The state of vulnerable consumers and the SNAP participant profile

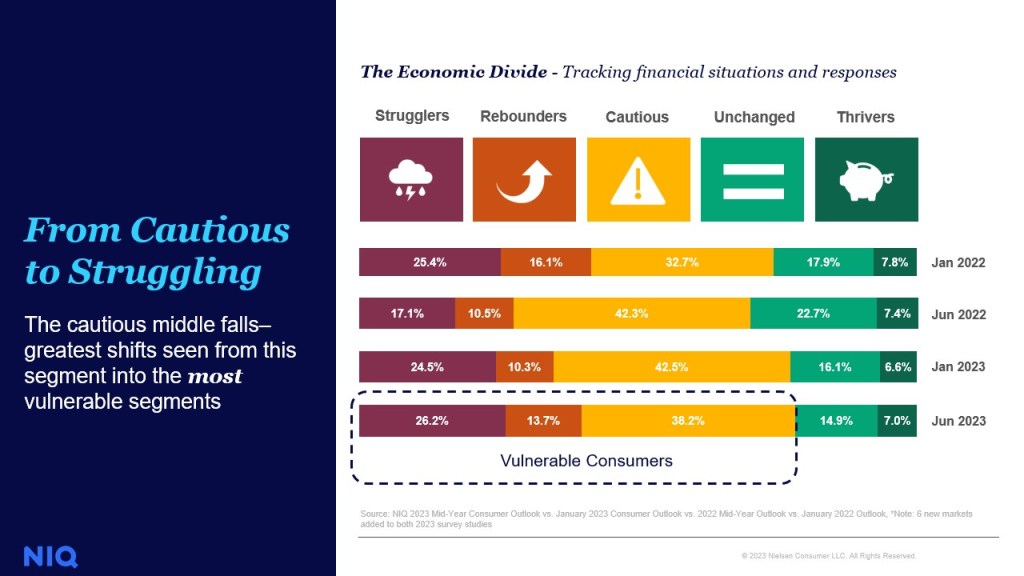

NIQ’s consumer economic divide research shows that over the course of 2023, consumer spending became more polarized. Many consumers who previously identified their spending outlook as “cautious” are now in more vulnerable financial positions with 78% of US consumers identifying as “vulnerable” and more than 38% remaining “cautious.” As economic insecurity persists, it will be more important than ever for CPG brands and retailers to engage and reach vulnerable consumers.

With this growing population of vulnerable consumers comes heightened food insecurity. NIQ’s partnership with Feeding America on the Map the Meal Gap project shows how this consumer shift is translating to more food insecurity:

- 1 in 3 people facing hunger and food insecurity are unlikely to qualify for SNAP

- 9 out of 10 high food insecurity counties are rural

- 8 out of 10 high food insecurity counties are in the South

For a detailed breakdown of food insecurity by region, and categories where vulnerable consumers currently over index, watch the full webinar.

The Farm Bill and Impact of emergency allotment

The legislation authorizing SNAP falls under the nutrition area of the Farm Bill, which is administered by the USDA. 76% of the Farm Bill’s budget is allocated towards nutrition, with SNAP accounting for the largest portion—whether this will remain the case in 2024, when the Bill is up for renewal is an open question. Many US lawmakers are debating how much should be devoted to nutrition. Manufacturers and retailers will want to keep a close eye on this debate as policy will affect SNAP benefits and consumer spending power for the next five years.

Currently, participation in SNAP stands at 42 million households. They represent 12% of the US population and 16% of food and beverage sales. So understanding the behaviors and trends amongst SNAP participants is key for manufacturers and retailers to not only understand overall volume trends in CPG, but how to meet this consumer group’s needs.

With a sizeable portion of the US population participating in SNAP— and a decrease in emergency SNAP benefits —comes new shopping behaviors and implications for CPG manufacturers and retailers.

