Innovation snapshot

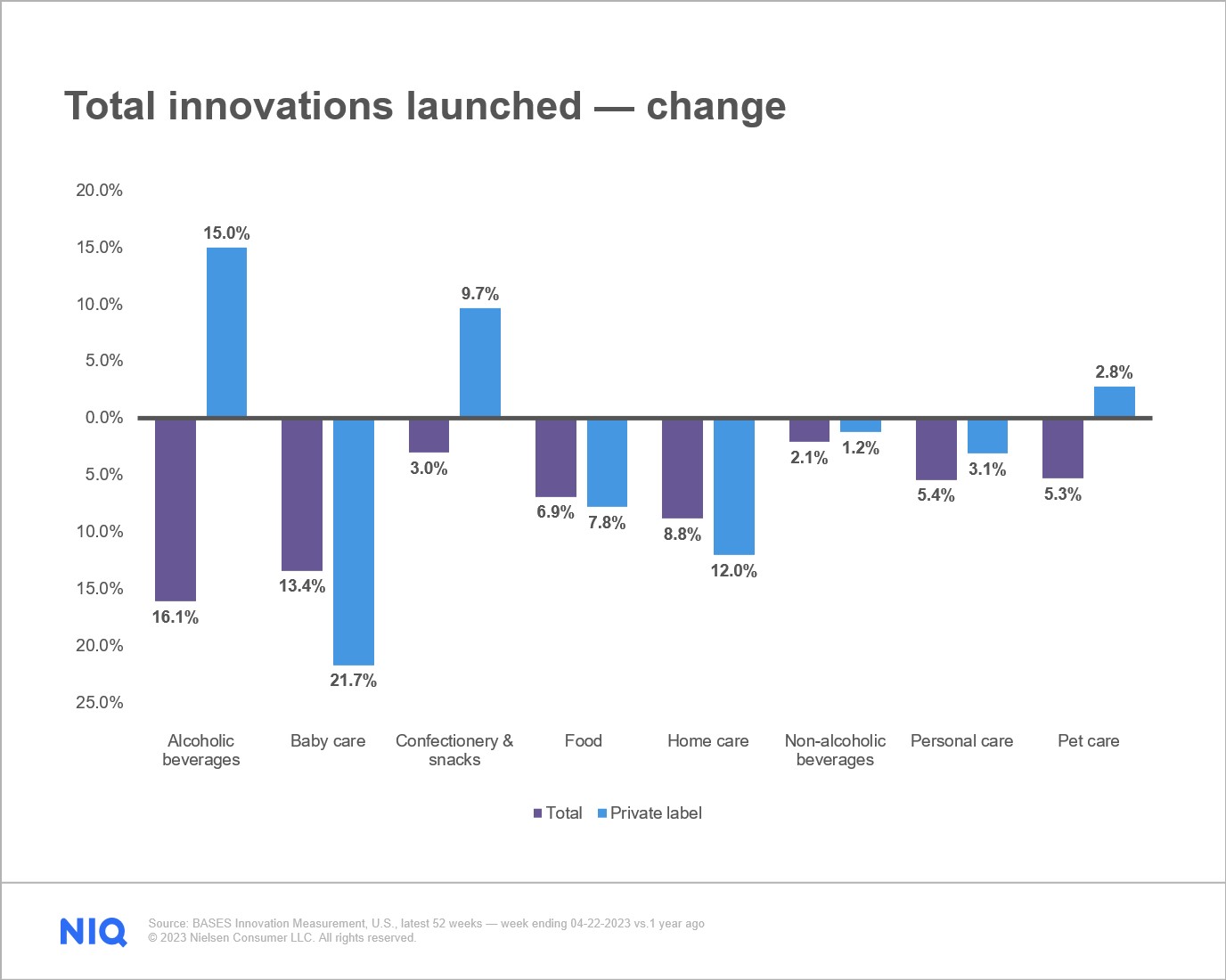

In recent years, innovations launched in the U.S. have nosedived across all FMCG categories. However, from April 2022 to April 2023, we observed some positive trends in select categories for private label innovations — even as the trend remains generally negative for all other categories.

Alcoholic beverages, confectionary and snacks, and pet care are the categories showing growth in the number of innovations launched, with the alcoholic beverage category leading the way with a 15% increase.

