Before the COVID-19 pandemic, remote work was a luxury that many employees used infrequently. As we adjust to the “new normal,” there is a push to continue hybrid working, incorporating a mixture of in-office and remote work. An internal study of the 8,500+ GfK workforce in 2021 found that staff wanted more flexibility in how and where they work.

In the survey, 70% said that WFH gives them a higher quality of life, 50% said their stress levels have decreased, and 88% are happy with the time saved not commuting. For GfK, remote work has become normal. But it’s important to note that 62% of GfK workers and 66% of managers said that while they would prefer to work mostly from home, they would still like to visit the office at least one day a week. A hybrid working model is preferred by the majority of staff.

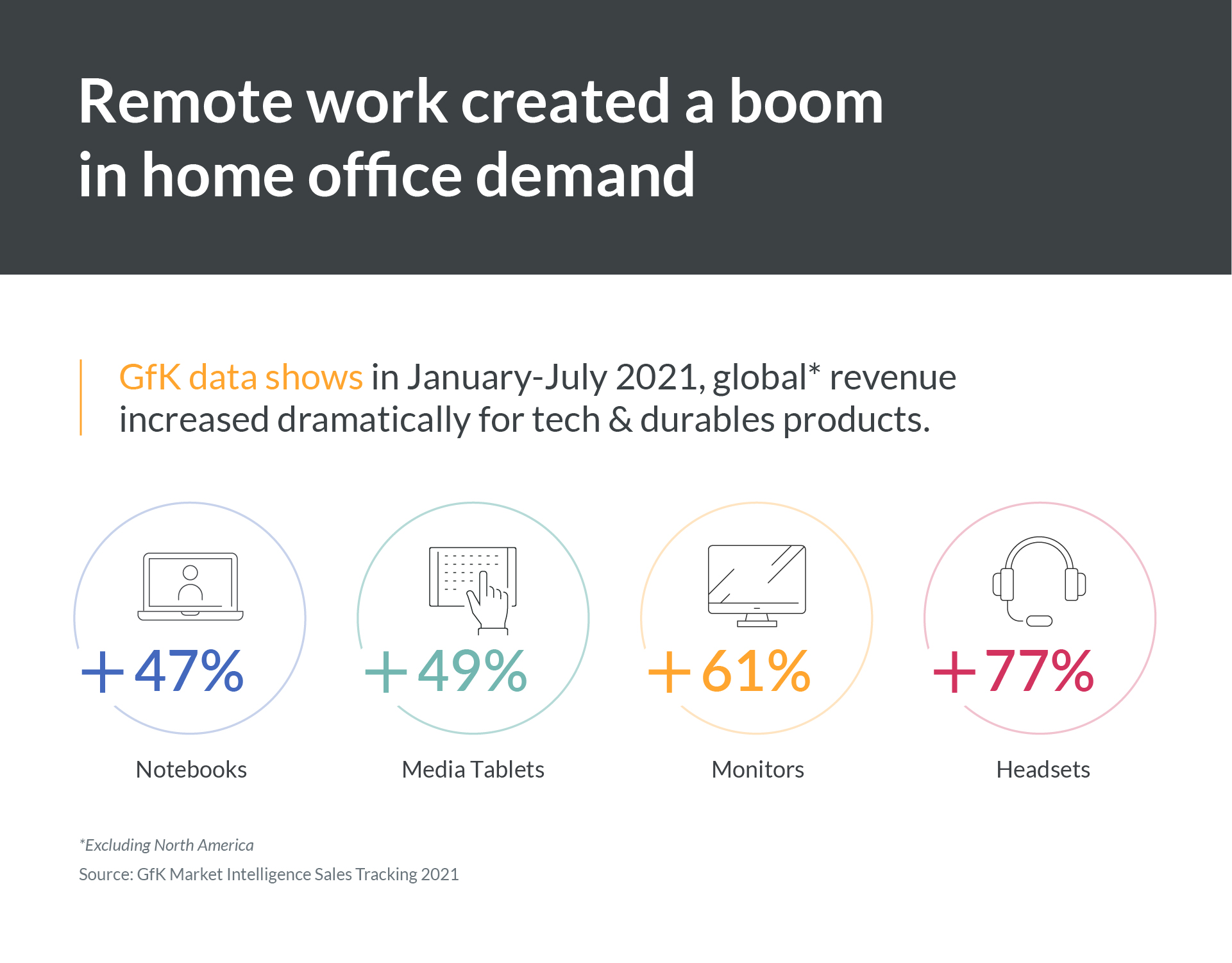

So it’s no surprise that the sales of home office equipment have risen since then. This shift to remote work means that WFH consumers demand home office equipment that helps them work seamlessly, protects their privacy, and replicates in-person interactions. To remain competitive, brands need to understand how to target these consumers with remote work products that improve their work lives.

