Current challenges to winning on the shelf

Recent developments in the CPG industry have added new complexities to retail success that must be accounted for in modern retail strategies. And the data show that these trends are likely to persist and should not be ignored (in either the short- or the long-term) when battling competitors for on-shelf success.

The brick-and-mortar store is shrinking. From 2009 to 2022, square footage in supercenters (-5%), supermarkets (-3.5%), dollar stores (-0.4%), and drug stores (-13.3%) has decreased, leaving less merchandizing space and greater competition on shelf.

E-commerce saw rapid growth in 2020, and the digital shelf has become the new standard, with e-commerce sales in the third quarter of 2023 accounting for 15.6% of total U.S. sales. Today’s consumers expect a seamless and engaging online experience. Rich media, dynamic content, and personalization are key retail strategies, but many brands still struggle to align their online and in-store experiences.

Out-of-stock (OOS) issues cost the U.S. retail industry $48 billion last year alone (52 weeks PE Sept 2, 2023). Persistent challenges like geopolitical conflicts, extreme weather events, and health issues are all variables that can cause significant disruptions in the supply chain – challenges that often result in significant losses in revenue to both manufacturers and retailers.

The solution? Retailers and suppliers working together to meet consumer demand through enhanced collaboration, and it all starts with the correct data. Data grants manufacturers and retailers both foresight and a real-time view of the supply chain obstacles in play so that they can navigate challenges and succeed at the shelf.

How consumer data solves challenges at the shelf

In today’s omnichannel environment, shoppers have become channel-agnostic, exploring a wide range of avenues and formats to get the products they seek. To succeed, brands must, on average, touch consumers six times. They must also ensure their products are readily available when customers are ready to purchase – and that the products are priced competitively to win the sale. Best-in-class data drives this entire cycle.

There is an exponentially growing number of items, stores, channels, and consumer transactions that need to be coded from online and in-store sales, across retailers. This is data that doesn’t come out-of-the-box cleaned, aligned, deduplicated, and integrated into how CPG companies operate. It’s critical to ensure accuracy while maintaining a real-time view in this dynamic, fast-changing omnichannel environment. Let’s take a closer look at how the right retail data partner can help eliminate some of the main challenges being faced by retail companies today.

The impact of out of stocks

The most obvious challenge to the shelf, both online and in-store, is out-of-stock issues. Shoppers simply can’t purchase products that aren’t on in-store shelves—and the situation online can be even worse. In the digital world of algorithms, low and out-of-stock inventory triggers a downward spiral—your offering loses valuable ground in search rank, potentially harming sales even after your supply has been restored.

“Managing inventory and distribution is of paramount importance in our digital age,” says Jean-Baptiste Delabre, VP, NA Business Development, NIQ. “In the CPG space especially, where the purpose of the store shelf has changed so drastically, brick-and-mortar stores are now often online fulfillment centers as well. Managing inventory is incredibly complex when being tasked with supporting in-person shoppers, online shoppers arriving for click-and-collect products, as well as third-party shoppers like Instacart, Door Dash and Uber Eats.”

Noteworthy retail outages of late have been seen in specific categories, rather than the store-wide empty shelves retailers experienced four years ago. By spotlighting select products, we can see that the peak revenue losses were not only substantial, but represented huge outliers compared to anticipated yearly out-of-stock averages:

- Baby Formula: March 2022: $9.3M in weekly missed sales, representing 40% more than the yearly average.

- Eggs: November-December 2022: $10.3M in weekly missed sales, representing 150% more than the yearly average.

- Feminine Products: June-July 2022: $2M in weekly missed sales, representing 280% more than the yearly average.

Companies can’t manage what they can’t see, so it’s crucial to leverage technology that monitors every sale, every SKU, every day to activate omni-level strategies at scale. This technology, fueled by accurate, real-time data, can help manufacturers and retailers level-up their retail strategies and inform decision-making on everything from on-shelf optimization to the effectiveness of their media campaigns.

