Executive Summary

This whitepaper, commissioned by NIQ/GfK, examines the current developments and market potential of AI-enabled PCs (AI-PCs), focusing on the critical role manufacturers, distributors and the channel play in bringing these devices to market. It highlights the key factors driving AI-PC adoption, including market trends, replacement cycles, customer awareness and concerns, and distribution challenges.

The paper provides manufacturers, distributors, retailers, and resellers with actionable insights to overcome barriers such as low customer awareness, high pricing, and privacy concerns, while preparing for upcoming demand driven by replacement cycles and new product launches.

By combining NIQ/GfK’s sell-through and sell-out Market Intelligence with lessons from other industries like Smart Home, the paper identifies strategies for optimizing Go-to-Market efforts and building customer trust in AI-PCs.

Contents

1. Objectives and Methodology

Overview of NIQ/GfK’s Market Intelligence and data sources used to analyze AI-PC trends, sales, and customer perceptions.

2. The Rise of AI-Enabled PCs: 5 Key Factors for Success

The Rise of AI-Enabled PCs: 5 Key Factors for Success

Analysis of the key drivers of AI-PC adoption, including market growth, replacement cycles, customer awareness, distribution challenges, and security concerns.

a. Replacement Cycles and Market Readiness: The upcoming replacement cycle and its impact on AI-PC demand.

b. Consumer and B2B Perception: Awareness gaps and challenges to address for widespread adoption.

c. Market Trends and Growth Expectations: Insights into trends, adoption rates, and segmentation, and strategic recommendations for AI-PC expansion.

d. Lessons from the Smart Home Industry: How learnings from the Smart Home adoption can inform AI-PC strategies.

e. Proofpoint Channel — Overcoming challenges: How distributors can overcome market barriers and capitalize on AI-PC growth opportunities.

3. Conclusion

Key findings and takeaways for manufacturers, distributors, retailers and resellers to successfully capture this market opportunity.

1. Objectives and Methodology

This whitepaper draws from NIQ/GfK’s extensive sell-through and sell-out Market Intelligence, combining insights to analyze AI-PC adoption trends. NIQ/GfK´s distribution data covers over 300 distributors across 48+ markets, tracking distributor sales to retailers and resellers enabling users to identify market trends in real-time. With the unique combination of sell-through and sell-out information gathered from retailers and resellers, covering 200 product groups across IT, office, telecoms, and consumer electronics, NIQ/GfK unlocks valuable, comprehensive supply chain insights — making sense of supply & demand, and price differences along the supply value chain.

This paper also integrates NIQ/GfK’s Consumer Insights, providing a deeper understanding of end-user awareness, perceptions, and purchasing behavior related to AI-PCs. This holistic approach offers a comprehensive view of the market and helps identify the key factors influencing adoption rates.

2. The Rise of AI-Enabled PCs: 5 Key Factors for Success

Artificial Intelligence (AI) is transforming how we work, interact, and innovate. AI-enabled PCs are at the forefront of this shift, offering new opportunities for efficiency and productivity.

Both component and hardware manufacturers are bringing AI-driven devices into the spotlight. But where does the market stand today, and what can we expect moving forward? This section explores key developments in the computing market and the potential of AI-PCs.

