Consumer concerns and impact on spending

In the current economic climate, 53% of Indonesian consumers claim to be better off financially, much higher than the global percentage of 26% and APAC percentage of 36% for consumers feeling financially better off, according to our latest Consumer Outlook survey.

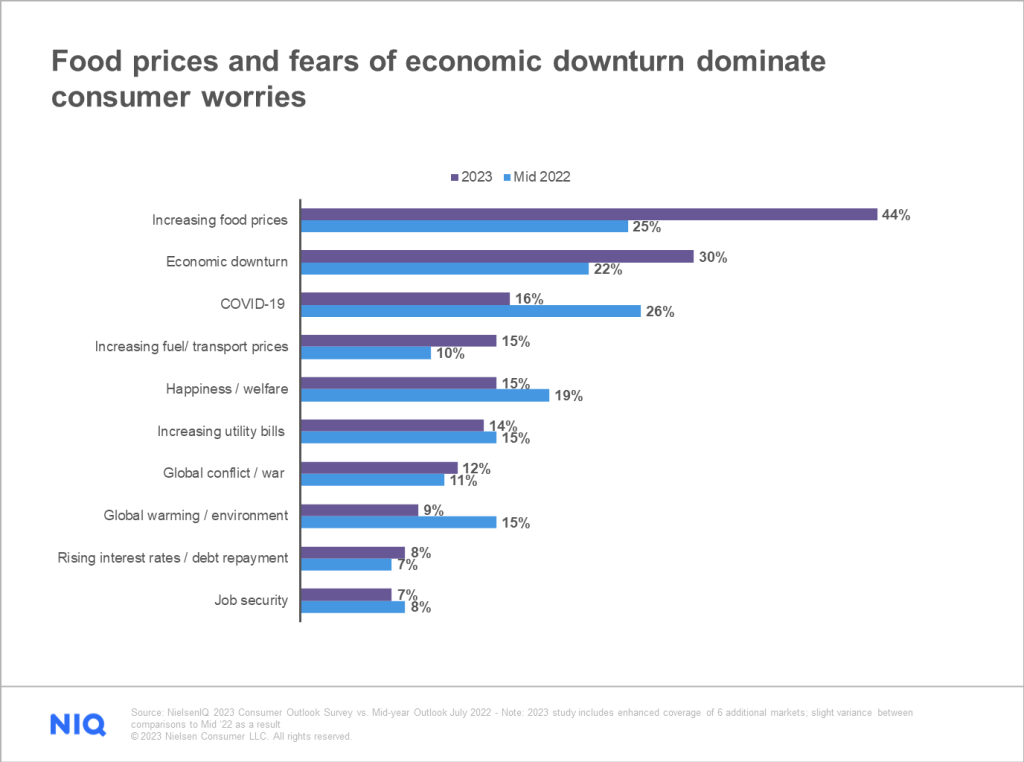

However, despite the positive attitude, consumers are wary of spending and have adopted a cautious mindset. Almost one in five Indonesians (18%) also feel that they are financially worse off. This is giving rise to Indonesian consumers saving more and watching their spend. The top three reasons for their caution are rising food prices, fears of an economic downturn, and the ongoing pandemic disruptions, respectively.

These concerns have shaped the spending tone for Indonesians in 2023. According to the Consumer Outlook Survey, the priority of saving for unforeseen circumstances rose from 5th to 4th most important in the ranking at 58%. The top three spending priorities for Indonesian consumers are physical wellness (70%), followed by planning for the future (64%) and mental wellness (60%), similar to the previous round of the survey conducted in May 2022.