To better understand how on-shelf optimization technology can impact a company’s bottom line, consider this case study of a popular beer manufacturer:

Case study

Manufacturer A Leverages NIQ Data to Drastically Increase Sales by Reducing Out of Stocks and Optimizing Supply Chain

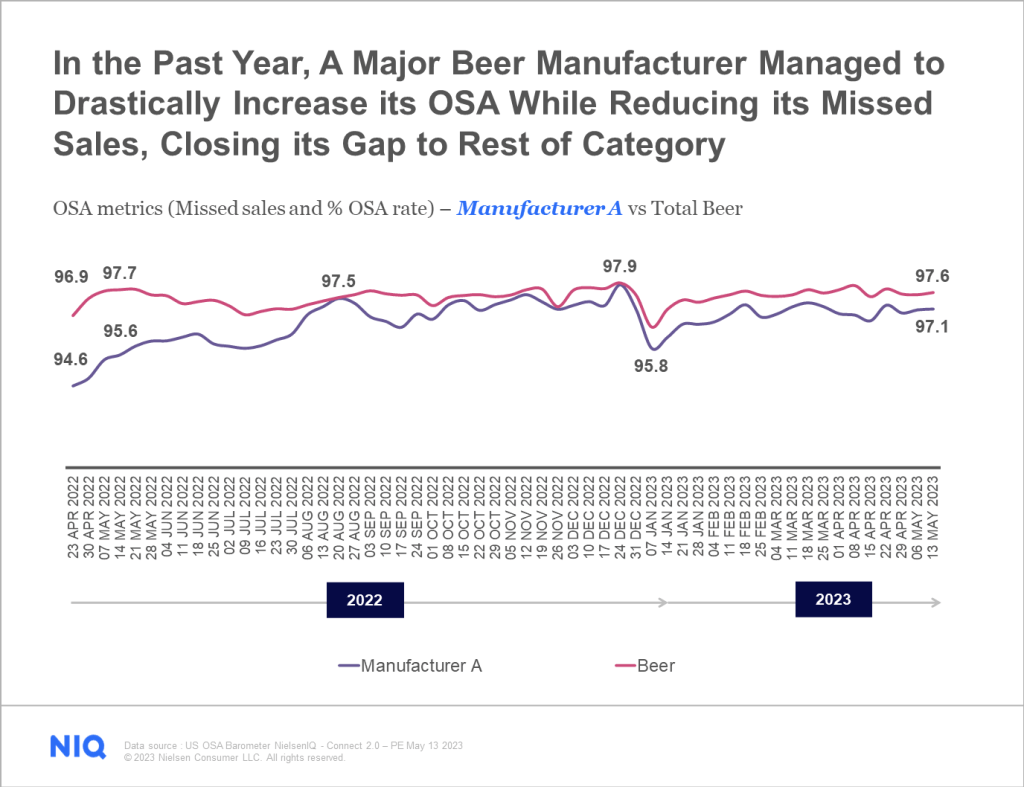

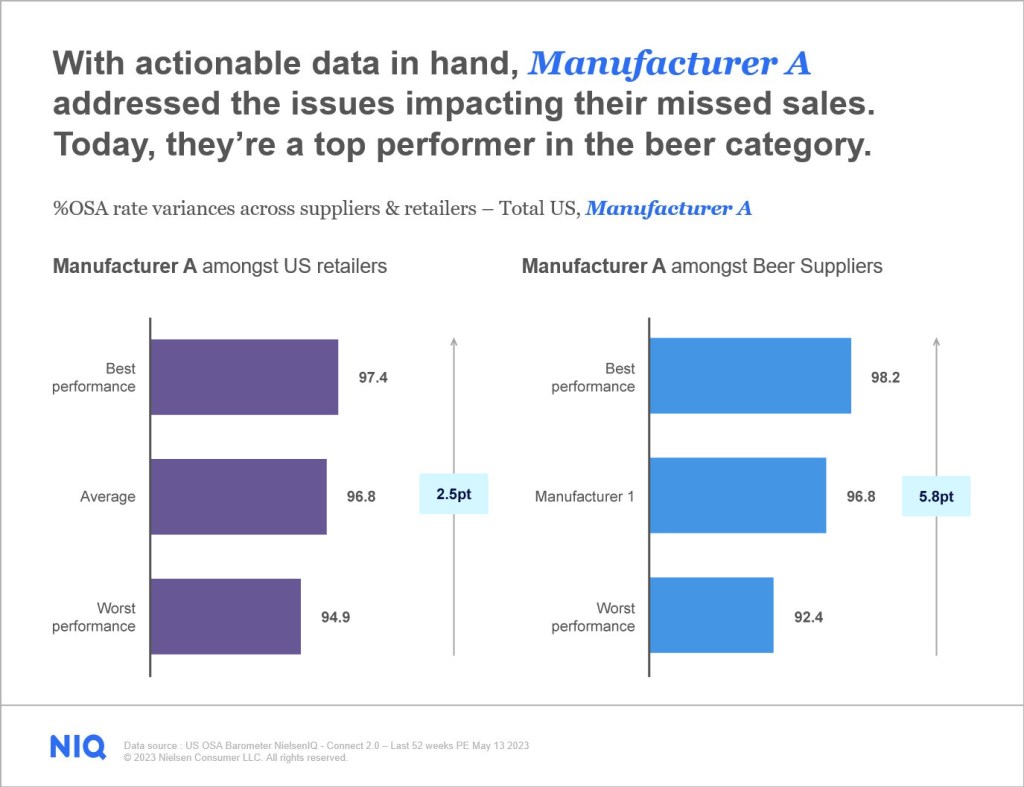

In April 2022, using NIQ’s On-Shelf Availability solution, Manufacturer A was able to identify a significant opportunity in missed sales compared to the rest of the beer category. At that time, they were losing $400,000 in sales every week due to product availability problems. By locating the gaps, and through better collaboration with retailers, Manufacturer A was able to minimize their weekly sales losses by 45% as of May 2023.

