Reading the Prime Day tea leaves

The omnichannel sales environment is a constantly evolving landscape, demanding that retailers and e-commerce leaders keep a constant finger on the pulse of shopper behavior. Major e-commerce events like Prime Day, to be held July 16 –17, have been significant drivers of traffic in the past — and unlock countless data points about consumer attitudes and their willingness to spend.

Using data to drive excitement

A major obstacle that retailers and brands must contend with when holding an exclusive shopping event like Prime Day is a recent decline in impulse shopping. After years of consistently representing up to 16% of purchases, impulse shopping dropped to just 9% of trips, according to U.S. consumers surveyed by NIQ BASES Omnichannel Shopping Fundamentals between Fall 2022 and Fall 2023. Interestingly, this shift is primarily impacting online (-8%) rather than offline (-5%) behavior, and those purchases have all shifted directly to ‘reminded’ shopping habits.

To combat this trend, Prime Day 2024 will once again promote invite-only deals, where shoppers are encouraged to request an invitation to exclusive Prime Day offers that are in high demand. Rather than relying on an impulse purchase during the main event, Prime Day shoppers who are selected will be notified by email with a unique link to purchase the deeply discounted item. By deeply understanding how consumers are shopping, retailers can embrace their shifting preferences and update promotional strategies to appeal to them.

For more insights about Prime Day and e-commerce shopping, join us for The Prime Directive, a LinkedIn Live event on July 16 at 11 a.m. EDT.

NIQ experts Sherry Frey, VP, Total Wellness, and Brian Crosby, Director, BevAl Account Development, will dig into category performance data and highlight key macro trends to watch.

