Buying or renewing car insurance is no longer a simple task for motorists. For insurers understanding the increasingly complex purchase journey is critical to building a successful strategy to maximize sales and customer retention. We have carried out extensive research into the purchase journey of UK car insurance buyers and we’re sharing it in a series of blogs, so let’s start at the beginning – The Research Phase.

How drivers research

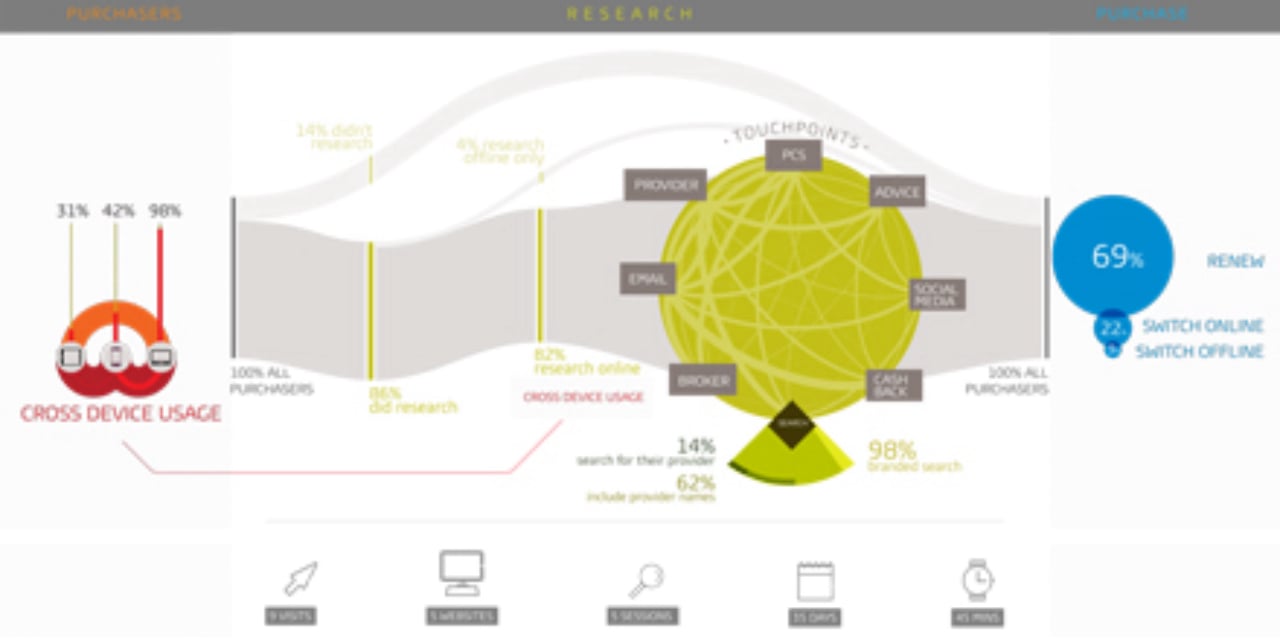

Eight in 10 people (82%) conduct research for car insurance online. Many car insurance buyers engage in what is known as ROPO (research online, purchase offline) tactics. ROPO has major implications for motor insurance providers, who need to develop Call Centre tactics for dealing with customers who come prepared to haggle over their renewal premium armed with research on alternative prices. It also has implications for the attribution of sales: it’s important to recognize the central role of online – even if it is behind the scenes – when assessing the ROI of the Call Centre.

Where drivers buy

Our research shows that the majority of people (69%) renew their existing policies. Almost a fifth (22%), buy car insurance with a new provider online, and 9% switch provider offline. Over half (52%) use a connected device (smartphone or tablet) during the purchase journey. Half (50%) of people who purchase online have carried out research on their smartphone, many requesting quotes through the device. Clearly, it’s essential that providers offer websites optimized for all connected devices, including quote retrieval that works across platform and device.

Devices used in motor insurance purchase journey – click here to view infographic

Researching online

Online research focuses on three types of websites: Price Comparison Sites (PCS), insurance providers and search engines. People typically do their research in a few concentrated sessions. Those who buy online spend almost an hour on average, in more than five sessions, over the course of more than a month, giving insurance providers plenty of opportunity to influence buyers’ decisions. Many journeys involve having multiple browser windows open simultaneously as consumers compare offers across sites. We’ll look at the role of branding in a later article.

Most offline research involves the telephone. 12% of offline switchers look at brochures. Less than 2% go into branches. At 5% word of mouth is surprisingly low: only around 5% overall talk to family and friends. Brands social media strategies need to take this into account.

Researching with search engines

A search engine is the most likely first point of call for those who switch online and those who renew. In contrast, offline switchers are more likely to go straight to a providers website, possibly to check on the provider that they are about to call. Online researchers who start their journeys with a search engine (39% overall) frequently do at least one more search, giving provider brands more than one opportunity to be present in results and convert browsers to buyers.

Researchers starting with PCS (26%) divide into those who use PCS once as a first step, and those who go through multiple sessions. Researchers starting with provider domains (24%) tend to stick to providers in their research sessions. No matter where purchasers start their online research journeys, online and offline purchasers alike search multiple sites.

Conclusion

If there is one thing our research screams out, it is that providers cannot be complacent. As we address in a later article , even auto-renew customers aren’t necessarily loyal. Complex, time-consuming, unique, even convoluted it may be, but all car insurance purchase journeys have one thing in common; everyone is researching other offers looking for the best deal. Providers needs to arm themselves with accurate information on consumer behaviour and attitudes about all aspect of the route to purchase if they are to succeed in this cut-throat, competitive environment.

For more information on this study contact our Digital expert Will Youngman will.youngman@gfk.com

Related articles:

HOW PEOPLE BUY CAR INSURANCE: PART 2: THE ROLE OF THE BRAND

HOW PEOPLE BUY CAR INSURANCE: PART 3: ARE RENEWERS LOYAL?