Comparatively low shares of price promotions were the norm until early this year, but that will not be a successful strategy for Black Friday 2022 or Q4 in general. With sharp falls in demand, and no let-up in the pressure on consumers’ wallets, more substantial promotions may push consumers to spend more than planned on and around Black Friday – but it is not the only factor I’d consider, having delved into current consumer drivers.

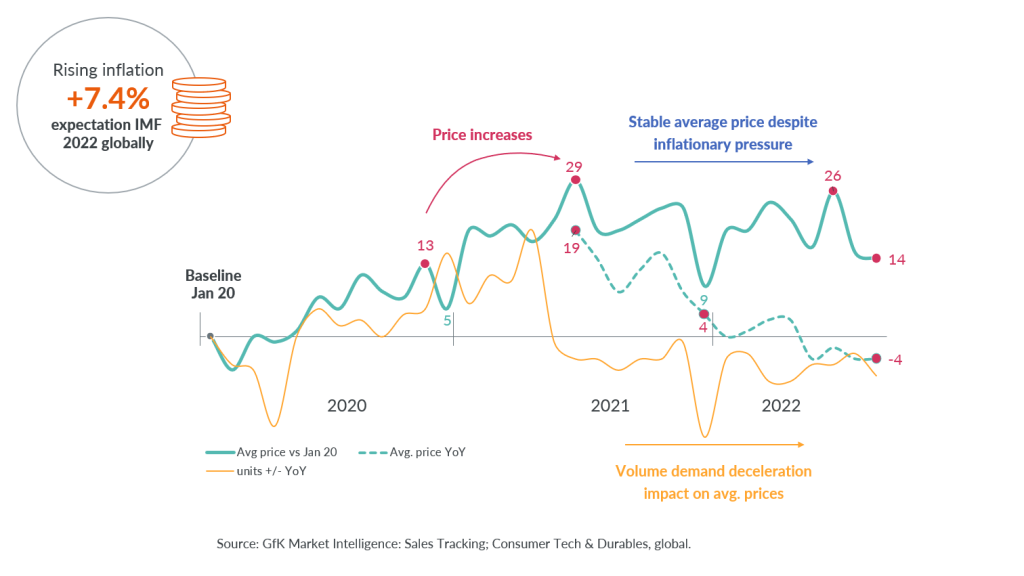

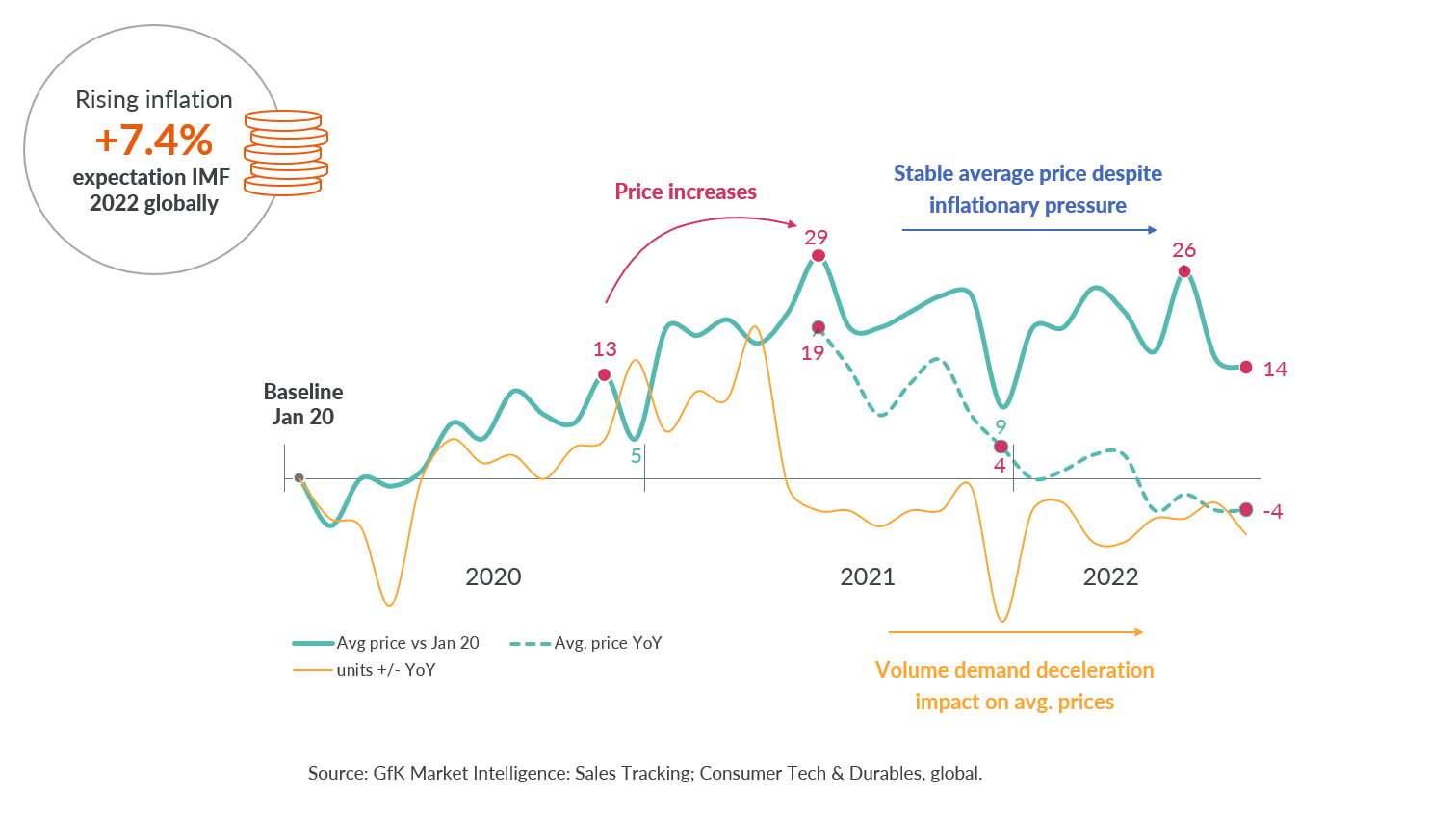

After a steady rise in prices throughout the last two years, 2022 has seen average prices (considered in US dollars) hold level in the broad view – despite the impacts of inflation. This is due to a significant drop in the volume of demand seen since mid-2021.

Tech Consumer Goods average price growth (USD) and unit growth year on year (versus January 2020)

As soon as this became visible, average price increases halted, and like for like prices even declined. For example, across major domestic appliances, the average price in USD on segment level decreased by 3% in August 2022 versus the previous year, while average TV prices across the first half of the year fell by 5% overall, and 14% for 75+inch screens.

With elevated consumer price sensitivity fuelled by rising inflation and energy cost, retail has little room for price increases. Consequently, manufacturers are facing strong headwinds when aiming to offset rising costs of manufacture and delivery.

Compounding this situation, high stock levels in categories with particularly low volume demand have forced retailers into increasing price promotions.

Outlook for Black Friday 2022 and Q4

Non-must-have (luxury Small Domestic Appliances (SDA), luxury Major Domestic Appliances (MDA), wearables, photo) products in this area are likely to see the strongest declines in overall volume sales, however, premium segments will continue to sell in key markets.

