Constantly changing consumer behavior presents challenges and opportunities for retailers

In his session, “The Six Challenges Retailers Need to Master for Success in 2024” on January 16 at the NRF Big Show in New York, Jamie Clarke, Head of North America Retail, NielsenIQ, shared six challenges to master in 2024 that will impact the way retailers manage their operations. Clarke started the conversation by describing the current condition of the retail industry as being in a perpetual state of flux – consumers are pivoting and adapting in response to a rapidly changing economy.

Each of the challenges he shared will require a strong connection with consumers for retailers to be successful this year. They all offer opportunities for retailers to set themselves apart in an increasingly competitive marketplace.

Understanding and winning constrained consumers

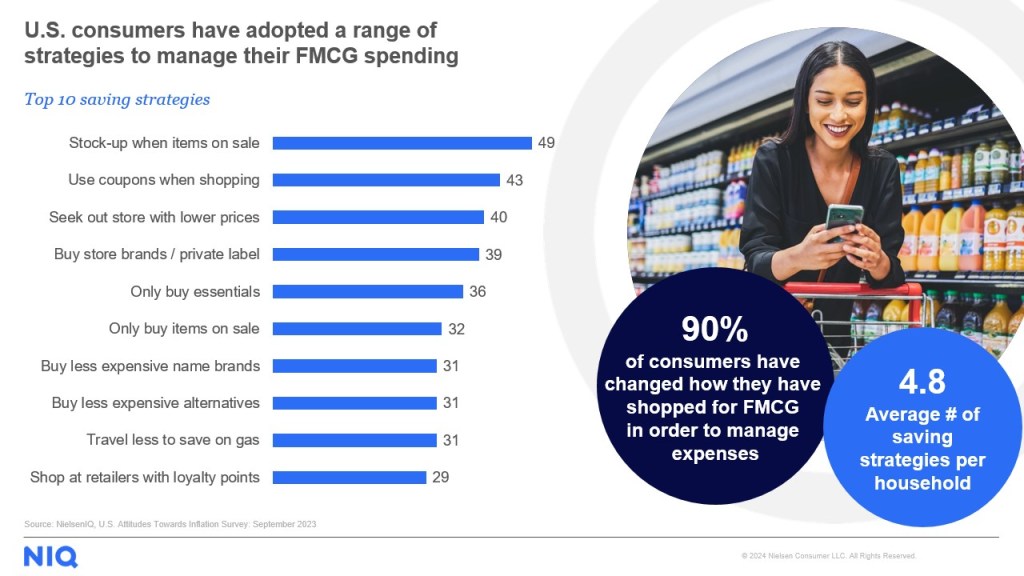

Consumers are now more sophisticated in how they approach saving to make ends meet. According to NIQ’s 2024 Consumer Outlook, four in ten consumers say they’re hopeful they’ll be in a better position by the end of the year. To get to a more financially secure place, consumers are embracing a range of strategies to increase income and cut costs, including taking advantage of sales, using coupons or discounts, buying private labels and switching the stores they frequent.

For retailers to master this challenge, they need to understand that 70% of growth in the industry is coming from value retailers, which only have 43% share in the market. Clarke said that the best path to growth for all segments is to match the shoppers’ desire for value within their core offering.

