What it means to be a brand today

Perception is everything and some would argue that’s how private labels have continued their path to growth: building a reputation among consumers for being more than just an affordable option.

“The concept of brand loyalty is often measured by how willing shoppers are to stick to their brand choice despite a competitor offering a lower price. In today’s price-driven economy, loyalty isn’t as clear cut,” said Lauren Fernandes, Vice President, Marketing & Communications, NIQ.

A recent global survey found that 62% of global respondents say they are willing to try a new brand because of a lower price. And while 36% say that lower prices can persuade them to buy something other than their usual brand, there’s a solid group of consumers (16%) who say they avoid buying the cheapest product option because they don’t trust the quality.

“The gap between private labels and name brands continues to close, and it paints the picture of how fundamentally different the brand playing field is today,” according to Fernandes. “It’s becoming less about a brand’s ‘name and recognition’ and more about its credibility and reputation for delivering on consumers’ tangible expectations for affordability, quality and more.”

Store brands have done well to build brand equity by meeting multiple consumer needs – and it’s shifting the perception of desirable branding in the eyes of all consumers, regardless of income level. In fact, even the most financially secure households have among the most favorable opinions of private labels products – with 72% of high-income ($100k+) U.S. shoppers saying they feel that private label is a good alternative to national brands.

Is your brand resilient enough to keep customers?

Everyone can appreciate good value

62%

of global respondents are willing to try a new brand because of a lower price

72%

of high-income U.S. shoppers feel that private label is a good alternative to national brands

36%

of global respondents say that lower prices can persuade them to buy something other than their usual brand

Source: 1) NIQ 2024 Consumer Outlook Survey, 2) NIQ Consumer Survey. PLMA Consumer Research report

The cultural capital of brands

As we’ll explore, a product’s ability to speak to the identities, lifestyles, and aspirations of consumers have become a major purchase motivator. Pure cost/benefit ratio is only one of multiple drivers of consumption – brands must also focus on developing cultural capital to succeed. Retailers and manufacturers need to start thinking about brands as signals that drive consumers to what they feel they need. Because the reality, according to consumers, is that nearly 1-in-5 global respondents say they struggle to find brands that they can relate to.

