The baby formula shortage

Recent supply shortages of baby formula in the U.S. have dominated news cycles for weeks as anxious families scoured stores for precious product. Retailers were challenged to keep the category in stock, and the experience has many thinking about how they can prepare to better manage on-shelf availability (OSA) in the future.

The situation attracted wide news coverage beginning in February of this year following a product recall and temporary closure of a manufacturing plant due to sanitary concerns in Sturgis, Michigan. Since this plant is owned by Abbot—who produces about 43% of the baby formula sold in the U.S.—significant supply disruption resulted.

One plant closure did not cause this all by itself. There were other factors leading up to the incident, related to COVID-19 supply chain issues that have affected a wide range of consumer products in the past two years. Baby formula had already been in relatively short supply and bottomed out during the week of April 30 with an 81.2% OSA rate. For comparison, the average OSA rate for all CPG products in the U.S. is 93.3% in 2022

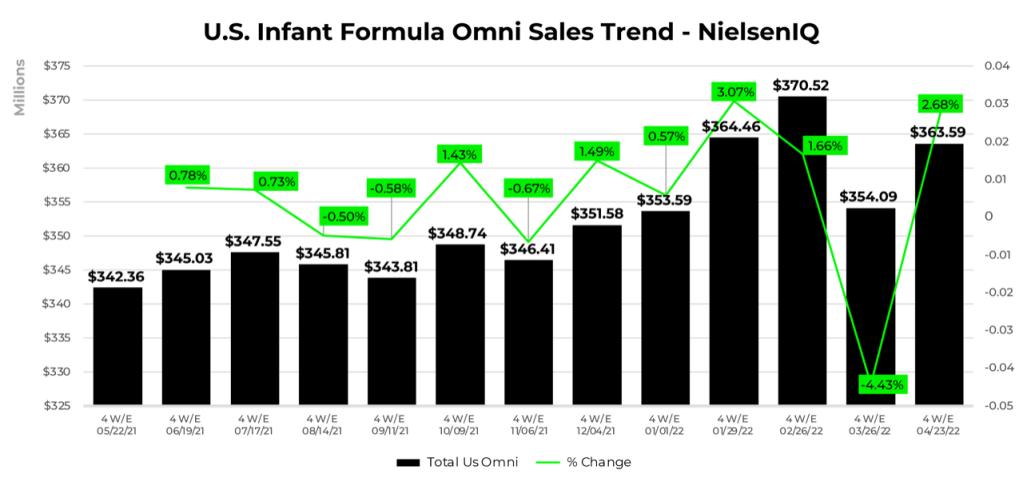

Infant formula was certainly a special situation, since a subset of children were highly dependent upon certain products that were prescribed for specific nutritional needs. News of the plant closure at the end of the year triggered a run on the category that peaked in January and February as shown above, followed by a 4.43% drop in sales in March, attributable to a dearth of supply.

While the situation has eased somewhat, it took several months and some emergency imports from Europe to cover the shortage. Similar sequences of events—supply chain or manufacturing disruption, followed by panicky consumer pantry loading that exacerbates the shortages—have been repeated multiple times in the COVID era:

- Bathroom tissue (COVID-19 crisis beginning March-April 2020)

- Household disinfectants (COVID-19 crisis beginning March-April 2020)

- Pasta (Spring 2020 and persisting today)

- Meat and poultry (Beginning spring 2020 due to COVID meat plant closings)

- Cream cheese (spot shortage pre-holiday 2021)

- Cooking oil in the E.U. (since the Ukraine conflict stopped sunflower oil shipments)

Created demand

Each of these events was defined by a combination of supply shortage and a sudden surge in demand triggered by news reports and empty store shelves.

Consumer stockpiling or “pantry-loading” is not always a bad thing for brands or retailers. Part of the intent of many price promotions is to encourage shoppers to purchase sale items in excess of their immediate needs. Consumers get a better price and manufacturers move products faster, freeing up inventory cash and warehouse space.

