8.9% was the increase for the total food retail in Greece for 2023

Based on NielsenIQ’s latest measurement data for the whole of 2023, the turnover of the organized food retail trade showed a positive trend of +8.9%, with inflationary pressures being the almost exclusive driver of the sector’s growth.

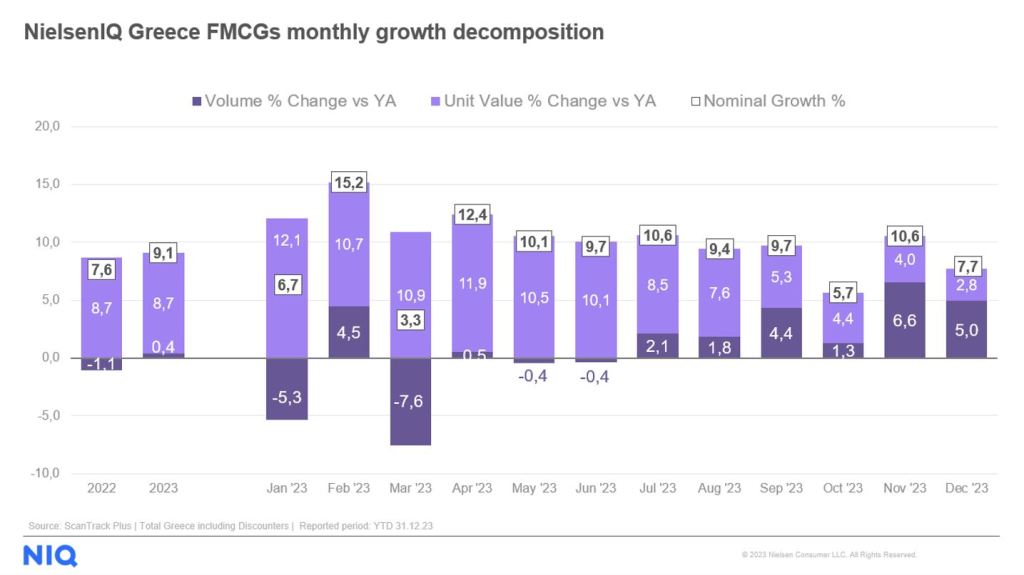

Making a brief month-by-month analysis, for FMCGs in particular, by deconstructing the market trend in terms of demand and price level, it is interesting to comment on the significant double-digit price increase in the first six months of the year, while in the second half of the year there is a de-escalation in inflationary pressures, with a corresponding boost in volumes and consumption. Overall, for 2023, fast moving consumer goods increased their sales in value by 9.1%, while it is noteworthy that while prices increased with the same intensity, as in 2022 (+8.7%), demand showed marginal increase, to +0.4%.

Select categories show unit sales growth

As Vaios Dimoragas, CEO of NielsenIQ Greece & Bulgaria, commented, “At the beginning of 2023, given the persistent inflation in fast-moving consumer goods, there were quite a few concerns about a significant drop in consumption. In practice, the overall volumes were not significantly affected and in fact at the end of the year they also marked a marginal increase, but obviously with different behavior per category and, as the case may be, with a differentiated product mix. Greek consumers are undoubtedly under pressure, but they are looking for and actually finding solutions so that they are not deprived of the basics, which is an encouraging message for the resilience of the market.”

As for the individual major FMCG categories, Food & Beverages showed a positive trend of +9.0%, while demand remained unchanged in relation to 2022. The categories that concern Personal Care Products presented the same growing trend, yet their more moderate price increase stimulated the consumption of these categories. At the same time, the highest sales increase in value was recorded by Household Products as a whole, with their unit sales also presenting a positive trend at 0.8%.

Total Bazaar (clothing, electrical appliances, books, tools, garden items, car items, home equipment, etc.) is a category that showed the lowest positive trend in terms of turnover, at +4.0%, while Fresh & Bulk products, on the contrary, showed the most positive trend, at +10.2%.

Growth varies by store size and region

Regarding the different shop typologies, 2023 was another consecutive year that stores of more than 2,500 sq.m. (hypermarkets) continued their growing trend at +12.4%, while the relatively lowest growth rate (+7.2%) was presented by stores between 1000-2500 sq.m., which however make up more than 40% of the food retail turnover.

Lastly. While observing the performance of the different geographical areas, in which NielsenIQ deconstructs the market, it is worth commenting on the fact that in Athens and Thessaloniki the turnover of the food retail trade increased by 8.1 and 8.3 respectively, while generally higher positive trends were shown in the more rural areas and especially the regions of Crete (+12.9%) and the Peloponnese (+9.5%), with inflationary pressures being significantly more intense in those areas compared to the urban centers.

![Understanding your audience: The power of segmentation in retail [podcast]](https://nielseniq.com/wp-content/uploads/sites/4/2025/07/Podcast-Understanding_your_audience-The_power_of_segmentation_in_retail-mirrored.jpg?w=1024)