Coming, going, or shifting: Breaking down incremental sales

Answering this billion-dollar question became especially important as COVID-19 modified shopping behaviors, and tens of millions of shoppers bought online for the first time, according to NielsenIQ e-commerce data. With increased fulfillment and delivery costs, e-commerce presents additional challenges and margin pressures, so gaining new customers and growing their online spend has become a critical factor in maintaining healthy growth.

Although a company can track and tally online and offline revenue to measure growth, businesses are missing the context behind why and how the growth occurred, or how it compares with the competition. For that, you need to go straight to the shoppers themselves. Understanding changes in omnishopper behavior—online, offline, and jointly—can arm companies with the insights they need to execute strategies that maximize positive components and improve opportunity areas.

Behavior impacts incremental growth in three primary ways:

- Existing shoppers spend more

- New shoppers make a purchase

- Shoppers shift their spend across brands/merchants

Determining the percentage of sales attributed to each factor—and how they work together—unlocks new insights. The components are the same for both manufacturers and retailers, but the implications and actions can differ.

Assessing incremental opportunity through a retailer’s eyes

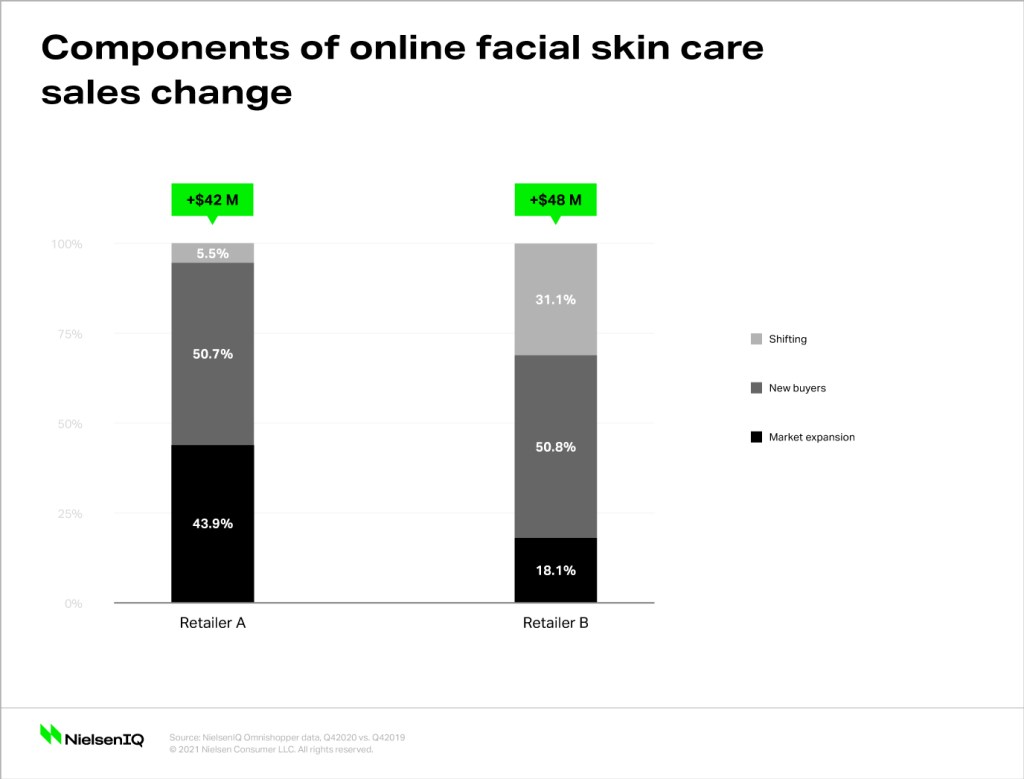

Consider this example comparing changes in facial skin care sales at two beauty merchants from Q42019 to Q42020. Both retailers increased category sales online by about $45 million; however, 95% of retailer A’s online growth was incremental, as it attracted new buyers, and existing shoppers purchased more. Comparatively, only 69% of retailer B’s online growth was incremental, because a large portion of the sales growth was a result of people shifting their purchases from in-store to online. Although some level of retail shifting is expected, retailer A’s slice of the omnichannel pie increased more than retailer B’s. Gaining this competitive insight adds greater context for each retailer’s performance.

This may motivate retailer B to revise its marketing strategy to attract new buyers. Or it might encourage the retailer to better understand what’s preventing existing shoppers from increasing their spend online—pricing, assortment, or website interface, for example. Conversely, retailer A may discover that it isn’t achieving the same incremental growth rates in all categories. It might then adjust its advertising to rotate categories highlighted in its images.

Analyzing a manufacturer’s incremental value

Understanding the consumer factors driving growth or decline can help a manufacturer both in its tactical execution and in its conversations and shared strategy with retail partners. Whether growth is derived from increased spend from current shoppers or the attraction of new shoppers, a manufacturer that can show that its brand drives incremental sales for a retailer will fare better when requesting a seat at the table to discuss strategies and recommendations.

Furthermore, a manufacturer may use the results to identify shifting gains and losses among other brands. This valuable information can tell a manufacturer which brands are encroaching on its shoppers, or provide another data point to support expanded distribution or assortment recommendations with its retail partners.

The incrementality opportunity

Quality omnishopper insights and omnichannel market intelligence are the only ways to pinpoint the source of shifts in sales growth and consumer behavior. And accuracy matters. You must know—with precision—who your customers are and how their shopping behaviors change over time. Importantly, when assessing shifting and incrementality, panel participation must remain stable so trends aren’t mistaken for fluctuation in participation.

Armed with this intelligence, CPG manufacturers and retailers can target marketing and promotional efforts to head off competitive threats and drive brand and category growth. With NielsenIQ as a partner, you’ll have the accurate intel you need to seize the incrementality opportunity.

Understand critical business drivers with our omnishopper resources

Accurate analysis of incremental sales shifts is a significant advantage in the omnichannel retail world.

Learn how you can track buyer behavior on- and offline across key brand and category KPIs.

Ready for more accurate omnichannel data?

Submit the form below to get in touch with NielsenIQ about the new Omnishopper Insights reports.