It’s not a surprise – for many retailers, their Christmas season performance is the decisive factor for the entire year’s financial success. This is particularly true for those selling tech and durable goods. While peak season sales embrace Black Friday, Cyber week, Christmas week and post-Christmas promotions, it’s increasingly difficult for retailers to set the right priorities for each of these events. To do so, they need the best intelligence on what is selling and when.

Each peak season is different

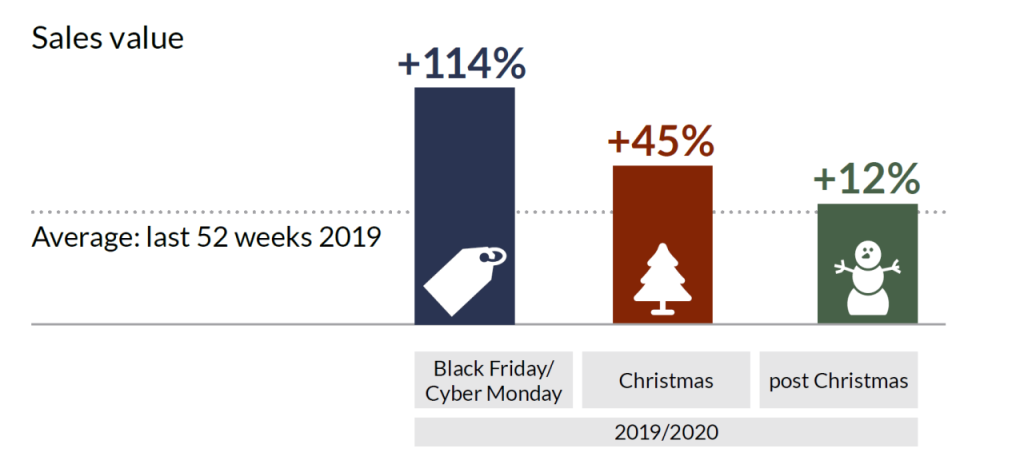

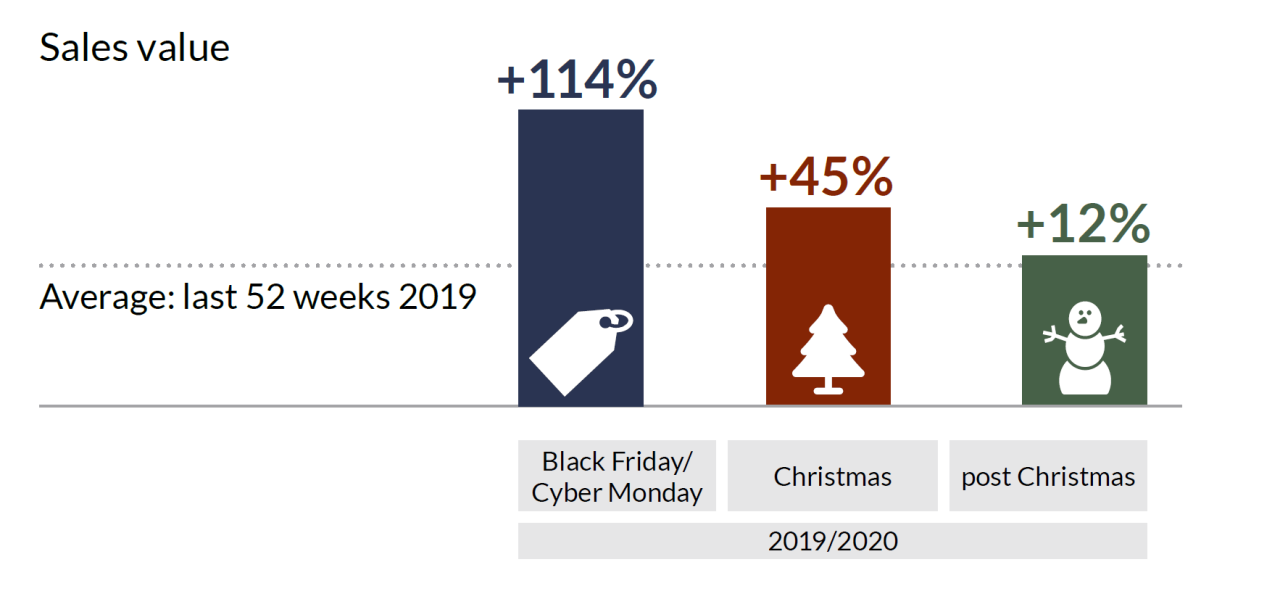

When it comes to Black Friday, Cyber week, Christmas week and post-Christmas sales, retailers need to know that each peak season is different. They must react to different consumer expectations and demands to succeed in the peak season sales. First, the size of the business opportunity must be considered. The fact that Black Friday week and the following week after it are responsible for more than double the revenue of an average week indicates where to focus most energy. Combined with a 16% growth compared to 2018, this sub-season is most crucial for securing revenues and margins.

