Disruptions drive re-evaluation

As a result of these disruptions, consumers have reprioritized what matters to them, and are seeking shopping experiences and products that cater to their new needs. In fact, our recent NielsenIQ 2022 Consumer Outlook online survey reveals that 74% of global respondents believe that their priorities, and resulting shopping habits, have been impacted to some degree by COVID-19. This includes 30% who feel they have a totally different set of priorities than they had in 2019. Consumers, continuously squeezed by inflationary and supply chain challenges, will show their willingness to pay and search for products that address real-life needs and priorities. Retailers and manufacturers who want to succeed going forward will have to keep up, as consumers continuously redefine what “living with Covid” means to them.

Vaccinations support a cautious confidence renewal

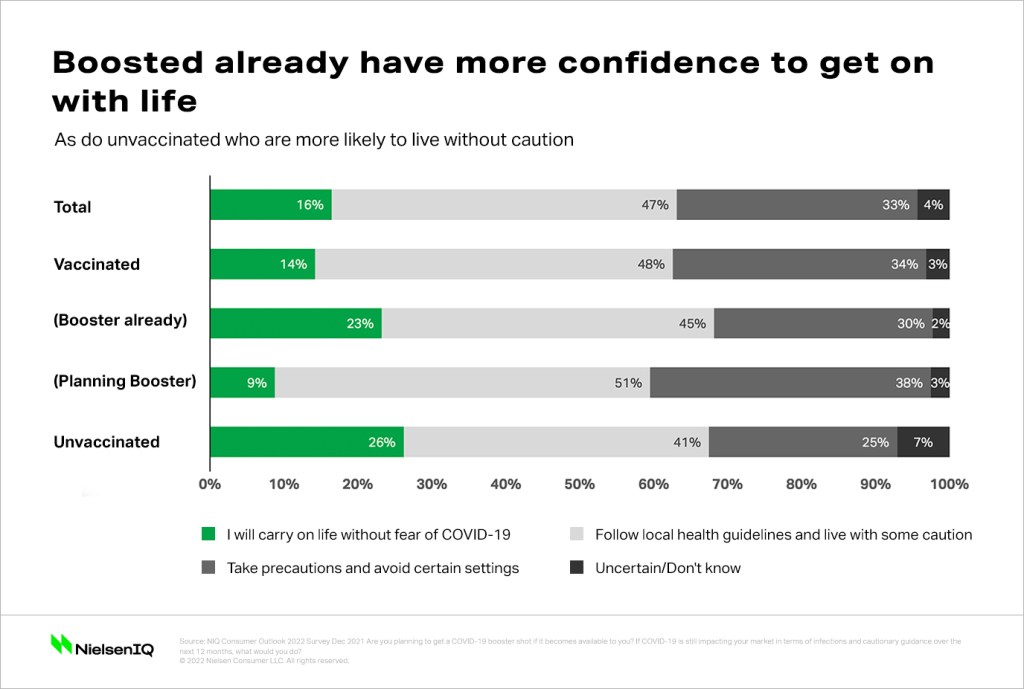

Understanding how consumers plan to re-engage with the world begins with how careful they’re being. Globally, nearly half (47%) said they would live with some caution if COVID-19 continues to impact their market in the next 12 months. 33% will be more vigilant, saying they’ll continue to take precautions and avoid certain settings even if positivity rates stay low, while only 16% said they will carry on with life without fear of COVID-19.

82% of vaccinated respondents, who likely feel invested in their safety, say they are more likely to be cautious compared to 66% of those who are unvaccinated. Meanwhile, 26% of unvaccinated consumers say they will live without fear of COVID-19 compared to 14% of vaccinated. But the vaccinated who have already received a booster shot are showing renewed confidence with 23% now trying to carry on with life with no fear of COVID-19. This continued polarization of mindsets underscores two important factors: the rapidly changing landscape as societies live with COVID-19, and the importance of meeting the hygiene and safety requirements of consumers, even as vaccines and boosters continue to roll out.

