FMCG consumption in Vietnam returns to normal

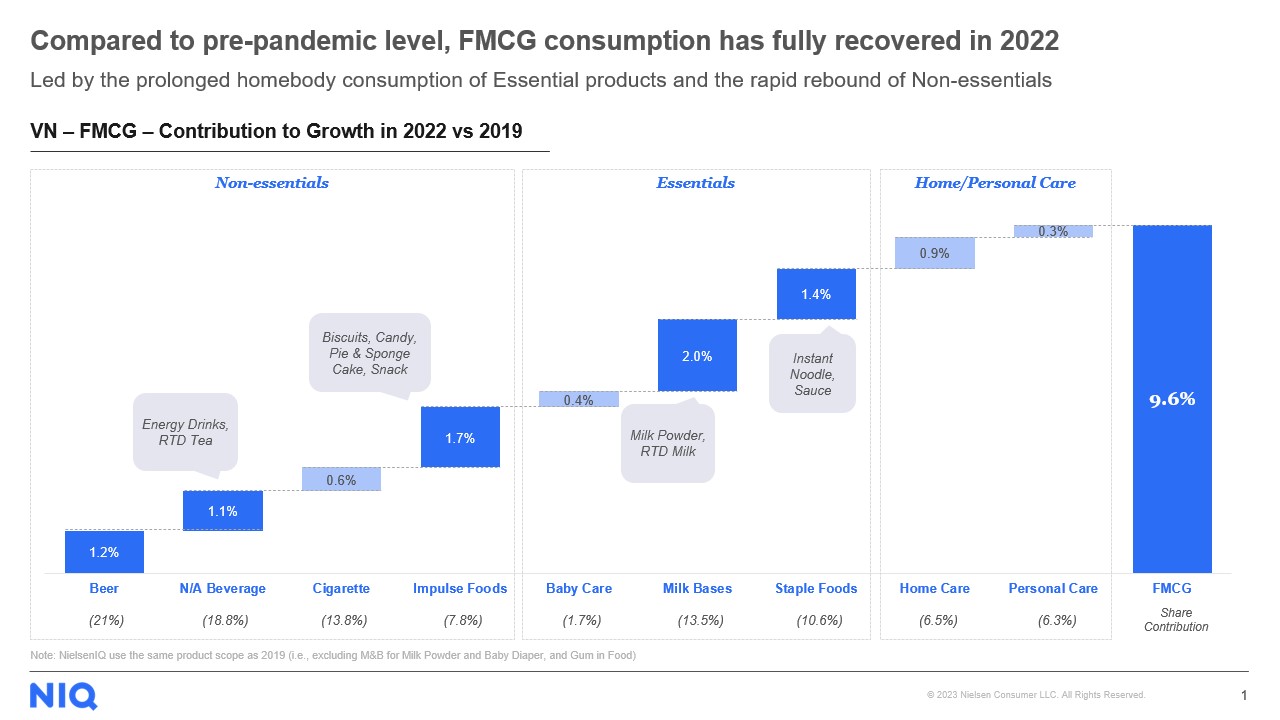

FMCG consumption in Vietnam has returned to normal, and this is a positive sign for the economy. In 2022, the FMCG growth rate reached an impressive 9.6%, surpassing the pre-COVID levels of 2019. Moreover, compared to 2021, the industry has experienced a remarkable growth of 17.5%, indicating a strong positive trajectory.

The increase in demand for health and hygiene-related products, as well as everyday essentials, contributed significantly to this growth, highlighting the importance of these products in the consumer basket. This growth demonstrates the resilience of the FMCG sector in adapting to changing consumer behavior and concerns.

Understanding the impact of inflation on FMCG sales

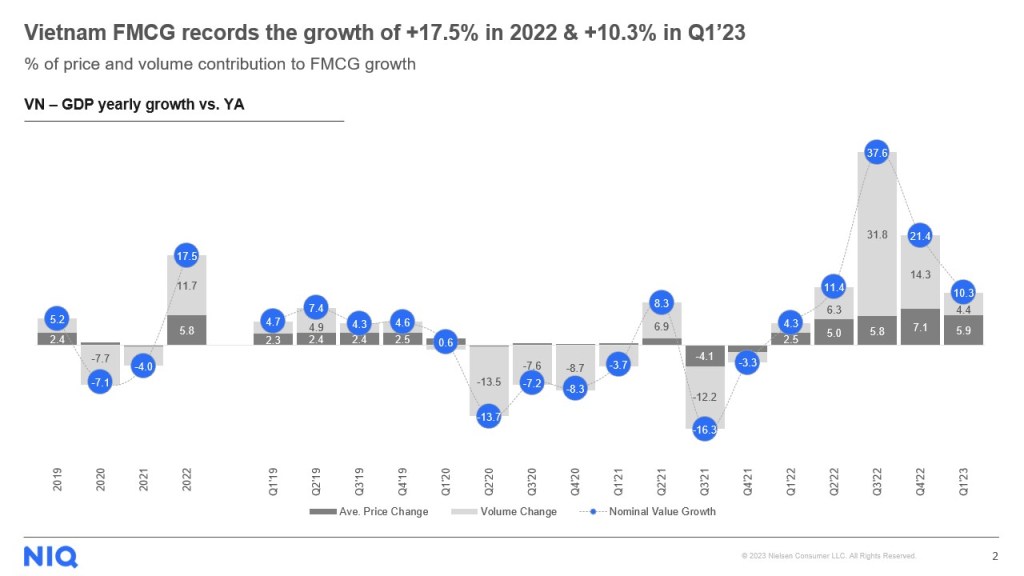

Looking closely, organic consumption and pricing were the two primary drivers of the 2022 FMCG growth rate, with pricing changes accounting for 5.8% of the overall increase. However, the contribution of pricing factors to the growth rate has resulted in visible inflationary pressures in the industry. In recent quarters, the influence of pricing on the growth rate has steadily intensified. According to NIQ’s retail measurement services data for Quarter 1 of 2023, FMCG experienced a 10.3% growth compared to the same period last year. While this growth is positive, manufacturers and retailers need to monitor the impact of inflation on FMCG sales in the coming months and adjust their pricing strategies accordingly to ensure continued success.