Balancing value and volume

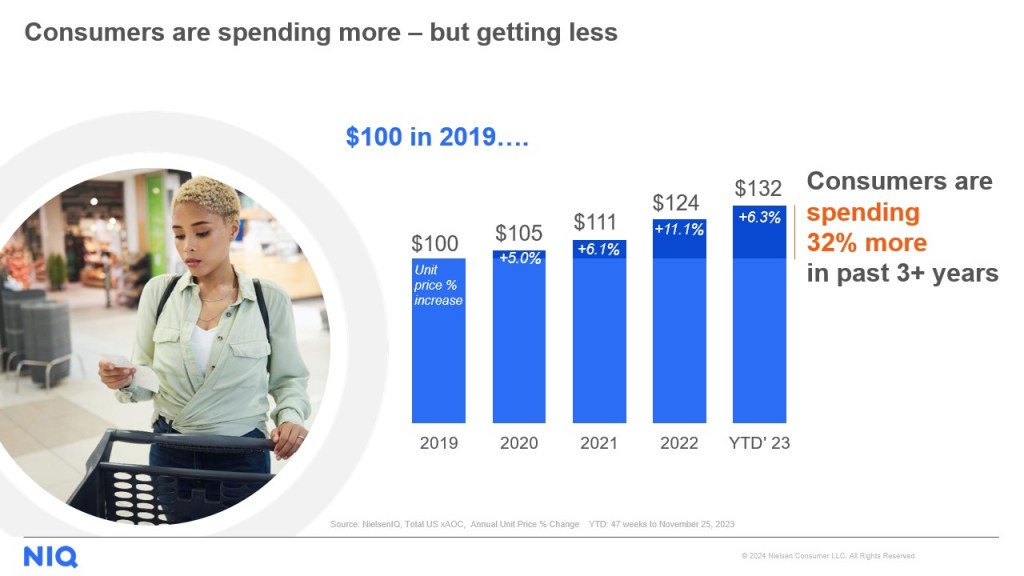

Food prices continue to impact the consumer mindset, according to the new Consumer Outlook report, with housing costs and the economy closely behind. The proof point Clarke gave is that for every $100 in 2019, consumers are now spending $132.

“While we see the rate of inflation for the FMCG industry slowing, retailers are still struggling with volume declines,” said Clarke.

So how can retailers win back volume to ensure long term growth? Using promotions, Clarke suggested, but retailers need to be strategic. For instance, help the 49% of consumers who say they stock up when items are on sale do just that.

Meeting consumers where they are

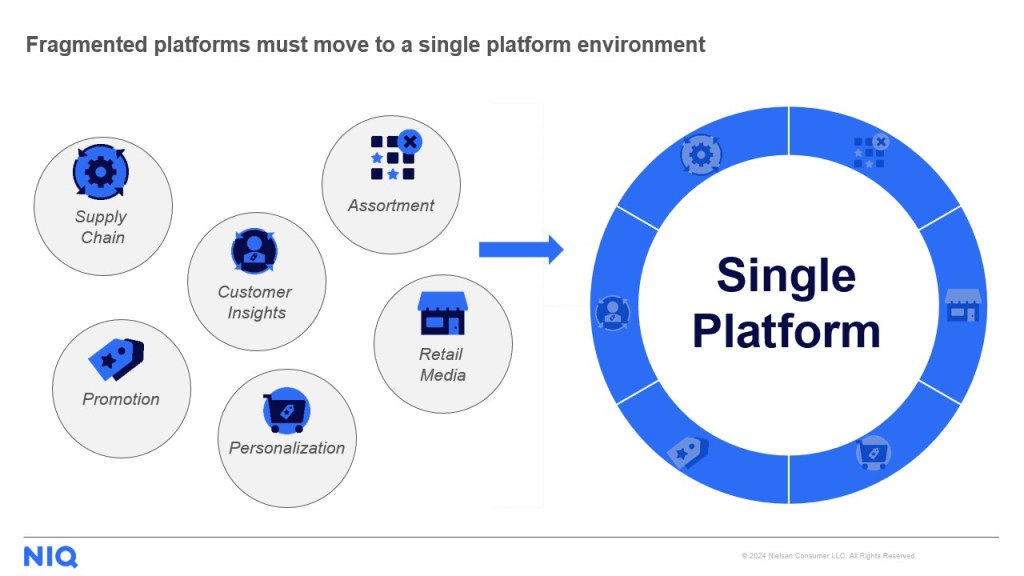

The hyper-competitive retail landscape still requires a great customer experience and increased operational efficiency, along with greater agility and scalability. Only a unified commerce strategy that integrates all the shopper and product data collected by retailers into a single platform can deliver that goal.

“Unified commerce ensures enhanced, more consistent customer experiences across digital and physical channels, and offers a 360-degree view across all front-end and back-end systems,” explained Clarke. “It creates a seamless, consistent customer experience across all channels and enhances decision-making with a single view across all channels so retailers can make more informed decisions on inventory, pricing, promotions and customer engagement.”

