Easing Price Inflation

Data from the Central Statistical Office indicates a promising decline in the inflation rate for consumer goods and services. In the first three months of 2024, the monthly year-over-year inflation rates were recorded at 3.7%, 2.8%, and 2.0%, respectively. This trend points towards a weakening impact of price increases on the overall economy, providing consumers with a slight respite after the higher inflation rates experienced in previous years.

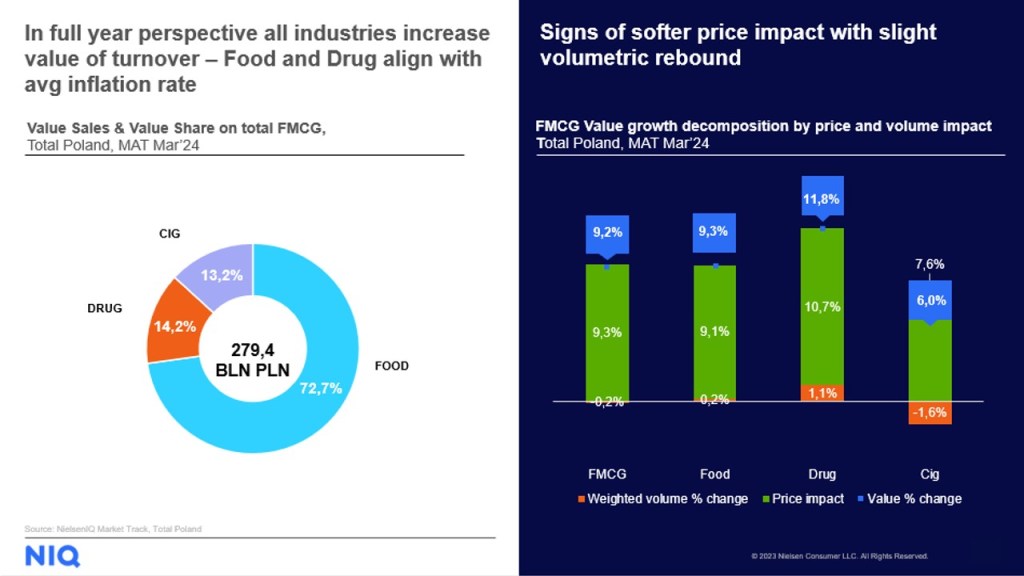

FMCG Sector Dynamics

According to recent data from NIQ, the FMCG sector’s value in the twelve months ending March 31, 2024, reached PLN 279.4 billion, marking a 9.2% year-over-year growth. This represents a deceleration from the 11.2% growth observed in 2023. Importantly, while the value growth has moderated, there has been a noticeable improvement in volume dynamics with a current reading of -0.2% compared to -1.4% in 2023.

Category Insight Spotlight:

- Food & Beverage: Experienced a value growth of 9.3% and a modest volume growth of 0.2%. Standout performers in this category include Frozen Food, Dairy, and Non-Alcoholic Beverages.

- Home Care & Cosmetics: Continued to see strong value growth at 11.8%, although slightly lower than in 2023. Volume growth has been particularly strong in Lip Makeup, Color Cosmetics, and Face Care, demonstrating robust consumer demand in these segments.

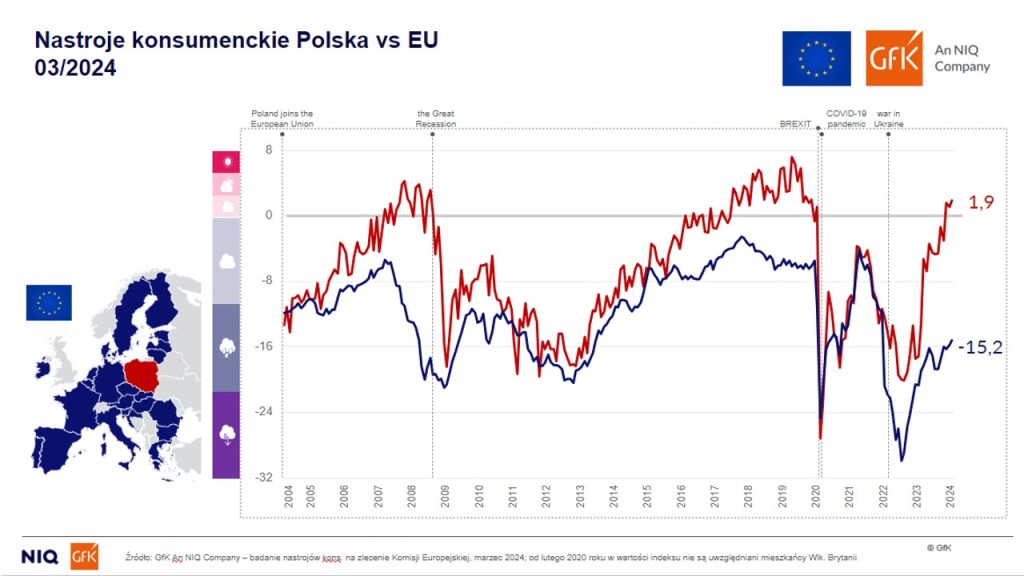

Consumer Sentiment Trends

The GfK – An NIQ Company’s Consumer Sentiment Barometer showed a slight increase to 1.9 points in March 2024, up by 0.8 units from February.

This improvement is largely driven by better assessments of current and projected financial situations of households, though there is a slight apprehension about the country’s future economic situation and a reduced propensity to spend on durable goods.

Technology and Durables Goods Market

In contrast to the FMCG sector, the technology and durables goods market displayed a minimal decrease in overall value, totaling PLN 50.77 billion in 2023.

The slight dip reflects ongoing economic challenges and geopolitical uncertainties, which have led consumers to prioritize basic needs over technology expenditures. Notably, smartphones continue to dominate the sales value within this market, followed by IT equipment and major domestic appliances.

What’s next

The first quarter of 2024 illustrates a promising transition in the Polish economy, marked by softened inflation and improved consumer confidence. While the FMCG sector shows healthy adjustments in sales dynamics, there is a contrasting cautiousness in the technology goods market, underscoring the complex interplay of economic factors influencing consumer behavior.

As we move forward, these trends will be critical in shaping strategies for businesses operating within these sectors, ensuring they align closely with the evolving consumer landscape.

Ready to learn more?

Interested in more insights for the FMCG and Technology and Durables markets in Poland? Contact us today.

![Understanding your audience: The power of segmentation in retail [podcast]](https://nielseniq.com/wp-content/uploads/sites/4/2025/07/Podcast-Understanding_your_audience-The_power_of_segmentation_in_retail-mirrored.jpg?w=1024)