Replacement Cycles and Market Readiness

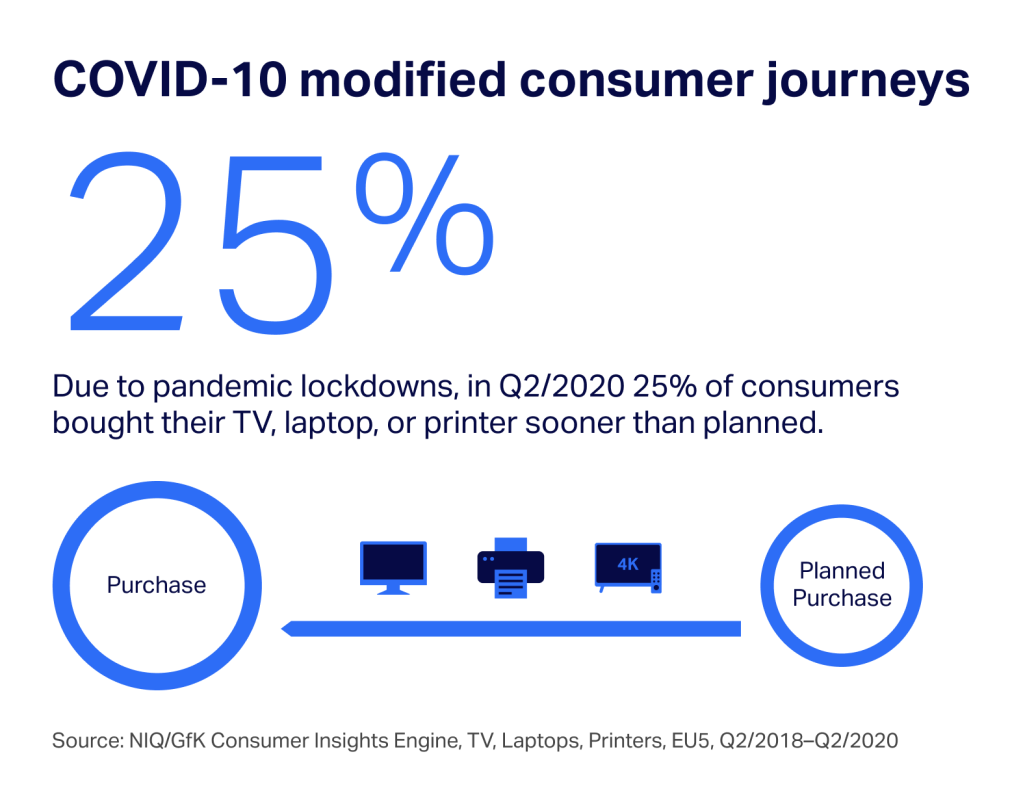

In recent years, the Tech & Durables market has surged, particularly during the 2020–2022 Covid-19 pandemic. This period had two primary effects on the market: First, consumers and businesses accelerated purchases to enable remote working and learning, leading to high sales, especially for mobile computers. Additionally, consumers brought forward personal purchases for gaming, entertainment and similar, as they were confined to their homes due to lockdowns and reduced work hours. Second, this disrupted expected replacement cycles, leading to preponed product purchases. NIQ/GfK Consumer Insights research suggest that 25% of consumers bought laptops, TVs, or printers earlier than planned in Q2/2020.

This confronted manufacturers with significant challenges. As replacement cycles were preponed and demand accelerated, they had to quickly adapt business planning to ensure product availability. However, product capacity was constrained by lockdowns, particularly in Asia, disrupting the supply of components, manufacturing, and logistics.

Distributors were able to compensate for these obstacles, and played a crucial role in maintaining supply to retailers and resellers. They offered the opportunity to safeguard supply while production sites were closed, as they held sufficient inventory to accommodate demand for 4–6 weeks for their retail and resell clients. For example, NIQ/GfK’s unique ability to combine sell-through and sell-out data insights uncovered that, in Germany, mobile and desk computers sourced from distributors increased by 18% in 2020 compared to 2019.

This was key for manufacturers. NIQ/GfK’s Consumer Pulse Study revealed that product availability at this time was a key factor in business success for manufacturers, as 26% of consumers purchased a different brand than planned due to their usual brand not being in stock. One in three of these consumers stated that they discovered a new brand as a result, which they planned to stick with post-crisis. Hence, product availability clearly played a role in brand loyalty.

“Our Consumer Pulse Study found 26% of consumers purchased a different brand than planned due to pandemic stock shortages. This underscores the importance of distribution to safeguard product availability helping brands in shaping brand loyalty in a highly competitive environment.”

Simone Bouchir

Product Manager Distribution & Supply ChainIntelligence

Source: NIQ/GfK Consumer Pulse Study

Distributors benefited greatly from this development, increasing their sales volume by +29% compared to the same period in 2019. Their sales to retailers, particularly online retailers, surged in demand by even more than +33%, while business with resellers grew by +40% in 2020.