The Christmas weeks (week 50 and 51) may have fallen behind Black Friday/Cyber week, but they still generate 45% more revenue than a usual week. However, relevance appears to be declining over time, for instance, in 2019 turnover was slightly below that posted in 2018.

The post-Christmas season (weeks 52 to 02) is different again. Here we see a 12% uplift versus an average week, with growth in 2019 amounting to almost 10% compared to 2018. Vouchers and gift cards – as well as having the time to shop – are key drivers of consumer demand during this time of the year.

The center of gravity keeps shifting to the Black Friday weeks, particularly for big-ticket item purchases. Every fifth Euro of the year is spent within these seven weeks of the peak trading season. Or put another way, the season’s performance is about 50% higher than that of an average retail week.

When is the best time to promote a product?

Consumer purchase behavior captured in GfK’s weekly Point of sales Tracking for tech and durables tells the story of what to promote and when it during the peak season sales weeks:

- Black Friday/Cyber Monday: Consumer Electronics (CE) are the star. Big-ticket items such as TVs soar in Brazil, Spain and Italy. Audio devices contribute strongly to the uplift in categories such as Small Domestic Appliances (SDA). Consumers are increasingly seeking out premium segment purchases, with a focus on entertainment categories including PTV and Audio. Overall, attractive discounts are the trigger to save the most Euros in absolute terms.

- Christmas: SDAs, Photo and IT product categories reveal the highest momentum. Printers, hairstyling tools and coffee machines are key movers in the final weeks of the year. The real gifting season peaks now. Smaller ticket items sell well, with a focus on traditional shops rather than online retail. Products to place as gifts under the tree are key.

- Post-Christmas: Here we see a shift back to CE, namely audio devices. Also, SDAs are more in demand this season. Price promotions pick up again and a more normal mix of assortment is in demand. E.g. Major Domestic Appliances see relative strong demand compared to the Christmas weeks. SDA and CE categories maintain their seasonal strength.

How do you protect sales margins?

Looking at the level of discounts granted, the pressure on margins can be massive. But not playing along is not an option at all – consumer expectations for seasonal promotions become stronger every year and is a major trigger driving demand. The only option to secure peak season sales performance is to listen to consumer needs and behaviors to look out for opportunities. We break it down to three main takeaways:

1. Less complexity: This is the new consumer mantra. According to our latest FutureBuy study, 62% of global Tech and Durables shoppers complain about too much choice. This hampers decision-making. Instead, we recommend promoting fewer hero products that deliver performance and simplification.

2. Clear communication: Alerted by media reports questioning the validity of seasonal promotion deals in previous years, consumers are increasingly skeptical about sales, discounts and promotions. It’s important that they are assured that price drops are genuine and that they see Black Friday and other seasonal price drops as offering a real benefit to them.

3. Premiumization: Owning fewer but higher quality products is a clear and significant trend, especially during Black Friday week. Offering product segments one or two levels above the standard segments yields revenue potential, despite discounts to be granted. That’s why in 2019, average prices rose to a new peak compared to 2018 – at more than 40% above an average week.

We saw this in the success of OLED and >50-inch TVs, and headphones/headsets, where prices rose by more than 50% on average Demand was strong for high-performance notebooks for gaming, and with ultra-thin designs, as well as true wireless in-ear Bluetooth headphones. Similar trading-up patterns were visible in the Telecom and Domestic Appliances markets. Ultimately, this ensures interest and traffic, and supports consumers’ aspirations.

How will peak season sales look like in 2020?

The year-end peak sales season has undergone a major shift over the past years with Black Friday dominating the promotional calendar as the game-changer. As this trend grows, markets have become more predictable as sales dynamics repeat themselves. Different sub-seasonal focus areas have established themselves in most European countries, as well as in markets such as Brazil. Knowing the details on a country and product level will support profitable decision making for the peak season sales in 2020.

Want more about this topic?