CPG well-positioned due to homebody consumption

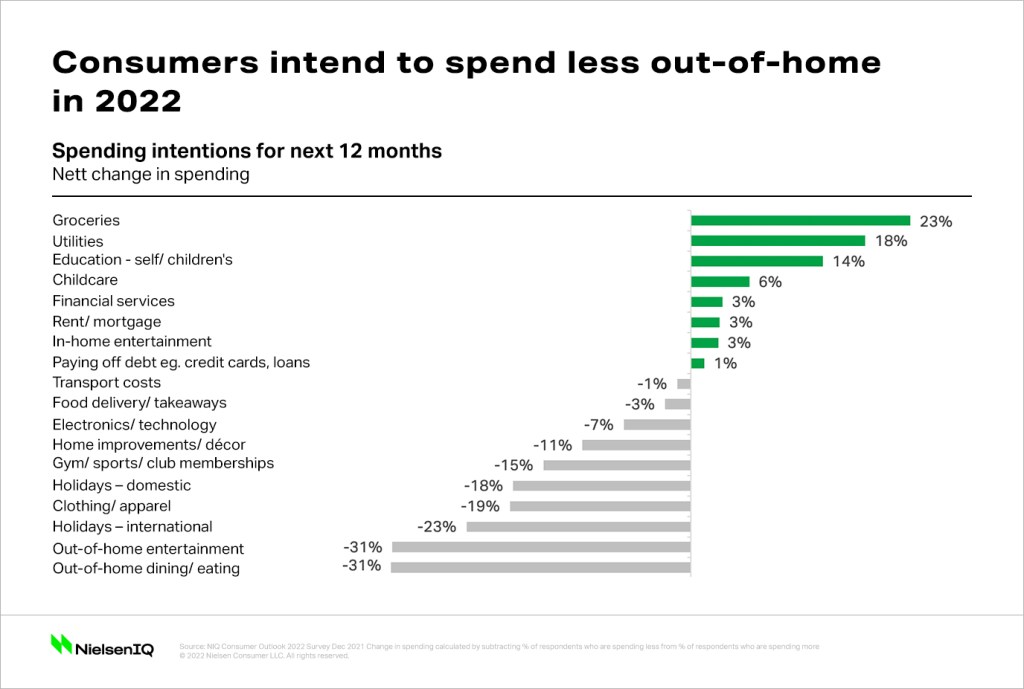

For many consumers, spending intentions center around two primary factors: in-home consumption and contending with constrained wallets, which are impacted by the swift pace of inflation. In fact, 56% of global households say they’re spending more on their normal weekly shop compared to six months ago. With the rising cost of goods, consumers are being mindful of their budgets, and at-home lifestyles have contributed to less out-of-home spending. Therefore, asserting a brand’s value proposition has never been more important.

“Over the next 12 months people are expecting to spend more on groceries, utilities and at home basics while many signal they will spend less on discretionary items and out of home occasions” observes Nicole Corbett, Director, Global Thought Leadership, NielsenIQ. “It’s clear that the prevailing mindset is of once again living with COVID-19 in 2022 and centered increasingly around the home. Based on what consumers are telling us we might expect that CPG will continue to benefit from people redirecting money they might have usually spent out of home in areas like events, restaurants, out of home entertainment and international holidays pre-pandemic to make their in-home experiences more enjoyable.”

Identify consistent themes in consumer outlooks

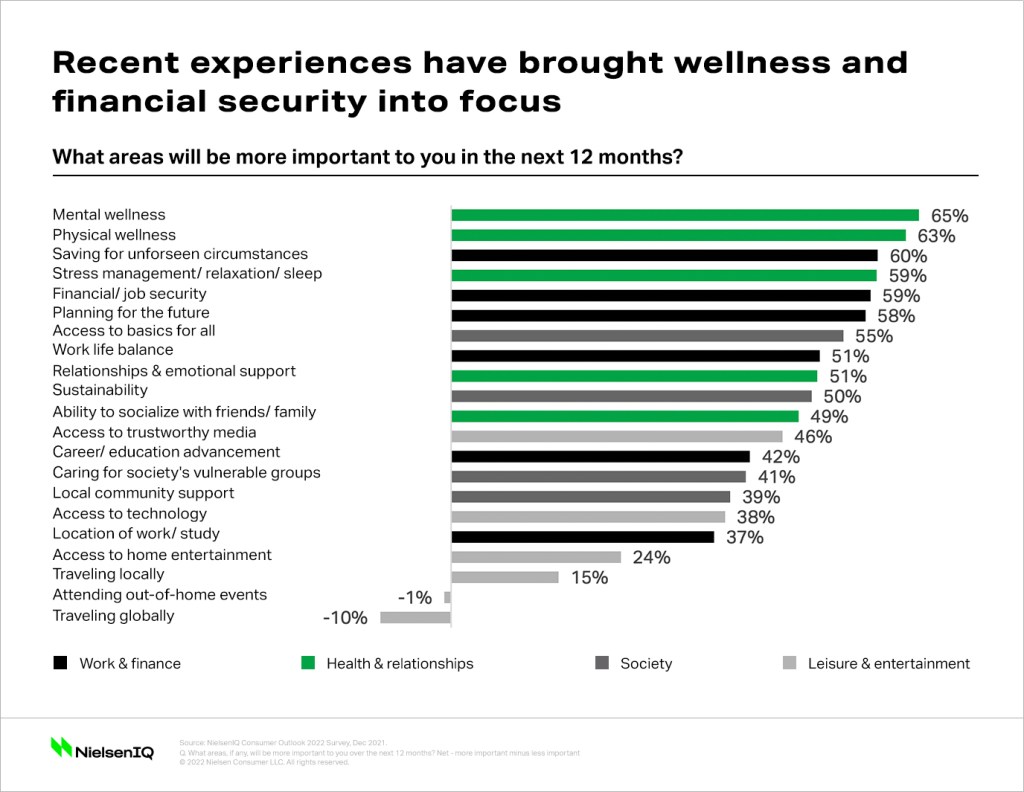

As consumers analyze what will matter the most to them looking forward into 2022, they are focused on their own mental and physical well-being, and are de-prioritizing travel and out-of-home events. There is evidence that this is not a temporary shift and underlies societal changes that will create new opportunities to win.

