Czech consumers remain cautious spenders

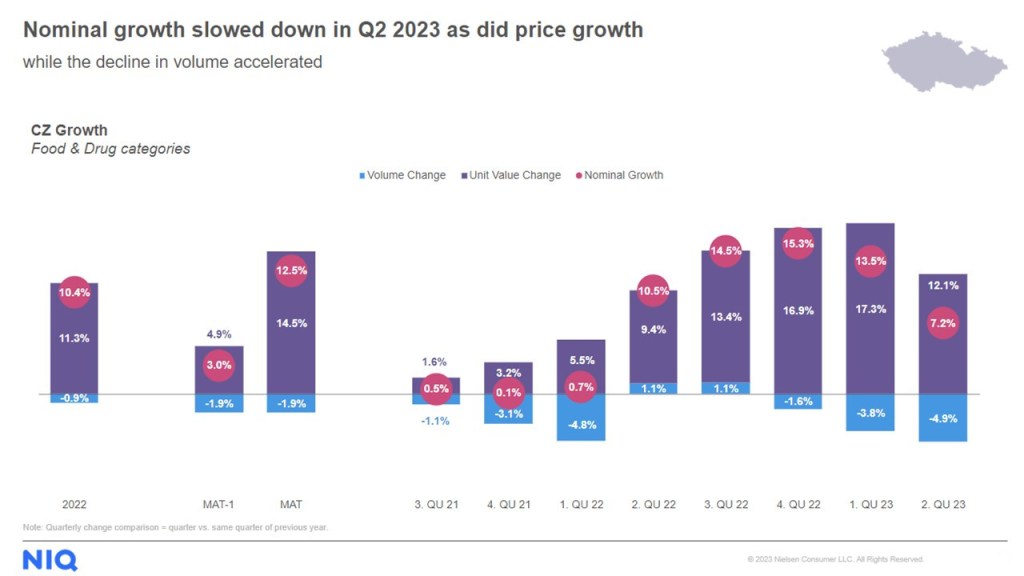

Inflation, which had been a looming concern, began to decelerate in the Czech Republic in the first half of 2023, aligning with a noticeable uptick in consumer confidence. One might have assumed that these changes would manifest in the shopping habits of Czech consumers and those would start moving away from the inflationary shopping mindset. Despite the abating inflation and growing confidence, Czech consumers seemed inclined to retain their saving-oriented approach, leading to a decline in the overall volume of food and drug purchases. The overall volume of consumer-packaged goods (CPG) declined in Q1 by 3.8%, in Q2 even more so (- 4.9%).

Which categories saw volume declines?

Amidst this economic landscape, not surprisingly, discounters emerged as a channel most resiliently coping with the prevailing consumer behavior. Their nominal growth rates outpaced the rise in prices, as a result of their ability to cater to evolving consumer preferences.

In the world of food categories, the volume drop persisted throughout the year, accompanied by persistently high price growth in most of the top categories, often exceeding general inflation rates. Instances of shoppers downtrading to cheaper options kept noticeable with categories like chocolate tablets and soluble coffee showcasing clear signs of this trend. Interestingly, certain exceptions such as butter experienced a price decline of over 6% in the first half of 2023 (compared to the same period of 2022), coinciding with a consumption increase of more than 3%, but still reflecting a downtrading phenomenon. Certain categories like flour and oils or juices and carbonated soft drinks experienced significant volumetric declines, raising questions about potential factors such as consumers reducing the amount of stockpiling of those products and on contrary using up previous stocks. The question of cross-border shopping, especially in Poland, comes to the fore again as one of the major banks in Czechia releases the figures on the increase of this phenomena stating: “Average monthly card payments for groceries in Poland are nearly 8 times higher than those in 2019.1

For the majority of top drug categories, volumetric effect is also negative. Double-digit volume decline throughout the first half of 2023 (compared to the same period a year ago) experienced categories such as laundry liquid detergents, laundry softeners, dishwasher detergents, and more.

How are consumers coping with challenges?

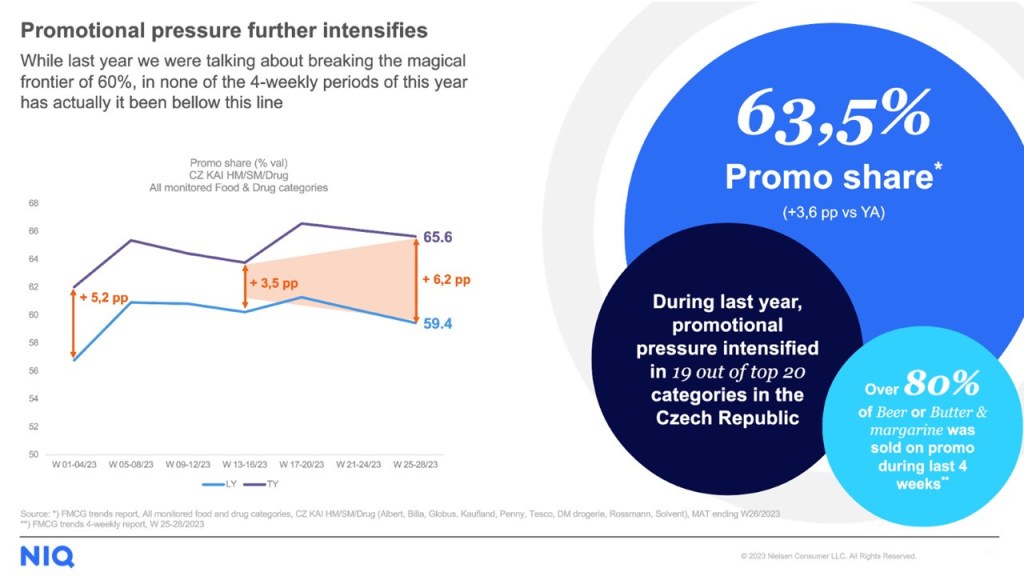

In the face of inflationary trends, consumers have consistently relied on 2 prominent coping strategies: private labels and promotions. Private label share surged significantly over the past year and a half, reaching new heights. While the rate of growth may have slowed down slightly, their continued prominence underscores their value in providing consumers with cost-effective alternatives.

The story of promotions follows a slightly different trajectory, confirms Karel Týra, NIQ Managing Director for Czech Republic, Slovakia and Hungary:

“Not only can we not say that the rate of growth is slowing down in last couple of months, but the trend rather even intensifies. In last quarter, almost two-thirds of all the CPG goods in Czech super- and hypermarkets were purchased while on promotion, while a year ago, we were talking about breaking the magical frontier of 60% only. This demonstrates an enduring affinity for promotional offerings among Czech consumers.”

The FMCG landscape in the Czech Republic stands as a testament to the intricate interplay between economic factors, consumer behavior, and retail strategies. The transition from pandemic to inflationary concerns has yielded a cautious consumer base that has adapted its purchasing habits while maintaining an enduring reliance on private labels and promotions. As the economy continues to evolve, businesses and retailers will need to remain attuned while crafting strategies to succeed in the evolving marketplace, among changing preferences of Czech consumers and navigating the shifting tides of the FMCG sector.

Sources:

1: How did Czechs spend on food in neighboring countries? Economic and strategic analysis of the Czech Republic, LinkedIn: Tereza Hrtúsová