Source: NielsenIQ 2023 Consumer Outlook Survey vs. Mid-year Outlook July 2022

Understanding the saving strategies

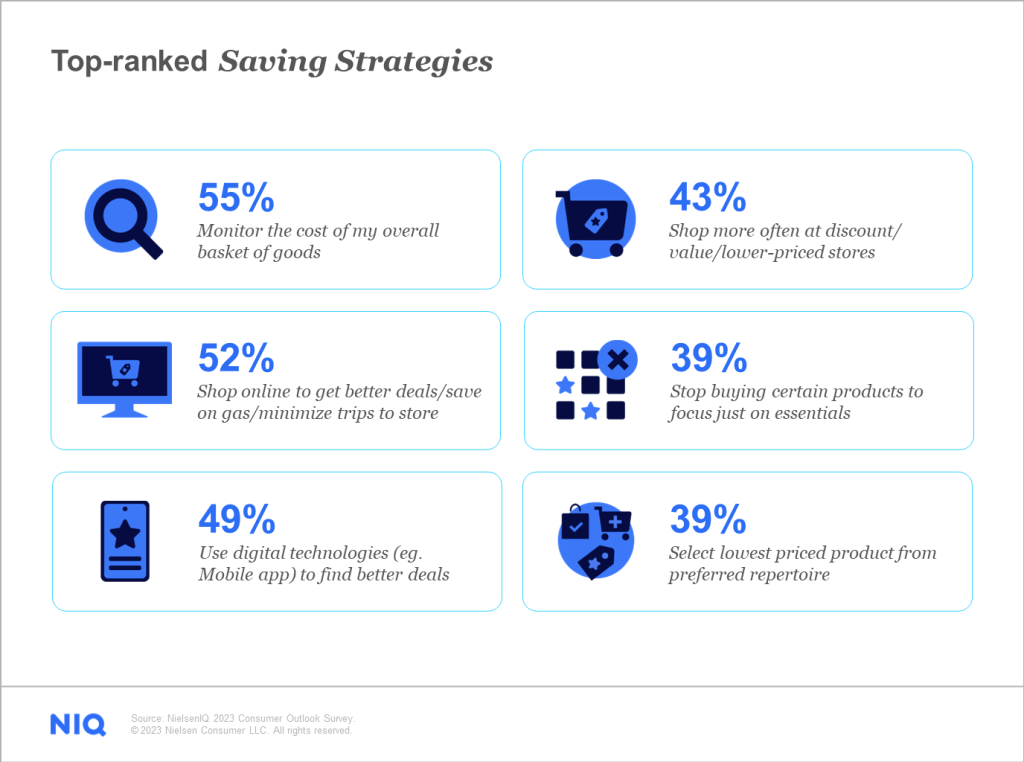

As the general consumer behavior has shifted towards more savings, this does not necessarily mean consumers have halted consumption. Instead, consumers have employed different strategies to reduce spending and are being more proactive in finding” good deals.” They want to make sure their overall basket cost is well within their individual budgets. In terms of the preferred strategies among Indonesian consumers to save money, monitoring costs is at the top, followed by online shopping.