“When you dig deeper into what those priorities are and how it will change purchasing behavior, you quickly conclude that our COVID-19 experiences are mapping to what’s more important” says Corbett. “Factors like mental health, physical health, financial security and planning for unforeseen circumstances are at the top of the list because these are the areas that COVID-19 has put pressure on. The time has also enabled us to reflect on more social issues with sustainability, supporting local community, and caring for vulnerable groups being more important versus pre-pandemic.”

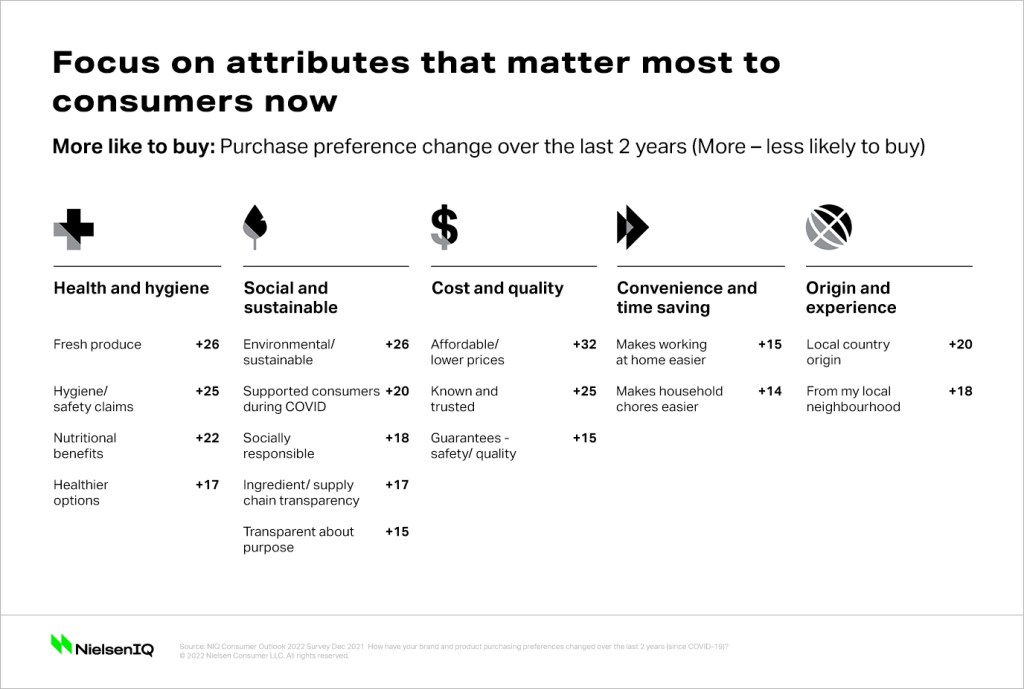

Purchase preferences have changed since 2019

The ability to identify changing priorities is only one part of the equation, according to Corbett. Additionally, manufacturers and retailers must ensure that portfolios allow for consumers’ changed circumstances, focus on specific product benefits that consumers seek, and offer items that they can afford. As a result, consumers’ repertoire of brands or consideration sets may look very different than they have in the past. Consumers will continue to scrutinize the necessity of products, and items that do not speak to their specific needs may be left behind.

Agility will be critical in 2022

There will be the potential for continued behavior polarization or disruption as consumers with different mindsets approach the world moving forward. With employment interruptions, supply chain breakdowns and varying recoveries, there are many signals cautioning that we may have yet to see the last twist in our COVID-19 experiences. Consumers are preparing for the unexpected. With new virus variants, government mandates or even the divergent consumer approaches to spending, industry players need to prepare for a number of different scenarios in 2022. In a year where the social and consumer landscape may change rapidly, companies that recognize the importance of agility and responsiveness are more likely to navigate these challenges successfully.

An important component of that nimble mindset will be to track and anticipate shifting consumer outlooks through super-charged change. Agility will be critical. Retailers and brands that consider different trajectories and recovery scenarios will be better placed to address consumers changing priorities, states of cautiousness, and increasingly constrained wallets. They must ensure their offerings can morph and resonate with how the landscape will continue to evolve in the years to come.

Stay ahead by staying in the loop

Don’t miss the latest NIQ intelligence—get The IQ Brief in your inbox.

By clicking on sign up, you agree to our privacy statement and terms of use.