How did consumers shop Black Friday this year?

Consumers showed strong engagement with Black Friday deals, countering analyst concerns over a spending slowdown. However, NIQ rapid survey insights show that the traditional notion of Black Friday as a one-day event is evolving. NIQ survey insights show that a third of consumers (32%) took advantage of early deals available in the days and weeks leading up to Black Friday, signaling a shift towards extended shopping periods.

- 24% of consumers waited until the day of Black Friday and shopped online to take advantage of deals

- 19% of waited to shop in physical stores on Black Friday to take advantage of deals

- 32% of consumers did not wait and took advantage of available, early Black Friday deals—however, these consumers did still browse the deals, on Black Friday

- 12% of consumers did not participate in Black Friday shopping on the day, because they shopped early Black Friday deals.

Where did consumers shop for Black Friday 2023?

Walmart and Target emerged as the top physical store destinations, for Black Friday shoppers with electronics and beauty stores rounding out the top-five retailers.

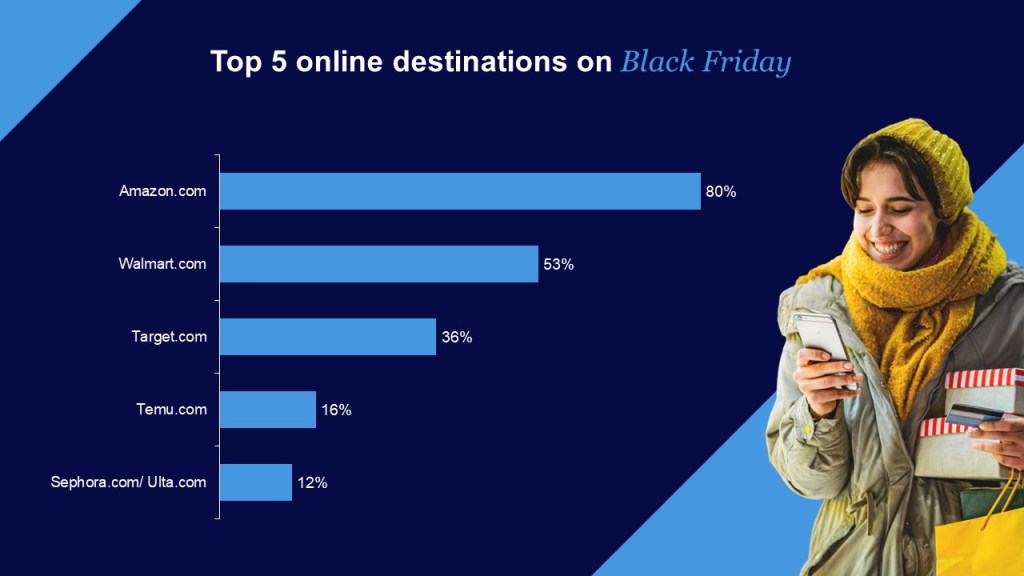

In the online space, Amazon, Walmart.com, and Target.com maintained their dominance, while newcomer Temu.com gained attention. Malls remain relevant, with 25% of consumers choosing this traditional shopping environment.

How much did people spend this year on Black Friday?

NIQ’s Calculated Celebrations report found that half (51%) of US consumers planned to spend moderately (between $200 – $500) on the holidays. Black Friday spending aligned with these intentions, with roughly half (46%) of consumers spending within $75 – $300 this year. 57% of consumers reported staying within their budget and 30% spent a similar amount as the previous year.

How did consumers pay for items this Black Friday?

44%

Debit card

44% of consumers noted paying for their Black Friday purchases today via Debit card

36%

Traditional Credit Card

36% of consumers noted paying for their Black Friday purchases today via traditional credit card

23%

Cash

23% of consumers noted paying cash for their Black Friday purchases today

20%

Digital Wallet

20% of consumers noted paying for their Black Friday purchases today via digital wallets

6%

Buy now, Pay Later

6% of consumers noted paying for their Black Friday purchases today via Buy Now Pay Later

What did consumers think of this year’s deals?

After another year of high prices and deal seeking, consumers came to Black Friday sales with discerning eyes. It was a mixed bag—with the majority stating that the deals were “the same as last year.”

Over a third (34%) of consumers noted that Black Friday deals were the same as last year, while some (26%) walked away from the Black Friday shopping experience satisfied, confirming that 2023’s Black Friday deals were better than those in 2022.

It’s evident that consumer behavior is evolving, challenging traditional norms. The rise of early deal seekers, the dominance of key retail players, and the dynamic payment preferences underscore the need for CPG brands and retailers to adapt strategically.

The takeaways from this year’s Black Friday by the numbers

As Black Friday transforms from a one-day spectacle to an extended event, brands that navigate the shift with agile, omnichannel approaches can not only meet but exceed consumer expectations.

It just requires up-to-date consumer insights and omnichannel data. Best-in-class providers can provide the data and insights you need to adjust for extended promotional periods, optimize online and in-store presence, and tailor your pricing strategies for Black Friday.

Source

- NIQ Black Friday Survey: 1500 US Consumers, Friday November 24, 2023