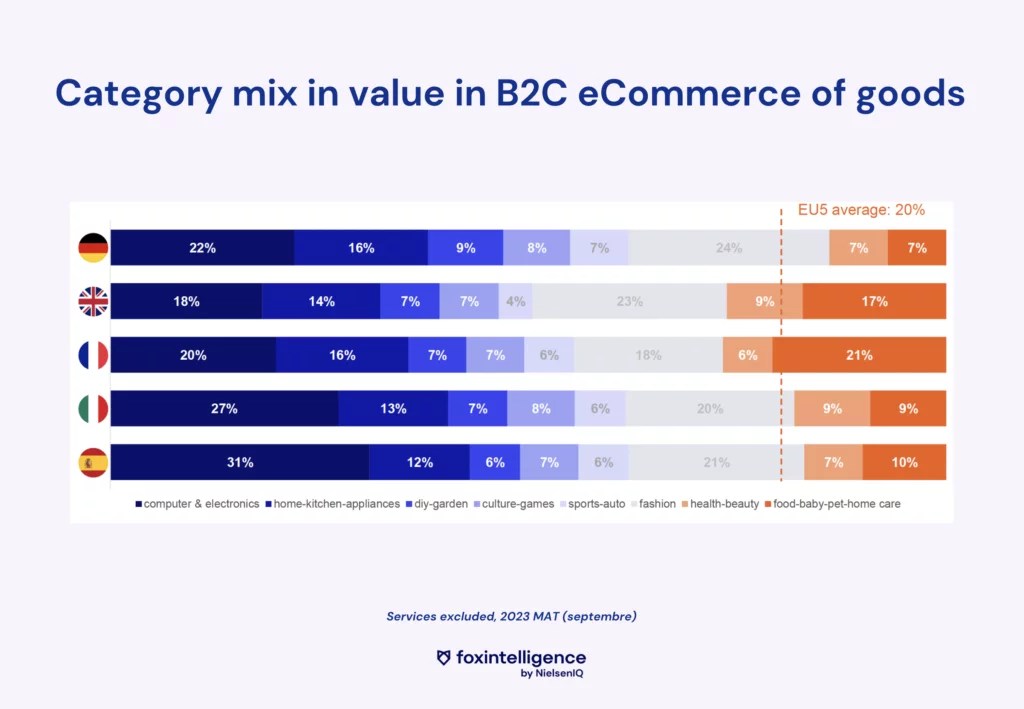

1. Category Mix: FMCG Gains Online Market Share in Europe

FMCG (fast-moving consumer goods) is gaining market share online in Europe. Compared to durable consumer goods, FMCG categories have a higher share in the United Kingdom (27%) and France (26%). In Germany, it is below the average at 14%.

Before the health crisis, FMCG categories were, on average, 4 percentage points below in the EU5. The high-tech category, on the other hand, was 6 points above the average – it’s the category that has seen the most decline since the health crisis.

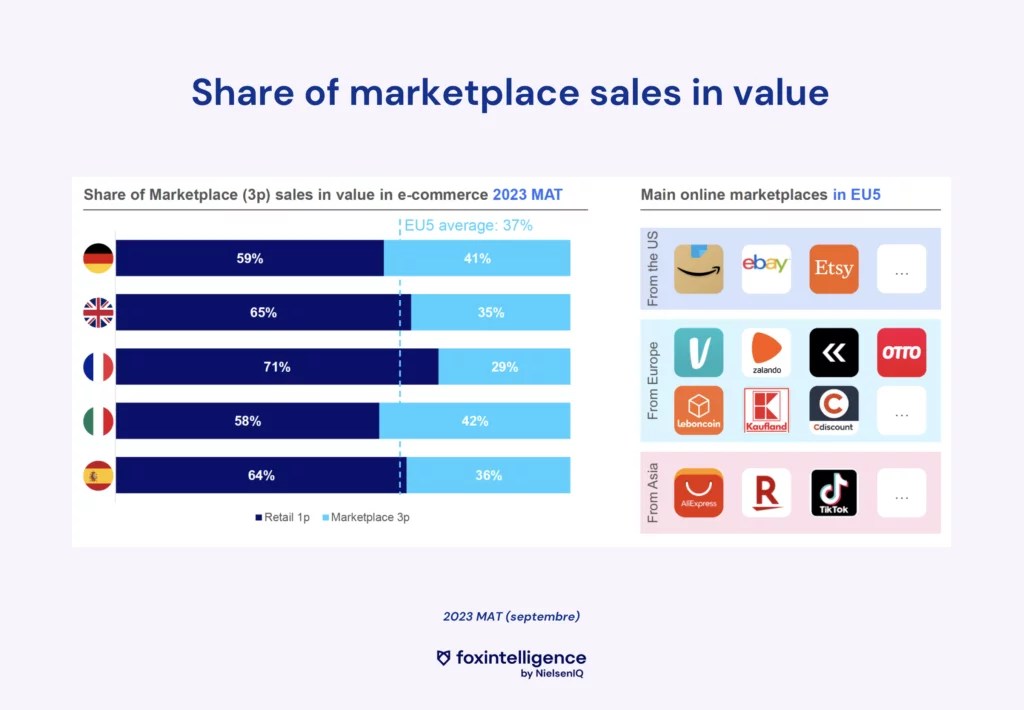

2. Marketplaces Play a Bigger Role in Sales Value

Marketplaces are on the rise, currently representing over a third of online sales in Europe.

