TEMU: A rapid rise in the french market

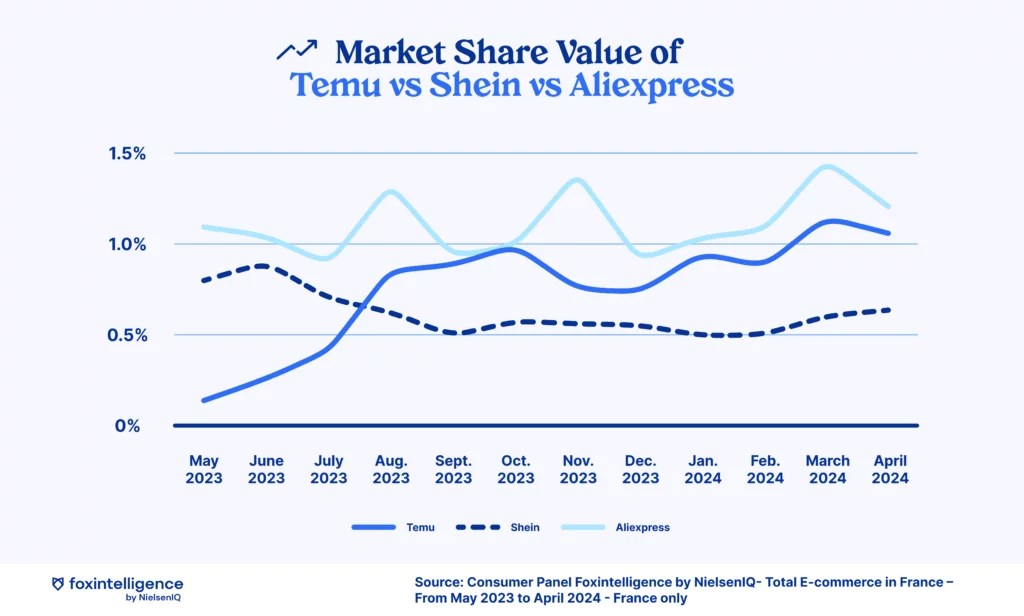

Since its launch in April 2023, TEMU has quickly ascended in the French e-commerce market. This rapid rise can be attributed to several factors, including attractive prices and a diverse product range that immediately appealed to French consumers. In just four months, TEMU managed to surpass one of its main competitors, Shein, in terms of market share by value. This swift progress highlights the effectiveness of TEMU’s strategies to attract and retain a broad and varied customer base.

- Competitive Pricing Strategy: TEMU implemented a discount pricing policy that attracted many consumers looking to save money.

- Diverse Product Offering: The platform offers a wide range of products, from electronics to clothing, catering to various consumer needs and preferences.

- Targeted Marketing and Promotions: Aggressive marketing campaigns and attractive promotions helped TEMU quickly gain visibility and popularity.

This rapid growth reflects massive consumer adoption, confirming the relevance of TEMU’s strategy in the current economic context.

🦊 Discover your true online market share and trends

TEMU emerges as a serious competitor to Shein

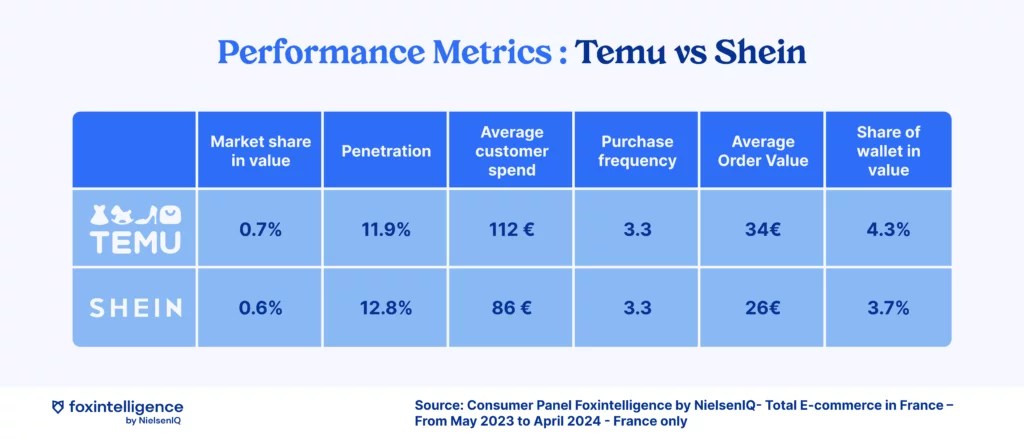

One year after its launch in France, with a penetration rate of 11.9%, TEMU has built a customer base nearly as large as Shein’s. This high penetration translates into a loyal customer base, with an average annual spend of €112.5 per consumer. Additionally, TEMU customers make an average of 3.3 purchases per year, indicating high satisfaction and effective retention strategies.