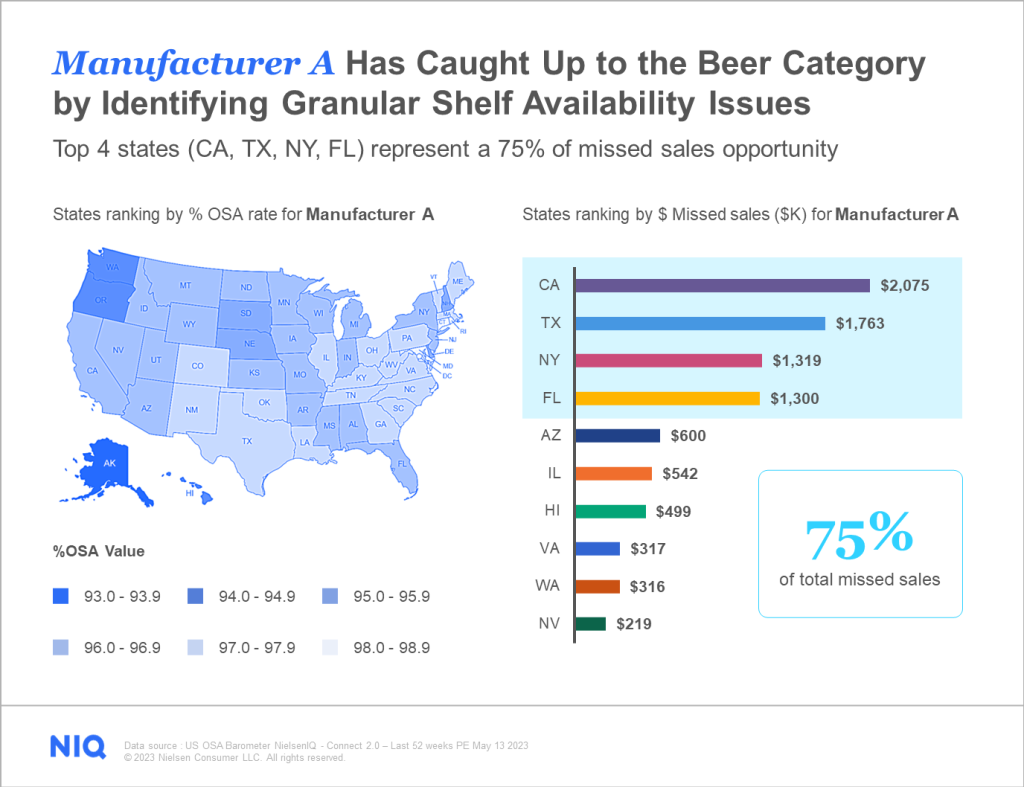

Because of the depth of knowledge provided by NIQ’s On-Shelf Availability Barometer, even after this initial round of savings, Manufacturer A knows that 75% of their remaining missed sales opportunities come from just 4 states (CA, TX, NY, FL). Moving forward, they will be able to focus their retail strategies and resolve the issues that are unique to those markets, minimizing wasted effort and resources in markets with smaller missed sales figures.

Missed opportunities on the shelf commonly stem from distribution issues, supply chain challenges, and ineffective collaboration with partners. By identifying where your unique gaps exist on a granular level with the right data partner, you can close these gaps and optimize your presence on the shelf. Having accurate data on product availability–at a granular level–opposed to relying on broader, sample-based data can also minimize risk across your promotional spend.

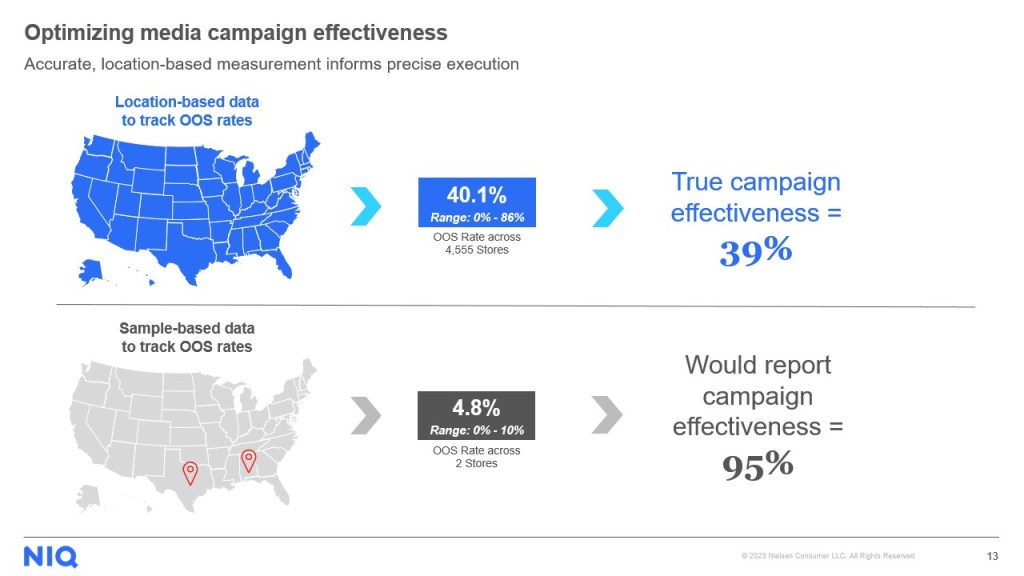

Making smarter inventory decisions with the full view

Let’s look at an example of how better inventory data can optimize the effectiveness of a media campaign to promote a product. For a campaign to be effective, you need to ensure that the product you are promoting is available/in stock. If you’re using sample-based data, it’s possible that your out-of-stock rates appear lower than they really are. Not tracking inventory levels–at the store level–could result in your team missing critical information about where a product is available (and where it is). The result? Lots of wasted advertising spend and dissatisfied customers.