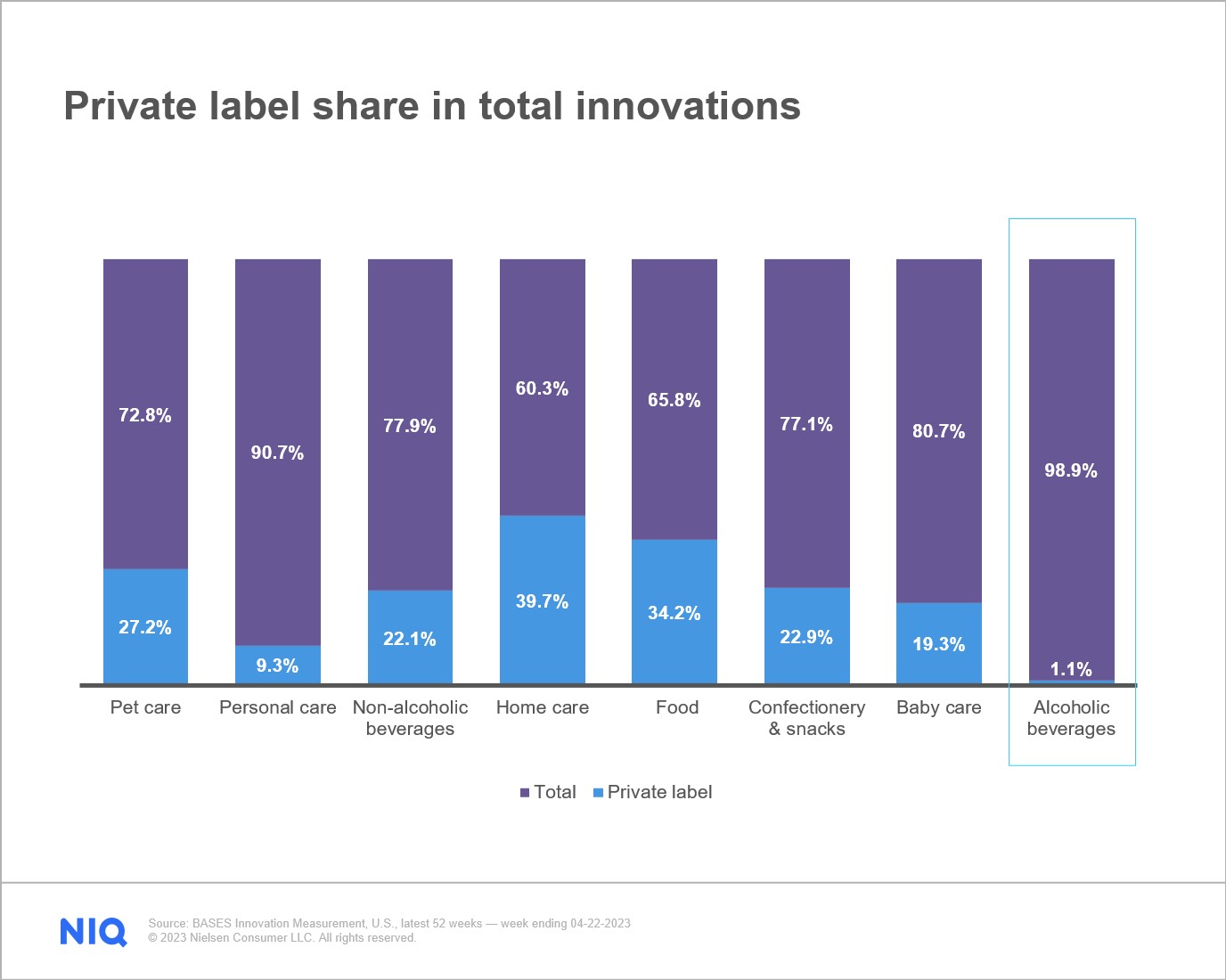

Even with this 15% increase, private-label innovations still represent only 1% of alcoholic beverages’ innovations. As such, there are plenty of potential growth opportunities for retailers to expand their portfolio in the alcoholic beverages space.

A closer look at the shelves

In the past few years, private label items have slowly been moving away from their traditional role as the budget-friendly, knock-off alternative to branded items. Instead, when consumers purchase private label items nowadays, they receive reasonably priced items that get the job done. Consumers are no longer considering private labels to be less than their counterparts; rather, the quality has notably improved. However, with this increase in quality also comes an increase in price, as we saw between April 2022 and April 2023.

The price of private label innovation

Most categories mark higher prices for private label innovations, even when the general category trend goes the other way. For example, we frequently see this in food, home care, and pet care categories. However, the highest price hike comes from non-alcoholic beverages, which counts for a staggering triple-digit increase.

Interestingly, the direct opposite of non-alcoholic beverages — alcoholic beverages — measured the most significant decrease, as opposed to the former’s greatest increase. The 2 opposing categories are experiencing completely opposing trends.

