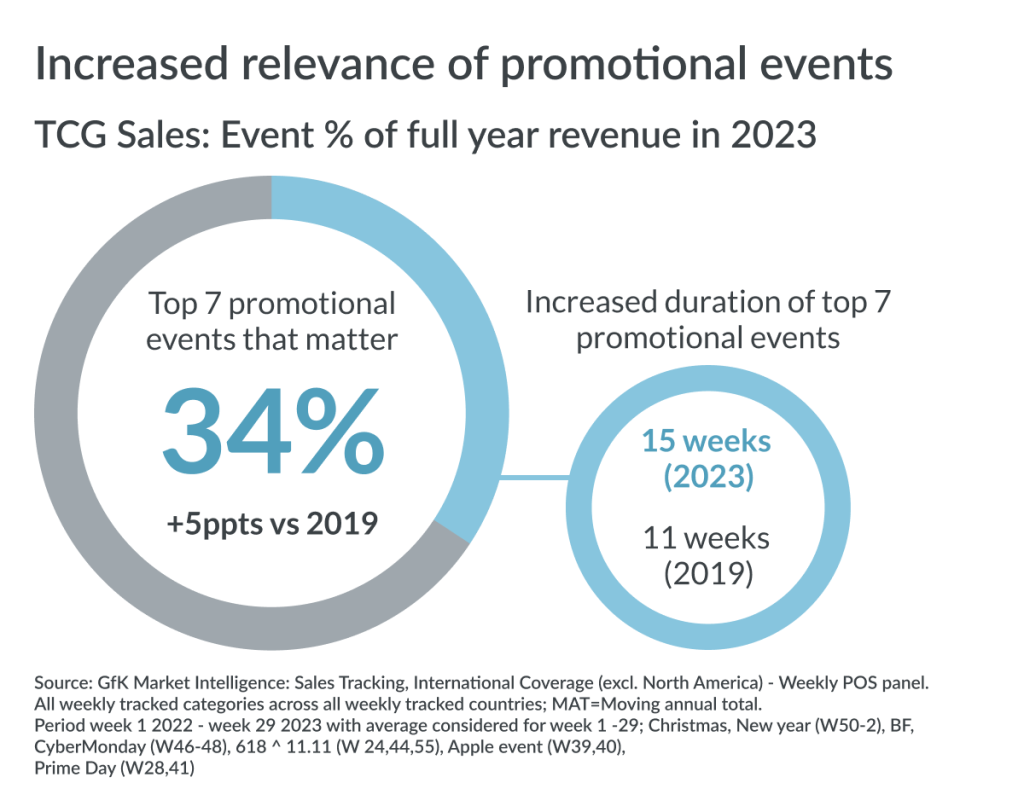

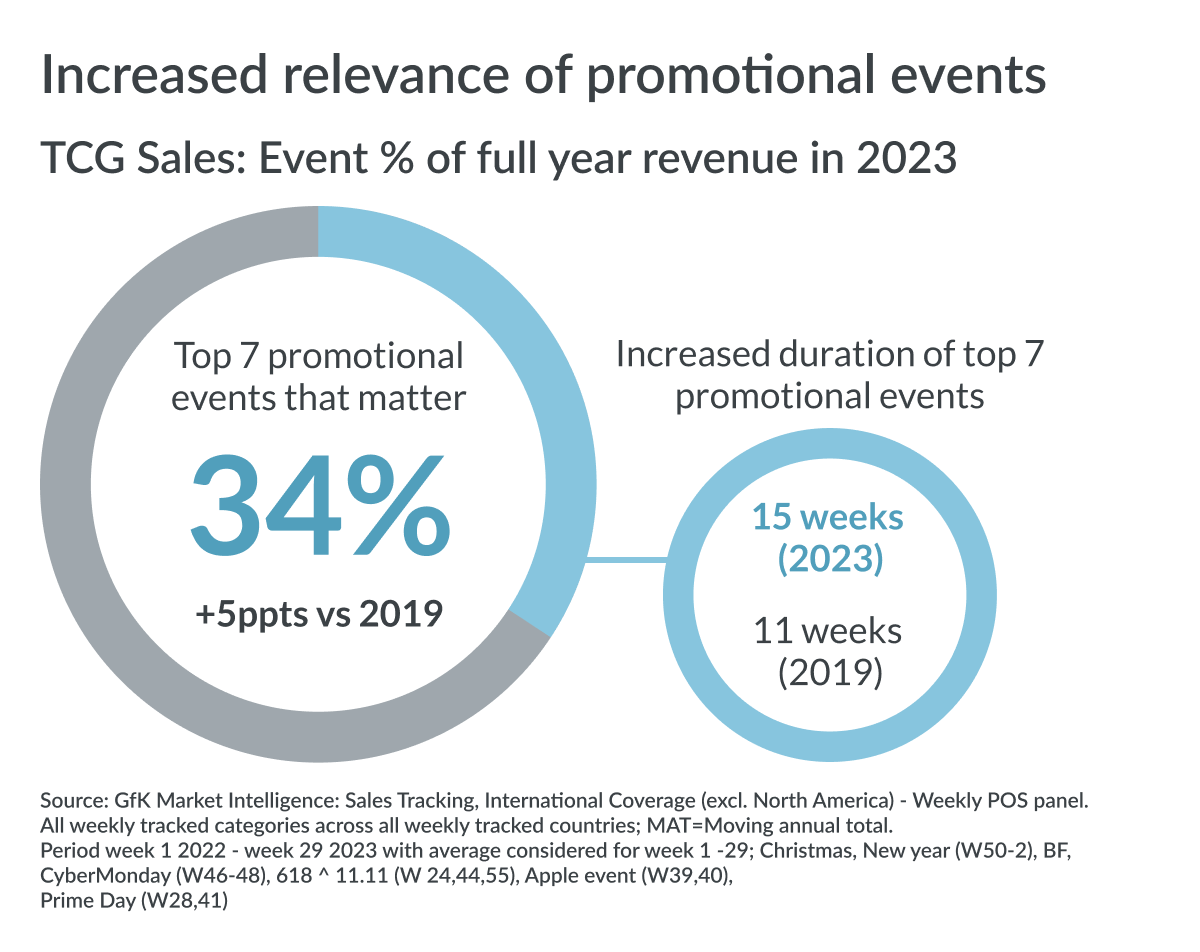

Promotional events remain hugely relevant to consumers – and therefore to manufacturers and retailers. Back in 2019, the top seven annual promotional events took place across 11 weeks of the year. Last year, those same seven events covered 15 weeks of the year – and the purchases made during those events produced a third of the total year’s revenue for Tech and Durables.

The big question for manufacturers and retailers is, which promotional strategy is best at attracting consumers while also protecting margins? Are price discounts always the most effective option, or can non-price promotions, like bundling or cash-back, play a lucrative role?

Pros and cons of price discounts

Price discounts have always been the most obvious choice for attracting consumers. From a manufacturer perspective, price promotions are easy to execute via sell-out allowances, and the ability to measure the impact on volume of sales is generally better understood than for non-price promotions.

However, price promotions can place a strain on margins and accelerate the problem of price erosion, potentially harming brand health unless carefully managed.

Manufacturers and retailers can feel pressured to run price discounts in order to be considered by consumers during important annual promotional events, even if this is not the best option for them from a margin and brand health perspective.

Non-price promotions

The question is whether non-price promotions might be a better option for brands.

Brands have sometimes struggled to find analytics that can show the extent to which offers such as bundling or cash-back are being leveraged at promotional events, as well as how effective these offers are in driving volume and uplift of sales.