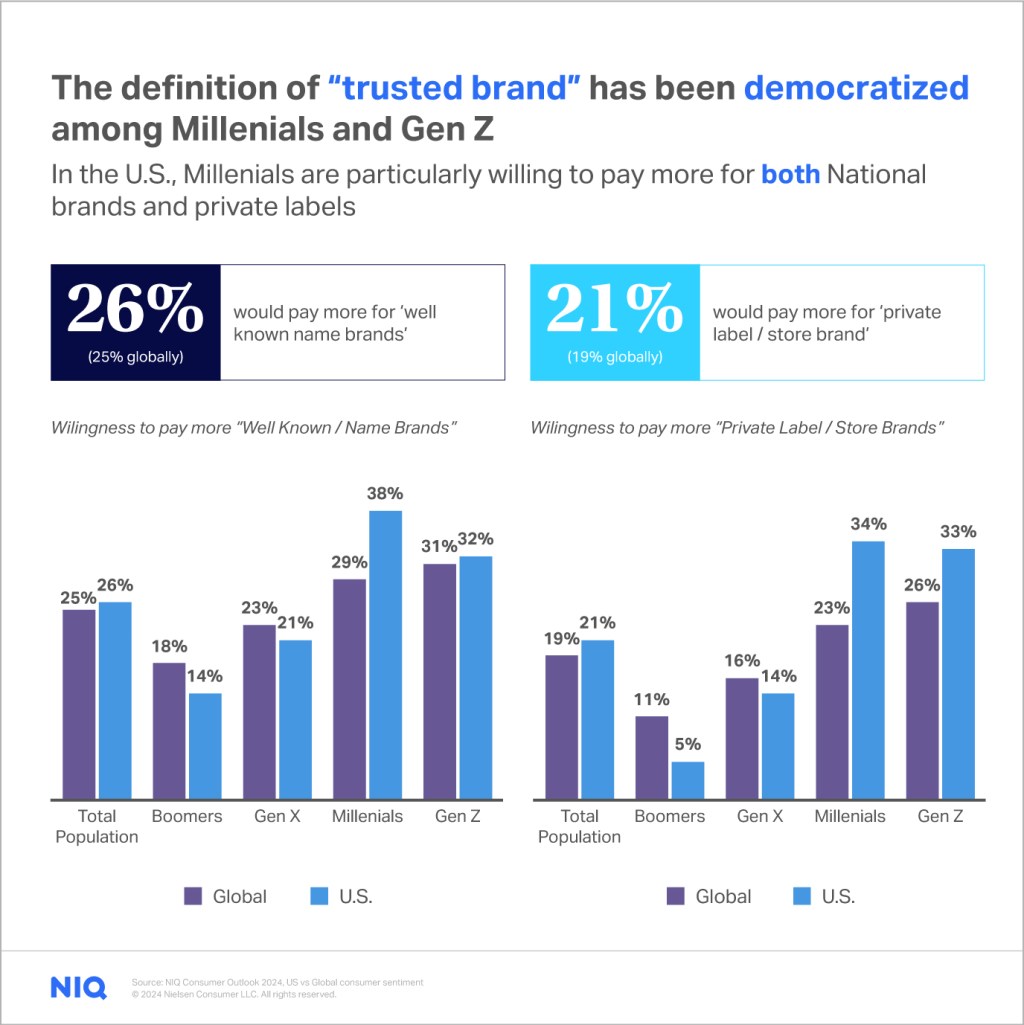

Take for example the shifting perceptions of private label among young shoppers in the U.S. – 70% of surveyed Gen Z & Millennials say that private labels are just as good as national brands and are even willing to pay more for them. Unlike their older Boomer counterparts, young consumers likely don’t have preconceived notions of private label products as boring or bland, but instead have only experienced the private label commitment to innovation that we’ve seen in recent years. The generational momentum shown by private labels is proof that the playing field can be leveled if your brand is able to connect their own values to the traits that matter most to specific audiences.

Real-world investments being seen in brand equity

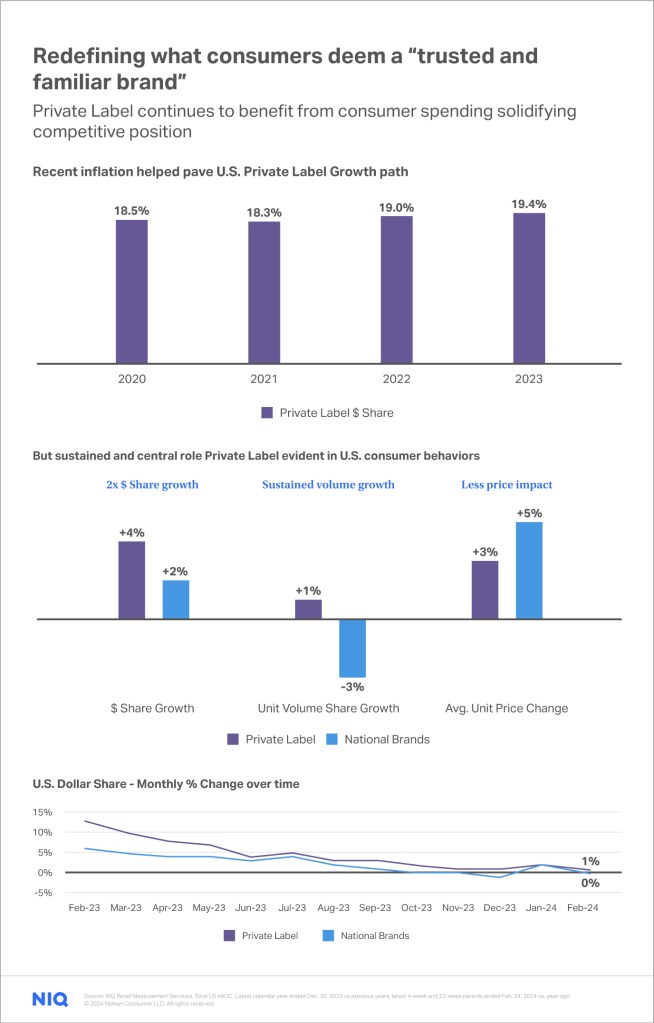

Going beyond consumer sentiment, recent sales figures support that these strategies are not only building brand equity, but also growing business impact, with private labels showing sustained share and volume growth compared to national brands.

As customers continue to prioritize products that resonate with their needs, it stands to reason that all brands now have access to consumers if they can get their value equation just right. This is further reflected by the investments being made today by U.S. retailers who have identified this fact.

- CVS pharmacy is launching private label offerings in personal care products and specialty drugs, with a focus on the $100 billion biosimilar market.

- Dollar General is expanding their Clover Valley brand and offering produce in 5,000 locations, giving the company more individual points of produce distribution than any other U.S. mass retailer or grocer.

- Target is expanding their Good & Gather brand to include baby and toddler products.

- 7-Eleven aims to have 34% of its sales sourced from proprietary items by 2025, with 25% coming from fresh food and drinks and 8% from private label goods.

These handful of retailers are making big investments in categories that not only offer the savings their customers seek, but also resonate loudly with their consumer lifestyles and unique needs.

To help cut through the clutter, NIQ BASES Omnichannel Shopping Fundamentals (OSF) provides path-to-purchase insight for 130+ food and non-food categories across pre-trip, shopping, post-trip attitudes, behaviors, and purchase influencers, both online and in store. Click below to read a case study on how a retailer was able to use OSF to develop shopper-based strategies for growing their brand equity within the snack category.