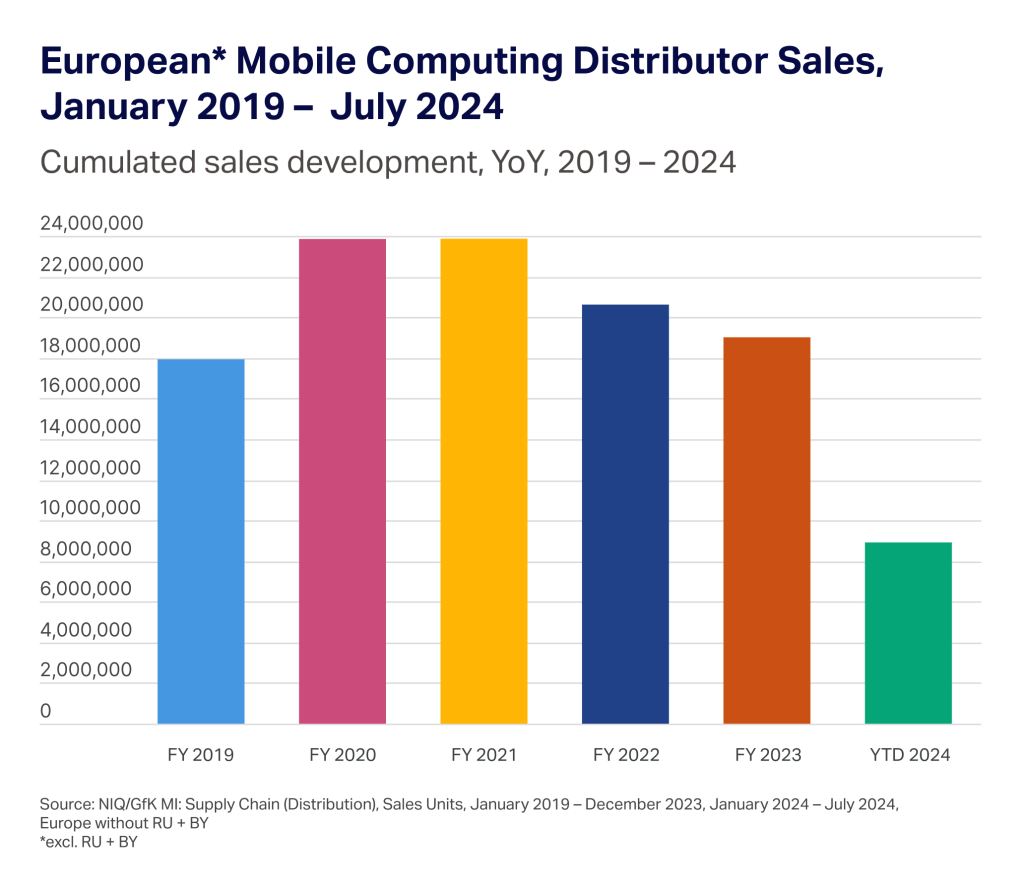

In total, European distributors sold nearly 24 million mobile computers in 2020, while retailers and resellers sales-out amounted to 36 million units overall at the Point-of-Sale.

However, with preponed purchases and replacements, computing markets experienced a steep decline in post-pandemic sales, particularly in 2023–2024. Following significant growth and exceptionally high sales during the pandemic, in 2020 and 2021, it is not surprising that a decline of -14% in 2022 and -8% in 2023 followed due to market saturation. Now, the first seven months of 2024 have shown early signs of improvement, partly fueled by the introduction of AI-compatible products to the market.

While early adopters may be drawn to AI-PCs launched in mid-2024, NIQ/GfK anticipates that — as the average age of a replaced PC is 5,4 years — the majority of replacements will follow standard cycles, with momentum picking up in 2025.

As the next replacement cycle approaches, distributors will again be crucial in managing stock and meeting demand, this time for AI-PCs. With NIQ/GfK’s unique ability to combine sell-through and sell-out data, manufacturers are able to closely monitor the ramp up of AI-PCs across sales channels. By combining both data sources, supply and demand can be perfectly aligned.

