Consumer cost-cutting strategies

We know that consumers will continue to balance their wallet costs by adjusting grocery purchase habits. Different tactics include:

- Changing the frequency they shop

- Buying more on promotion or in bulk

- Switching brands or to private label

- Exiting certain categories

- Shopping across more retailers or channels

What is the solution?

Category management provides a compass to navigate these challenges. Any good category manager knows that an effective category management strategy utilizes the 4 P’s.

Shoppers are looking for better deals and promotions. Reviewing price and promotion can certainly be a suitable short-term strategy, but if the right product is not on the shelf, even this is futile. For a longer-term solution, we should look to assortment optimization.

More SKUs does not always mean more sales

Counterintuitively, adding more items to a product portfolio doesn’t always bring additional sales. There could be multiple reasons; for instance, overcrowded shelves can reduce visual clarity for shoppers or mask out-of-stocks.

In addition, the more items there are, the more price sensitive shoppers become. When faced with an overwhelming number of options, shoppers use price as the deciding factor.

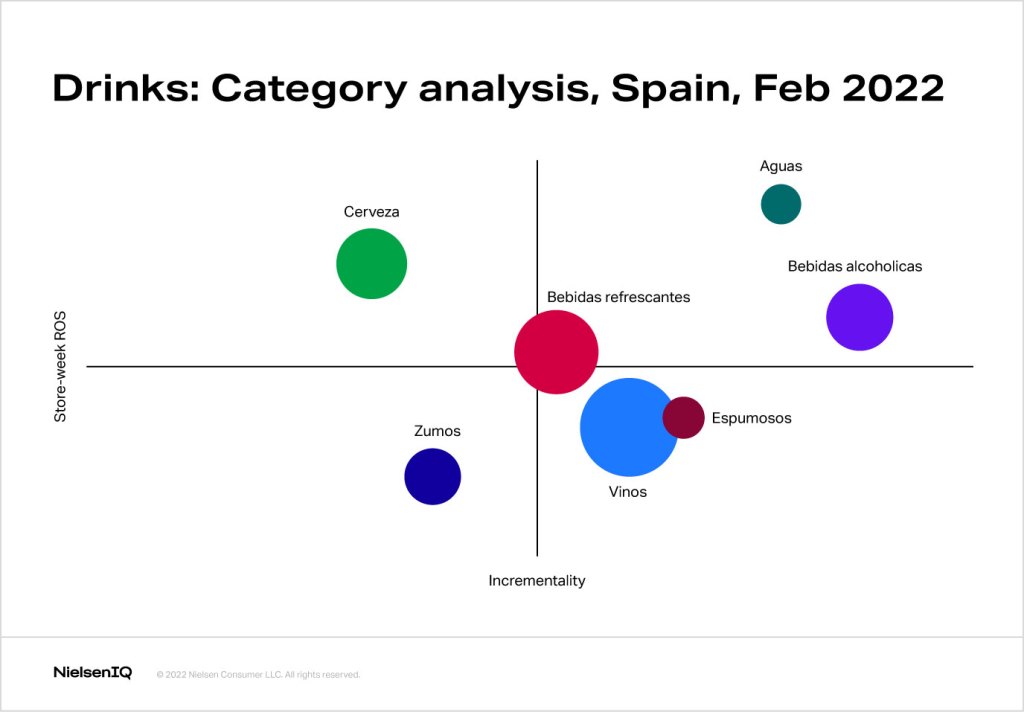

The example below shows an analysis of the drinks category in Spain. Water (Aguas) has a high incrementality and a high sales rate. Although Beer (Cerveza) also has a high sales rate, it suffers from cannibalization, shown by its much lower incrementality. Since water SKUs are less likely to cannibalize each other, expanding the number of SKUs in the water category is more likely to drive an increase in sales in the drinks category.

Indeed, a deeper look into the data suggests that by decreasing the overall number of beer SKUs (delisting some and listing other new, unique items), we could even see an increase in sales. The key is keeping a focus on optimization.

This is just one example, but of course, the opposite could also be the case. It’s impossible to know without incrementality modelling.

What about innovation?

In a scenario where we know there is strong scope for additional items in a category, we should also consider the following best practices:

- Understand the market and category trends. Innovation must be relevant to the shopper. Look at product attributes consumers are interested in—Health and Hygiene, Sustainability, and Product Origin are all important areas to consider beyond price and promotion.

- Review the shopper decision tree. Shopper decision trees tend to be reviewed every 5-10 years. Given the rapid economic shifts we have witnessed in the last 2 years, can you say with confidence that your shopper decision tree is still relevant? An accurate shopper decision tree can not only help in understanding how the shopper shops the category but also reveal relevant or expanding segments you are not playing in.

- Don’t consider product extensions as innovation. Although the shopper decision tree identifies nodes where you may not play, increasing a pack size to serve the “economy pack” segment is not innovation. Your innovation should stem from unfulfilled shopper needs by the category as a whole—look for the white space.

- Don’t be scared of premium innovation. Even in times of crisis, if your innovation is explained and wanted by shoppers, they will buy it. For example, as consumers’ pockets are squeezed, they cut back on out of home entertainment but look to recreate the experience at home with a “treat” occasion. This opens space for premium ready-to-eat meals or pizza and meal kits.

Back to basics

In challenging times, stick to the basics of category management. Review your assortment and make sure you are bringing the right products to the market with the right space on the right shelf.

Having an optimized portfolio, with decisions fueled by accurate data sets and trustworthy solutions, will strengthen and bring credibility to your retailer discussions, ultimately creating a win-win with improved category sales.