Promotions are designed to create increased demand, after all.

Pantry-loading defined: When shoppers buy quantities in excess of their normal expected consumption, either to take advantage of favorable pricing/promotions or to stockpile against fear of impending supply shortages.

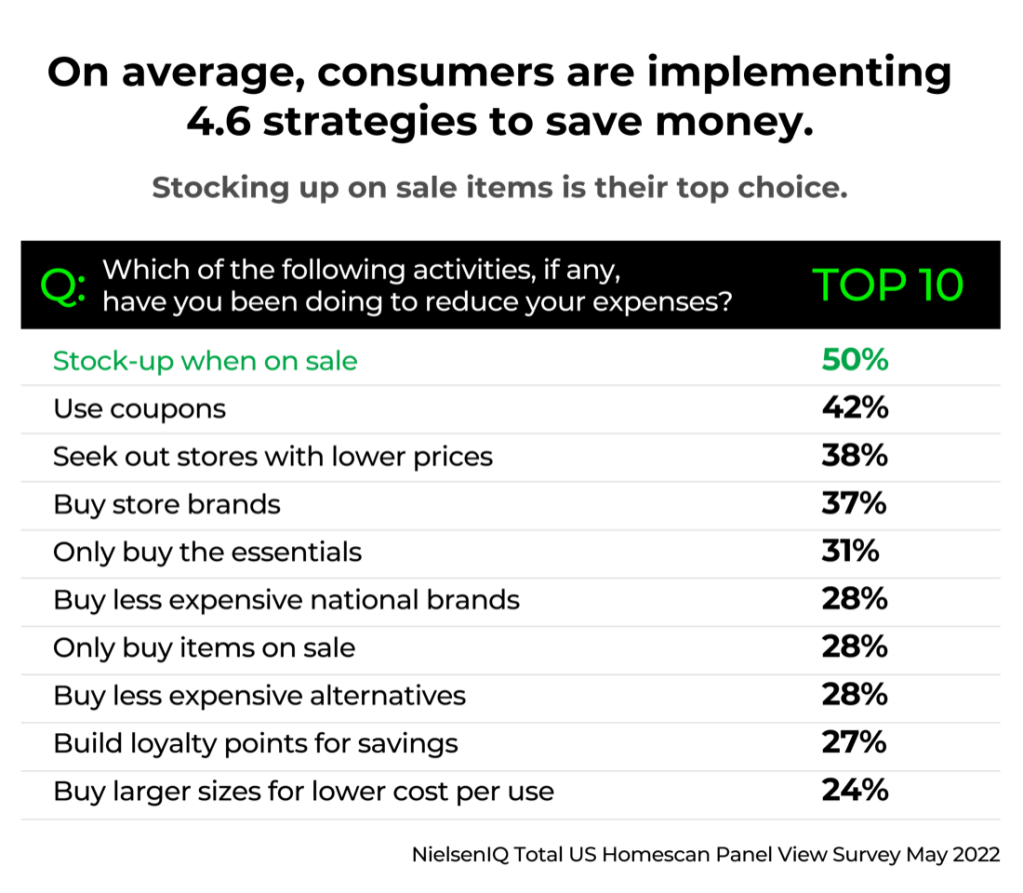

Stocking up on sale items is just one of several strategies that households routinely combine to save money, cited by 50% of consumers in the chart below. Stocking up due to product shortages is a very different kind of motivation that may be very hard to predict.

When their shoppers make a run on a product category due to perceived or actual shortages, the consequences for retailers can be severe.

Some customers will be lost if they are disappointed by out-of-stocks. Promotion planning can be wrecked. Ordering processes are disrupted, and new substitutes must be found, obtained, and put onto store shelves. Pricing decisions are also made more complicated.

