Inflationary concerns impact Black beauty consumers

Concern over persistent inflation is top of mind for Black shoppers of all economic backgrounds. 51% are extremely concerned about prices increasing for everyday items and coping with higher prices by using coupons (42%) and stocking up when items are on sale (49%).

However, the story is more nuanced when you look below the surface. Black households above the median US income continue to enter the market, and drive sales in the luxury beauty space — sales of luxury facial skin care, cosmetics and nail grooming and fragrances are outpacing those of products sold in the mass beauty category. On the other hand, Black households below the median income are buying less product or being priced out of the industry altogether.

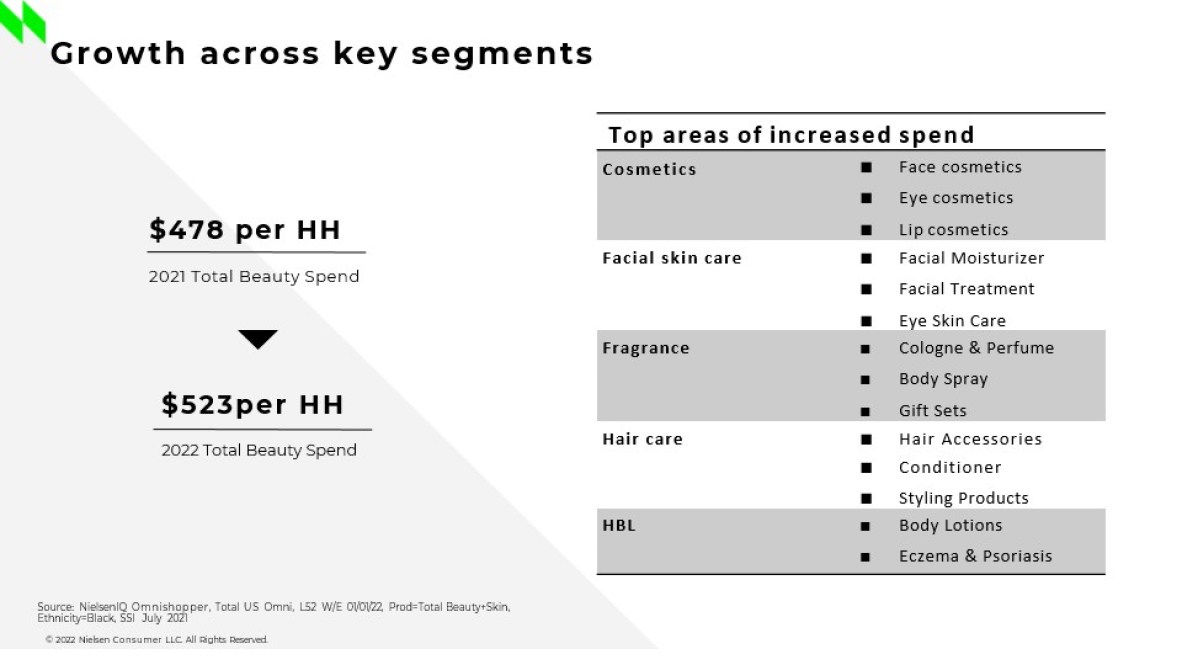

Despite economic uncertainty, Black consumers continue to invest in beauty. As a group, Black Americans are increasing their spend on beauty products at a slightly faster rate than the total US market. During the latest 52 weeks, Black consumers spent $8 billion on beauty and black cosmetics – a 10% increase compared to the total market’s 9% growth.

How Black consumers shop beauty

As a group, Black shoppers are spending more on beauty across categories both online and instore:

When it comes to where Black consumers shop beauty, they’re filling up their online baskets in increasing numbers (across income levels). As a result, e-commerce spending among Black consumers is surpassing in-store spending on a per-buyer basis ($323 per buyer vs. $293).

Amazon.com is the number one beauty outlet among Black consumers across household incomes followed by Walmart, Target, and department and beauty stores. Reaching Black consumers will mean solidifying offerings online as well as in their top-5 retailers.

Black beauty shoppers are also choosing from a mix of well-known direct-to-consumer merchants and smaller Black-owned offerings across skin (Fenty Beauty and Dermstore) and hair care (Mielle, Prose, and K18) cosmetics (Perbelle, IL Makiage), and fragrances (Dossier, Jomshop). The most significant growth in Black-owned and founded brands is occurring in hair care and hand and body lotion.

Meeting the moment with authenticity

Acquisitions of Black-owned and founded brands are eliciting consumer concern for authenticity and altered ingredients — maintaining trust while transitioning and growing should be a core principle for any brand engaging with Black consumers in 2023. Engaging authentically and paying attention to the value equation will go a long way for beauty manufacturers in 2023.

As concerns over rising inflation and economic uncertainty continue to weigh on many Americans, reevaluating shopping lists to prioritize essential items is becoming a common practice. In this challenging landscape, it is crucial for beauty brands and retailers to monitor how Black consumers are affected and respond accordingly to ensure continued engagement with this important demographic.