E-commerce Insights: Focus on Amazon Buyers’ Behavior in the European Market

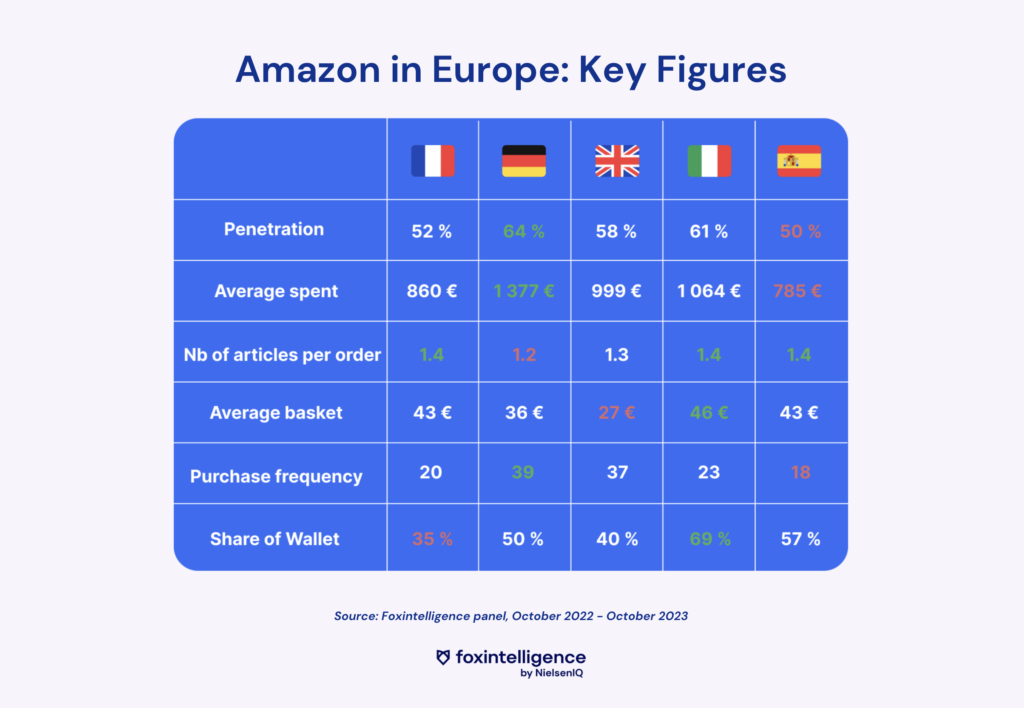

Penetration Rate*: In Spain, Amazon’s penetration rate is the lowest, covering 50% of the online market. In Germany, the platform covers 64% of the market.

*Penetration rate refers to the proportion of consumers who have made a purchase among potential consumers. In other words, it indicates the market coverage rate.

Average Spending: Germany also leads in average spending, with Germans having spent an average of €1,377 on Amazon in the last 12 months. In Italy, the average spending surpasses 1,000 euros, reaching €1,064. In the UK, the average is €999, and in France, it is €860. Spaniards are the least spenders at €768. Average spending varies twofold across the European market.

Average Basket Value: The average basket value ranges from €27 for the UK to €46 for Italy. Both the French and the Spanish have an average basket value of €43, while Germans have €36.

Number of Items per Order: Unsurprisingly, the act of purchasing has become commonplace on Amazon. For all analyzed countries, the number of items per order ranges from 1.2 to 1.4.

Purchase Frequency: It varies twofold between Spain (18 orders in a year) and Germany (39 orders placed).

Wallet Share: In France, Amazon’s customer** base allocates 35% of its online shopping budget to Amazon. In Italy, out of €100 spent online, €69 goes to Amazon for the customer base. The Italian customer base is the most loyal in Europe.