COVID-19 lessons

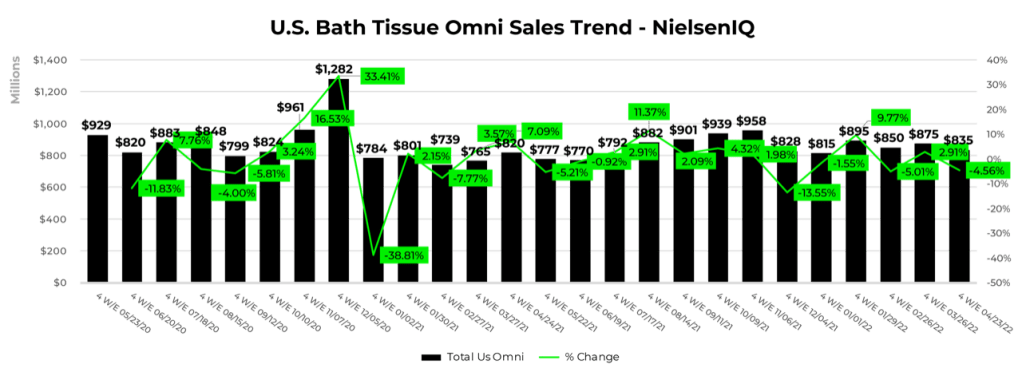

A great example of this type of behavior was the “great toilet paper panic” that spanned the winter of 2020-21 as shown below.

When news of an expected suspension of bath tissue shipments from China was reported, many shoppers rushed to secure extra supplies. Container ship snafus further disrupted the supply chain, and the OSA crisis became a self-fulfilling prophecy—not to mention a meme. The situation left retailers scrambling to find alternate sources and, in a few instances, impose purchase limits on their customers.

Hand sanitizer, bleach, and disinfecting cleaners were all also subject to variations of this effect during the early months of the pandemic. Meat plant closures caused low supply situations in those categories as well, as did stock up behavior on shelf-stable food products like canned beans and dried pastas.

Low OSA became a highly visible consequence of these events, as stores across the country operated with significant, persistent voids in these categories. Shoppers (and news reporters) could directly observe this, which may have made the circumstances somewhat self-perpetuating.

