Home technology and small and major appliances enjoyed double-digit sales growth in 2021 as consumers looked for solutions to enable them to work, study and enjoy life from home.

But since the initial recovery in 2021, multiple disruptive factors, including the war in Ukraine and high food and fuel prices, have severely dented disposable incomes. EU consumer confidence has fallen sharply over the course of 2022, and 43% of global consumers feel now is a better time to wait than buy.

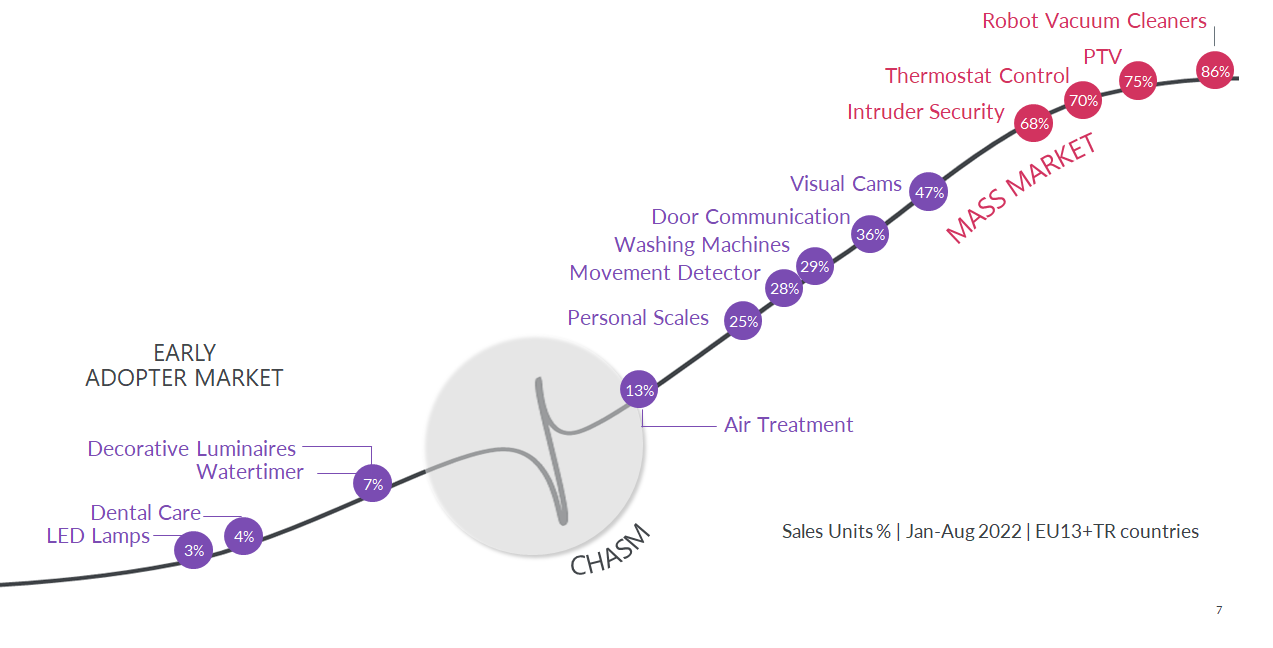

Amid this demand slowdown, some technical consumer goods (TCGs) are proving more resilient than others, particularly smart products with multiple functions that help simplify life.

Here we look at how simplification can activate consumer willingness to spend, and how brands can maximize its power by leveraging other 2022 trends.