In fact, different categories and industries have different levels of pricing contribution to FMCG growth. For instance, the pricing factor makes a noteworthy contribution to Beer category at 14.2%, whereas Staple Food and Milk-Bases products contribute 7.7% and 4.8% respectively. Thus, we see that the impact of pricing on FMCG growth is not universal and companies should consider the specific category of products they offer and develop their pricing strategies accordingly.

Navigating the changing priorities of the Vietnamese consumer

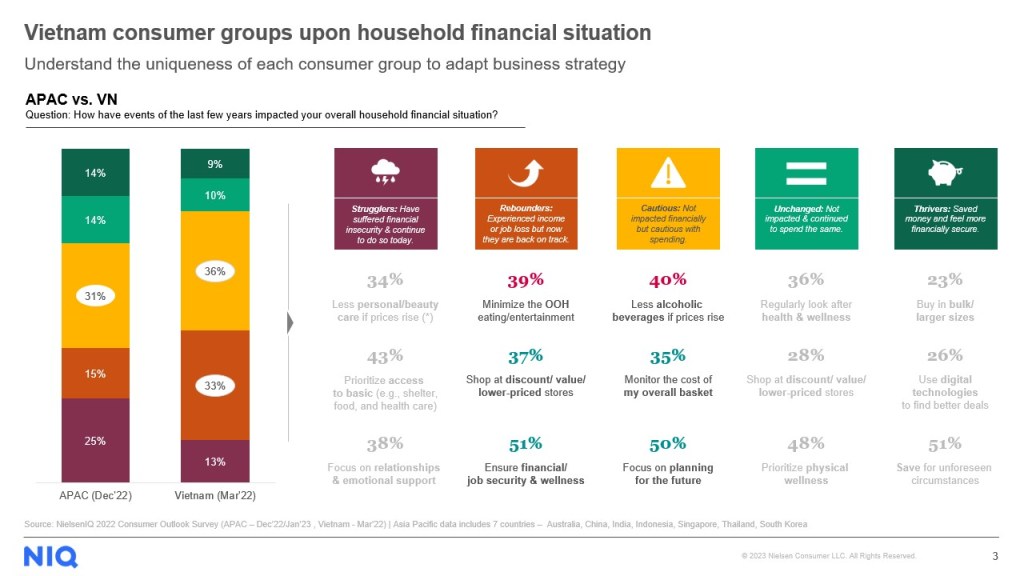

According to NIQ’s Consumer Outlook survey 2023, approximately 80% of consumers in the Asia Pacific region are likely to alter their shopping preferences this year. This trend is reflected in Vietnam’s FMCG industry, where consumers have shifted from wants to needs: essential items such as staple foods, milk-based products, home essentials and personal / beauty care have become the top priority.

When we look at consumer segments as per NIQ’s Economic Divide research, which segments consumers into five distinct groups based on how their household financial situation has been impacted in response to recent economic and societal pressures, we see that 70% of consumers in Vietnam fall within the “Cautious Spender” and “Rebounder” groups — an important factor impacting spending decisions. And while both groups have different approaches to managing their expenditures, both are focused on making smarter purchases and finding better value. By reducing alcohol consumption, minimizing out-of-home expenses, and shopping more frequently at discount stores, these consumers are making every dollar count. Additionally, if prices rise in the next three months, these consumers will likely cut back on discretionary items such as snack confectionery and alcoholic beverages.

This does not mean that reducing prices is the key to drive growth for your brand — consumer behavior is more complex. While affordability is important for Vietnamese consumers, they are also willing to pay a premium for products that meet their specific needs and preferences. Health consciousness is also on the rise and there is a growing demand for healthier snacks, packaged foods, and beverages. Premiumization and brand recognition can offer companies in Vietnam significant opportunities for growth, as long as they address the specific needs and values of their target consumers.

Key Strategies for FMCG Industry in Vietnam

As the FMCG industry continues to evolve and adapt to changing consumer behavior, there are several strategies that manufacturers and retailers in Vietnam can adopt to remain competitive:

- Understand the spending intentions to build adaptive strategies amongst different consumer groups.

- Review resources spent on the entire portfolio and give higher priority to the essentials category.

- Drive growth through bigger pack sales and value-offering communication to consumers.

- Monitor the out-of-home landscape, and seek out the occasional consumption of non-essentials, yet be cautious about the pricing strategy.

- Build consumer trust — it is critical given that familiar and popular brands are considered “safe choices” with certified quality.

The FMCG industry in Vietnam has experienced remarkable growth lately, thanks to the shift in consumer behavior and preferences. However, with inflationary pressures and evolving consumer priorities that could potentially impact sales and profits, it’s crucial that FMCG businesses keep a close eye on their pricing strategies. By tailoring their approach to meet the specific needs and values of their target consumers, manufacturers and retailers can unlock exciting growth opportunities and cement their place in the Vietnamese market.

Get the full picture of Vietnam’s FMCG industry

Navigate the shifts in consumer behavior and retail landscape, with the most accurate and trusted data in the industry. Book a meeting with us to see how we can help you make data backed decisions for your business.