On the other hand, if you have accurate data on product availability – at the local level – media campaigns will be much more efficient and could save your team up to 60% annually on previously wasted ad budget/media spend.

While completely eliminating out-of-stocks is a pipe dream, retailers with the right data can minimize their impact on the shopper experience and maximize profitability. With product availability as optimized as possible, stores can shift focus to understanding the nuances of consumption behavior in the e-commerce environment and in-store.

Update your omnichannel retail strategies

Online consumption behavior and in-store strategies have evolved to have many overlapping elements, and understanding the interplay between these behaviors is crucial for retailers and brands aiming to create a seamless experience. Consumers often engage in “webrooming” (researching online before buying in-store) and/or “showrooming” (browsing in-store before purchasing online) prior to making a purchase.

In-store retail strategies are best for products that a shopper is likely to purchase after they have had a chance to physically interact with a product or buy on impulse. Products more suited to online shopping are usually those that require less urgency or have wide familiarity–often with the convenience of doorstep delivery or pre-planning.

Successful retailers need to have access to the granular data necessary to create a cohesive omnichannel experience by blending the strengths of both online and in-store behaviors to cater to diverse consumer preferences. Even when evaluating products that typically skew toward in-store purchase, retailers must understand how online interactions (i.e. social media, websites, or loyalty programs) impact in-store success.

Digital personalization is an element of the omnichannel experience that is still in its infancy for many retailers. There is an opportunity for said retailers in the online space to go far beyond their current personalization options, which often just offer products that customers have purchased before. By leveraging data partners like NIQ Omnishopper, your business can follow shopper behavior and understand evolving consumer habits, enabling you to develop data-backed plans and tailor-made retail strategies that are as unique as your customers. Real-time hyper personalization, anyone?

Reimagine how you cater to consumer preferences

Consumer preferences drive the success (or failure) of products on both digital and in-store shelves. By leveraging granular consumer data, CPGs can tailor their products, innovate more effectively, and optimize their retail strategies to meet ever-evolving consumer expectations.

In a world of seemingly unlimited options, manufacturers and retailers have a tremendous opportunity to appeal to consumer preferences by making their product attributes clear on packaging and online searches. In fact, recent NIQ Label Insight data indicate that many businesses are leaving money on the table by not doing a better job of connecting consumers to the product they’re searching for. Further, the data show that 78% of grocery searches on Amazon are unbranded and that 84% of brands fail to claim at least 1 of their top 3 most-searched product attributes. Manufacturers that have a deeper understanding of consumer preferences can drive more impactful, meaningful innovation, improve product marketing, and optimize their assortment strategies.

Take for example the trends we’re seeing in consumer preferences around sustainability claims on packaging. In a joint study, NIQ and McKinsey found that consumers are more loyal to products with strong sustainability claims. According to NIQ’s 2023 CPG Sustainability Report, 92% of shoppers say sustainability is important when choosing a brand today.

Manufacturers can minimize waste and often improve brand perception with recyclable materials, minimalist packaging, and reusable pack design. But a total overhaul of a packaging strategy is costly: thoroughly researching the impact new packs will have on consumers can minimize investment risks. Data analysis of how packaging options and label claims can impact sales in your specific category should tell part of that story.

Shoppers can’t always articulate how changes in shape, material, or pack weight influence their perceptions and decisions, so solutions like BASES Neuro test nonconscious reactions to packaging with electro-encephalogram (EEG) research. By gauging subconscious resonance of how consumers feel about factors like visual perceptions, physical experience when handling the product in-store, sustainability associations, and quality perceptions, a manufacturer can gauge how a reimagined product will resonate with consumers when they interact with it at the shelf.

A profile of customer preferences that includes which product attributes the expect to find on the shelf can distinguish your brand from competitors, both in-store and online.

Intelligent omnichannel data not only helps brands and retailers manage out-of-stock issues and optimize products—it also mitigates challenges with product mix optimization and SKU rationalization.