Beginning in March 2020, the USD approved states to provide SNAP households with extra pandemic-related benefits known as emergency allotments (EA). EA benefits were phased out over 2022 and all EA benefits ended after February 2023.

SNAP participants now have less money for everyday needs—NIQ data shows that after the benefit reduction, SNAP recipients bought less food and beverages overall (-3%), and made fewer purchases (-1%). An NIQ survey of SNAP participants also revealed that when asked where they planned to reduce spending, SNAP participants reported:

- Alcohol 45%

- Beauty 33%

- Pet 22%

- Groceries 19%

A review of NIQ retail sales data confirms that SNAP participants bought fewer FMCG products overall (-3% in volume) from March of 2023 through July and followed through on making fewer purchases in Alcohol (-5%), Pet (7%), and Grocery (-2%) departments, as well as the Diary, Frozen and Produce, Meat. Watch the webinar for the full department category spending breakdown to see where SNAP participants are pulling back—and buying more).

58% of SNAP recipients also reported that they will decrease spending on dining out

Certain categories (including sweet snacks, convenient meal options) where SNAP recipients over index can fill in these gaps in meal occasions, while other categories could see decreased spend (40% of SNAP recipients reported they’ll buy fewer fresh ingredients and more frozen to save money).

SNAP recipients are buying more food and beverage units in the dollar, club, and mass channels.

The evolving SNAP consumer

SNAP shoppers are multifaceted and over index in households with people under 45, African American and Hispanic households, and those with 5+ members and incomes of less than $40k.

While SNAP households skew young, there is a significant and growing portion of SNAP participants (21%) that are elderly/disabled. Elderly participation in SNAP is affecting trends in store, contributing to growth in categories like digestive health and immune system health.

NIQ’s health ailments panel also reveals that roughly low-income households over index for a variety of health ailments when compared to the total panel.

SNAP consumers and health & wellness

Although low-income households are limiting consumption of some, more expensive, healthy categories like produce, wellness is still on their minds. In a recent NIQ survey fielded to SNAP recipients respondents were asked to rank, in order of priority, several factors when buying groceries:

16% of SNAP survey respondents ranked healthy as their #1 priority when buying groceries 21% ranked it as their #2 priority.

The reality for most SNAP recipients is that while buying healthy can’t be their top priority, they make healthy choices when and where they can. When benefit allotments increased in 2020, consumption of wellness products among SNAP participants also increased. When benefits decreased in 2023, consumption of health and wellness products also fell.

However, SNAP recipients are still consuming wellness products at a higher rate than 2019 in both cases. The benefit helped increase consumption over a longer period of time. With this change, SNAP recipients have stronger Wellness preferences than before. In fact, they’re buying more products with claims like “100 calorie,” “sugar conscious,” and “functional benefits.”

In 2023, SNAP recipients bought 22.4% of unit volume sales of Beverages that meet NIQ’s “Better For” criteria, representing about $2.7 billion, a 2.6-point decrease from last year when contribution stood at 25%. Similarly, on average we see SNAP recipients purchasing almost 14% of unit volume among select wellness related claims, a slight decline from last year.

What’s next for SNAP recipients, CPG, and healthier food consumption?

Here are a few key questions for CPG manufacturers and retailers to keep in mind in a market with a growing population of financially constrained consumers and the growing government and healthcare initiatives on food as medicine:

- What % of your consumers are SNAP recipients?

- What health ailments and diets are your consumers dealing with?

- How did their shopping behavior change in 2023?

- What are the top Wellness Trends (product claims) in your category?

- How do your consumers plan to mitigate inflationary pressure? Where do they intend to cut back?

The right data provider can help you segment your consumers, their ailments, and how they shop, down to the ingredients and claims they prefer.

To learn more about best-in-class wellness solutions and get the full download on financially constrained consumers, watch the full “Navigating the New Normal: Understanding the Financial and Wellness Landscape of Low-Income and SNAP Consumers” webinar today.