Amazon casts a wider net on Prime Day 2023

As we’ve previously demonstrated, omnichannel strategies that don’t have a view of Amazon performance data risk leaving billions of dollars on the table. In this latest analysis by NIQ, we delve into the global consumer shopping behaviors during Amazon Prime Day 2023. The annual two-day shopping event, which took place on July 11th and 12th, has expanded its reach worldwide. This year, Amazon Prime Day extended its offerings to consumers in 24 markets, including the United States, United Kingdom, Germany, Poland, Mexico, Brazil, Singapore, China, and more. Based on NIQ analysis, here is how consumers around the world say they shopped Prime Day.

What drove consumers to shop?

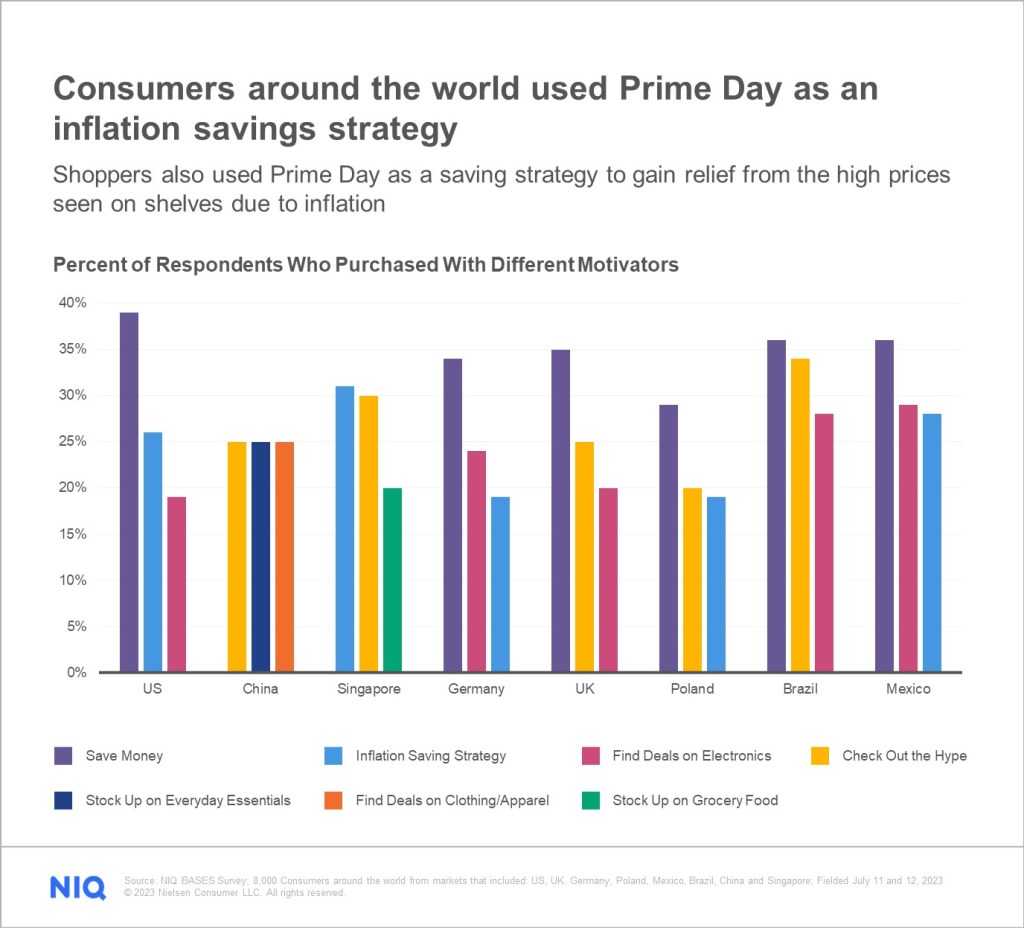

Consumers around the world were driven to shop Prime Day 2023 for various reasons. Many used it as an inflation savings strategy, seeking to combat rising prices and save on essential items.