Strong demand shows a willingness to pay more for consumer convenience

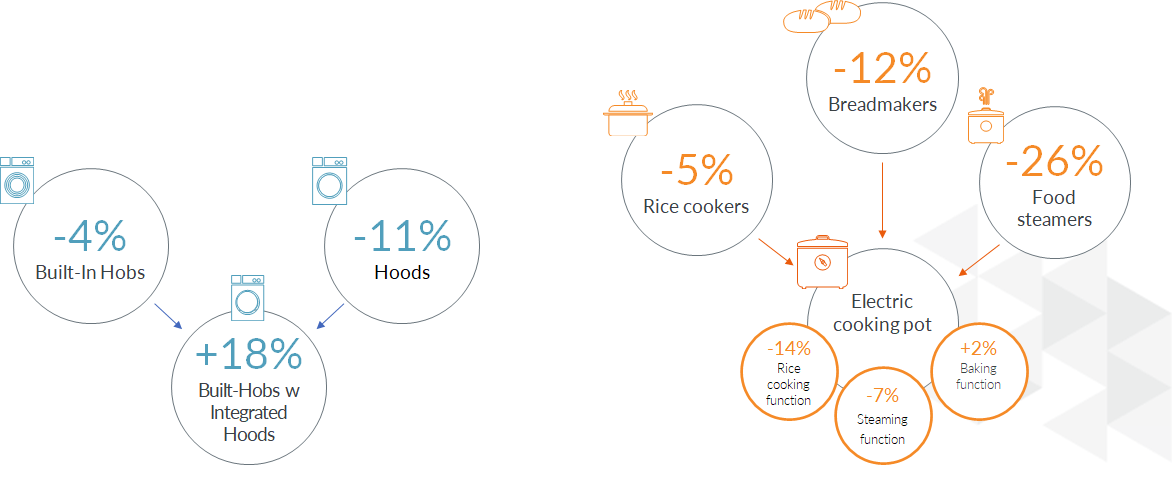

Although the sales value of consumer tech and durables declined by 5.5% in the first half of 2022, there were pockets of growth for some categories, and some products performed better than others within those categories. Our data shows product demand for items that met more than one consumer need or had multiple functions remained strong, even when their category as whole struggled. For example, year-on-year sales of built-in kitchen hobs dropped by 4% from January to August 2022 and hoods fell by 11%, yet there was a 18% jump in sales of built-in hobs with integrated hoods.

Similarly, sales of bread makers fell by 12% over the same period, but multifunctional electric cooking pots with a baking function rose by 2%. While those with a steaming function proved less popular from January to August 2022 than in 2021 (falling by 7%), this drop was less pronounced than for conventional food steamers, sales of which fell by 26% over the same period.

Multifunctionality is driving product demand

Source: GfK Market Intelligence: Sales Tracking Jan-Aug 2022 vs same period 2021

Despite demand deceleration in Jan-Aug 2022, there are still takers for premium products, echoing a GfK survey which found that almost (46%) of global consumers are prepared to pay more for products that make their lives easier.

The simplification trend can also be seen in robot vacuum cleaners. Sales increased in value by 48% in Jan-Aug 2021, double the performance of the category as a whole. Despite significant demand deceleration in 2022, year-on-year value growth for the robots was still 2% from Jan-Aug 2022 whereas the total value of vacuum cleaner sales slumped by 6%.

For washing machines, the total value of sales fell by 5% from Jan-Aug 2022. However, appliances with an additional drum clean function saw robust sales value growth of 12% as consumers opted for lower-maintenance appliances. And smart lighting was more resilient than standard options, limiting the decline to 8% in value from Jan-Aug 2022 even though the lighting category as a whole lost 14% in value.

Simplification activates consumers’ willingness to spend

Source: GfK Retail Point of Sales Tracking, International coverage (excl. North America), YTD: Jan-Aug 2022

