Impact of price sensitivity on consumption

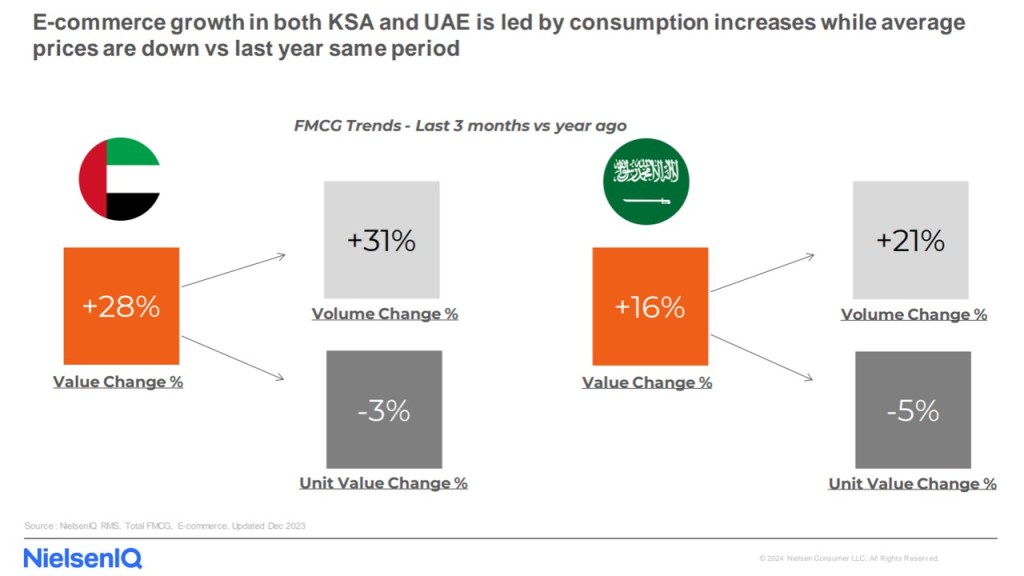

The observed consumption trends in the FMCG sector reflect a broader economic sensitivity, with consumers increasingly vigilant about pricing. In the UAE and KSA, e-commerce platforms have adjusted to these consumer sensitivities by reducing prices, leading to significant consumption increases—28% in the UAE and 16% in KSA. This strategic pricing has proven effective in drawing consumers towards digital shopping solutions, where convenience and cost-effectiveness meet.

Discrepancies in market dynamics

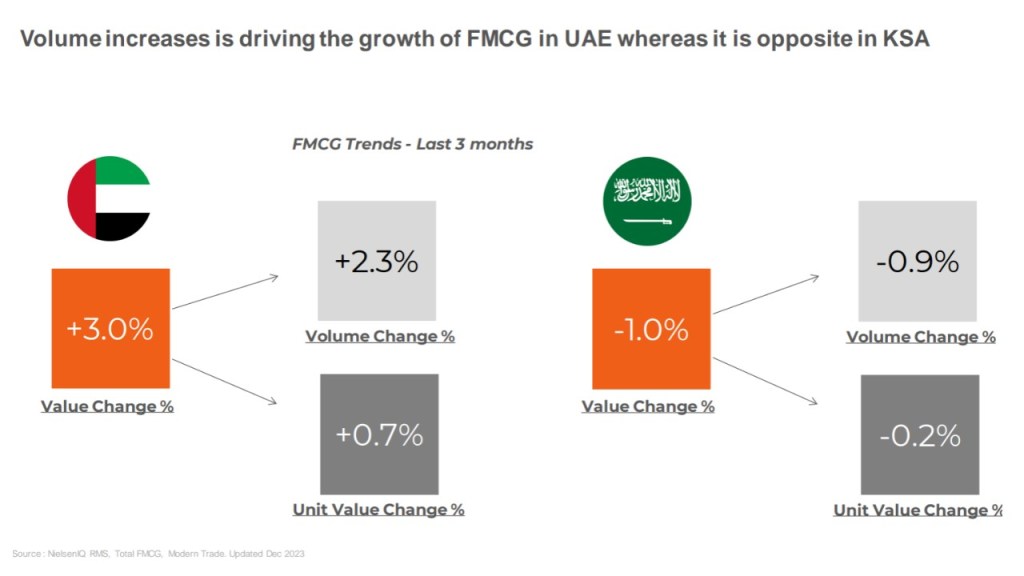

Traditional retail channels, or Modern Trade, in the UAE saw a slight consumption upswing by 2.3%. However, this was set against a backdrop of a 3% decrease in overall FMCG consumption. In KSA, the market experienced a more pronounced downturn, with consumption shrinking by 0.9%. strategies that consider regional economic conditions and consumer behavior patterns.

