The food and beverage channel is facing unprecedented challenges as consumer behavior rapidly evolves in response to economic pressures. In fact, 2.8 billion units disappeared from the Food Channel over the past year.1

As inflation continues to strain household budgets, many shoppers are turning away from traditional grocery stores in favor of value-oriented channels like Dollar stores, Mass Merchandise, and Club/Warehouse retailers. Amidst this shift, manufacturers are left with the critical task of revitalizing their sales strategies to adapt to the new consumer landscape.

Read on to learn how competitive pricing, innovation, and strategic planning have become essential tools for winning back shoppers and driving purchase decisions in an increasingly competitive market.

The Shifting Consumer Landscape

The rising tide of inflation is reshaping how consumers approach their everyday shopping, eroding purchasing power and forcing difficult choices. Since 2019, the value of $100 has decreased by more than 30%, meaning what used to cost $100 now costs over $130.2 With wage growth lagging behind inflation—expected to grow only 2.3% in 2024 compared to inflation at 2.7%—financial strain continues to mount for households.3 As a result, consumers are adjusting their spending by making deliberate trade-offs based on price and perceived value. Essentials like groceries are being prioritized, while non-essential or indulgent items are increasingly cut from shopping lists. The food channel, in particular, has seen sales decline by 2.4% in the past year, with 2.8 billion units disappearing.1 Of those, nearly 59% have vanished entirely from the FMCG market, a direct result of consumers scaling back on items they no longer perceive as delivering sufficient value.

In an effort to stretch their budgets, consumers are turning to cost-saving strategies. Many are shifting to value-oriented retailers like Dollar, Mass Merchandise, and Club/Warehouse stores, where they can find lower prices and greater perceived value. Private Label products are also gaining favor, as are loyalty rewards programs and other tools that help consumers manage the total cost of their shopping baskets. These habits, once considered temporary, are now becoming the norm for many households and could mark a permanent shift in the retail landscape. For manufacturers, adapting to this evolving consumer mindset is critical, as the ability to meet shoppers where they are and deliver value through competitive pricing and innovation will determine long-term success.