By combining and comparing data from online scraping during promotional events with our own world-leading sales tracking, we have quantified the sales relevance and impact of both price and non-price offers.

Let’s look at some facts from France and the UK, focusing on the categories of Cooling, PTV and Loudspeakers during Black Friday last year.

We checked which products were supported by what kind of promotion and summed up their revenue: Sales of products that were on price promotions accounted for 52% of the total promoted revenue taken, while bundle offers accounted for 40%, and cashback offers accounted for 8%. But how much of this revenue really came on top? We also quantified the efficiency of each promotion type and calculated the uplift in revenue (incremental revenue*). Price promotions were responsible for 58% of the generated uplifts, while bundle offers took 35% and cashbacks 6%.

In summary

Price promotions currently deliver the best potential for revenue uplifts, but this needs to be balanced against the risk of accelerating price erosion of the products, as well as possible negative effects on brand equity and margins.

gfknewron Predict can help you optimize your price promotions to deliver maximum uplift, while at the same time providing insights on how to slow down price erosion

Footnote:

*Christmas, New Year, Black Friday, Cyber Monday, 618 and Double-11, Apple event, Prime Days.

*Incremental revenue = sales uplift from promotional periods compared to baseline revenue. Study covered France, UK and the categories Panel TV, Refrigerators and Loudspeakers / Soundbars