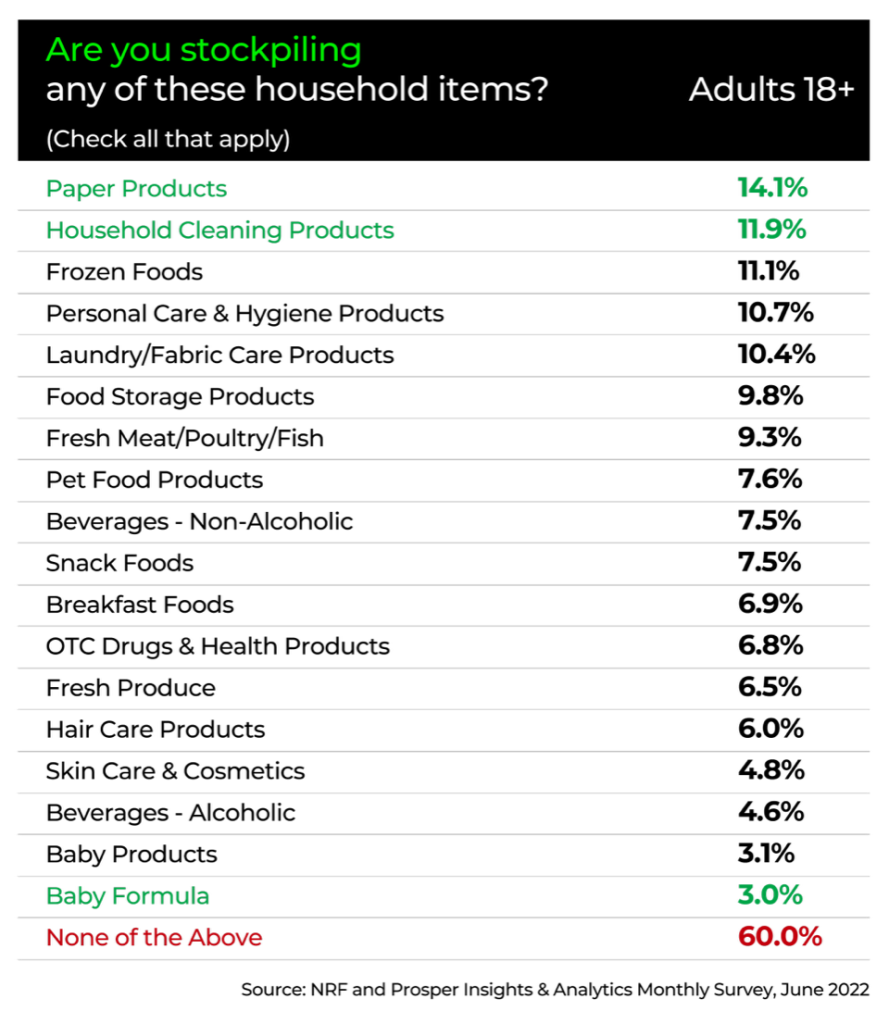

Many retailers and brands responded to product shortages by suspending price promotion activity during the first year of COVID, since it made little sense to drive further demand. Even in some non-promoted categories, however, shopper habits may have been affected in persistent ways. The National Retail Federation reported as recently as June of this year that more than 14% of shoppers continue to stockpile paper products and 12% stockpile household cleaners, as shown in the chart below.

As of early June, 82% of U.S. consumers say that they are not experiencing product shortages, the NRF said. Some consumers do report that they are stockpiling certain items, but most are not.

Combine strategies to manage disruption

So, what can be done to prepare for potential OSA disruptions in the future?

“Throughout the pandemic, retailers have dealt with a variety of supply chain and product challenges,” Katherine Cullen, NRF’s senior director of industry and consumer insights, told NielsenIQ. “And they have become adept at identifying and implementing new strategies to address them—new suppliers, switching how items are transported and, at times, moving up their timelines for getting new products into the country. ”

Retailers who also pay active attention to their OSA conditions and who track shopper behavior (basket composition data) will be better positioned to recognize pantry-loading behaviors when they occur and take proactive steps to preserve on-shelf availability and maintain service levels for shoppers.

Systematic monitoring and detection of OSA issues and demand surges can provide several critical advantages in this regard:

- Early warning. Real-time visibility of low-stock conditions allows more time to recognize demand surges and plan more effective responses

- Accurate facts. Retailers can know with certainty that products are actually on the shelf, a critical piece of information for evaluating category management and promotion decisions

- Shelf impact. Understand the impact at the shelf when items are out of availability, including substitutions for out-of-stock items

- Channel insights. Compare in-store versus online shopper behaviors to plan effective merchandising strategies

“On-shelf availability is a critical aspect of business intelligence for CPG retailers,” said Jean-Baptiste Delabre, VP of Retail Analytics, NielsenIQ. “Retailers who pay active attention to their OSA conditions and who track shopper behavior, including basket composition data, will be better positioned to recognize pantry-loading behaviors when they occur. They can then take proactive steps to preserve on-shelf availability and maintain service levels for shoppers.”

“[Retailers] have also developed strategies for communicating [supply] challenges to shoppers, so they know what to expect,” Cullen said. “They have rolled out tools to help shoppers find the products they need. That includes helping shoppers see what items are in stock and where, and clearly communicating delivery timelines.”

Ultimately, a precise picture of OSA is essential for promotion planning and evaluation. Applying OSA insights alongside demand, assortment, and price elasticity in an integrated way allows retailers and brands to control all the levers that may affect consumer response.

Use NielsenIQ OSA to enhance your response

NielsenIQ has the most comprehensive shopper behavior data set in the industry. Retailers can use this resource to spot early warning signs of suspected pantry loading and make earlier adjustments to ordering, promotions, prices, and shelf assortments to ensure better OSA.