Taking Shein as a reference, which is well established in France with a market penetration of 12.8%, an average spend of €86.2 per consumer, and a similar purchase frequency of 3.3 times per year, TEMU has managed to match or even surpass Shein in some aspects in just one year. These results demonstrate the rapid adoption of TEMU by French consumers and its ability to effectively compete with well-established platforms, showcasing dynamic and impressive growth.

🦊 Discover your penetration rate and that of your competitors

Who are TEMU’s consumers? A demographic exploration

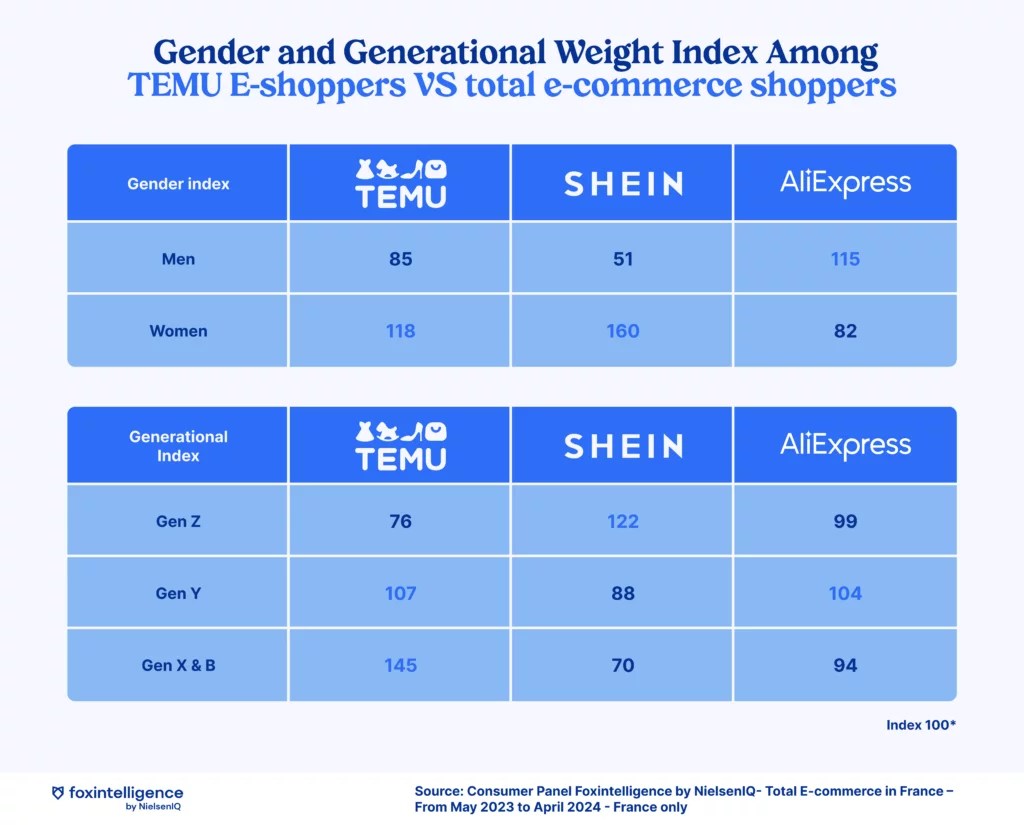

Analyzing the demographic profiles of TEMU’s customers reveals marked differences compared with its competitors. TEMU has a relatively balanced customer base in terms of gender, with a strong presence of Generation X and B, illustrating its ability to attract a more mature market segment. This generation is notably over-represented with an index of 145, well above the average. Generations Y and Z are also present, with indices of 107 and 76, respectively.

In comparison, Shein predominantly attracts a young, female clientele, establishing itself as the preferred platform for young female consumers. Women are over-represented on the platform with an index of 160, and Generation Z is very prominent with an index of 122.