Winning Back Consumers

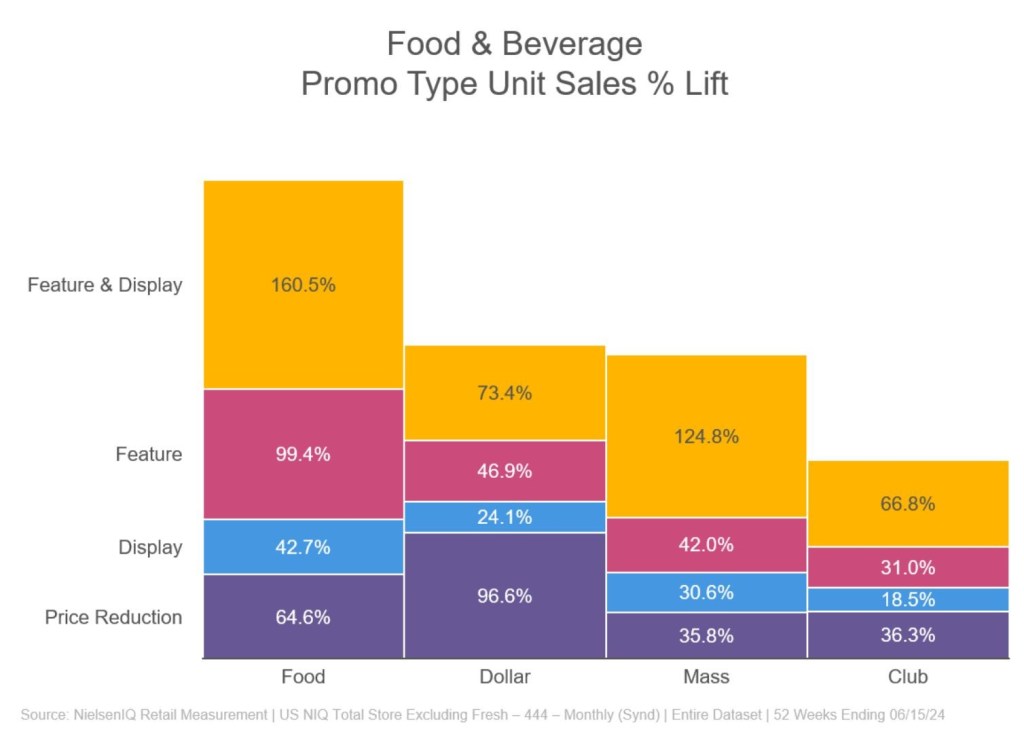

In today’s shifting retail environment, manufacturers have a prime opportunity to win back consumers by recalibrating their pricing strategies and aligning more closely with retail partners. While unit sales are down, trips per buyer is up 3.9%.5 As consumers make more frequent, yet smaller, trips, manufacturers have more chances to engage them with impactful promotions and marketing campaigns. Promotions in the Food Channel consistently deliver stronger unit lifts compared to value-oriented channels, making this a key lever for growth.

However, for these strategies to be truly effective, manufacturers need to focus on quality merchandising and consistent messaging that resonates with shoppers. This includes frequent and well-timed promotions that are aligned with retail partners’ strategies. While 56% of retailers say they are heavily focused on differentiated promotions to boost sales, only 20% of manufacturers are doing the same.6 Most tend to focus more on distribution and innovation, leading to misalignment. The most successful manufacturers work hand-in-hand with retailers to create seamless, win-win strategies that can activate more consumers at the right moment.

To drive sustainable growth, manufacturers also need to understand that value is defined differently across retail channels. For Dollar stores, value comes in the form of a low unit price, whereas Warehouse clubs attract shoppers by offering large unit volumes at competitive prices. This underscores the need for manufacturers to refresh their price and pack architecture, particularly in the Food Channel, where consumers are increasingly seeking a balance between price and perceived value. Aligning the price and size mix with today’s market demands will help manufacturers not only maintain a competitive edge in the Food Channel but also encourage consumers to see value beyond just price.