Consumer and B2B Perception

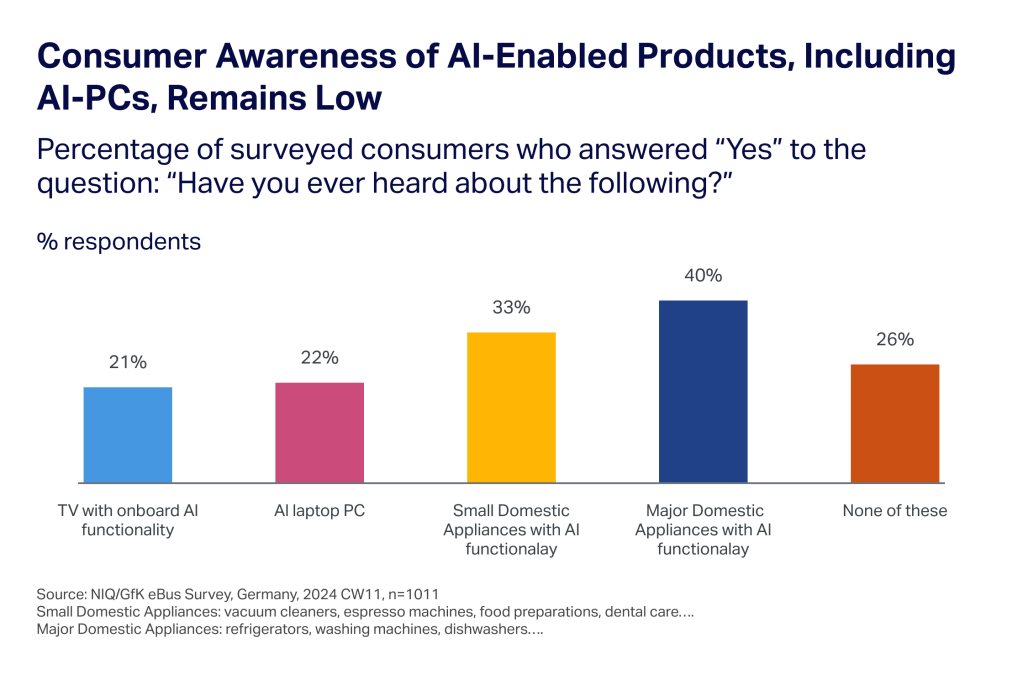

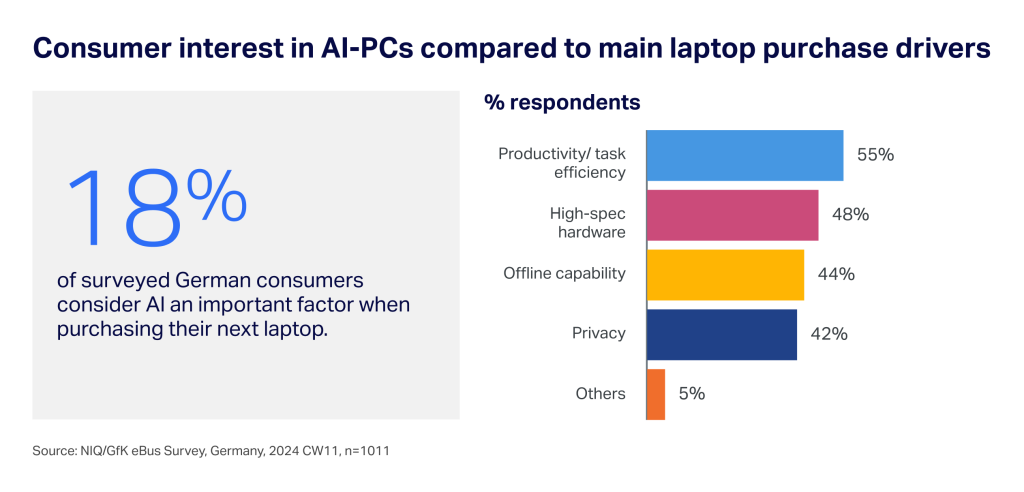

A key challenge facing AI-PC market penetration is the lack of consumer and B2B awareness. NIQ/GfK’s 2024 eBus survey indicates only 22% of German consumers have been aware of AI-PCs, and even fewer (18%) considered AI an important factor when considering their next laptop purchase.

Increasing awareness will be vital to drive adoption. Manufacturers, distributors, retailers and resellers must focus on communicating the unique capabilities of AI-PCs to close this knowledge gap and accelerate market growth.

NIQ/GfK data shows that consumers who consider AI a key purchasing factor prioritize enhanced productivity, higher specifications, and offline capabilities. To penetrate markets with this new technology, manufacturers must clearly communicate relevant benefits and use cases to potential customers.

