Balancing immediate pricing strategies with long term goals

Over the past year, 68% of Canadians have noticed the price of groceries soar, according to our 2022 Consumer Outlook survey. With overall inflation surpassing 5% year-over-year growth for the first time in more than 30 years, higher grocery prices are just the tip of the iceberg.

Rising prices for everything from bread and alcohol to rent and gasoline mean Canadians are watching their budgets, making more intentional product trade-offs, and changing the way they shop.

For manufacturers and retailers looking to meet evolving consumer needs, it’s important to consider the stark differences in the financial impact of Covid and varying degrees of uncertainty regarding the geopolitical climate, consumer circumstances, priorities, and behaviors are vastly different.

The economic divide shaping the Canadian consumer landscape

Over the latest 12 weeks, 70% of CPG categories experienced volume declines in Canada. Categories that experienced a boom in sales as a result of heightened at-home consumption were expected to experience marginal declines as restrictions eased, but the declines extend much wider amid rising prices and reduced promotions.

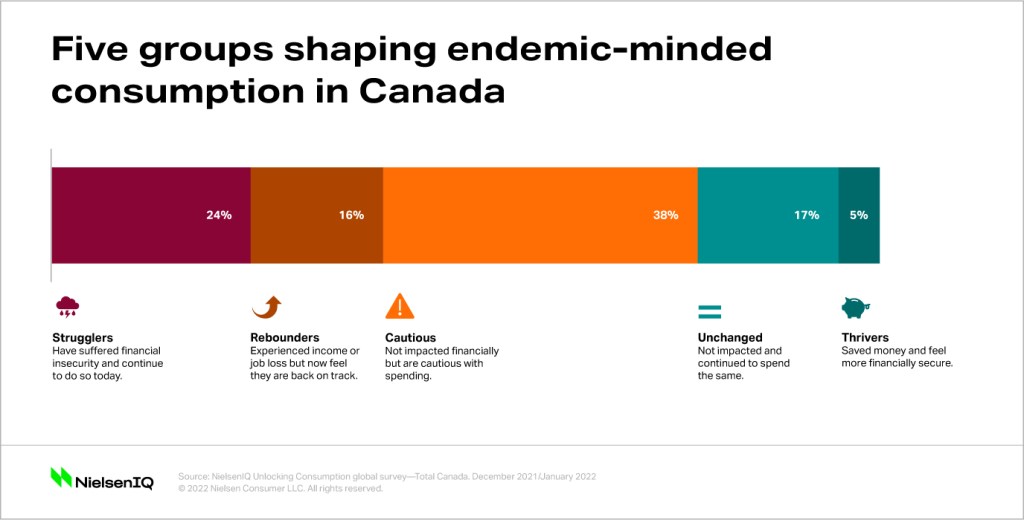

There is a pressing need for companies to understand this new terrain because it’s changing the way consumers shop. Our latest NielsenIQ study examines this shift through the lens of five new consumer cohorts, their unique mindsets, and the shopping habits you can expect from them in 2022.

These segments demonstrate that 78% of Canadian respondents (namely, those identified within the cohorts of Strugglers, Rebounders, and the Cautious) are altering their buying and consumption patterns to be more cost-conscious.

“With rising prices, essential versus discretionary items are being re-evaluated and value trade-offs and compromises are the new norm,” said Nicole Corbett, Director, Global Thought Leadership, NielsenIQ. “Retailers and brands cannot assume past pricing and promotional strategies are relevant in today’s world. These changing retail dynamics are playing out against a backdrop of new consumer priorities and needs and preferences that are very different from 2019.”