Key Strategies to Engage Shoppers and Drive Purchase Decisions

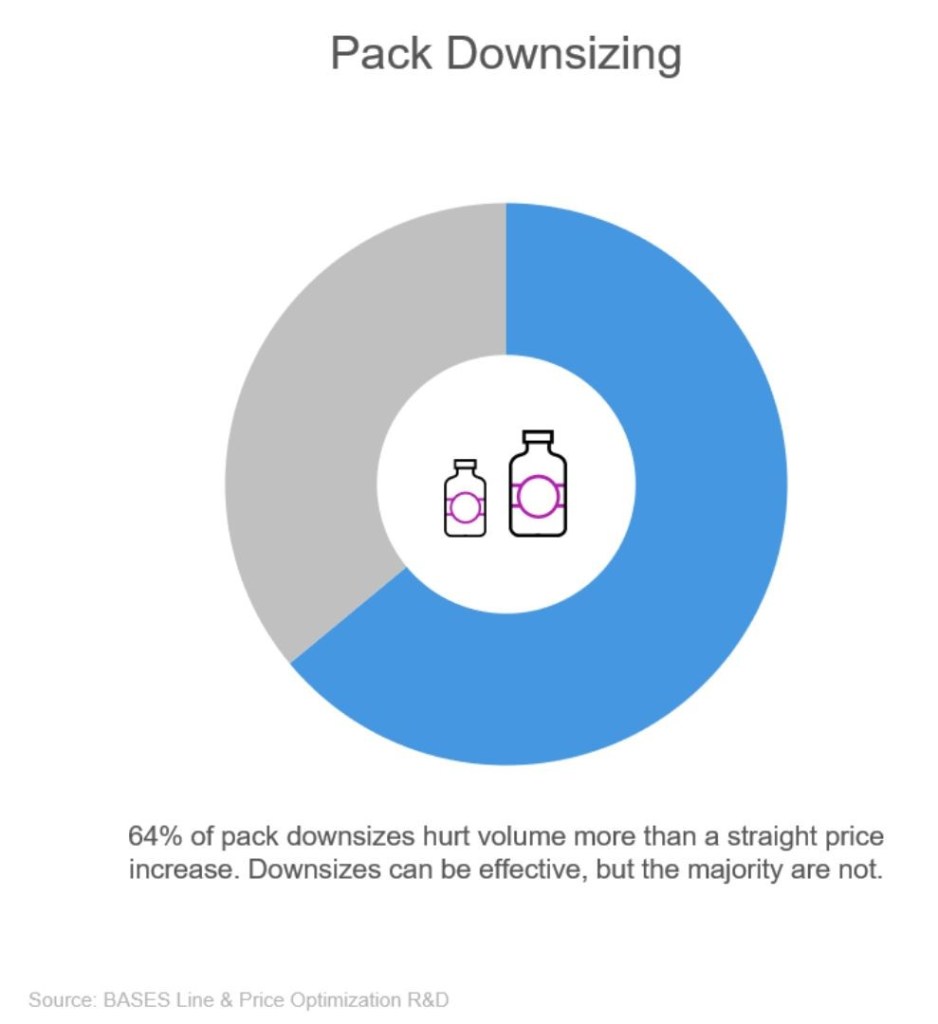

Engaging shoppers and driving purchase decisions in today’s competitive landscape requires a deep understanding of consumer expectations, particularly when it comes to packaging and value perception. Packaging size plays a crucial role in meeting consumer needs, as shoppers assess whether a product delivers enough volume or portion to justify its price. If a package doesn’t meet these expectations, it risks being rejected by consumers, who may either switch brands or shift to other channels offering a better value proposition. Products that miss the mark on size and value only have a 5% chance of surviving in the market.7 Packaging that strikes the right balance between affordability and functionality not only boosts consumer relevance but also sets the correct expectations, drives favorable price-value perceptions, and enhances a brand’s ability to fulfill new usage occasions while generating incremental revenue and profit.

Winning in the Food Channel requires a relentless focus on activating shopper trips and recalibrating the price-pack architecture. As consumers make more frequent, smaller trips, manufacturers have an opportunity to engage them through high-impact marketing strategies, including targeted promotions and purchase incentives that drive growth by increasing trip frequency. Quality in-store merchandising, combined with differentiated promotions, captures shopper attention and encourages repeat purchases. To remain competitive, it’s essential to recalibrate pack sizes to align with consumer preferences for both affordability and volume savings. By introducing smaller, competitively priced packs for convenience and larger value-driven packs for long-term use, brands can effectively compete.

Ultimately, it’s not just about offering the lowest price—it’s about delivering total value. This means aligning price with perceived value and investing in innovation, quality, and brand equity to strengthen price justification and build long-term consumer loyalty.

Winning Back Shoppers: Your Next Steps for Success

In today’s evolving market, understanding how to engage shoppers and drive purchase decisions is critical for manufacturers looking to stay competitive. By focusing on competitive pricing, recalibrating packaging architecture, and activating frequent shopper trips, brands can win back consumers and thrive in a value-driven landscape.

For more in-depth strategies and insights, be sure to check out our Reviving the Recipe: Strategies for Reigniting Growth in the Food and Beverage Channel webinar, where we dive deeper into the challenges and opportunities within the Food Channel and offer actionable steps to help you succeed in this dynamic environment.

Discover Insights Circles, NielsenIQ’s dedicated platform offering impactful industry insights across key categories relevant to you.

Sources:

1 – NielsenIQ Omnisales | Syndicated US for Manufacturers | Total Client Dataset – Commercial | Total US All Outlets | 52 Weeks Ending 06/15/24

2 – NIQ, Retail Measurement Services; Total US xAOC; Total Store; Average unit price % change vs year ago; Monthly periods ending December 30, 2023

3 – Trading Economics – United States Wages and Salaries Growth, Note: Total 2024 calculated as average of Q1, Q2 & Q3 forecast

4 – NielsenIQ Panel On Demand Omnishopper | US OSH – NDH Syd Full View 3 yr | Entire Dataset | 52 Weeks Ending 06/15/24

5 – NielsenIQ Panel On Demand Omnishopper | US OSH – NDH Syd Full View 3 yr | Entire Dataset | 52 Weeks Ending 06/15/24

6 – Advantage Sales Manufacturer Outlook Study April 2024 (Base 55) and Retailer Outlook Study April 2024 (Base 45)

7 – BASES Factors for Success