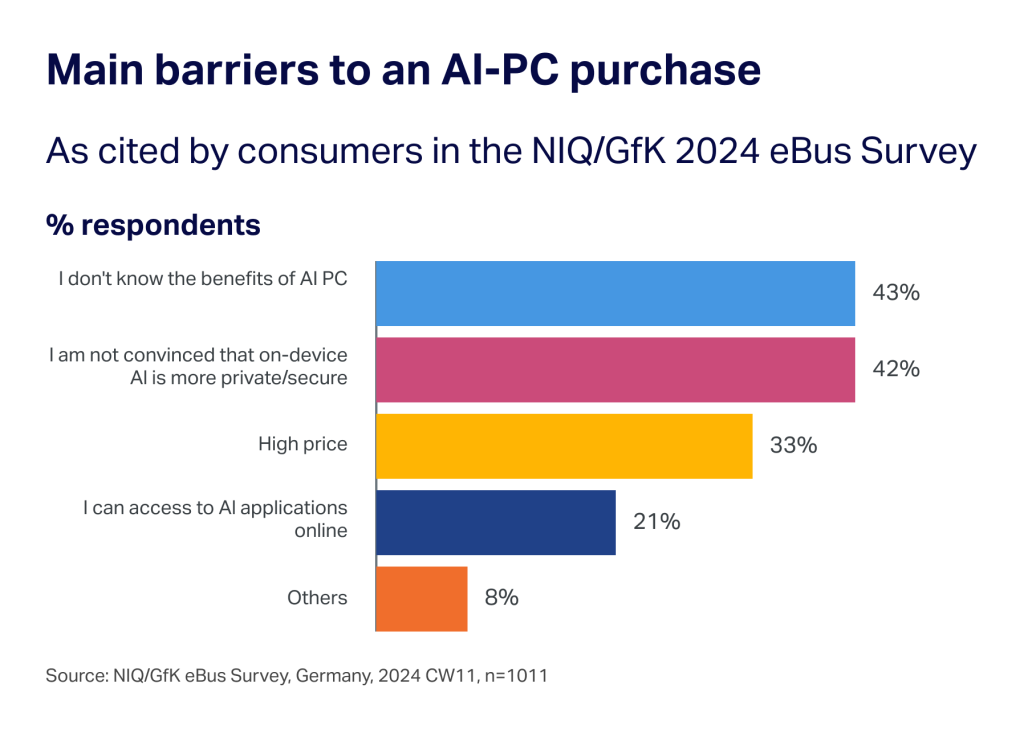

The main barriers to purchasing AI-enabled laptops in Germany revolve around limited awareness and privacy concerns. 43% of eBus survey respondents reported being unfamiliar with the benefits of AI-PCs, while 42% expressed doubts about the privacy and security of these devices. In comparison, only 33% cited high prices as a significant factor preventing them from making a purchase.

To foster greater adoption, manufacturers must build brand and product awareness while communicating the value and benefits of AI-PCs, and addressing customers’ security and privacy concerns. Distributors and the channel on the other hand need to ensure that communication and marketing efforts are well executed and sales staff are trained.

To identify relevant purchase drivers and keep track of brand positioning, gfknewron Consumer offers unique and easy access to consumer insights. This solution enables manufacturers, distributors, and the channel to better understand adoption barriers, refine marketing strategies, and anticipate consumer needs effectively.

Explore how gfknewron Consumer can help you stay ahead in the AI-PC market.

Market Trends and Growth Expectations

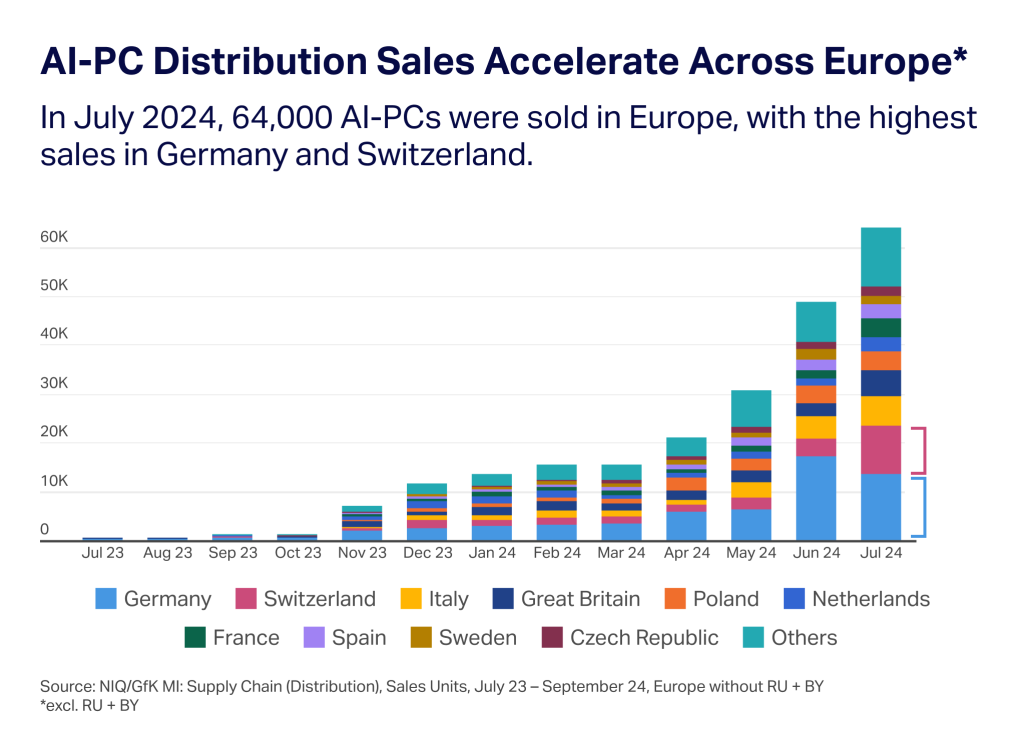

Despite low awareness the AI-PC market is gaining momentum, with a steady increase in channel adoption rates across Europe. NIQ/GfK sell-through data shows a significant rise in sales in mid-2024. In July alone, 64,000 AI-PC units were sold by European distributors, with the highest channel demand in Germany and Switzerland. Italy and Great Britain also saw strong sales, while sales in France more than doubled between June and July.