**Amazon Customer Base: Customers who have made at least one purchase on Amazon in the last 12 months.

Discover your penetration rate and that of your competitors

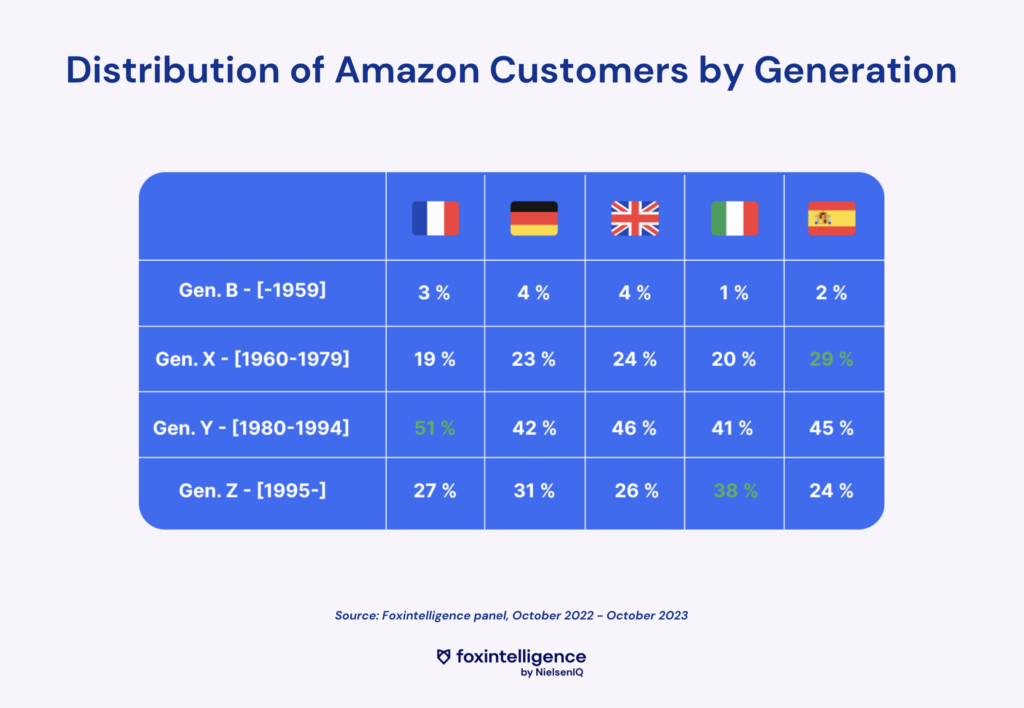

Who Are Amazon Buyers? Which Generations Spend the Most on the Platform?

In European countries, the Y generation contributes the most to Amazon’s revenue. In France, it represents 51% of buyers.

In Spain, the X generation’s influence is significant, accounting for 29% of Amazon customers, while the Z generation accounts for 24%.

In Italy, the Y and Z generations together make up 80% of the platform’s online customers.

The Main Product Categories Purchased on Amazon in Europe

The categories with the highest impact on Amazon’s revenue are Culture & Games, DIY & Garden, Electronics & Computers, Fashion, FMCG (fast-moving consumer goods), and Home & Appliances.

Key takeaways:

- Surprisingly, FMCG (fast-moving consumer goods) is the most purchased category on the platform in the UK!

- The French are the e-shoppers who spend the most in the Culture & Games category.

- The Electronics & Computers category leads in all analyzed countries.

Discover your true online market share and trends

How Did Amazon Emerge as the Global E-commerce Leader?

Through a subscription-based loyalty program: Amazon Prime. It is Amazon’s primary competitive advantage. Currently, no other player can compete with the benefits offered to Prime members. Beyond selling products, the platform provides a multitude of services:

- Free one-day delivery (or even less in major cities)

- Access to Prime Video and Prime Music, on-demand video and music platforms from the brand

- Prime Gaming, including a paid subscription on Twitch and content on PC games

- Access to Prime Days, promotional days dedicated exclusively to Prime members

- Etc.

The advantages of being a Prime member are ever-increasing, and members have no reason to order from a competitor. Amazon’s strategy is simple: monetize existing customers.

Read the full article on Amazon Prime