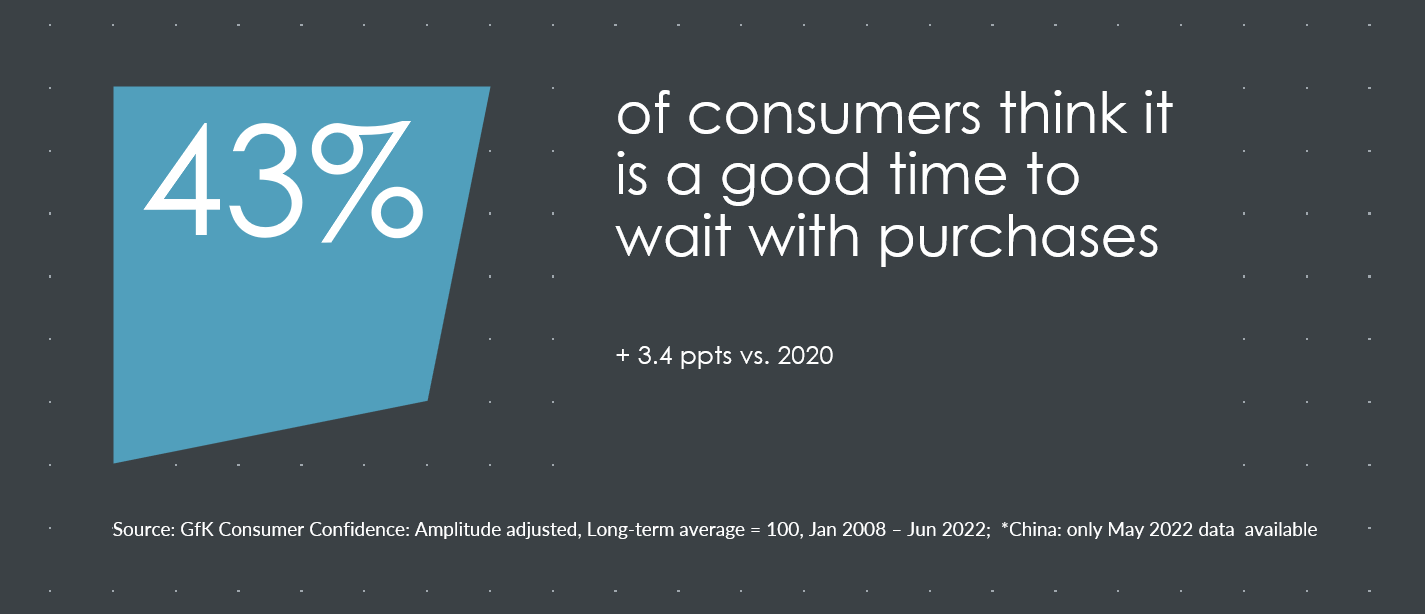

Volume sales will be under greater pressure than average, as the mass market delay or cancel non-essential spending. Already 43% of people globally think that now is a better to delay purchases that to make them (up 3.4 percentage points compared to 2020). However, premium products in these categories will remain in demand. This is because the typical premium buyers (high income) will remain comparatively unaffected by the rising cost of living and continue their typical buying habits. If they do reduce spend, they will turn to “affordable premium” – and this is likely to become an increasing topic as price sensitivity grows in 2023.

Must haves (Smart Mobile Phones, TVs, standard Major Domestic Appliances, basic Small Domestic Appliances) products’ volume sales are likely to be more stable. However, average prices will be under pressure as the product mix suffers

Entry-price segments will become more relevant as lower-income purchasers reduce their spend, even on essential items, to stay within a given and decreasing budgets.

A point to note is the special situation for IT and, to some extent, SDA. These were the fastest growing segments since the pandemic and so market saturation is now quite high. Especially for IT, this means that we do not expect an uptick in the entry-price market in Q4, even though IT is a “must have”, as the usual replacement demand is low due to recent market saturation.

What are the expectations for heavy discounts during peak sales season such as Black Friday 2022?

It is obvious that product groups that have experienced particularly weak demand over the past months are most likely to be discounted more strongly – to clear out inventories.

TVs are the most prominent category for this, with heavy pressure to sell off volume via promotion offers. This trend is already strongly visible in the Jan-Aug data, which shows the share of price promotions (price cut 15%) more than doubled compared to the same period last year.

A further example is cordless vacuum cleaner handsticks. After strong sales in 2021, there has been clear deceleration in demand this year. Hence price promotion sales (15%+ price cut) for this product group have grown by almost 30% compared to last year. I also expect to see strong discounting for these products during the coming Q4 peak season 2022.

A 3rd example is lower priced IT products; the IT product group has suffered demand drops this year, after saturation in recent years. Promotion activity has therefore more than doubled during Jan-Aug this year compared to last, but mostly for items selling below USD1000.

Where can we expect moderate or no discounts during Black Friday 2022?

Products that are still enjoying stable or strong demand will naturally see far less drive for discounting. A prime example is robot vacuum cleaners with dirt extraction (docking station). Sales of these have more than doubled this year compared to last – resulting in a drop in the share of price cut promotions.