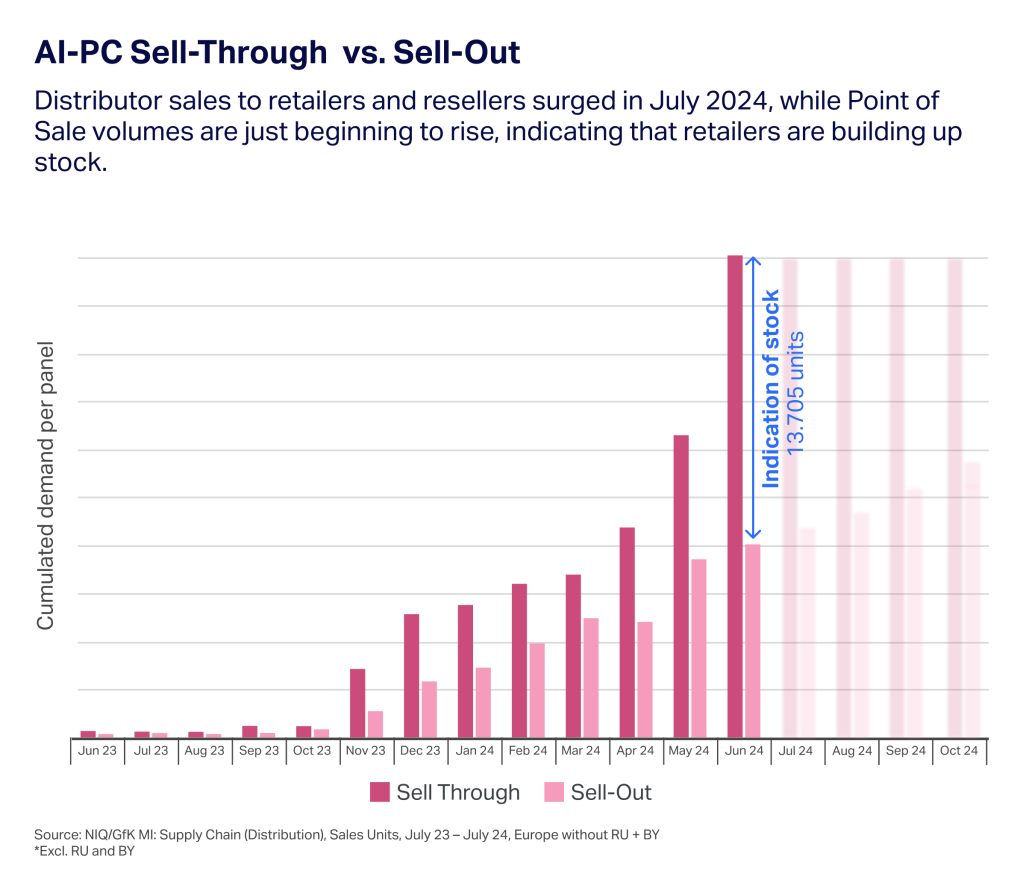

Retailers and resellers are stocking up in anticipation of increased demand, with new AI-Enabled PC models launched in July 2024, and especially for upcoming seasonal events. Online retailers, consumer electronics (CE) stores, and IT retailers have all significantly increased their orders for AI-PCs from distributors – leading to high channel demand exceeding sell-out volumes. With around 13,705 units volume difference across all channels, this represents nearly 50% of total distributor sales to retailers and resellers in Europe.

Meanwhile, system houses are also preparing for increased B2B demand, placing larger orders with distribution partners during the summer of 2024 to ensure they meet expected levels.

By July 2024, AI-PC distribution market share had surged to 9%, from 3% earlier in the year.

“The quick ramp up of AI-PCs in distribution provides positive expectations for Computing markets. Our combination of Distribution and Point-of-Sale data revealed that retailers and resellers are preparing for upcoming demand indicating rising stock levels. With expected replacement cycles and the year-end business, we expect a rise in promotions for AI-PCs.”

Tatjana Wismeth,

Head of Distribution and Supply Chain Intelligence.

Using insights like these, drawn from combining NIQ/GfK’s sell-through and sell-out data, manufacturers, distributors, and channel partners can strategically align supply with demand, optimize Go-to-Market strategies, and maximize market opportunities by anticipating market dynamics.

With the upcoming end of Windows 10 support, new model releases, and major seasonal events like Cyber Week and Christmas, there are decisive opportunities to forge a strong market position and boost sales further.