Prime Day is emerging as a mid-year stock up holiday for consumers around the world

However, a noteworthy trend is the growing perception of Prime Day as a stock-up holiday for everyday essentials, indicating consumers’ willingness to take advantage of the event to refill the supply shelves, personal care closets and pantries. While not reflected in the Top 3 reported motivations, the reasons slightly below the line are the ones CPG players should watch.

In the US, 16% of consumers saw Prime Day 2023 as an opportunity to stock up on supplies, surpassing those who shopped for holiday gifts (12%). The UK also witnessed consumers using Prime Day as a savings strategy against inflationary pressures, with an emerging trend of considering it a stock-up holiday for everyday essentials (14%). In Brazil, Prime Day saw a surge in consumers looking for deals on clothes (20%) and beauty + cosmetics (19%). In China, savvy shoppers used Prime Day as a savings strategy due to high inflation and prices (20%), while also taking advantage of cross-border, global shopping deals (20%). In Germany, 11% of consumers looked to Prime Day as a stock-up event for everyday essential goods. Poland experienced consumers exploring Prime Day deals for discounts on electronics and clothing/apparel, with 16% of consumers using it as a stock-up event for everyday essentials. In Mexico, deals on clothing + apparel were a top priority for consumers, alongside the motivation to stock up on beauty supplies (15%). Additionally, in Singapore, stocking up on beauty items was a top priority (20%). Overall, consumers demonstrated their diverse motivations for participating in Prime Day, showcasing the event’s broad appeal and its evolving role as both a savings and stock-up opportunity.

How much did consumers around the world spend on Prime Day?

The majority of surveyed consumers around the world indicated spending under $200 USD on Prime Day deals. For the most part, purchases were fairly moderate with the number of products purchased ranging from 1 – 6.

However, shoppers in Asian markets, such as Singapore and China, surpassed this average significantly. In Singapore, more than half of the shoppers reportedly spent over $200 USD, while in China, over 40% of surveyed consumers stated that they spent more than 3605 CNY (equivalent to $500 USD) on Prime Day this year. Chinese consumers also had larger basket sizes, with the majority stating that they purchased 10 or more items on Prime Day this year.

Interestingly, the common thread among consumers, despite varying spending patterns, is their satisfaction with the Prime Day deals they snagged. While the deals weren’t massive, they were enough to entice consumers who have experienced sticker shock due to rising prices of goods for most of this year. This satisfaction remains consistent across the board, suggesting that even those on tighter budgets managed to find satisfactory deals in their respective regions.

In fact, a majority of consumers around the world also believed that the deals provided on Prime Day 2023 were better than the deals offered during other “Shopping Holidays” like Black Friday, Singles Day and Cyber Monday.

That said, despite the excitement of a deal, purchases were still very much guided by budgets. Globally, 1 in 7 shoppers adhered to their budget and refrained from indulgent purchases. Among those who did indulge on Prime Day, their indulgences remained calculated and subdued. Many treated themselves to something they considered an affordable luxury, with only a few going significantly beyond budget.

What did shoppers buy on Prime Day 2023?

Around the world, Electronics and Clothing/Apparel topped the list of categories that consumers shopped; however, the rising presence of everyday essentials (grocery food, personal care, etc.) can’t be ignored. It’s interesting to note that within the two largest economies – the US and China – Consumer Packaged Goods accounted for 3 of the top 5 categories purchased.

Prime Day Shopping Trends and a look into Holiday shopping 2023

Consumers will continue to face higher than average inflation rates in CPG for the remainder of 2023 and are beginning to show that recessionary mindsets and behaviors are taking hold. With consumption continuing to decline, growth is being driven exclusively by rising prices, and CPG companies need to be more strategic to get their piece of the shrinking pie.

Though constrained consumers will continue to shop conservatively, Prime Day 2023 proved that shoppers are still hungry for deals and have shown a willingness to make calculated splurges beyond their budget for the right items. Retailers and manufacturers who are looking for growth opportunities must offer products that tie back to consumers values, needs and joyful wants.