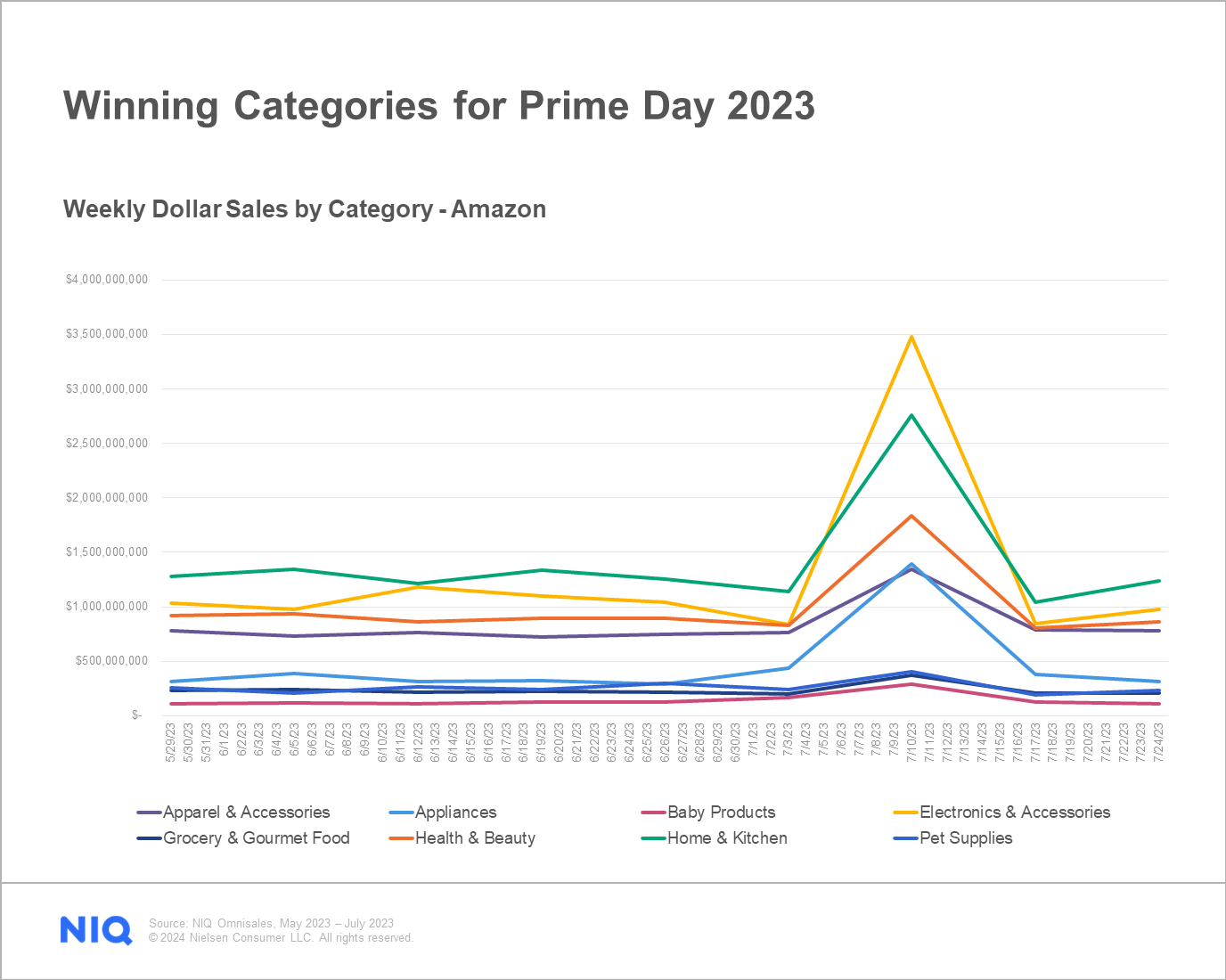

Categories that conquered Prime Day 2023

As seen in previous years, electronics and home/kitchen goods were Prime Day 2023’s top-selling categories. Shoppers have come to expect deals on these categories but are also driving dollar sales in Health & Beauty, Grocery, and Pet supplies.

Will shrinking inflation pump up Prime Day spending in 2024?

