Connecting opportunities to consumer brand preference

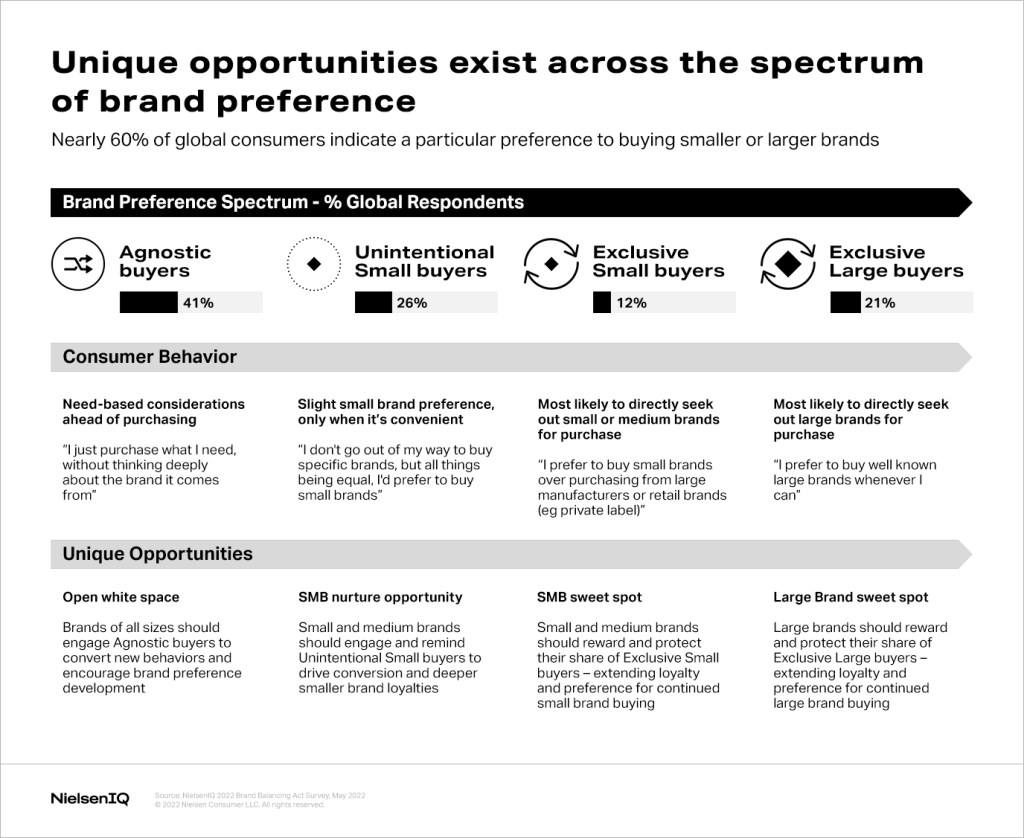

When asked to identify their usual approach to buying across the consumer goods space, surveyed global consumers fit into one of four key groups of brand buyers:

- Agnostic Brand Buyers, or, those who don’t think deeply about which brand is behind their purchase

- Unintentional Small Brand Buyers who form the middle-ground of demonstrating “some” preference to buying smaller brands, but only when it’s convenient to do so

- Exclusive Small Brand Buyers who claim they prefer to buy smaller brands

- And, Exclusive Large Brand Buyers, who prefer buying well-known large brands whenever possible

Consumer needs and reasons for choosing a brand have fragmented while the retail landscape has grown more polarized. With that in mind, it’s imperative to dive deeper into the mindset of these different brand buyers. Strategies fueled around the specific motivators and values across the brand preference spectrum are most likely to succeed.

