Grocery inflation trends: Price surges and consumer spending patterns

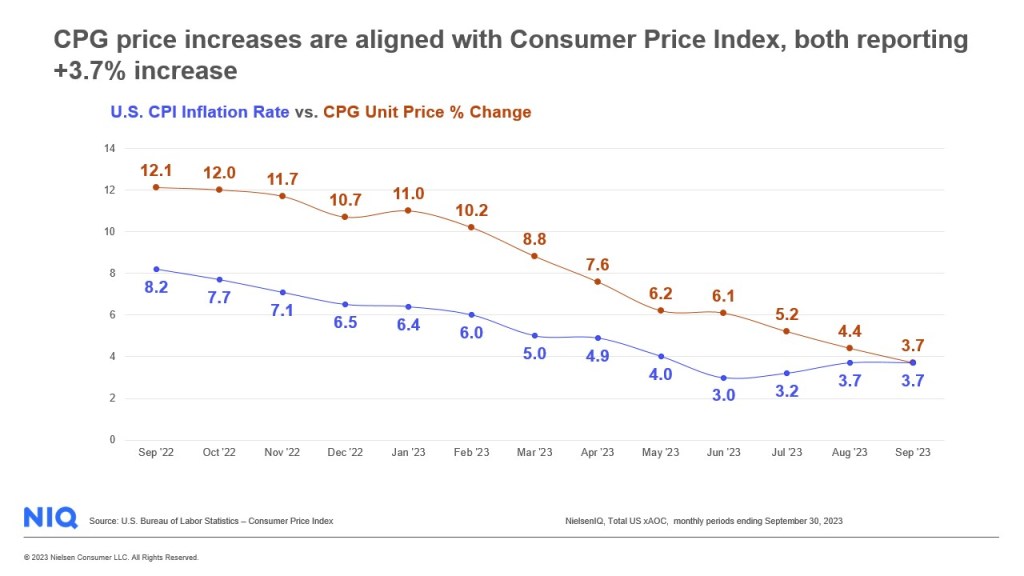

The CPG market has witnessed sustained price increases, albeit at a slower pace, marking the lowest rate of growth since June 2021 in September. The unit price hike for CPG products reached +3.7%, showing a decrease of -0.7 points from August.

This aligns with the overall inflation trend, which displayed a gradual softening in consumer prices. Notably, food prices rose at a rate of +3.4%, showing a more optimistic outlook compared to non-food items, which increased by +4.8%.

Declining consumption and the impact on sales growth

Although CPG sales growth continues to be primarily driven by rising prices, the pace of dollar growth has begun to decelerate due to a combination of lower price increases and reduced consumption levels.

Concerns loom within the industry as consumption rates continue to slide downwards in comparison to last year. While consumer spending may be on the rise, the number of items being purchased is dwindling.

September witnessed a modest +1.1% increase in dollar sales, juxtaposed with a concerning -2.9% decline in unit consumption.