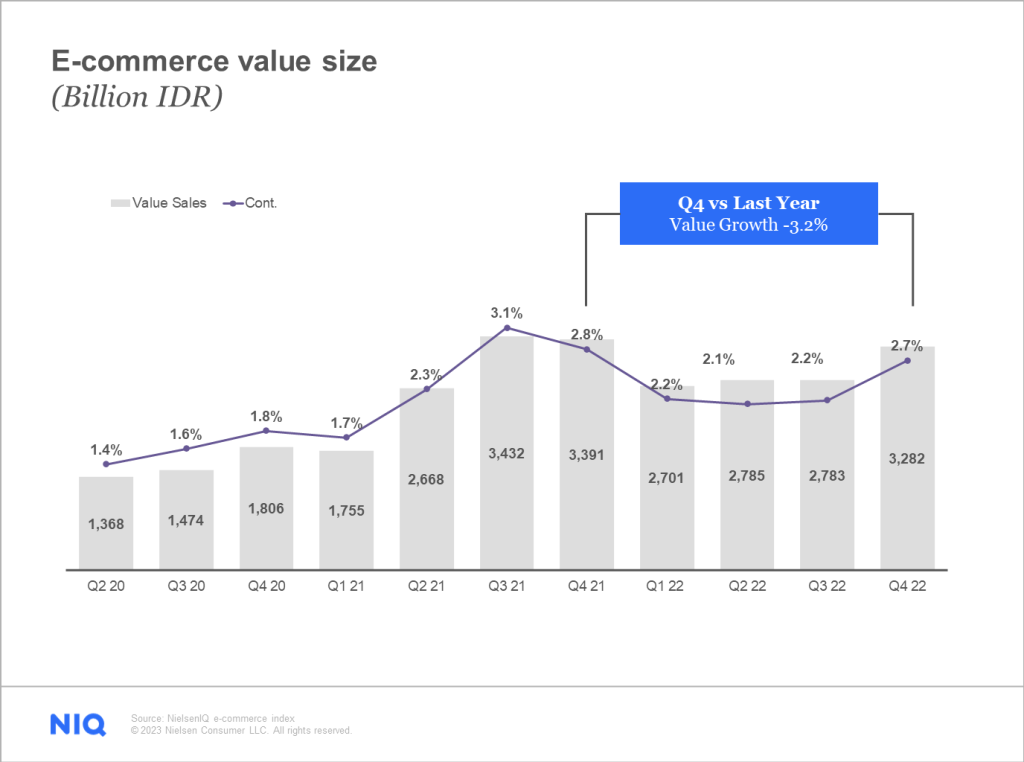

Indonesia’s E-commerce market bounces back

As Indonesians continue to seek better deals, online (e-commerce) continues to be an important channel in the Indonesian market. The overall e-commerce value grew to 2.7% in Q4’22.

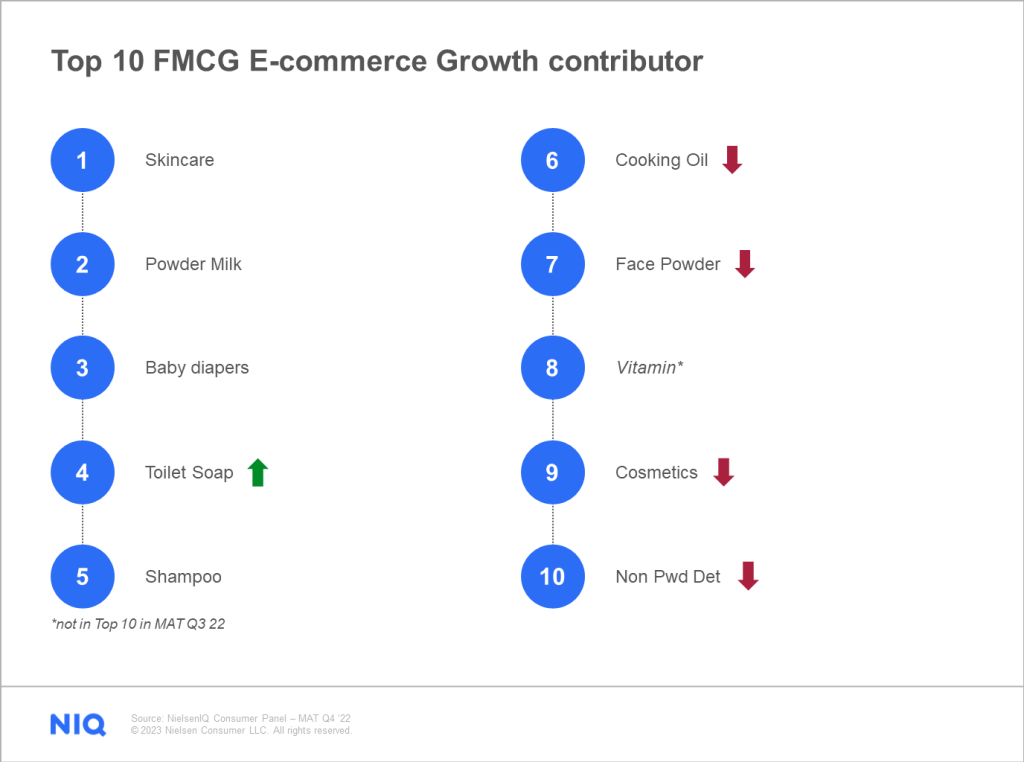

FMCG e-commerce continues to grow across socioeconomic status (SES), driven by higher purchase frequency and an increase in the number of categories being purchased online. When we look at the contribution of top FMCG e-commerce categories to total FMCG, skincare, cosmetics, cologne, face powder, and foundation maintain over 10% contribution, and we are seeing ecommerce play a larger role across categories.