AliExpress, on the other hand, shows a male predominance, with an index of 115 for men and 82 for women. The generational distribution is more balanced, with indices close to the average for all generations.

These contrasts demonstrate the diversity of strategies and market segments targeted by these platforms. It also highlights TEMU’s unique position in the French market, appealing to a wide range of consumers, from young adults to older generations.

Shopping behavior analysis of TEMU customers

Frequent Shoppers Opting for Cheaper Items

TEMU consumers stand out for their high online shopping activity. On average, they spend €2,500 annually on various platforms, significantly above the total average spend of €1,800 for e-commerce consumers. Their purchase frequency is also notably higher, with 45.8 purchases per year compared to the market average of 27.7.

These frequent shoppers prefer cheaper items, with an average price per item of €13 compared to the overall e-commerce average of €15.Their average basket value is also lower, at €55 compared to €65 for the market average. These figures indicate that TEMU customers are avid shoppers attracted to often cheaper products.

Shoppers Who Favor Low-Cost Retailers

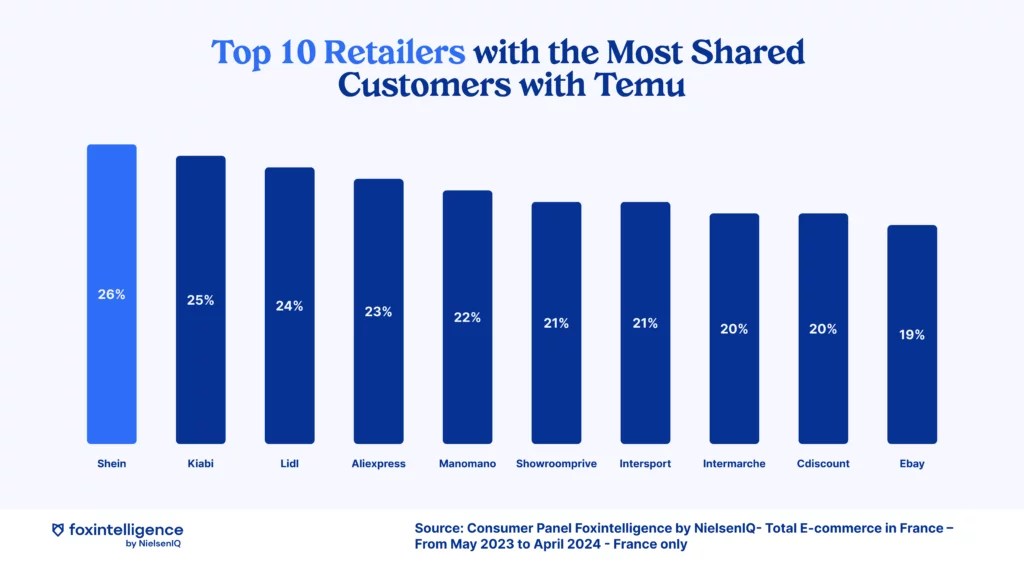

An analysis of shopping behaviors reveals a strong mix of TEMU customers with other low-cost retailers.

This mix illustrates how TEMU customers navigate various stores to find low-cost items, whether daily products or online fashion. In comparison, Shein customers have a greater affinity for stores specializing in fashion and beauty, highlighting the distinction between the two customer bases and their shopping preferences.

Here is the top 10 list of retailers with the most shared customers with TEMU.

Growth potential and new customers

TEMU’s growth potential remains promising, demonstrated by its ability to maintain a loyal customer base while attracting a significant number of new consumers each month. With a strategy focused on continuously improving the customer experience and expanding its product range, TEMU is well-positioned to continue its growth and strengthen its presence in the French e-commerce market.

In April 2024, nearly 20% of TEMU’s customers were new to the platform, a rate four times higher than that observed at AliExpress. Additionally, in France, 96% of TEMU’s customers over the past 90 days were returning customers, showcasing the platform’s established loyalty.

These figures highlight not only TEMU’s current successes but also its commitment to seizing new opportunities and expanding its influence in the online commerce world, offering a positive outlook for the platform’s future.

Key Insights

- In just four months, TEMU surpassed one of its main competitors, Shein, in terms of market share value.

- The generations X and B are overrepresented among TEMU consumers with an index of 145.

- TEMU consumers are highly active online, spending an average of 2,500 euros per year compared to the market average of 1,800 euros.

- 96% of TEMU customers in the last 90 days were repeat customers.