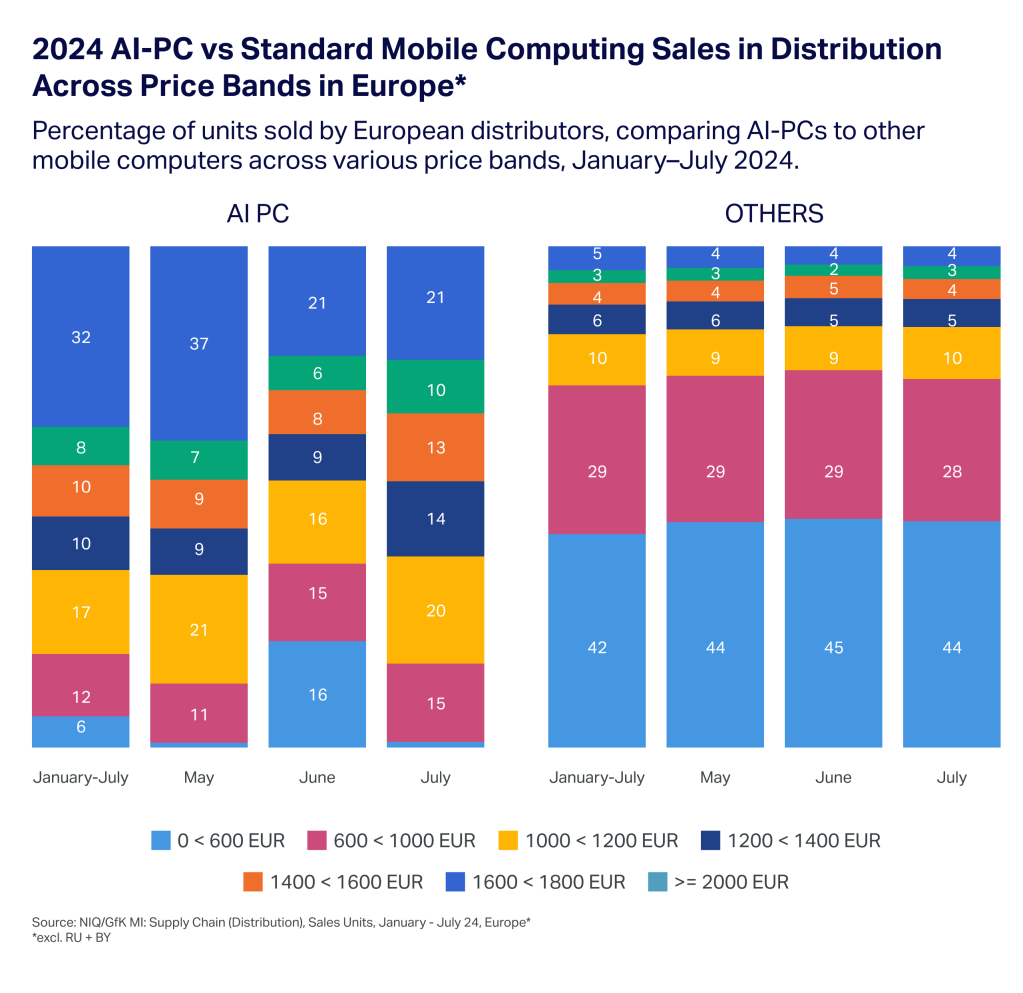

However, pricing dynamics also require close attention. While standard PCs without AI capabilities typically sell for less than €1,000, AI-enabled models target premium segments priced above €1,000, due to advanced components. This premium segment currently accounts for 77% of distribution sales.

In 2024, around one-third of AI-PC sales have distribution price tags of at least €2,000. However, prices have yet to stabilize and still vary, suggesting potential price erosion over time, with product launches, promotions, and increasing competition also expected to increase price pressure in the coming months.

Despite price pressures, customers must still clearly understand the value of AI-PCs to justify their relatively higher costs. To overcome their resistance, and clearly communicate the AI-PC value proposition, manufacturers, distributors, and the channel must collaborate to guide efforts that educate, raise awareness, and build acceptance for AI-PCs.

Lessons from the Smart Home Industry

The slow adoption of Smart Home products at the beginning of its market entry offers valuable insight into the potential challenges AI-PCs may face, including issues related to customer awareness, security concerns, and adoption timing. Lessons from the Smart Home sector can guide AI-PC strategies for achieving broader market acceptance.

Awareness

When terms like “Internet of Things” and “Smart Home” were introduced, many potential customers struggled to understand their definition and value. Similarly, AI-PC awareness remains low, with limited understanding of their use cases. As seen with Smart Home products, effective marketing and education will be critical to driving AI-PC adoption.

Promotions helped Smart Home devices gain traction among early adopters and tech enthusiasts, but widespread uptake was slow due to high prices and unclear value. Seasonal sales events are an opportunity to communicate the benefits of AI-PCs, both catching the attention of early adopters and educating broader audiences to speed up uptake.