Pre-pandemic, remote work was already surfacing as a global workforce trend

While remote work has accelerated during the pandemic, it didn’t necessarily ignite it. Before COVID-19 lockdowns, 8% of the US workforce worked remotely, and, by May 2020, that figure had risen to 35% before declining slightly to 24% in August. In the UK, ONS found that less than 30% of the workforce had worked from home in 2019.

For almost a decade, experts have predicted that remote work will become commonplace. In 2015, it was forecasted there would be 1 billion digital nomads by 2035, or “location independent” workers. The pandemic temporarily trumped these figures, as the number of remote workers in North America and Europe escalated to 125 million people in the first few months of 2020. This increase is over five times the number of people working from home before the pandemic. In addition, GfK data reveals that 84% French, 74% British, and 72% Germans who worked from home in 2020 would like to continue doing so.

Remote work quickly becomes the new normal

In 2020, remote working became the norm very quickly to help curb the spread of COVID-19. Sohjin Baek, Global Strategic Insights Manager at GfK, believes the pandemic switched up consumer purchasing habits. “Categories like computing, and accessories such as keyboards, mice, and cameras, are booming because people are working and learning from home.”

Technology and durable (T&D) sales continued to flourish, driving revenue growth between 2020-2021. Webcams were up 227%, PC/VOIP headsets 53%, monitors 45%, keyboards 33%, mice 28%, mobile PCs 27%, and inkjet printing devices 26% (GfK Talking Tech webinar). The work and learn from home phenomenon created a boom in home office demand.

The reason for these sharp rises in T&D purchases is due to the technical and human challenges remote workers face. They need products like mice and keyboards, fast connectivity, and access to cloud and app services to upload, share, and work collaboratively. To interact with colleagues on video calls, they also need technology and durables, such as webcams and headsets.

GfK data shows for the period of Jan-Jul 2021, compared to the same period in 2019, global revenue (excluding North America) increased dramatically for remote work T&D products: notebooks were up 47%, media tablets 49%, monitors 61%, and headsets 77%.

The impact of telecommuting on consumer spending and innovation

“Before COVID-19, most technology and durables were on a downward purchasing spiral”, says Ines Haaga. “Companies and brands were selling fewer T&Ds, especially in Europe, because we have a particularly saturated market. Everyone had the device already in place, and the replacement cycles were getting longer.”

However, during the unprecedented uncertainty, T&D brands met rising consumer requirements. T&D products had their highest demand when consumers felt disconnected, and staffing numbers declined. Additional technology improved people’s connectivity and helped corporations manage whilst running on skeleton teams.

Meanwhile, increasing demand for telecommuting products severely impacted supply chains. As lockdowns occurred globally, factories in Asia shut down. That market holds the majority of global T&D exports, so brands had to shift much of their production beyond China. Prices of remote working products increased sharply because of Europe and the US shortages. China and India had more affordable solutions available, but, regardless of location and socioeconomic status, consumer electronics demand rose significantly – we all needed it for work.

GfK data reveals that COVID-19 has increased online sales for technical consumer goods globally by 35%. While companies like Amazon and Tesla received criticism for keeping their factories open, COVID-19 also sparked innovation. A prime example is Fetch Robotics, which provides autonomous mobile robots to warehouses, experiencing a 63% increase in inbound requests from February to March 2020. Innovation is behind WiFi Mesh technology, which improves Wi-Fi signal strength at home via two or more devices or ‘nodes’. “Vendors are promoting WiFi Mesh because you have several access points in your apartment, and they work seamlessly together,” explains Sohjin Baek.

What’s next in remote work for technology and durables?

BBC Worklife research found that our way of working has shifted permanently. Only 12% want to return to full-time office work, and 72% want a hybrid remote-office model moving forward.

The increase in remote work has implications for the economy. Remote work searches were up 360% in the two years to June 2021, according to Glassdoor. Practical considerations around certain at-home T&D will require innovation as we spend more time at home. Quiet robot vacuums are essential and 24/7 T&Ds, like refrigerators, need to be unobtrusive when people attend webinars or video calls.

Energy use in T&D also requires consideration as domestic utility costs rise when people are home-based. Conversely, if everybody worked from home for just one day a week, it would save around 1% of global oil consumption for road passenger transport per year. Despite the increase in household energy use, the overall impact on global CO2 emissions would be an annual decline of 24 million tonnes (Mt) – equivalent to the bulk of Greater London’s annual CO2 emissions.

Finally, increased use of technology and durables will drive future innovation. Efficacy, durability, and energy use are existing fundamental issues, but they have become more pronounced since the change to a home-based lifestyle. Brands must focus on how T&Ds perform under additional strain while tackling the pressure to stay ahead in a post-pandemic world.

Want to know more about what’s next for T&D brands?