The current state of unsettled US consumer attitudes

Despite continued strength in December wages, concerns over inflation and possible recession eroded consumer confidence. Tech and Financial Make the News Cycle for Job Cuts. In the US, consumers are saving and shopping like the recession is here. NIQ research finds that:

- 59% of US consumers think they are currently living in a recession, vs. 53% in Mid 2022 — 49% expect to be in a recession for 12+ months

- 42% expect to spend more on grocery and household items in 2023

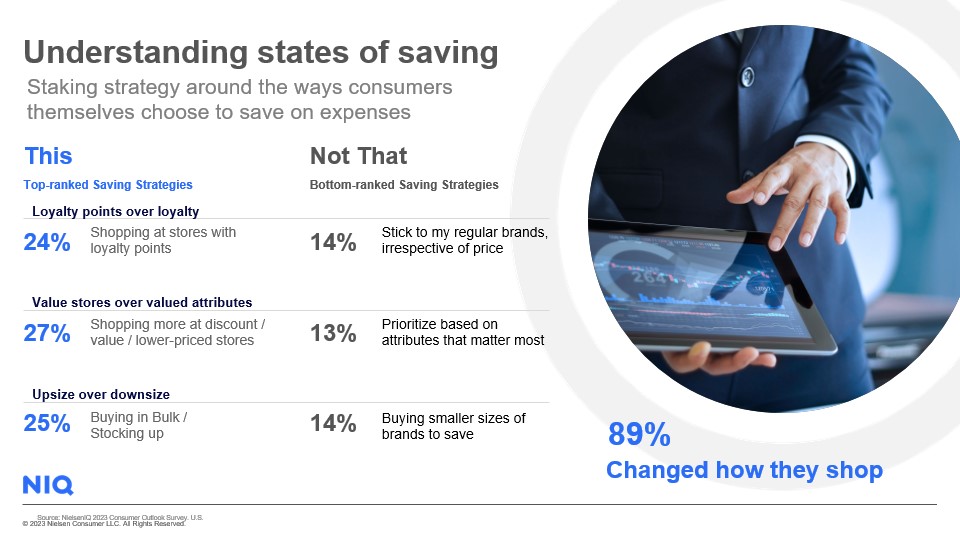

- Many are using multiple strategies to save money:

What’s next?

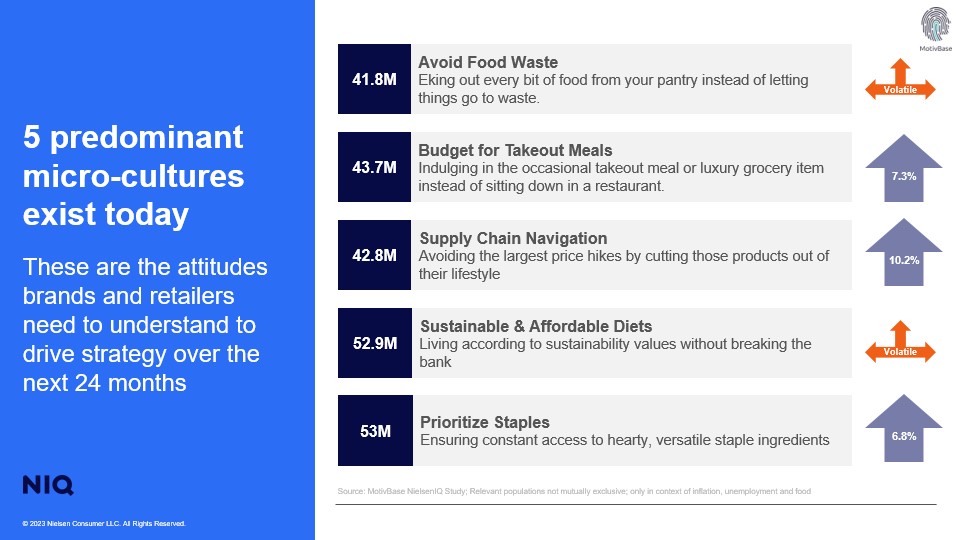

As a result of these mounting economic pressures and shifting mindsets, NIQ and partner MotivBase found that consumers are being more selective about which food items are staples, while also investigating more sustainable eating choices.

With the combined power of machine intelligence and PhD Anthropologists, MotivBase and NIQ conducted an observational study of consumer language to identify attitudes that CPG brands and retailers need to understand to drive strategy over the next 24 months:

The study confirms that shoppers are trying to adapt to this economic environment by bracing for extremes. The uncertain future has them in an ongoing state of skepticism. Consumers are safeguarding their households by anticipating purchases, planning for unexpected events, and saving for a rainy day. A growing number are also budgeting for takeout meals, a small indulgence that drives continued happiness and mental self-care.

What this all means for brands in 2023

Now that we understand how today’s economic climate is impacting consumers, here are a few things for brands to keep in mind in the coming months when selling to unsettled consumers:

- Shoppers are back in stores so navigating planograms needs to be easier than ever. It doesn’t need to be the same experience as online, but it can’t be frustrating.

- Online and offline deals and promotions need the same level of attention. Shoppers need a reason to interact with both physical and online purchase paths. Whether it is larger pack sizes that might live online, in-store or online only deals, or discovering novel items at the physical shelf, shoppers are more engaged with retailers that leverage both brick and mortar and online assets effectively.

- Assortments need to reflect the needs of many cultures and consumer needs. Retailers need to stock the brands that shoppers expect to see.

Check out our webinar on this very topic

Learn the impact economic conditions have on shoppers and what values shoppers can expect from brands so you can quickly pivot and win market share