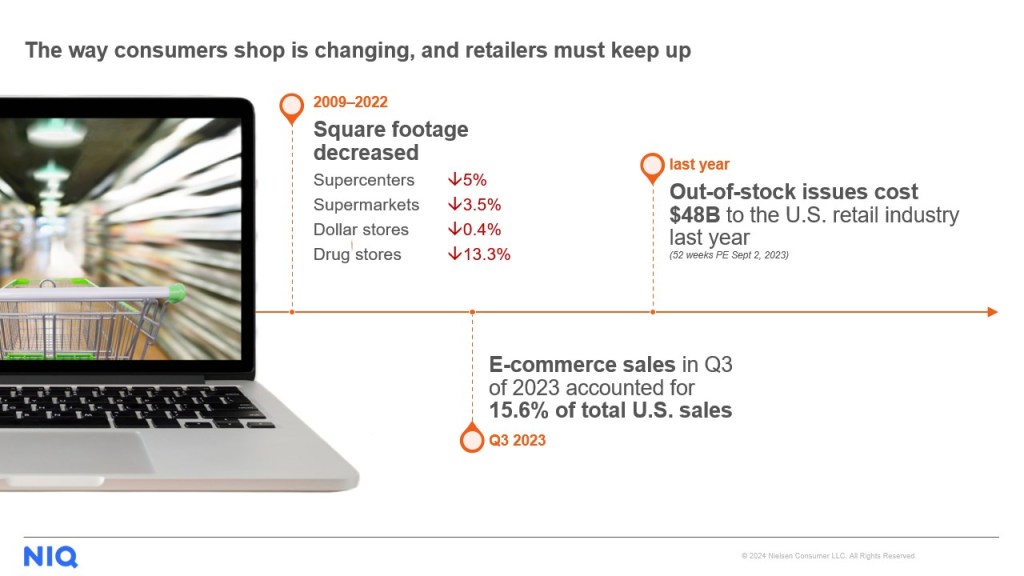

Mastering the omni experience

Store space is shrinking, leaving less merchandising space and greater shelf competition. E-Commerce sales in Q3 of 2023 accounted for more than 15% of total U.S. sales, and out-of-stock issues cost $48B to the retail industry last year.

Shoppers expect a seamless and engaging experience across channels, but many retailers continue to struggle aligning their online and offline experiences. Clarke suggests that rather than view in-store and online channels as complementary, merchants need to shift their mindset to a more unified one.

“While online ‘shelf space’ is theoretically infinite, you need to offer products consumers want. You can’t manage what you can’t see, so it’s crucial to leverage technology that monitors every sale, every SKU, every day,” Clarke confirms. “The right retail data partner must be able to instantly track sales and share performance to help retailers identify trends and understand competitive and category performance across channels.”

Increasing retailer and supplier collaboration

Retailers have always collaborated with suppliers to some extent—in fact, more than $2B is spent every year on collaboration beyond traditional trade funds and retail media. But enhanced collaboration is critical to long-term growth.

Clarke cited a recent NIQ/Coresight Research report that confirms meeting the needs of shoppers is a top advantage of enhanced collaboration. Improved collaboration also has a direct impact on overall company revenue and profits.

“Collaboration programs often don’t fully live up to their promise. They’re viewed as a ‘tax’ on suppliers, and retailers may not use insights or have transparent ROI measurement,” he confirmed. “Fragmented platforms must move to a singular version of truth. An all-encompassing, end-to-end platform that addresses the entirety of retail analytics use cases emerges as the optimal scenario. This platform should seamlessly integrate supply chain analytics, customer insights, merchandising analytics, personalization and retail media, providing a comprehensive solution for all facets of a retailer’s business.”

Embracing AI + democratization of data

Acknowledging that AI was pervasive at the NRF’s Big Show this year, both on the exhibit floor and in the educational sessions, Clarke gave his personal perspective on the topic and its near-term impact on retailing.

“For me, as a former retailer, AI is only as good as the data I have so I’m really focused on having granularity of data and breadth of data at critical points. I can’t have my data disaggregated—I need to have it all in one place, and I need external data in the same place so I can use AI to be more efficient,” he said. “Then my team will be enabled to make better decisions faster.”

So, what does all this mean for retailers?

Data needs to be leveraged at all times and at all touch points

“Data delivers improved customer experience. Data improves decision making and efficiency. Data gives companies greater agility and scalability. Data provides a 360 view,” concluded Clarke. “Companies need a single platform that enables them to gain insights for shoppers, promotions, retail media, personalization and assortment.”

Watch the live session

Want to get more retail insights to master the challenges ahead in 2024?

Stay ahead by staying in the loop

Don’t miss the latest NIQ intelligence—get The IQ Brief in your inbox.

By clicking on sign up, you agree to our privacy statement and terms of use.