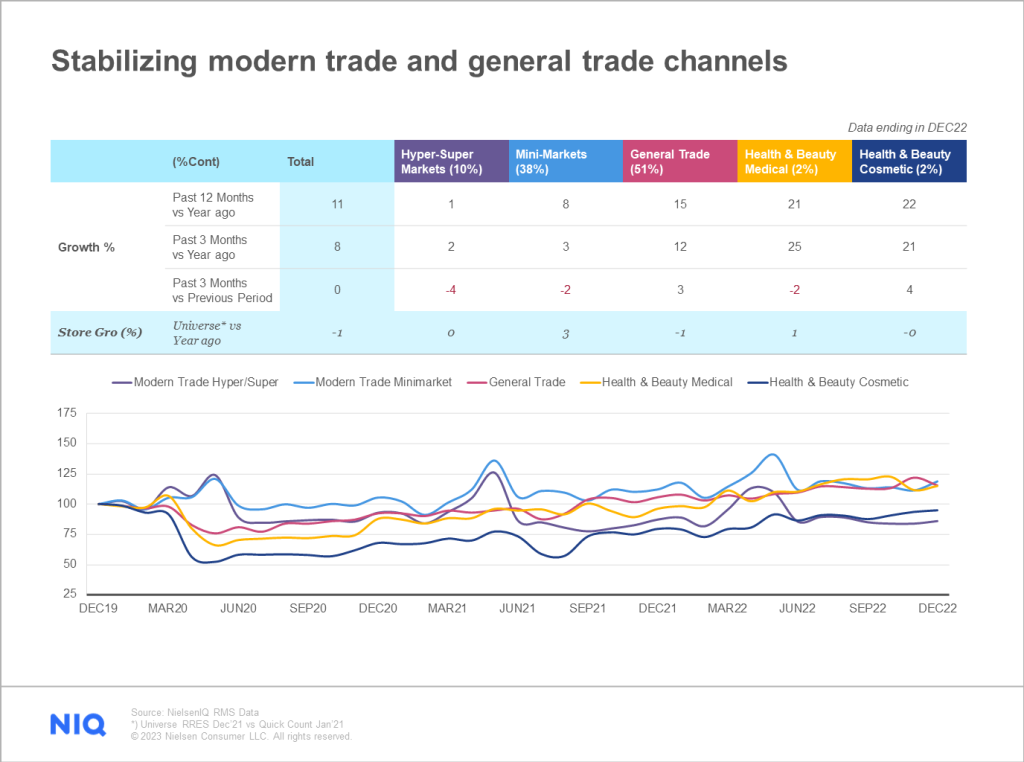

Stabilizing modern trade and general trade channels

All channels except e-commerce have been maintaining a stable value in the past 6 months, with the most recent spike happening between March and June of last year thanks to the festive period. Modern Trade Hyper, Super, and Minimarkets were the channels that experienced the spike.

