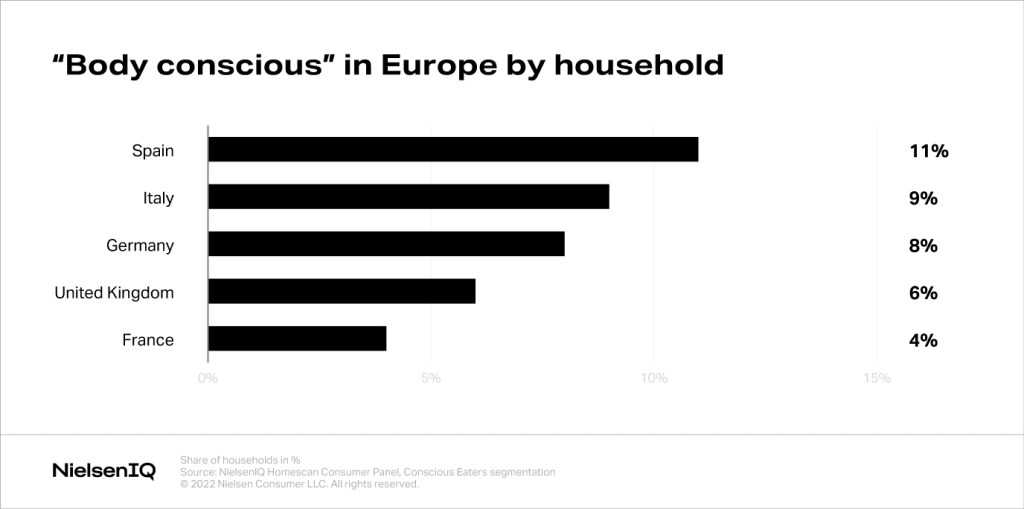

The Body Conscious

The Body Conscious segment is made up of members of the body and soul community. These consumers can be found across all demographics, but some bias towards younger households without kids. This group is the strongest in Spain (11%), followed by Italy (9%), Germany (8%), the U.K. (6%) and France (4%).

Body Conscious consumers are primally focused on their own personal physical and mental performance and are following diets enabling them to achieve this goal.

Close to Nature

Consumers that are in the Close to Nature segment want their food to be regional whether they support the region or the country, want to eat fresh, or have access to seasonal products. They also want their food to be free of any artificial additives or GMO.

The Close to Nature and Conscience Driven group generates the big chunk of share value for organic and bio food: 46% in Germany, 38% in Spain, 34% in France and Italy, and 33% in the U.K. This segment possesses quite the potential when thinking about assortment and shelf optimization possibilities.

Conscience Driven

Conscience Driven shoppers are highly motivated by the ethical consequences of their diet. They care about animal welfare, are often vegetarian and vegan. Sustainability is very important to them.

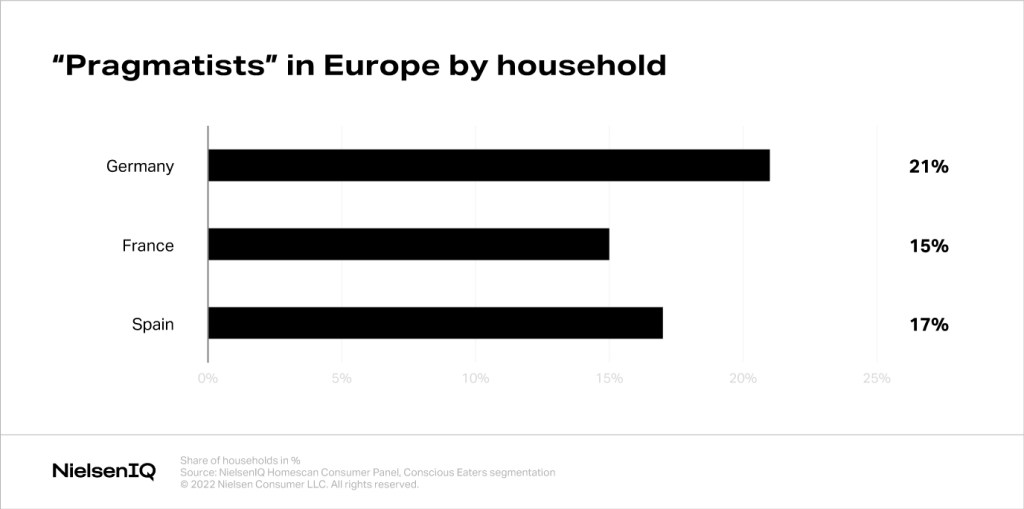

The Pragmatists

The Pragmatists have rather low or moderate interest in conscious nutrition. Taste is the name of the game for them.

In Germany (21% of the households), are mainly focused on saving time when browsing through shelves—they do not want to spend too much time cooking or even thinking about their food. It is just something to be grabbed from the store in the most convenient manner.

Meanwhile, their French (15% of the households) and Spanish (17% of the households) counterparts are much more passionate about their food, cooking every day and spend much more time preparing the meals.

Actively Engaged

The Actively Engaged segment is in general older. In Germany, their focus is taste and quality, while in other countries they like to monitor their health by avoiding sugar, fat, salt, and etc., with the U.K. being the market with the highest GMO and processed food avoidance rate within this group.

The Unconcerned

The Unconcerned segment considers food and nutrition the least important and they are likely to be on a diet. They are driven by price and taste, which for this group are critical factors impacting their decisions in front of the shelf.

Key takeaways

The store in 2022 will be the place of complex decisions made by different groups of consumers influenced by external variables (inflation, pricing, product availability via supply chains, promotions) and their own personal drivers with conscious consumption amongst them.

Integrating the choices and behaviors from these segments into your overall strategy will allow for a multi-channel assortment and space strategy.

For each of these segments, there is an impact on brand perception and product choice. For the Trendies, Body Conscious, and Close to Nature consumers, showcasing nutrition and health values first will drive deeper conversion. For the Conscience Driven segment, identifying the product’s and brand’s sustainable credentials is key to drive purpose and familiarity, but it must be authentic.

Getting these factors right will not only increase sales but allow brands to integrate more emotional factors into their pricing and assortment strategy.

Make your assortment strategy work for you

While assortment is getting harder, your competitors are looking for every edge. Stay ahead with proactive strategy and solutions to simplify the complexity of the changing retail and manufacturing landscape.