Price impact across store departments

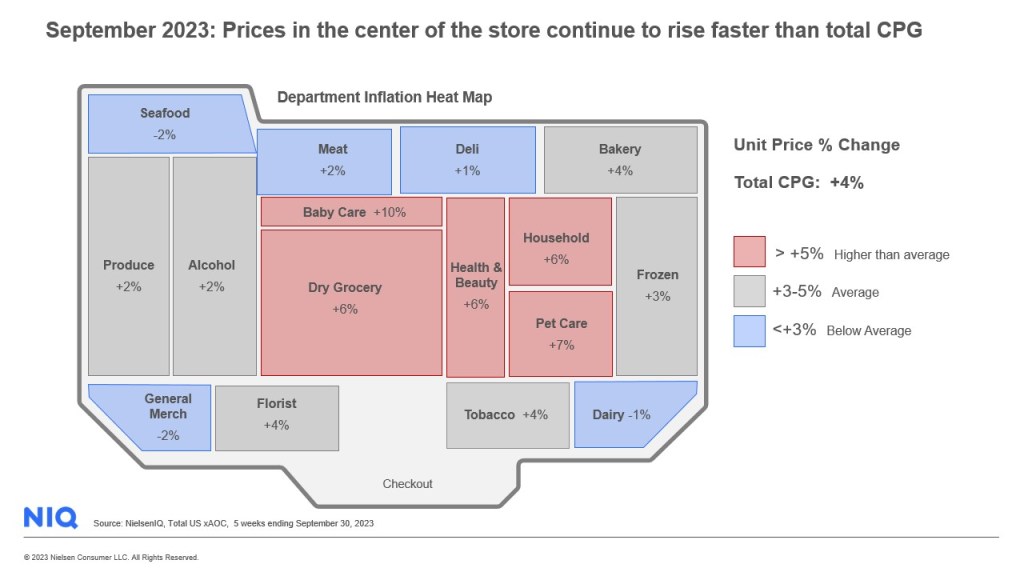

The ongoing surge in prices has significantly impacted various sections of retail stores. Declining consumption patterns are forcing consumers to focus their spending primarily on essential items.

Food inflation, while showing signs of slowing at 4%, still remains higher than the average rate, with a marked -2% decrease in consumption. Non-food items also experienced a +5% price increase, but the decrease in unit sales was more pronounced at -3%.

As prices stabilize, retailers and manufacturers must explore new avenues for growth, including innovation, promotional strategies, and catering to evolving consumer demographics such as an aging population and multicultural cohorts.

Departmental price fluctuations and consumer preferences

In this price-pressured environment, almost all CPG departments have felt the impact, with food departments experiencing notable fluctuations.

Dry Grocery (+6%), Bakery (+4%), and Frozen Foods (+3%) were the top three sectors experiencing price hikes within the food category. For non-food items, the leading departments with price increases were Baby Care (+10%), Pet Care (+7%), and Health and Beauty (+6%). Essentials in food and household necessities are expected to continue driving sales, given that 35% of consumers are intensifying their focus on purchasing essentials, marking a 3-point increase since October 2022.

Grocery inflation trends continue to evolve—retailers and manufacturers will need to pivot strategies and innovate to align with changing consumer behaviors, emphasizing value, essential purchases, and targeted promotional initiatives to stay resilient in this price-sensitive environment.

How consumers are coping

The current landscape of consumer spending is increasingly driven by the pursuit of value for money. Private label products, offering an average of 13% savings compared to national brands, have made a significant impact, capturing 19.3% of consumer spending in the CPG sector. Their growth has outpaced national brand sales by 8% in the past year, highlighting a shift in consumer preferences towards cost-effective alternatives. As prices continue to surge, a reported 31% of shoppers are turning to private label goods as a primary savings strategy, indicating a sustained upward trajectory in their market share. Retailers diversifying their private label offerings are poised to capitalize on this evolving consumer choice.

Consumers are actively changing their purchasing behaviors by gravitating towards stores offering lower prices, particularly in the wake of inflation. Value-based retailers have seen a notable uptick in sales, marking a 3% increase and claiming 42.7% of CPG sales in September. The food category notably contributed to the significant 11% surge in value retailers’ market share over the past year. As consumers seek out better deals, the assortment variance across retail channels becomes pivotal in breaking purchasing deadlocks. In scenarios where products are identical, the option with the lowest price consistently emerges as the victor.

In a climate where the cost of living is escalating, promotional sales have become a pivotal factor in consumer decision-making. Sales through promotions have notably outperformed non-promoted sales, showing a 6% growth versus a 1% decline, and accounting for 26.5% of dollar sales in September.

A substantial 50% of shoppers are inclined to stock up when their preferred brands are on sale, emphasizing the influence of promotions on consumer buying habits. However, a cautionary note is sounded against aggressive promotion as a sustainable profit strategy. The emphasis should be on purposeful promotion to build brands rather than undermining consumer loyalty.