Security Concerns

Smart Home devices faced security concerns, particularly around cloud connectivity and data privacy, especially in privacy-conscious markets like Germany. Manufacturers had to clearly communicate how they protected customer data. AI-PC manufacturers must follow suit, clearly explaining their data security measures, while distributors ensure that retailers and resellers are prepared to address customer concerns.

Timing

Smart Home devices took a decade to reach 25% market penetration in home appliances, partly due to a longer product cycle. AI-PCs, with shorter replacement cycles, may see quicker adoption — assuming awareness, security, and value perception challenges are addressed. The upcoming replacement cycles offer a unique opportunity for customers to upgrade if values are fully understood and justify the investment.

In conclusion, AI-PCs face similar adoption hurdles as Smart Home devices, particularly around awareness and security. Overcoming these challenges through strong communication and clear use cases will be key to accelerating adoption.

Proofpoint Channel — Overcoming challenges

A well-structured Go-to-Market strategy is crucial for the successful adoption of AI-PCs, and distributors play a central role in this process. Peter van den Berg, General Manager EMEA at GTDC highlights their importance:

“IT distribution is already playing a significant role in the sale, adoption, and support of AI-enabled devices and applications, and these responsibilities are projected to grow significantly in the near future.”

Van den Berg further explains, “Distributors provide a wide range of services to vendors and solution providers, from design and integration to procurement, financing, logistics and billing. The rapid pace of technological change requires distributors to have deep market knowledge and the ability to anticipate evolving customer needs. They are uniquely qualified to meet these demands and strengthen their partner networks.”

For AI-PCs to succeed, collaboration between manufacturers, distributors, and the channel is essential.

Manufacturer Expectations

Manufacturers must clearly communicate the value and use cases of AI-PCs, addressing data privacy concerns and integrating this messaging into broader marketing strategies. By tracking consumer insights, manufacturers can adjust their approach as needed to ensure effective communication and market responsiveness.

Additionally, manufacturers need to safeguard product availability together with the channel. Synchronizing supply and demand is critical to maximize success. As outlined in this whitepaper, the unique combination of sell-through and sell-out market insights can help to understand and react to market dynamics fast.

Distributor Responsibilities

To successfully sell AI-PCs, distributors must ensure the channel is well informed and trained while safeguarding product availability and supply at the same time. In the past, distributors have proved to be a key enabler for innovative product adoption. Since product supply must be ensured, distributors must optimize and align supply and demand when markets accelerate and replacements are expected to be fully realized in 2025. NIQ/GfK´s Distribution and Point-of-Sale information can help perfect channel sales and pricing strategy.

Channel Role

As the final link in the supply chain, the channel must communicate the value of AI-PCs to customers. Ensuring retailers and resellers have the right knowledge and customer support will be key to building trust and driving demand. Marketing initiatives and promotions need detailed analytics to adjust quickly to changing market environments in the upcoming periods.

In summary, the success of AI-PCs relies on strong collaboration across all market players. As Peter van den Berg notes,

“Unlocking greater levels of efficiency, productivity, and innovation is key to channel success in this high-value space. The growth of AI-enabled devices and solutions will depend on the strength of the IT distribution ecosystem and its ability to deliver these solutions to market in a timely and cost-effective manner.”

3. Conclusion

The pandemic (2020–2022) drove significant growth in the tech market, fueled by demand for remote computing. This surge also led to early purchases and disrupted replacement cycles, with distributors playing a key role in maintaining product availability despite supply chain challenges. This role remains essential as the market prepares for the next cycle of replacements and the introduction of AI-PCs.

However, awareness of AI-PCs is still low. In Germany, only 22% of consumers are familiar with AI-PCs, and just 18% consider AI a factor in their next laptop purchase. Despite this, AI-PC distribution trends already show momentum, presenting substantial opportunities to uplift the computing market. For AI-PCs to reach their full potential, manufacturers, distributors, and the channel must collaborate to build awareness, while also addressing additional barriers like privacy concerns, and competitive pricing. Learning from the Smart Home industry, targeted marketing and communication will be vital in overcoming these barriers.

Close collaboration is key to succeed in this emerging market:

Manufacturers must clearly communicate AI-PC use cases and value propositions, while addressing data protection concerns and closely aligning with distributors and the channel. Distributors must ensure product availability and train the channel, while the channel itself plays a vital role in educating customers and serving as the first point of contact for their questions and concerns.

With a well-coordinated Go-to-Market strategy, market actors can drive understanding, build trust, and harness growing demand for AI-enabled PCs.

The era of AI-PCs has just begun.

Fuel your AI-PC strategy with NIQ/GfK insights

Discover the NIQ/GfK services designed to give you a competitive edge in the AI-PC market. Gain access to actionable Market Intelligence and supply chain insights to power your growth.