While sustainability remains an enduring and increasing area of importance for consumers around the world, the more immediate forces shaping the future of sustainable consumer tech goods include consumers’ need to save money, as well as increasing legislation.

Shifts in consumers’ eco-focus

The importance that people place on sustainability and protecting the environment as a personal value has been increasing year over year since 2016. It peaked in 2020 and 2021, with consumers ranking it as 16th most important out of a list of 57 core values.

Then, in 2022—and again in 2023—it dropped in the rankings, as people became focused on their personal financial security when the cost-of-living crisis was at its worst.

Global ranking 2023 (out of 24 major societal concerns)

Now, with people’s confidence in their financial outlook improving again, the conditions are in place for “protecting the environment” to once again become a higher priority driver of purchase decisions.

This overall upward trend in people embracing sustainability as a personal value holds true across all regions. Consumers in Latin America and Western Europe lead on this, but even in developing Asia, where economic insecurity precludes many consumers from acting on their green aspirations in their actual purchases, preserving the environment is moving upwards as a core value.

Concerns over climate change in particular continue to increase—and are the fastest growing of the 24 major concerns tracked by NIQ over the last nine years.

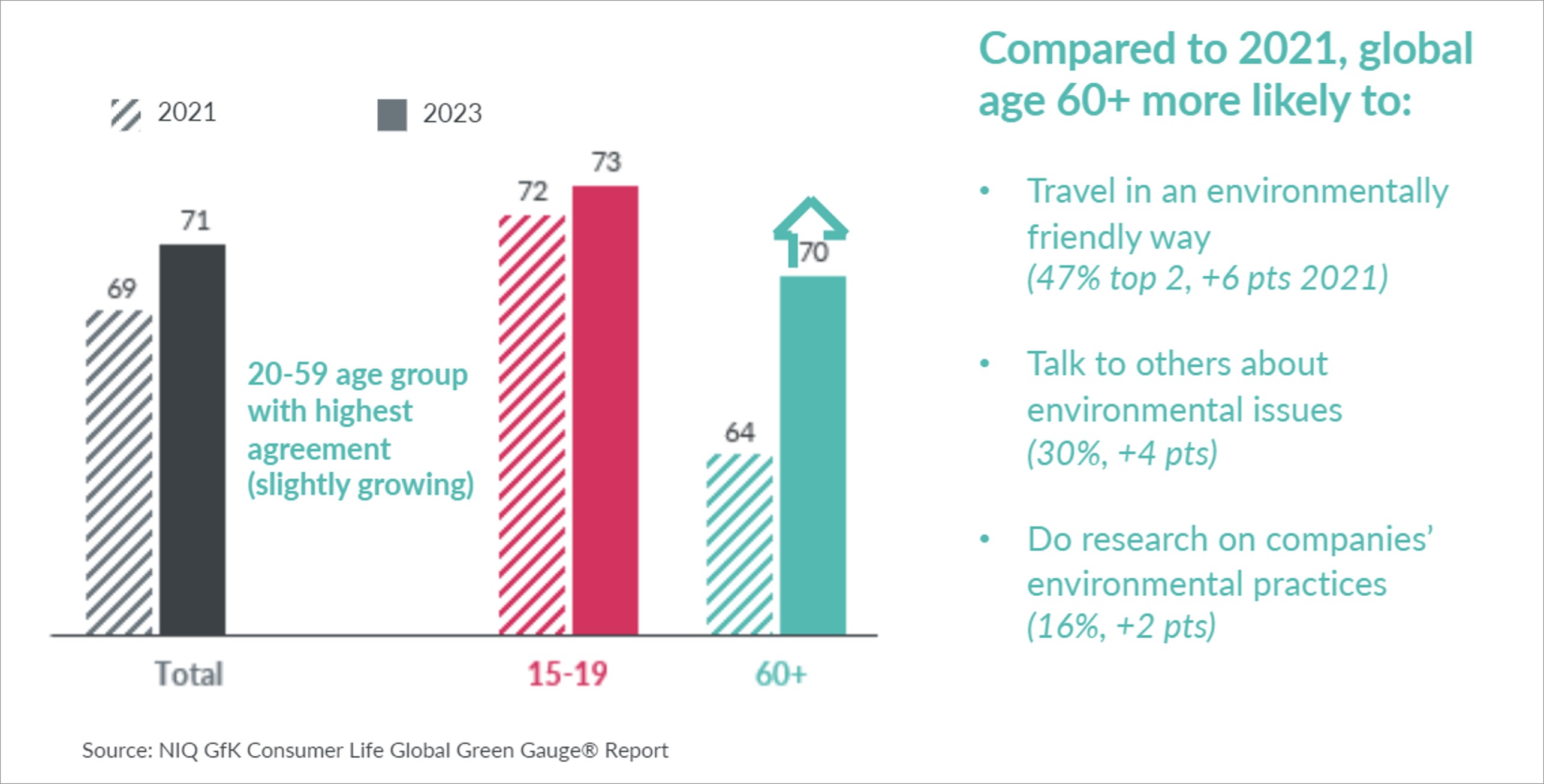

Our data also shows that older generations are catching up with younger ones in their sustainability concerns. In 2021, 72% of 15- to 19-year-olds saw climate change as being a very or extremely serious issue, compared with 64% of those aged 60 or over. Last year, those figures stood at 73% and 70% respectively—a significant acceleration among older generations.

“Climate change is a serious issue” (top 2), by age

Cost of living and legislation boosting sustainable tech products

Over the last three years, the cost-of-living crisis and inflationary pressures put a curb on many people’s ability to act on their aspirations to buy more sustainable products.

- 46% “First comes economic security and well-being, then we can worry about environmental problems”—up 4 percentage points vs. 2021

- 51% “The environmentally friendly alternatives for many of the products I use are too expensive”—up 4 percentage points vs. 2021

However, this financial uncertainty has also triggered consumers to buy consumer technical goods that enable them to save money in the long term—either by helping them reduce their energy and water use or by being easily repaired rather than replaced.

In 2025, first-of-its-kind energy labels for smartphones and tablets will be launched. These labels will prominently highlight circularity and repairability criteria to consumers, since the actual energy consumption of such devices is less pronounced. While the primary consideration for these purchases is financial, consumers value the fact that their purchase is also more environmentally friendly. They are saving money—and being green in the slip-steam.