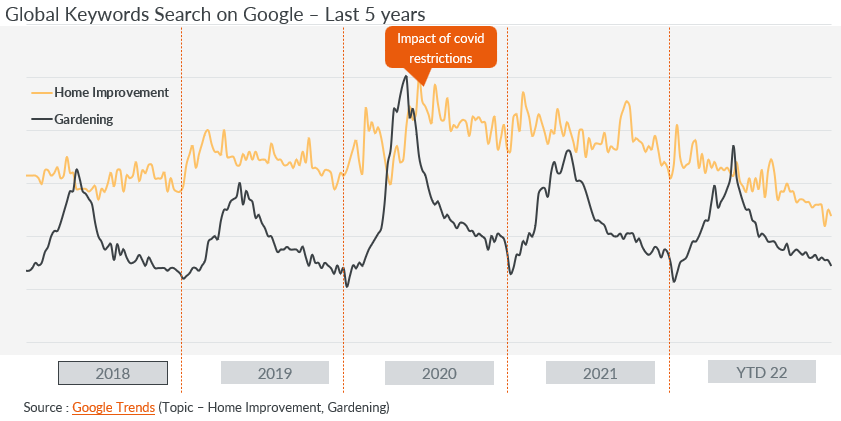

Urbanization and hybrid working drive the simplification trend

The relatively small differential cost for more functionality is likely a driver of demand for more versatile devices.

Increasing urbanization is also a contributing factor. By 2050, more than two-thirds of the global population will live in cities compared with a third in 1950. Meanwhile, urban living spaces are shrinking, a phenomenon framed at worst as a consequence of affordable housing shortages and at best as aspirational ‘micro-living’. Forced to be savvy with space, consumers are opting for versatile devices that take up less space on kitchen worktops and in cupboards.

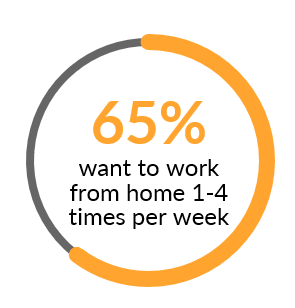

The ongoing work-from-home experience established during the pandemic is also a key driver of the simplification trend. Hybrid working is here to stay, with 65% of respondents to a GfK survey saying they would like to work from home 1-4 times a week. This is fueling demand for tech upgrading at home so that consumers can outsource recurrent tasks to smart devices such as robot vacuum cleaners and spend less time on chores.

Source: GfK Social Media polling 2022, LinkedIn 4,471 respondents across age groups and regions

Smart devices generally have benefited from consumers’ drive to create simplicity in their home lives. Intruder security devices, sales of which have grown strongly since the start of the pandemic, now increasingly offer smart connectivity with smartphones and the home ecosystem, enabling users to detect whether or not they have a window open, for example, and then adjusting the heating accordingly.

Similarly, the pandemic-provoked boom in video conferencing has seen the emergence of ever more versatile and convenient solutions that can be accessed with ease from multiple devices.

How can brands maximize simplification?

- Strong and relevant use cases are key to achieving mass market adoption with smart and products with multiple functions. In their marketing, brands need to emphasize how easy it is to use their products and how they will make life easier. For example, smart versions of robot vacuum cleaners accounted for 86% of unit sales in their category from Jan-Aug 2022 whereas LED lamps made up just 3% of sales in their category. One explanation is that lamps that can be operated remotely do not add sufficient consumer convenience while the benefits of an automatic floor cleaner that recharges itself and even empties its waste is self-evident.

Relevant use case and convenience are key to mass market adoption

Source: GfK Market Intelligence: Sales Tracking, Jan – Aug 2022

- While adding functions to a product opens premiumization opportunities, price can be a barrier to the adoption of smart home technology, so brands that overcome this by making simplification achievable within an affordable premium range will do well.

- Another way brands can leverage the simplification trend is by highlighting the performance and sustainability features of their products. Optimizing energy usage is the second most important smart home use case for consumers, with 39% of consumers in the Netherlands saying it is critical in these times of punishing fuel bills. Consumers considering their purchases more carefully will be looking for good value and clear benefits for their money.

Conclusion

We expect to see resilient growth in 2022 in smart product demand – especially for those that offer consumer convenience and multiple benefits to consumers’ lives. As households battle high inflation and delay spending decisions, the simplification topic will be a powerful way for brands to capture a more elusive share of wallet and maintain margins.

Want to understand more about simplicity in consumer lives?

![]()