Consumer spending priorities amid economic caution

Ramadan is a special month of reflection and spirituality for Muslims, especially in Indonesia, home to the world’s largest Muslim population. During this period, consumer behavior shifts as people focus on religious observances, gatherings, and Eid preparations. While Ramadan typically sees increased spending on food products, the economic landscape in Indonesia over the past few years has introduced new trends. Rising food prices and shifting priorities are influencing consumer spending with households tightening their spending budgets and reallocating their expenditures.

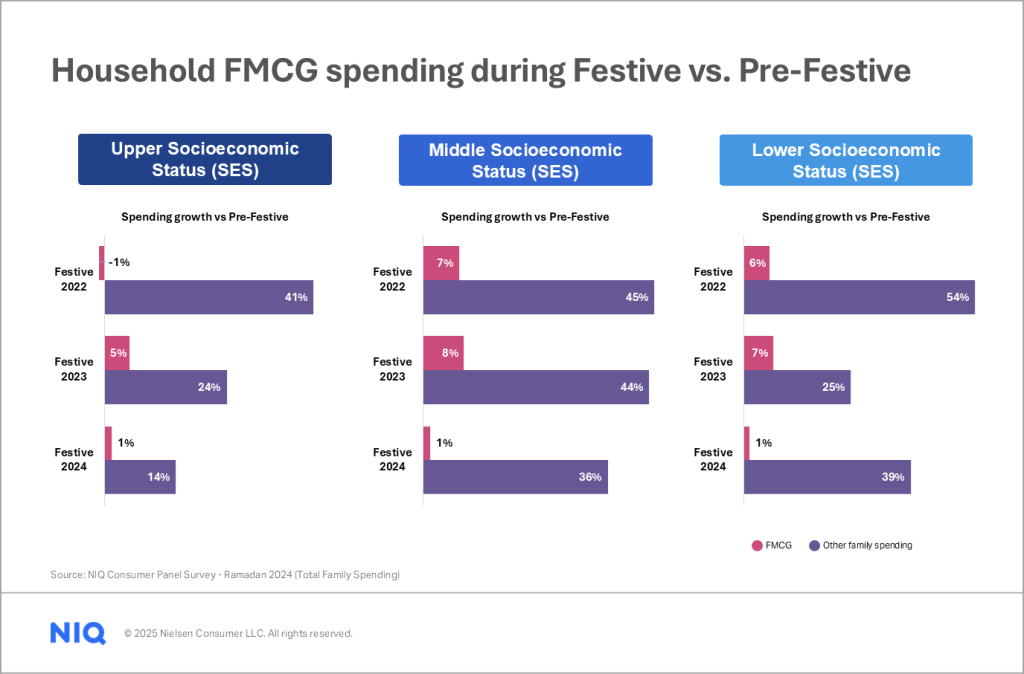

While household expenditure during Ramadan increased by 20% in 2024, the growth in FMCG spending was less than 10%, as consumers prioritized other categories. NIQ’s Consumer Panel Services data shows that this disbalance in FMCG growth was a result of consumers shifting their spending to leisure and fashion categories, a trend seen across all socioeconomic statuses (SES) during Ramadan.

To adapt to these changing consumer priorities, FMCG brands should focus on offering value-driven products and promotions that align with the current economic climate, ensuring they remain relevant and appealing to budget-conscious consumers.

Shifting brand choices: Consumers become more selective

Local and more affordable brands experienced higher growth during Ramadan in 2024 compared to premium and leading brands as consumers were more selective, opting for affordable food and beverage products to manage their budgets effectively while still enjoying the festive season.

Despite this shift towards affordability in food and beverages, consumers continue to seek premium and better-quality items for beauty, personal care, and healthcare products. Looking beautiful and staying healthy remains essential during Ramadan, leading consumers to choose premium brands in these categories.

Online channel growth driven by attractive price and promotion

Indonesians are increasingly exploring online shopping as an alternative channel for their FMCG household needs. Driven by attractive promotions and competitive pricing, consumers switched spending from offline to online channels during Ramadan, contributing to an increase in online sales by over 20%. Especially in the beauty category, premium brands are performing better due to increased online promotions and consumers’ willingness to spend more on online channels.

While promotions are essential for boosting sales, brands should be strategic about the timing and intensity. Simply running promotions doesn’t guarantee high sales volume. To be effective, promotions must be well-timed and appealing to capture consumer demand.

Capitalizing on the finishing sprint

Increase in disposable income, coming from the two-month regular salaries (February and March) and festive bonus, will drive higher spending in the final ten days of Ramadan. This is a particularly crucial period as it marks peak shopping period for gifts, clothing, and Ramadan-specific foods.

Middle and lower SES groups are actively purchasing FMCG products, with beauty categories continuing to grow as consumers aim to look their best during the festive season. For Iftar and Suhoor, people prefer home-cooked meals, opt for convenience products, and are drawn to promotions. Additionally, there is a major shift towards local and affordable brands, especially in the food and beverage sector.

By understanding these trends, FMCG brands can strategically position themselves to capitalize on the unique opportunities presented during Ramadan and beyond.

Unlock consumer spending behaviors for growth

Pinpoint shifting consumer preferences, identify competitive threats, and seize market opportunities with NIQ Consumer Panel Services. Book a meeting with us to learn more.