In the major domestic appliances (MDA) sector, where relatively high-energy-use devices are often used daily or weekly, consumers’ desire to save on energy bills has been reinforced with legislation in some regions—driving purchases of the most energy-efficient models. The fact that these models also carry higher prices demonstrates consumers’ willingness to invest money where they see long-term value.

Following the E.U.’s introduction of compulsory energy labeling for certain major domestic goods, the sales of A-class washing machines, refrigerators, freezers, and dishwashers more than doubled in one year.

A-class appliances now account for more than 80% of all purchases in certain core categories and countries

This trend is set to increase as A-class appliances become more affordable with each passing year.

Since EU legislation banned all F-class and G-class appliances from March 2024 onwards, the rise of better and more expensive appliances will continue.

Meanwhile, in the small domestic appliances (SDA) sector (where products use less energy than in MDA), there’s still some focus on energy saving—such as eco modes in irons and vacuum cleaners. But the key money-saving drivers for consumers are more about durability and repairability.

In France, this has been boosted by the first-ever repairability index, introduced in 2021, which rates a product’s ability to be taken apart, the availability of technical documentation, and the availability and price of spare parts. Initially applying to just five products (electric lawnmowers, laptop computers, mobile phones, televisions, and washing machines), the index now covers several categories across consumer electrical devices and domestic appliances. Belgium has already adopted this index, and the European Parliament has voted in favor of making it mandatory across all E.U. countries.

In 2025, this repairability Index will evolve into a durability index, with an even broader scope of regulation beyond just repairability.

How far do eco claims drive growth?

Our NIQ GfK Market Intelligence Sales Tracking shows that less than 10% of washing machines sold in Germany, France, Spain, Great Britain, and Italy last year were marketed with eco claims. However, those that did have eco claims showed the strongest year-over-year growth for the number of units sold, especially those with more than one such claim.

The same is true in the smartphones and laptops categories. Here, eco claims are more widespread, with nearly half of all smartphones and over a quarter of all laptops sold in those countries being promoted with three or more eco claims; these delivered the highest revenue growth.

Final thoughts

Consumers expect brands to lead the global sustainability transformation, but Tech & Durables brands are often not recognized as being eco-friendly. However, sustainable tech products are a prime area for growth, with multiple forces combining to increase demand in this area.

The key success factor for manufacturers going into 2025 is to focus their product marketing on convenience and performance, combined with multiple relevant and credible eco claims.