Interestingly, premium IT products – those above USD1000 – have not seen the increase in price promotions that I mentioned above for lower-priced IT. Discounting activity has been limited to the lower priced products.

How to drive premium sales in 2022 peak season

The split situation for lower-price versus premium IT products shown above is likely down to the polarization of consumers that has been accentuated by the mounting cost-of-living crisis.

Lower-income shoppers who would usually buy in the entry or standard price bands are heavily reducing or postponing their spend. But higher-income shoppers who habitually buy premium products are more ‘crisis resistant’ and continue to buy in the top-end of the markets, and at a relatively stable level of spend. While there are some early indications of a move to ‘affordable premium’, we nevertheless expect this consumer segment to continue to purchase in the premium end during the peak season.

The question is, how can retailers and manufacturers make it even easier for shoppers to make the mental sum that triggers them to decide on a more premium product, rather than a basic one, this Black Friday?

Our #1 recommendation: show consumers how to minimize the “total lifecycle cost” by investing more upfront.

Focus your advertising on how your higher-end products deliver far greater durability, or eco-credentials, or upgradeability and repair-ability and energy efficiency than the cheaper models. Show shoppers that, by spending a bit more now, they get a far greater monetary return over the full lifecycle of the product.

Take TVs and laptops (as well as most non-essential SDAs) as examples. Energy efficiency plays a very low part in consumers’ decision-making when choosing which model to buy in this area – if it is even considered at all. But a clear winner is when you can show that the increased durability, repair-ability and upgradability / updateability of one model over another delivers long-term money savings for the owner. This means that strong hardware and upgradable software, as well as powerful performance features, will trigger more premium purchases, even among consumers battling with inflation.

For MDA, however, the energy efficiency of a model plays an especially important role for consumers when deciding which item to buy. Best-in class energy labels, as well as low absolute energy consumption, can be leveraged easily in the face of soaring household energy bills. This is especially so for fridges and freezers, which are running constantly night and day, as well as Tumble Dryers, which use the highest average amount of energy. In washing machines, buying an A-rated model rather than a C-rated one could save 100kwh/year over 12 years (the average replacement cycle for MDA). Retailers should urge consumers that the long-term saving in energy bills more than offsets the increased initial purchase cost of buying a higher-end model – especially if the price of energy keeps rising into 2023 and beyond.