The omni revolution has muted impulse shopping

Another factor brands must contend with when asserting their place in the market is a recent decline in impulse shopping – a factor that would seem to indicate how differently consumers are shopping. After years of consistently representing up to 16% of purchases, impulse shopping dropped to just 9% of trips, according to U.S. consumers surveyed between September 2022 and Fall 2023. This shift is primarily impacting online (-8%) rather than offline (-5%) behavior, and those purchases have all shifted directly to ‘reminded’ shopping habits.

This shift speaks directly to two forces at play:

- Though consumers are open to more brands than ever before, they’re still somewhat hesitant to splurge on unplanned purchases.

- Online retailers are getting much better at making it easy to copy a previous order and reminding shoppers of what products they regularly purchase.

The data backs up this claim, with 25% of U.S. shoppers saying they made an order online via subscription, marking an 11% jump from measures of a year ago (Sept 2023 vs. Sept 2022). Additionally, 55% of consumers said they ordered a product through a retailer membership service, and 29% of consumers said they ordered a product as part of an ongoing “auto-ship” subscription (as measured in Fall 2023).

Across the 130 CPG categories measured in OSF, nearly half (46%) of U.S. shoppers reported that their shopping trips are done exclusively offline, but that marks a 27% decrease in the span of just four years. As shoppers become more comfortable blending their online spending with their brick-and-mortar trips, your target consumer now expects their path to purchase to be catered to the signals that matter most to them.

Families are driving fascinating shifts in omnichannel

Households with children are a prime example of how necessity has catalyzed omnishopping adoption, and how successful brands have risen to meet their needs. Picture the shopping experience for a parent who discovers that the box of diapers in the closet that they were positive was full is, instead, almost empty. Just a few years ago, that parent would likely groan, thinking about the steps involved in the unplanned trip they now urgently needed to make. Loading their child into the car, driving to the store, loading their child into the shopping cart, getting the diapers they needed through checkout, into the car, and into the house.

Flash forward to today, where unless necessity requires it, they simply open an app on their phone and in as little as one click, can have a box of diapers on their doorstep in less time (and frustration) than it would have taken to go to the store themselves.

The brands that are resilient with this demographic are ones who can make that nearly-empty diaper or cereal box a minor inconvenience – rather than a disaster – and the data proves it:

- Just 37% of households with kids say they exclusively shop in stores (a 33% decrease since Sep 2019), compared to 55% of households without kids.

- 53% of households with kids utilize immediate or same-day delivery or curbside pickup options compared to 37% of households without kids .

- Households with kids utilize multiple methods to make their lives easier, like retailer memberships (63% vs. 48% for households without kids), auto-ship delivery (40% vs. 20% for households without kids), and by subscriptions (38% vs. 16% for households without kids).

“Since 2020, stores have been clamoring to make shopping online and offline as seamless as possible,” says Jason Catlin, Director, Demand Solutions, BASES Customer Success. “A great example of a group that is shifting the entire omnichannel landscape are time-starved parents. Just think about what a powerful motivator convenience is for this group, and what a revolutionary opportunity that exists to drive revenue and loyalty with these shoppers. Walmart, Amazon and Target are just a few retailers building brand equity with service models that cater to shoppers who highly value anything that gives them time back in their day. Think of the pack sizes that fit these types of orders, the purchase cycles, the replenishment needs – how does your brand make it easy for these shoppers to get what they need quickly and conveniently?”

Strategies to building brand equity today

Brands today have an important task ahead if they hope to stay relevant. They must play a tangible role in their consumer’s lives that goes far beyond price and performance. Brands must understand:

Brand

Reputation

What are you known for beyond price, and is that something your core consumers still prioritize in this era of pressured decision making?

Consumer Necessities

What can’t your consumers live without and are you fulfilling those needs better than your competition?

Tangible

Value

What are you doing to solve the problems that have uniquely impacted your consumers?

Shoppers have never had more resources at their disposal to have their specific needs catered to – which is why it has never been more important to know what matters to them. Understanding what speaks to the identities, lifestyles, and tangible requirements of consumers will differentiate your brand from the competition.

NIQ offers the data that provides a clear view into the signals that will build brand equity and remain resilient and grow in volatile times.

Stay ahead by staying in the loop

Don’t miss the latest NIQ intelligence—get The IQ Brief in your inbox.

By clicking on sign up, you agree to our privacy statement and terms of use.

![Understanding your audience: The power of segmentation in retail [podcast]](https://nielseniq.com/wp-content/uploads/sites/4/2025/07/Podcast-Understanding_your_audience-The_power_of_segmentation_in_retail-mirrored.jpg?w=1024)