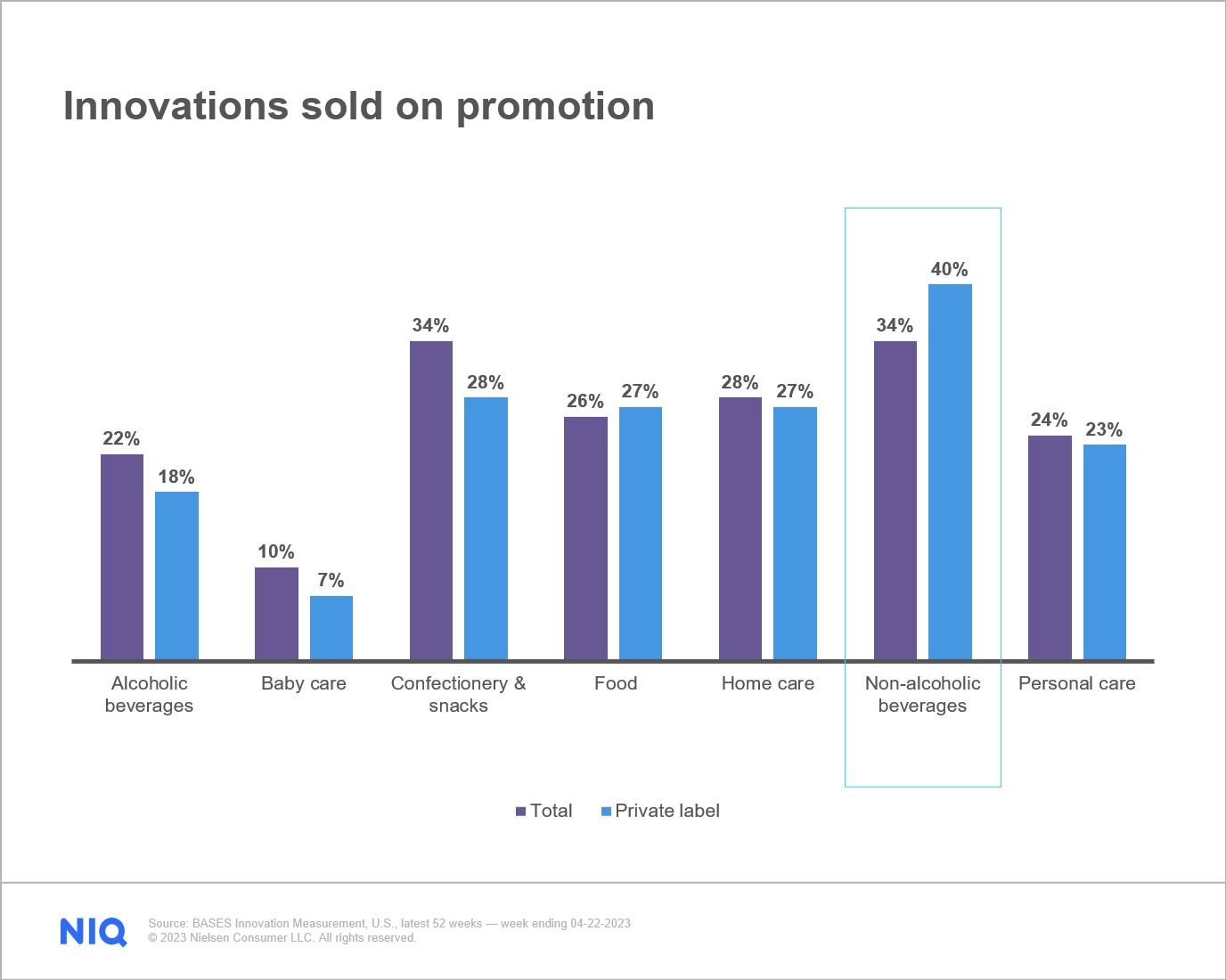

Innovations sold on promotion

Non-alcoholic beverages also lead by another measure: innovations sold on promotion. In fact, in this category, private label innovations outnumber the innovation amount for the entire non-alcoholic beverages category, leading with 40% compared to 34%.

Overtaking their branded counterparts with a 6% lead, private-label non-alcoholic beverages have the highest share of innovations sold on promotion across all categories.