Know how to solve assortment challenges

In both e-commerce and in-store retail, a delicate balance exists between product mix optimization and SKU rationalization. Product mix optimization involves curating a strategic assortment of products to drive sales and meet customer needs. SKU rationalization, on the other hand, aims to streamline and optimize the number of individual variants offered to improve efficiency, reduce costs, and enhance overall performance.

When we look at these common challenges side-by-side, we see that while the issues are not identical, the solutions to win on the shelf are often rooted in the same data:

In-Store Assortment Challenges

Online Assortment Challenges

What you need to know to solve the problem

Limited Shelf Space

Balancing Customer Needs

With shelf space in stores shrinking, retailers are forced to balance the number of products offered with the space available to display them. Online “shelf space” is theoretically infinite, but the challenge is offering products that consumers will want that are profitable.

Both challenges require pinpoint analysis of consumer demand and sales data to ensure you’re offering the right products.

Product Seasonality

Managing Inventory Levels

In-store retailers need to know when to ramp up inventory of a product with seasonal demand (i.e. pumpkin spice foods in the fall), and when to expect the demand to disappear, to avoid having missed sales on the front end and excess inventory on the tail end of the season. Similarly, demand spikes online are far more common, making inventory management crucial year-round.

Both challenges require careful planning and forecasting to avoid out-of-stocks or having excess product at the wrong time.

Product Cannibalization

Personalization

When multiple products from a manufacturer are competing on the shelf, they can cause as much as 20% in missed incremental sales and profit. Online, where offerings are seemingly endless, a similar risk occurs when failing to offer products that are relevant to each customer’s unique needs.

Both challenges can be addressed with assortment optimization programs and sophisticated data analytics.

Ultimately, assortment optimization relies heavily on the quality and completeness of your data analysis. Poor-quality data can lead to inaccurate or incomplete insights. Unfortunately, many brands are aware of the challenges listed above and are turning to incomplete solutions to solve them. Investing in the right tools and data to separate the numbers will provide a clearer view.

NIQ’s Omnisales data provides a precise and accurate measurement across online and offline channels, keying in on how consumers shop.

“The massive assortment that defined e-commerce a decade ago is largely no longer what can be found online in today’s world,” says Lauren Fernandes, Global Director of Thought Leadership.

“Modern retail strategies typically seek to leverage two things: the store investments they have, and the store’s proximity to the consumer for delivery and click-and-collect availability. Because of this, it is often the case that online inventory closely mirrors what’s available in-store, except for instances where shoppers are willing to incur additional time or cost to procure a product located elsewhere.”

“Considering this narrowing of assortment – and the general trend of shrinking retail space, it is of utmost importance to ensure that the handful of chosen products on the shelf are performing well. A retail data partner must be able to instantly track sales and share performance, understanding drivers across brick-and-mortar, e-commerce and the broader omnichannel to identify trends and understand competitive and category performance. Without accurate data to track consumer journeys and using product attributes wisely, CPG companies will struggle to tailor their assortments by channel with enough precision.”

Putting it all together

As we’ve explored, the path to success on the shelf is incredibly complex and multi-faceted. Retailers and manufacturers who can leverage the right data to successfully execute this multi-faceted approach have a huge opportunity.

To maximize success, an organization’s continued growth demands a data partner that keeps manufacturers and retailers in the driver’s seat. NIQ solutions can help you to integrate knowledge of consumer buying behavior by channel, guide you through strategic assortment optimization, and develop best-in-class omnichannel strategies to win on the shelf, in-store and online. With better consumer data, manufacturing and retail executives can make better, faster decisions to boost revenue and gain customer loyalty–overcoming the current challenges that exist on the shelf.

Learn more about how the NIQ’s solutions portfolio can deliver value to key retailer and manufacturer needs

Fill out the form to view/download an overview of this article and a guide to the NIQ solutions portfolio:

Stay ahead by staying in the loop

Don’t miss the latest NIQ intelligence—get The IQ Brief in your inbox.

By clicking on sign up, you agree to our privacy statement and terms of use.