CPG inflation rate slows but remains higher than pre-pandemic norm

The CPG unit price increase rate for March came in at 8.8%, marking the lowest level since November 2021 but still well above the normal 2-3% range. While overall inflation has slowed for seven consecutive months, CPG increases remain higher than the Consumer Price Index (CPI), which increased just 0.1 in March and 5% from a year ago. The high rate of CPG unit price increases remains a cause of concern for many consumers.

Tracking grocery prices

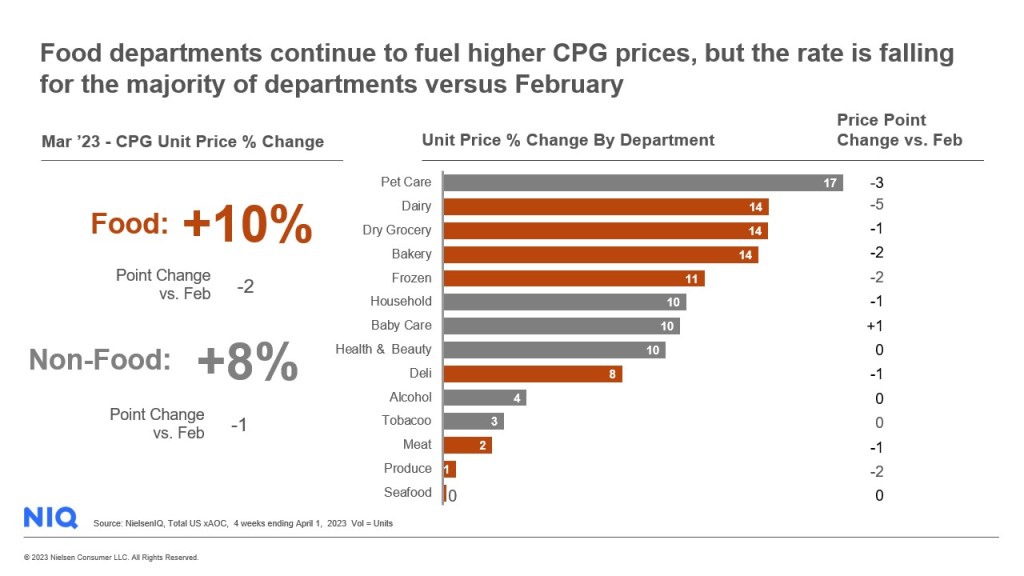

The declining consumption of CPG products compared to the same period last year is a concern for the industry, particularly as food inflation continues to lead the charge at 10%, with a consumption decrease of 2%. Non-food prices increased by 8%, but unit sales declined by 4% compared to March 2022.

However, the rate of inflation declined for most food departments in March when compared to February rates:

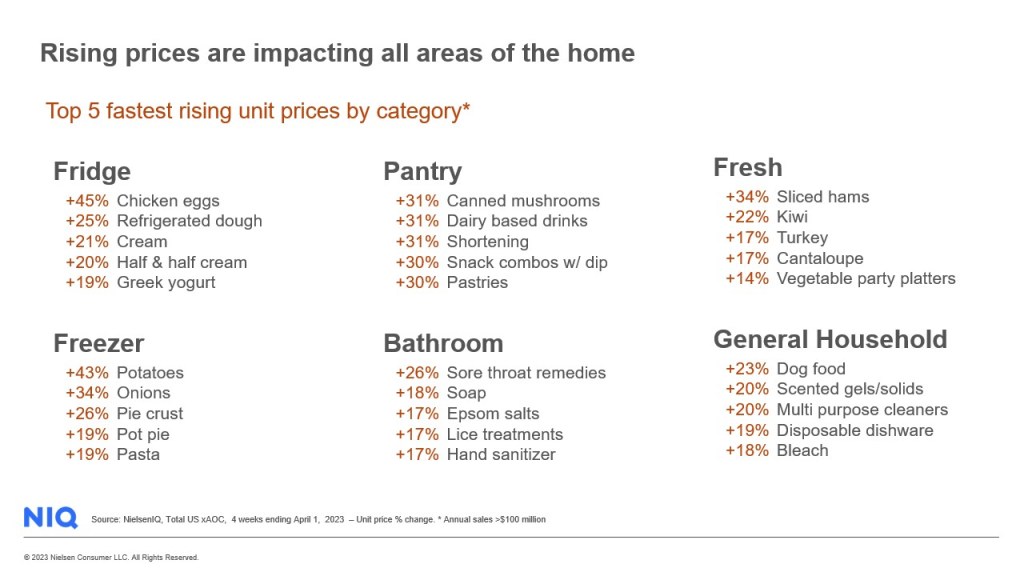

By tracking grocery prices at the category level, we see that the cost of many essentials (notably eggs, cold medicine, soap, and dog food) continues to climb:

As prices continue to stabilize, retailers and manufacturers must continue to seek new drivers of growth, such as innovation, promotion, and targeting growing consumer cohorts such as the aging population and multicultural communities.

Consumer behavior update: Private label sales, value retailer switching, and promotions

Private label sales, which on average provide 10% savings compared to national brands, maintained growth in March, up 9% as consumers sought value for money. Private Label captured 19.2% of the consumer wallet for CPG sales during this month. Retailers with well-established and diverse private label offerings will continue to benefit from this shift in brand choice.

The importance of value-based retailers is still increasing, with shoppers turning to stores with lower prices. Value retailers’ sales jumped 8% in March compared to the previous year, capturing 42.6% of CPG sales, with food being the primary driver of their share gains, with an impressive 16% increase in dollar sales versus the past year.

Promotional sales remain a key driver of growth, with 50% of shoppers willing to stock up when their brand is on sale. However, retailers must avoid promoting too aggressively to win back shifted share, as this is not a sustainable profit strategy. Promotions should be used purposefully to build brands, not to undermine loyalty.

So while there is a slowdown of CPG inflation rates, there is still a long road ahead of us to return to pre-pandemic levels. Retailers and manufacturers must focus on innovation, promotion, and value for money to drive growth and meet the needs of today’s consumers.