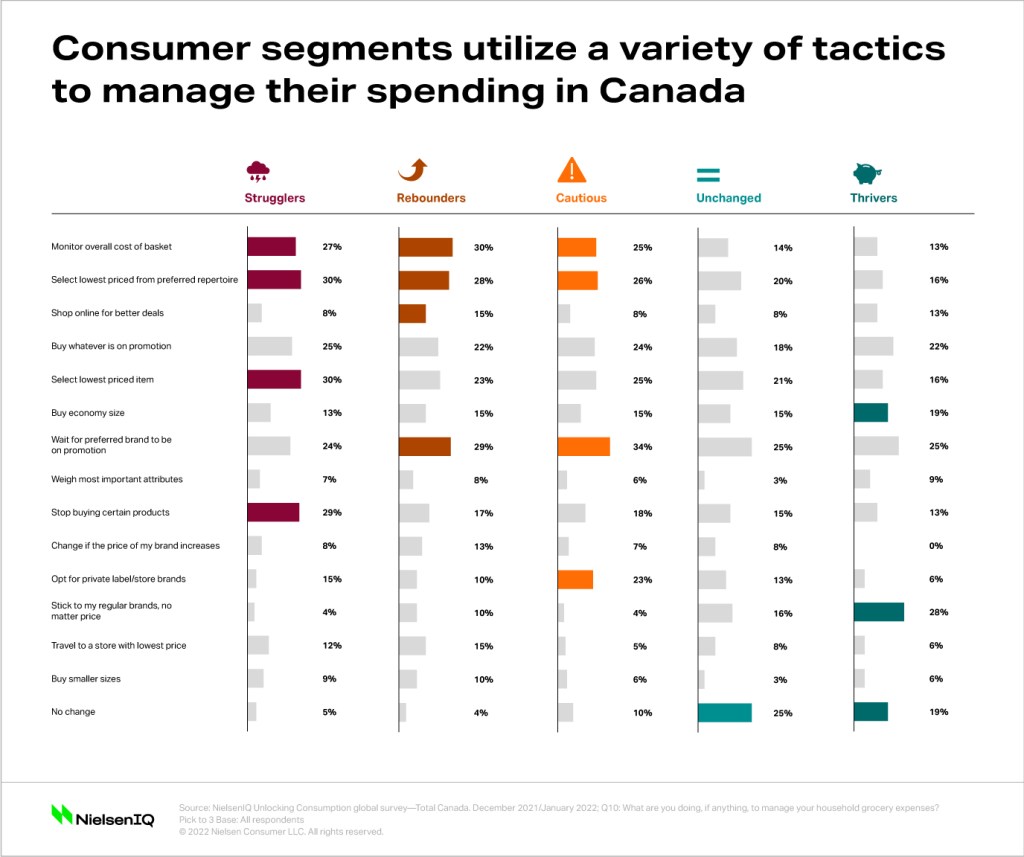

Connecting with these new consumer segments means understanding and responding to nuanced behavior shifts. For example, if the price isn’t right on a preferred brand or product, Strugglers will likely select the cheapest replacement or stop buying completely, while the Cautious segment will delay a purchase until it’s on sale.

This insight shines a light on the importance of managing price sensitivity and promotional effectiveness to optimize revenue. Shoppers may shop less or even walk away from non-essential or indulgent purchases altogether, but in staple categories they’ll look for affordable trade-offs, especially when there isn’t a strong value proposition to prevent them from substituting with private label options.

For example, as prices skyrocketed over the last 12 weeks, volume sales of private label cooking oils held steady with 1% growth while branded item sales fell 17%. The story repeated in countless other categories, from frozen meals to toilet paper. The trend was exacerbated as shoppers budgeted for surging gas prices.

To effectively navigate these turbulent waters, companies need a deep understanding of their customer base. Although pricing issues are critical to address in the short-term, a recent NielsenIQ analysis shows that companies also need to plan for the long haul.

Added value is important for long-term growth

Over the course of the past two years, many financial analysts and CEOs have miscalculated the time horizon of impact by global events only to experience lingering challenges and new pressures. It’s been a lesson on the importance of addressing short-term priorities while building toward long-term goals. Companies grappling with short-term pricing strategies today should also take the opportunity to assess new ways of adding value for their customers tomorrow.

One of the most important concerns for Candian consumers, and a driving force for CPG growth, is personal health and wellness. Companies are positioning themselves for long-term relevance with consumers with purpose-driven brands, plant-based alternatives, and reformulated products that meet consumers’ evolving dietary and wellness needs.

Two-thirds of Canadians indicated the past two years gave them a different set of priorities that influence their buying decisions. Physical health, mental wellness, environmental concerns, and social justice are just a few of the areas people support with their product purchases. Canadian shoppers also specifically signaled a desire to support local retailers and products.

Meeting these needs—and effectively communicating that to customers—can help brands compete for market share without relying solely on price. As we enter a new endemic-minded reality, companies need to understand that consumer growth is now polarized. Businesses must reinvent their portfolios and forge new strategies to navigate the new needs, priorities, and preferences of this divided consumer landscape.

Follow Canadian consumer behavior changes

Track, diagnose, and analyze consumer buying behavior with the #1 provider of Canadian consumer intelligence.