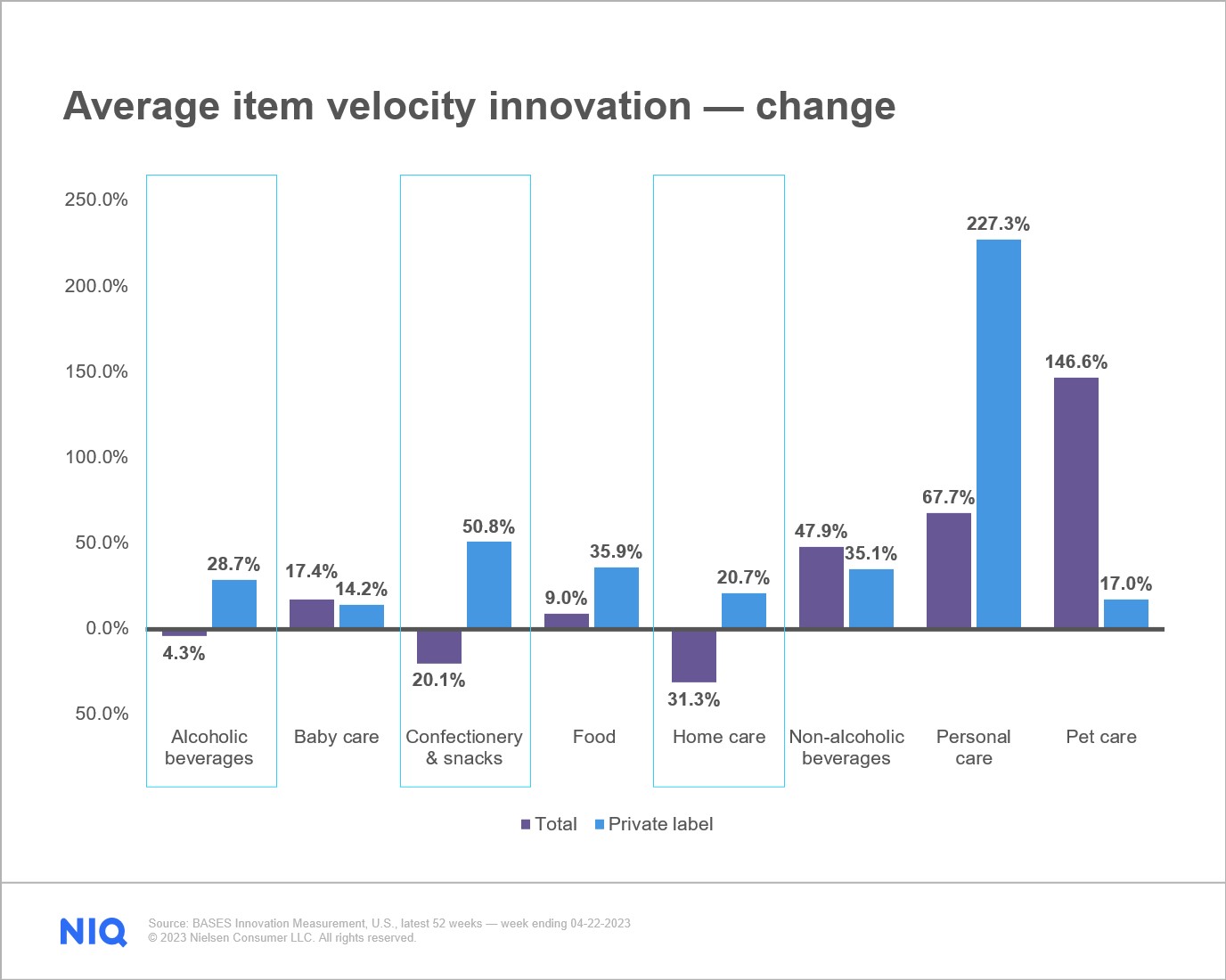

Private label innovation increases FMCG shelf turnover rates

We also see private labels’ growing innovation dominance in U.S. shelf activity: retailers’ new launches have increased shelf turnover across all FMCG categories.

All private label innovations show growth in innovation velocity, whereas, in some categories, we see a decrease with branded products. In alcoholic beverages, confectionary and snacks, and home care, private labels measured double-digit growth compared to the innovation velocity decline across the total category.

Innovation is vital for growth

Private label innovations are no longer simply the cheaper, more accessible option. As more and more retailers launch new products, private-label items are shaking off the traditional stigma of being ineffective or low-quality. Velocity is on the rise, prices are growing, promotions are more frequent, and private label growth poses serious competition to brands.

Today’s market calls for innovation

As you start planning for 2024 and beyond as a manufacturer, you’ll need to take measures to ensure you don’t lose sales to private labels. If you’re a retailer, there is a window of opportunity to create a strong innovation pipeline that, when executed correctly, will boost your profits and accelerate your private label growth.