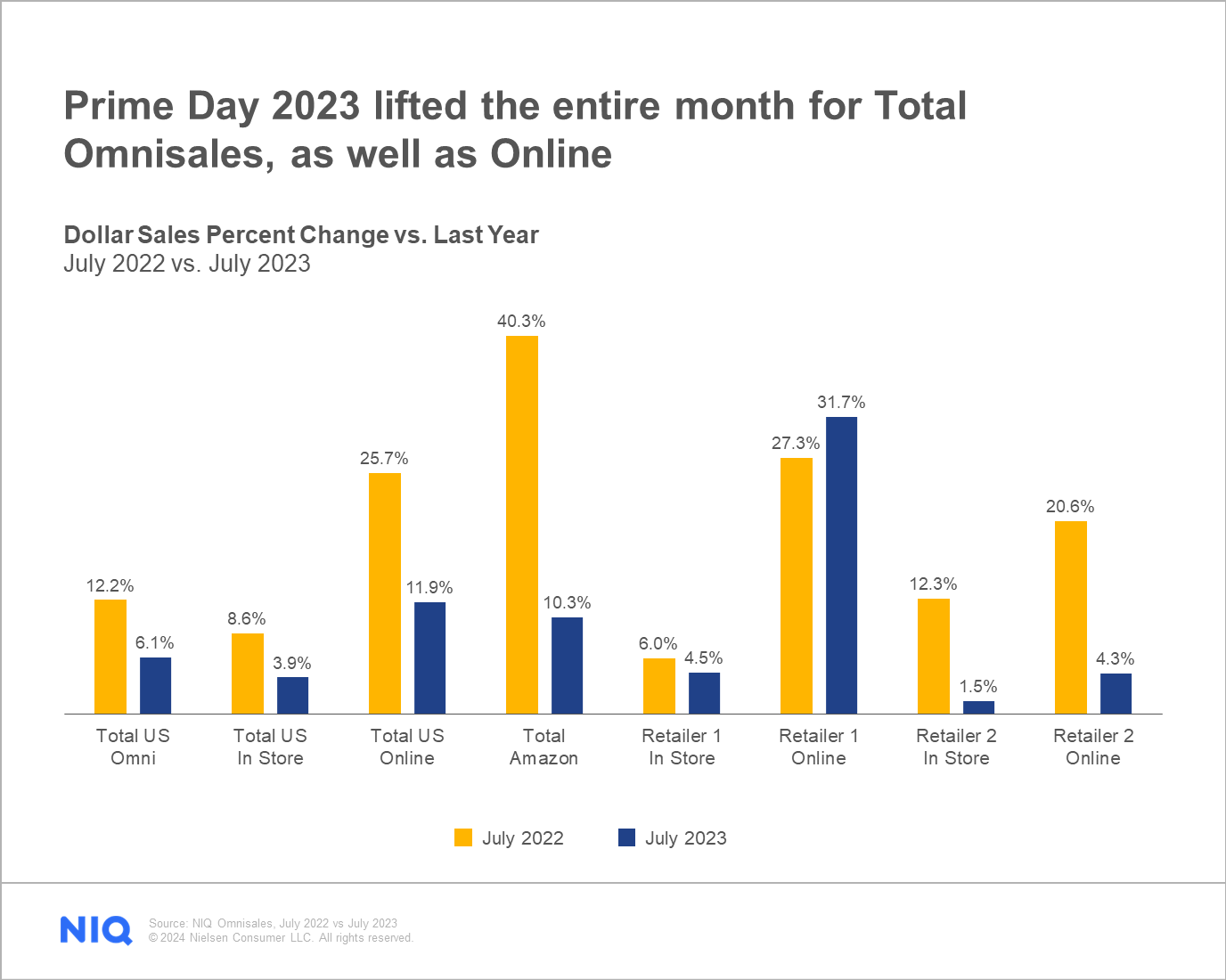

The month of July has become synonymous with Prime Day, but other major retailers have joined the party in recent years, historically leading to huge year-over-year lifts in dollar sales, as shoppers anticipate these events.

However, major retailers must separately consider differences in strategies that appeal to online and in-store shoppers, unlike Prime Day’s audience. These competing omnichannel events offer a golden opportunity for brands and retailers to innovate and explore new avenues in personalization and retail media that can set them apart from the online-only experience. Integrating tailored ads, optimizing consumer interactions, and reinforcing brand messaging effectively offers a foundation for enduring loyalty that can’t be met outside of the omnichannel experience.

Year-over-year shifts in how the total category and major retailers are experiencing sales growth in July offer unique insight into the consumer trends that inform which of these strategies are ultimately effective at capturing dollar sales.