Italy has the highest proportion of sales through marketplaces in the overall eCommerce, accounting for 42% of purchases. Germany comes in second with 41% of online purchases made through a marketplace. In the UK and Spain, it’s 35% and 36%, respectively.

France is at the bottom with only 29% of purchases made through marketplaces. However, the arrival of Temu in France may change the landscape!

3. Arrival of Temu in France

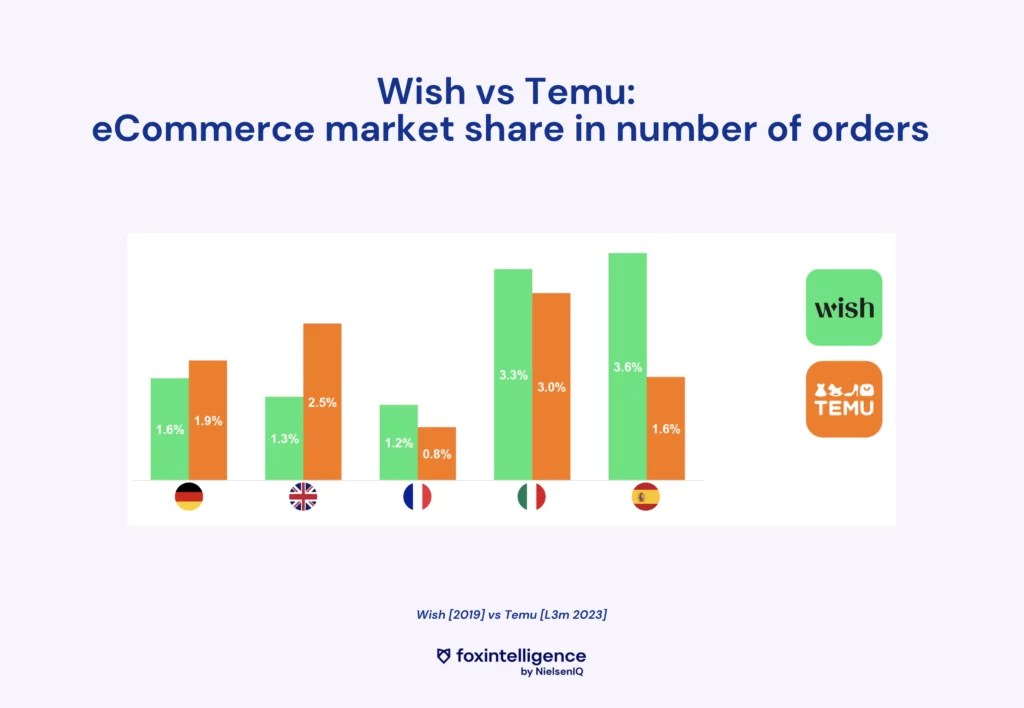

Temu originated in the United States last year. The Chinese group Pinduoduo launched its marketplace in the American market at the end of 2022 and then in Europe in 2023. In just a few months, Temu has established itself in the European eCommerce market and is emerging as a significant competitor to Wish, AliExpress, and Shein.

A few months after its launch in Europe, Temu has gained considerable market share: in the UK and Germany, it surpasses Wish’s market share at its peak in 2019.

4. Grand Entrances: TikTok Shop and Lidl Making Their Mark in eCommerce

Social Commerce: TikTok Disrupts Traditional Players in the Beauty Sector

TikTok Shop ranks in the top 5 merchants in the cosmetics category in the United Kingdom after less than 2 years of existence.

TikTok Shop customers are big spenders in the category:

- They allocate one-third of their online budget to TikTok Shop.

- Their average annual online spending exceeds that of e-shoppers: €108 vs. €70.

- Their purchase frequency is also 30% higher.