Pricing and category outlook

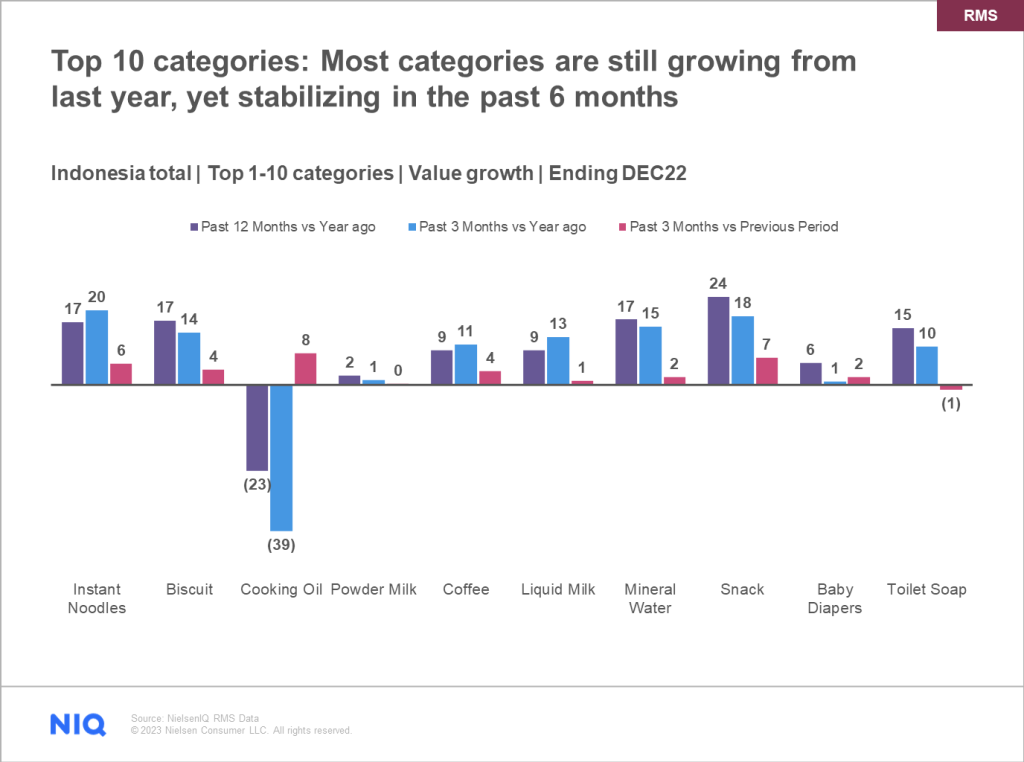

Both FMCG and cigarette sales stabilized in the latter half of 2022, but the price increases slowed down the growth in Q4’22. However, the growth was still higher when compared to the same period in the previous year.

We also see a tendency to buy small packs, to counter inflationary pressures, among Indonesian consumers. The price increases are impacting different SES groups and they are making choices to manage their spend.

Despite the current conditions, groceries and household items remain central to 2023 consumer spending intentions. Instant noodles, biscuits, and cooking oil are some of the top categories driving growth for FMCG in Indonesia.

Future Focus: How to navigate the industry implications of consumer behavioral shifts

Here are some strategies that manufacturers and retailers can use to navigate the shift in the consumer and retail environment in Indonesia.

- Manage your portfolio – As consumers respond to inflationary pressures by rationalizing their purchases, manufacturers and retailers need to regularly assess and identify what items are being considered “non-essentials.” This will allow them to reprioritize their portfolio of products and adjust their value propositions to add value for their consumers and meet shoppers’ evolving needs.

- Ensure meaningful differentiation – While consumers continue rationalizing their purchases, it does not mean they have stopped seeking genuine connections and representations in brands. Manufacturers and retailers must ensure their brands possess meaningful differentiation in order to stand out and maintain continued interest from buyers.

- Strategic innovation – Avoiding product portfolio stagnation is essential to surviving the current economic hurdles. Especially when consumers are seeking to justify the necessity of all their purchases. Manufacturers must explore proactive “renovation” to maintain appeal and excitement for consumers to buy their brand.

- Cater to Health and Wellness needs – Health and Wellness is a growing concern among consumers. However, the cost of many of these products is considered prohibitive, especially by those who feel they are financially worse off. Manufacturers need to cater to these cost pressures by enabling affordability across a spectrum of healthy goods.

Get the Full View™ of Indonesia’s FMCG industry

Navigate the shifts in consumer behavior and retail landscape with the most accurate and trusted data in the industry. Book a meeting with us to see how we can help you make data-backed decisions for your business.