Eretail media personalization, immense potential

Even though 3rd party cookies are coming to an end, 1st party cookies will remain in place. 3rd party cookies are small programs that are installed on a user’s computer and relay information back to the 3rd party that created them, detailing every site the user visits. They help advertisers target ads and measure the effectiveness of their marketing.

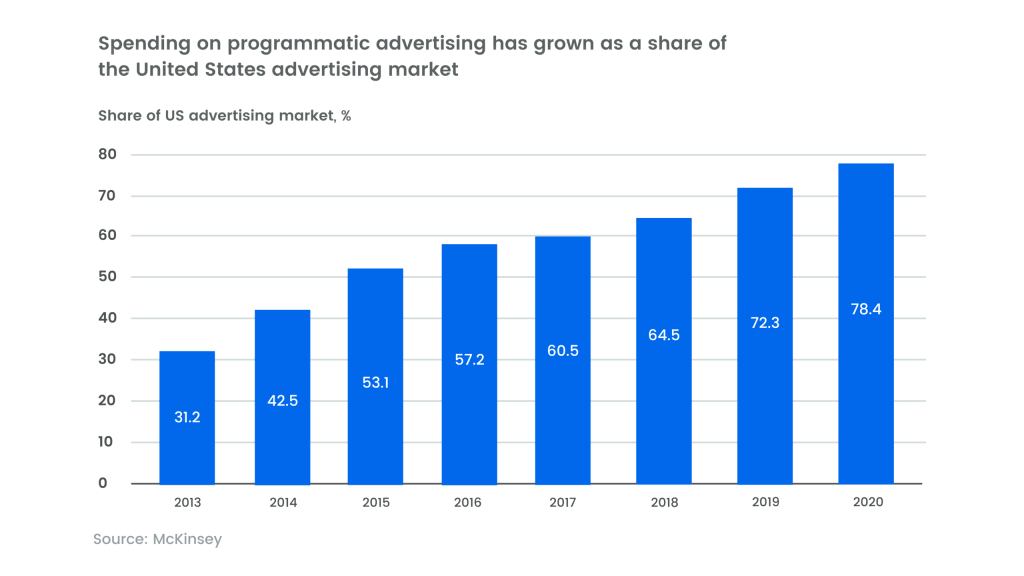

Programmatic, or 3rd party cookies have increased in use, even though their effectiveness is a matter of debate. 1st party data effectiveness can be measured more precisely.

1st party cookies remain on the retailer’s site or app and track all of the user’s activity on that site only. That information combined with the user identification and purchase data retailers have will become valuable in the absence of 3rd party cookies. Not only will retailers be able to collect increasingly precise information on shoppers every time they return to the site, thus targeting them with more customized ads at specific moments in the shopper journey, they will be able to sell advertising space rich with this hyper-precise user data. 1st party data will become the only option with cookies dead.

1st party data is already becoming the standard for all smart advertising in an age when customer data matters to people more than ever. Forward-looking retailers are thus in a strong position for discussions with brands that need better ways to navigate the new realities of media and deal with its many uncertainties.

Walled gardens

Walled gardens are data ecosystems that cultivate a closed feedback loop. Retailer’s media platforms control and own their walled gardens and the insights they collect. The contextual targeting it enables provides valuable information about the decisions and behaviors of shoppers and their interactions with eretail media.

Less intrusive than traditional advertising, this system can make the customer experience more enjoyable through it’s informed and appropriate micro-targeting, right down to the SKU level at the right moment. It energises the customer journey by using a variety of communication formats and making offers more relevant by proposing matching products.

Unlike in-store margins of 10 to 20% on advertising, this revenue stream will have margins of up to 80% according to Boston Consulting Group.

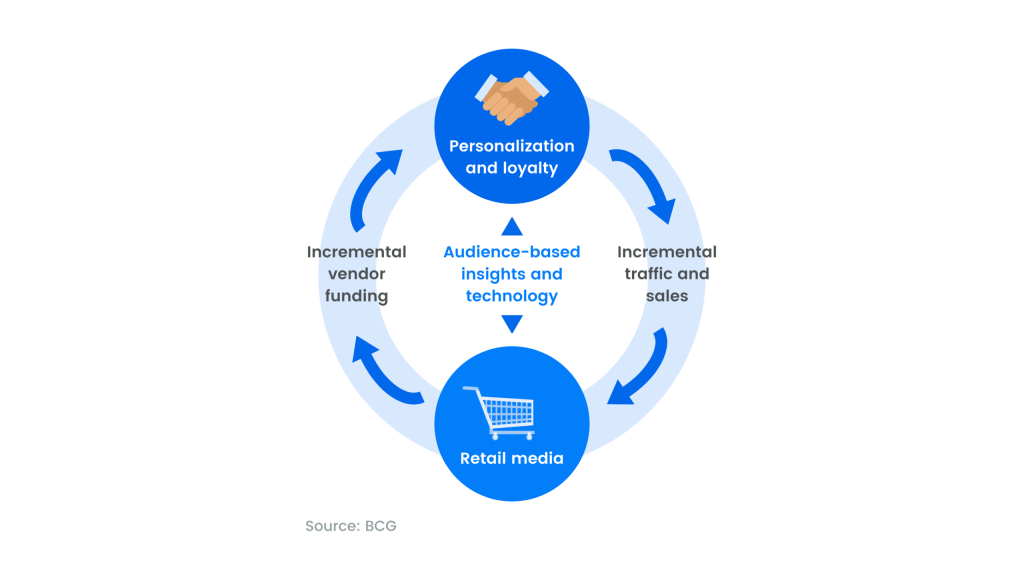

The media personalization flywheel from BCG illustrates how this closed ecosystem works:

A good retail media network self-generates funds for additional retail investments in personalization. This in turn drives a better consumer experience, increased customer loyalty and boosts manufacturer and retailer sales.

Retailers that engender trust in their shoppers by offering an improved shopping experience in exchange for personal data will gain a competitive edge.

Brands that customize their strategies with individual retailers will be able to benefit from joining data sets. This could lead to effective cross-selling, for instance. When manufacturers offer some of the data their tech partners provide them with, they can increase the retailer’s bottom line. This will motivate retailers to allow brands to experiment and try different activations that benefit both parties.