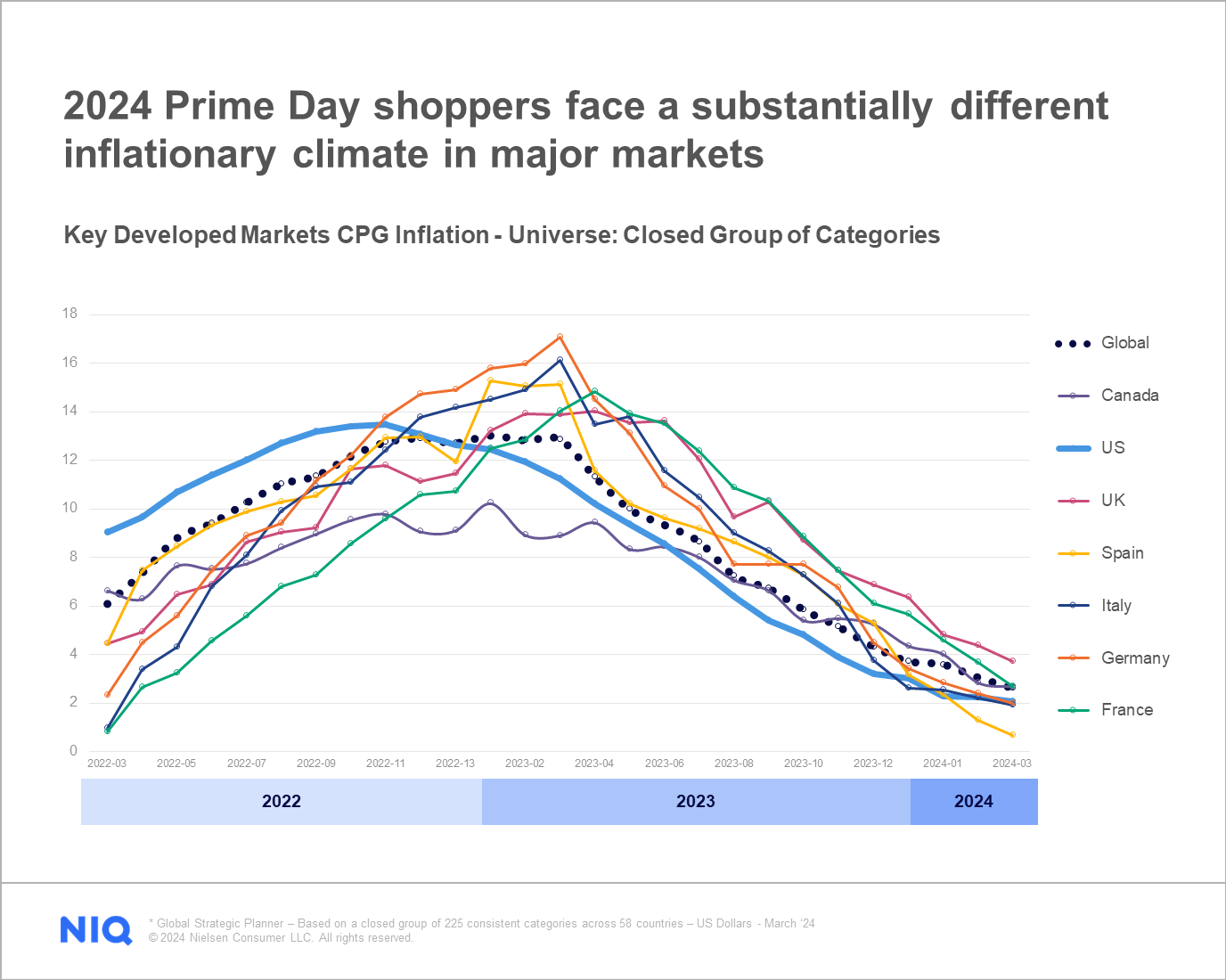

While still showing growth, the year-over-year total dollar sales percent change in July 2023 was, in many cases, considerably lower than what was seen in the year prior across outlets. Consumers who were likely still reeling from a year of inflationary pressure around the globe seem to have shown more cautious spending than in 2022, when inflation was still on the rise. With inflation trending down in major markets headed into this year’s Prime Day event, we could see a massive rebound in 2024.

Putting the right strategies in place is impossible without a comprehensive view of the full omnichannel landscape across consumer buying behavior, sales trends, and monitoring your position in the market relative to competitors. In today’s competitive manufacturing landscape, data and analytics are vital for success. By partnering with a trusted data supplier that covers a Full View of the market and every stage of the product lifecycle, manufacturers can successfully navigate modern challenges.

Better data for bigger sales

No longer just an on-ramp to omnichannel shopping for consumers, these big yearly shopping events can be major drivers of success if retailers and e-commerce leaders fully understand which products and promotions will resonate with shoppers.

Be sure to register for The Prime Directive, our LinkedIn Live event on July 16 at 11 a.m. EDT, for more online shopping and product insights.

Interested in meeting with a Prime Day expert?