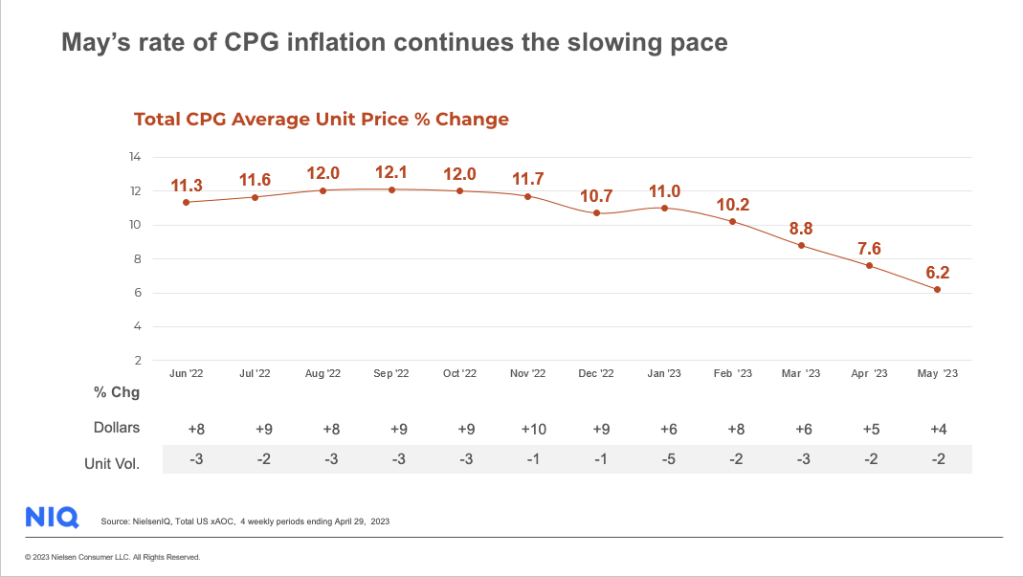

CPG inflation rate slows but remains higher than pre-pandemic norm

The US CPG unit price increase rate for May came in at 6.2%, marking the lowest level since August 2021 but still well above the normal 2-3% range. While overall inflation has slowed for eleven consecutive months, CPG increases remain higher than the Consumer Price Index (CPI), which rang in at 4.0% in May. The high rate of CPG unit price increases remains a cause of concern for many consumers resulting in declining consumption. Overall, consumers are spending more but purchasing fewer items.

The declining consumption of CPG products compared to the same period last year is a worry for the industry as 35% of shoppers are focused on only buying the essentials. The rate of food inflation is slowing but still high at 7% with consumption down 2%. Similarly, non-food prices increased 6% but consumers pulled back more so with a 5% decline in unit sales.

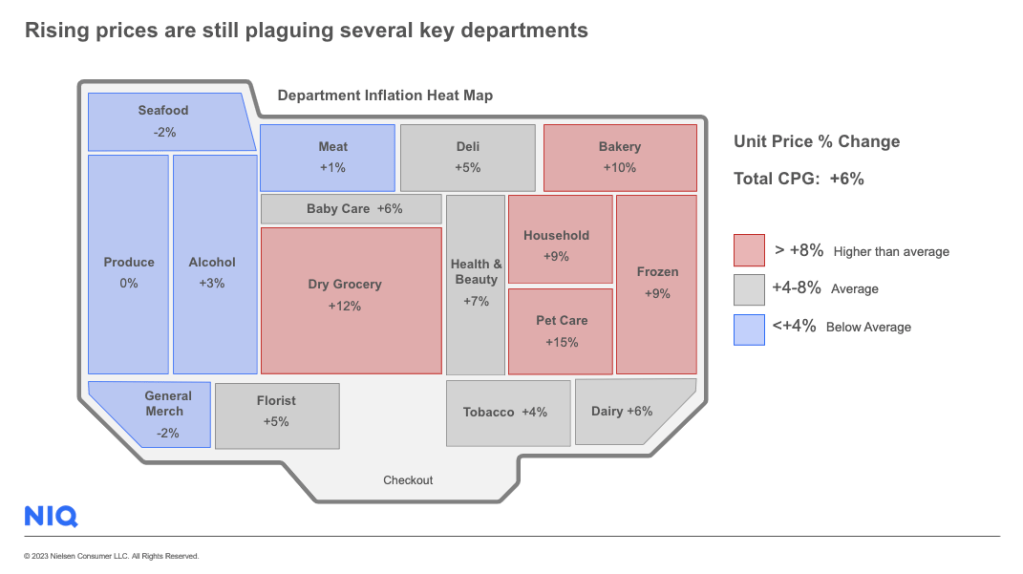

Rising prices are still plaguing key departments

Very few CPG departments are immune to rising prices as they continue to hit most areas of the store, driven by key food departments – Dry Grocery +12%, Bakery +10%, Frozen +9%, and Dairy +6%, reported the top 4 increases for food. For non-food, the top 4 increases were Pet Care +15%, Household +9%, Health & Beauty +7% and Baby Care +6%. Food will continue to fuel sales as consumers are scrutinizing their purchases with 35% of shoppers focused on buying the essentials (a 3 percentage point increase since October 2022).