E-commerce: A beacon of resilience and growth

Andrey Dvoychenkov, NielsenIQ APP General Manager, notes the e-commerce sector’s resilience amidst economic pressures. The sustained growth in e-commerce, even with rising costs, underscores a significant shift in consumer purchasing behaviors—favoring the convenience, variety, and competitive pricing of online shopping platforms. This shift is not only a reaction to economic conditions but a redefinition of consumer expectations and market norms.

This trend may also reflect the increasing confidence of consumers and their willingness to engage with e-commerce platforms. “By recognizing and leveraging these trends, organizations have the potential to reinforce their market presence and capitalize on the sector’s expansion,” says Dvoychenkov.

Opportunities in traditional trade and technology sectors

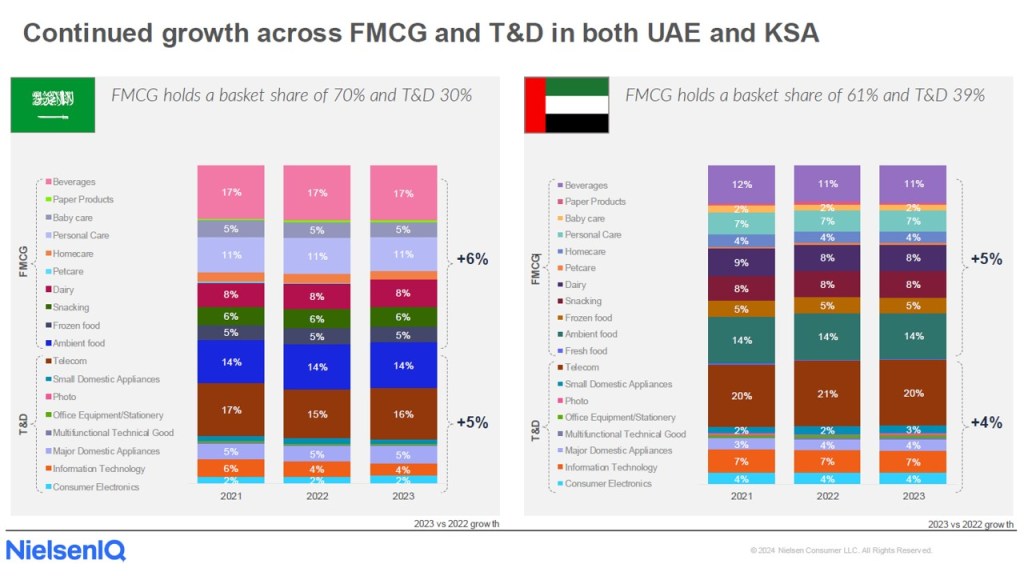

While FMCG faces challenges, the Technology and Durables (T&D) sectors in both KSA and UAE continue to post gains, driven by categories such as Telecom and Small Domestic Appliances. This growth suggests potential for cross-sector strategies that integrate FMCG dynamics with technology and durable goods.

In traditional trade, specific categories like Snacking are witnessing price increases, which, in KSA, have supported consumption growth, unlike in the UAE, where they have led to a decline in market value. This indicates that pricing strategies must be carefully tailored to regional consumption patterns and economic conditions to foster growth.

Strategic implications for businesses

The diverging trends across e-commerce and traditional trade channels underscore the need for an omnichannel strategy that bridges online and offline worlds. “For both FMCG and T&D sectors, adopting an omnichannel strategy is not just beneficial but crucial for success,” says Dvoychenkov. This approach allows businesses to leverage the strengths of each channel, ensuring broader market reach and consumer engagement.

In conclusion, while the FMCG sector’s recovery is still tentative, the surge in e-commerce presents viable pathways for acceleration. By embracing an omnichannel strategy, businesses can enhance their market presence and adapt to the evolving consumer landscape, ensuring sustained growth even in fluctuating economic climates.

NielsenIQ Barometer

The latest NIQ Barometer combines data from KSA and UAE and offers valuable insights into consumer behavior and the evolving strategies of retailers in the Modern and Traditional Trade, E-Commerce, and Tech & Durable (T&D) space.

The data aligns with broader retail trends of E-commerce Growth, Pricing and Value, Promotions, Traditional Trade Transformation within the FMCG & T&D sectors.