Lidl’s Rapid Rise in eCommerce

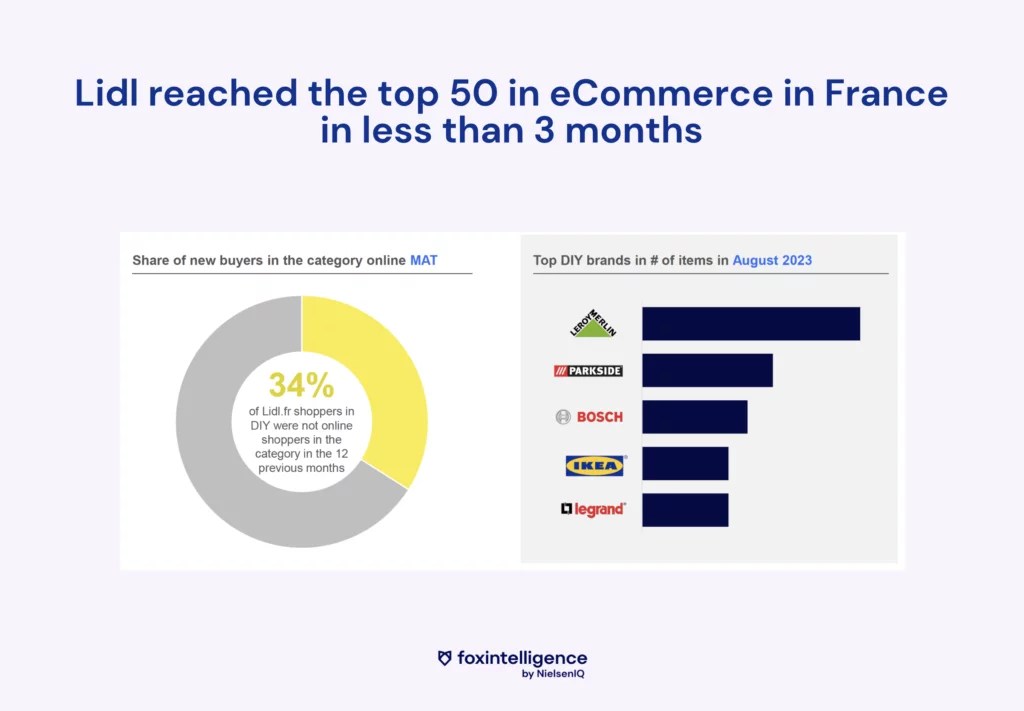

Lidl launched its eCommerce site in France, and in less than 3 months, the brand enters the top 50 of French eCommerce in terms of buyers.

The proportion of new buyers in the DIY category is substantial: 34% of e-shoppers had not made online purchases in the previous 12 months.

When considering the number of items sold, Lidl’s own brand, Parkside, ranks second in August 2023, just behind Leroy Merlin.

It’s a success for Lidl, which also manages to elevate its own brand, Parkside, to the second position among DIY brands in terms of items sold in August 2023.

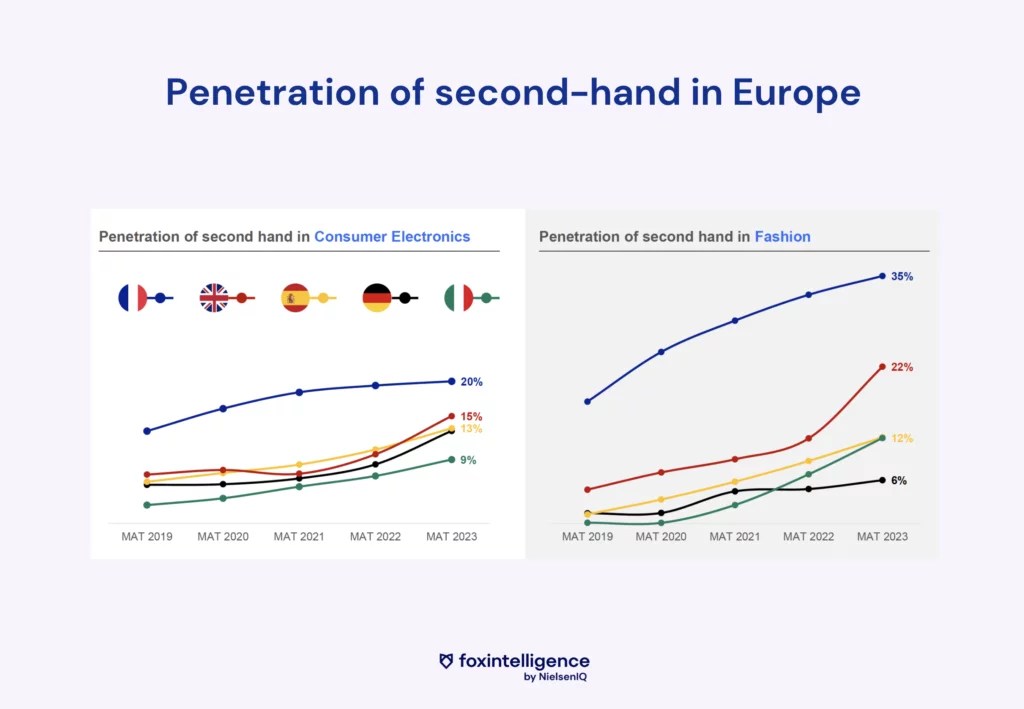

5. Second-Hand Sales Soar in Europe

Second-hand is not a new trend, especially in France. While the second-hand market has been strong in France, it hasn’t always been the case for our European neighbors.

However, there has been a significant acceleration since the start of inflation: the penetration rate of second-hand goods is increasing across all countries, both in the high-tech and fashion markets.