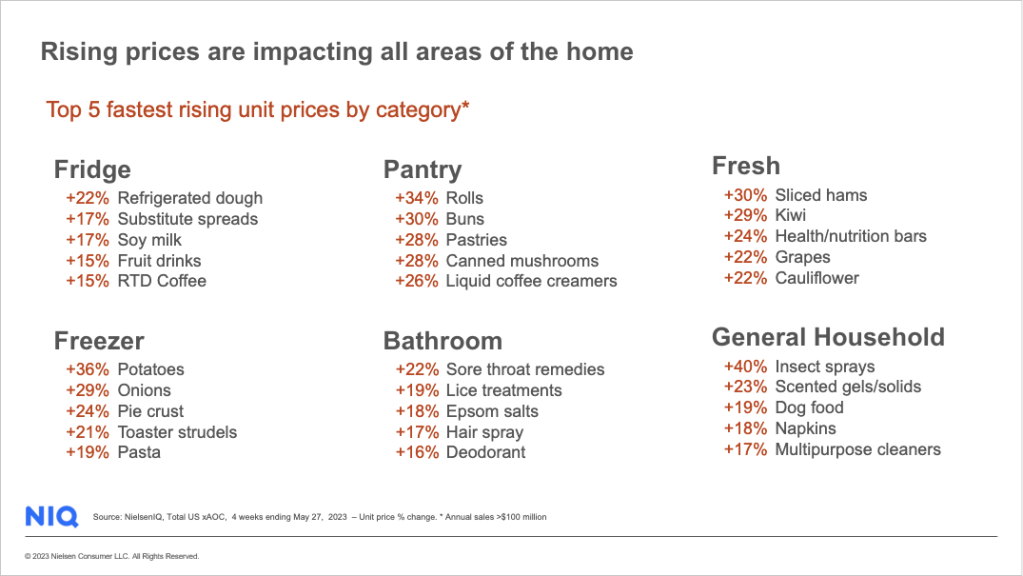

By tracking grocery prices at the category level, we see that many areas of the home continue to climb.

As prices stabilize in the months to come, retailers and manufacturers must continue to seek new drivers of growth as consumption continues to decline, such as innovation, promotion, and targeting growing consumer cohorts such as the aging population and multicultural communities.

Consumer behavior update: Private label sales, value retailer switching, and promotions

Private label sales, which on average provide a 13% savings compared to national brands, maintained growth in May, up 5%. Private Label captured 19.0% of the consumer wallet for CPG sales during this month. Retailers with well-established and diverse private label offerings will continue to benefit from this shift in brand choice.

The importance of value-based retailers is still increasing, with shoppers turning to stores with lower prices. Value retailers’ sales jumped 6% in May compared to the previous year, capturing 42.3% of CPG sales, with food being the primary driver of their share gains, with an impressive 15% increase in dollar sales over the past year.

Promotional sales, which increased 11% in May, remain a key driver of growth, accounting for 26.6% of CPG sales. However, retailers must avoid promoting too aggressively to win back shifted share as this is not a sustainable profit strategy. Promotions should be used purposefully to build brands, not to undermine loyalty.

Prepare for slower retail growth in the months ahead

Americans are keenly aware of rising prices and have adapted their shopping habits accordingly, seeking ways to save and make their budgets stretch further. However, in the coming months, the growth of the economy is expected to slow down, and the decrease in inflation rates will not offset the decline in consumer spending. In light of the new and unique challenges our market is facing, it is crucial to adopt a more strategic approach to capitalize on growth opportunities and gain market share within your specific category.

Moving forward, it is imperative to identify the key factors that drive and hinder your business. By doing so, you can concentrate on offering the right product, catering to the appropriate customer base, and establishing optimal pricing strategies. Additionally, it is essential to optimize your trade spend and ensure that it aligns with your business goals, working in your favor rather than against it. Collaborating closely with your retail partners is vital to executing the plan effectively and generating mutual benefits.