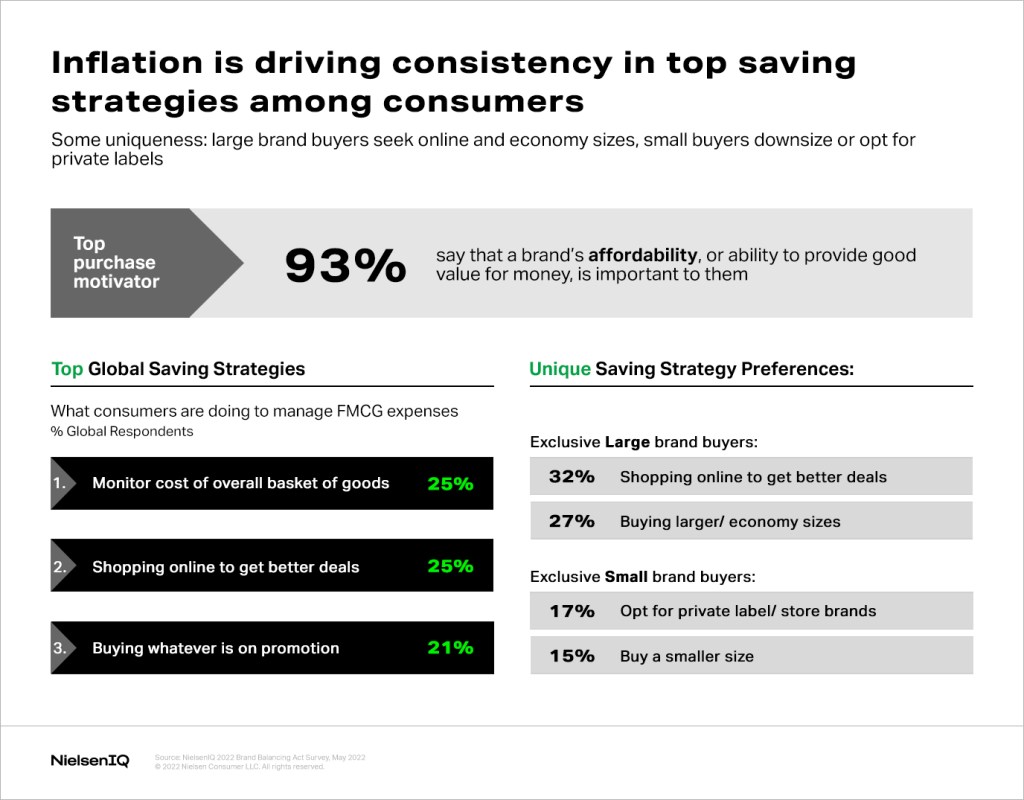

Inflation unifies some consumer preferences

With such narrow margins to spare in managing the branded balancing act, small and medium-sized businesses cannot afford to waste resources trying to appeal to core consumers. The good news for brands is that consumers are conserving costs in similar ways across the board.

Ongoing price pressures felt by consumers are having a unifying effect on approaches to saving. Across the globe, 93% of respondents say that a brand’s affordability, or ability to provide good value for money, is important to them, a top factor across all four brand preference segments. Furthermore, the top global savings strategies include:

- 25% monitoring the overall cost of one’s basket of goods

- 25% shopping online to get better deals

- 21% buying whatever is on promotion

Of particular note to small brands: unique savings strategies exist between those who say they exclusively buy small or large brands.

Exclusive large brand buyers are more likely to prefer shopping online to get better deals (32%) and buying larger/economy sizes of their products of choice (27%). Comparatively, exclusive small brand buyers are more likely to opt for private label/store brands (17%) and buy in smaller pack sizes to save money (15%).

In light of recent and upcoming online sales events like Prime Day, Back-to-School sales, Black Friday and more, e-commerce remains a primary resource to cost-conscious consumers.

“With prices as high as they are, and rising across many categories, from a consumer standpoint we actually see e-commerce leveraged for its cost-saving potential,” said Lauren Fernandes, Global Director of Thought Leadership at NielsenIQ. “The current climate and consumer cautiousness with spending could make big sales events a more essential purchase moment than in years past. It’s likely that many consumers have held off on big purchases to make the most of moment-in-time sales for items that would otherwise be outside of current budgets.”

Understand today’s brand buyers

Who they are

- Definition: 41% of global consumers who purchase what they need without thinking too deeply about which brand is behind the product.

- Opportunity: Largest segment of global consumers, huge opportunity for brands of all sizes to nurture and convert. Most open to persuasion.

Key Findings

- Purchase indifference: 43% find it hard to differentiate between various brand options available to them.

- Price sensitive: More than other brand buyer segments, 23% are Strugglers (have and continue to suffer financially), and 23% will buy whatever brand is on promotion. To them, affordability is highly associated with small brands.

Who they are

- Definition: 26% of global consumers who show some preference to buying small but won’t go out of their way to do so.

- Opportunity: A cohort for small and medium businesses to nurture and remind. They have the potential to develop deeper loyalties if smaller brands can resonate with them.

Key Findings

- Cautious majority: 41% are cautious (not impacted financially but cautious with spending) and need help justifying the value of their purchase choices.

- Resonance matters: To them, it’s important that brands have environmental or social benefits that resonate personally. This is a factor they’re more likely to associate with smaller brands.

Who they are

- Definition: 12% of global consumers who say they exclusively prefer to buy smaller brands over large brands.

- Opportunity: The “sweet spot” of consumer preference for small and medium businesses to protect and defend their share of.

Key Findings

- Sustainable interests: Top attributes regularly sought by exclusive small brand buyers are environmentally friendly (42%), natural/healthy 41%), sustainably produced (38%), and clean label (38%).

- Local supporters: 82% say it’s important that brands support local communities and highly associate this with what they know and expect of smaller brands.

Who they are

- Definition: 21% of global consumers who say they exclusively prefer to buy well-known larger brands wherever possible.

- Opportunity: The “sweet spot” of consumer preference for larger businesses to protect and defend their share of.

Key Findings

- Expect top quality: 96% of Exclusive Large Brand Buyers say it’s important that brands have superior quality compared to the competitive brands they could have bought. It is important that these brands are very well known.

- Direct communication: 57% of these buyers like when brands contact them directly in an informal or personal way. 61% like knowing a brand’s story, origin, or reason for being.

Big opportunities for small and medium-sized brands

In the current high-inflationary climate, understanding how to resonate with buyers, how to appeal to their unique needs, and bridging to the ways they find affordability is essential. With an incredible 41% of global consumers sitting in the camp of being “agnostic” in their brand preferences, the strategic playing field is ripe for even the smallest of brands to scale growth.

To motivate purchases, small and medium businesses must highlight what is new, different, or unique locally to cater to the “small brand” space of the preference spectrum. While balancing these important areas, small brands can’t lose sight of the nearly universal need to be affordable right now. Providing value in smaller pack sizes for those who wish to downsize and keeping prices comparable to private labels are two of the many ways to favor one’s bottom line with consumer interest in mind.

Stay ahead by staying in the loop

Don’t miss the latest NIQ intelligence—get The IQ Brief in your inbox.

By clicking on sign up, you agree to our privacy statement and terms of use.