Research highlights

Unprecedented converging headwinds—the COVID-19 pandemic, e-ecommerce growth, and the war in Ukraine—have caused massive disruptions to both supply and demand. Their impact has been compounded by (or perhaps are a root cause of) price inflation on fuel and consumer goods.

Retailers and suppliers have felt the consequences in the form of cost of goods, demand pressure and out-of-stocks, Ken Fenyo of Coresight Research said in his opening remarks. Resultant margin pressure has led retailers to pursue alternative revenue streams, find lower-cost products to address price sensitivity, and find ways of working more collaboratively with suppliers.

Fenyo shared topline findings from the research report “Discovering Hidden Treasure in Your Supply Chain Data.”

The research covered FMCG retailers and suppliers in North America to ask about present challenges and how they use and share data.

FMCG retail has seen several external shocks, Fenyo said, enumerating the pandemic, the war in Ukraine, the China lockdown, and the recent baby formula shortage. These are reflected in rising costs of labor, raw materials, and shipping costs, which are leading to out-of-stocks, shortages in the food supply chain, and increased inflation.

“Retailers and brands are beginning to think about alternative revenue streams and how collaboration can help improve outcomes, along with better ways to measure on-shelf availability (OSA),” he said.

They are pressing suppliers for better prices and service levels, he added. Out-of-stocks are becoming a loyalty issue, partly because of e-commerce raising the bar on expectations. Success requires information sharing both within organizations and between trading partners.

Fenyo pointed out five key findings from the survey respondents:

- 41% say low OSA was a big supply chain challenge

- 44% are beginning to cope with these challenges through data exchange

- 37% say lack of centralized data collaboration platform is a limitation

- 52% are working with a solution provider that has a cross-channel view of supply chain performance

- 51% of suppliers plan to buy data from retailers to improve supply chain management

Top challenges

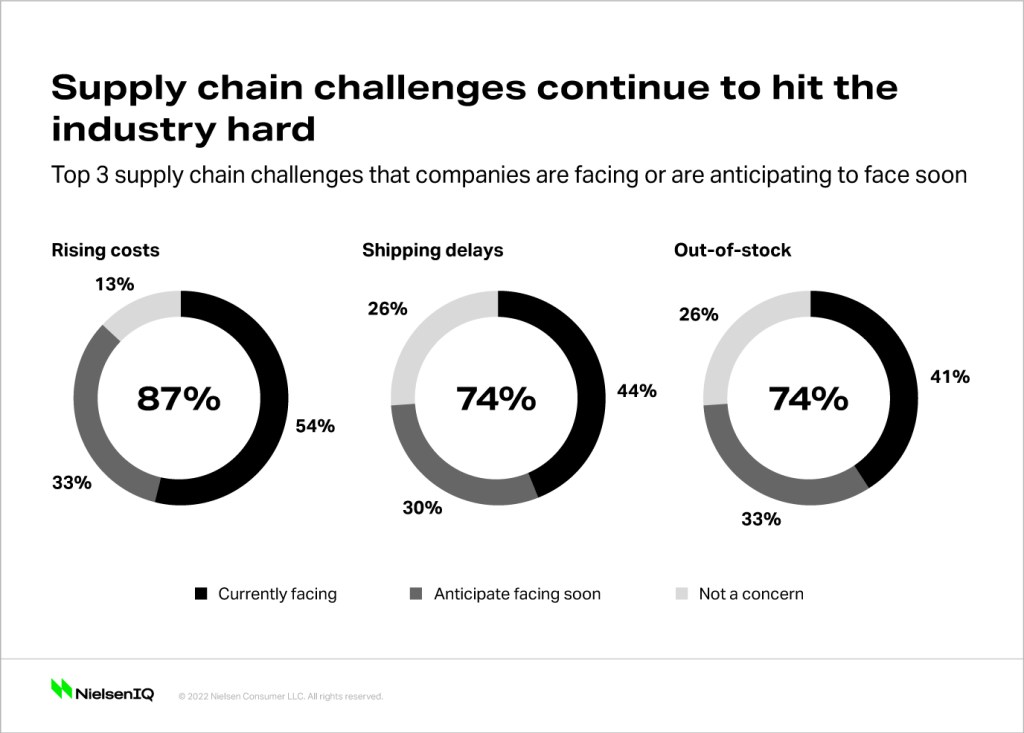

When survey respondents were asked what circumstances most affect their ability to maintain good product availability, four challenges rose to the top, Fenyo said. Those were: rising costs, cited by 54% of retailers and suppliers; shipping delays (44%); lack of accurate supply chain data (42%) and out-of-stocks/low on-shelf availability (41%).

“When I talk to retailers, everyone is talking now about costs. How to manage through inflation. How the cost of shipping containers is up three to five times what it was even a year ago,” he said.

Data sharing for better collaboration

The research found retailers and suppliers are trying to use more data more effectively to cope with supply chain challenges and work to make better decisions.

“Almost 80% of respondents said that exchanging data is now more important than ever,” Fenyo said. Forty-four percent have used data exchange as a way to cope with these challenges.

“Then the question arises, how to do they use the data and why are they using it? Most (61%) want to use it to improve sales. Many (57%) want better forecasting and planning. Almost half (49%) say they want it to improve margins also.”

Their initiatives include discussions across internal departments, along with seeking help from external solution providers. They are seeking to create metrics to help them see and manage on-shelf availability, customer satisfaction, and how these intersect with customer purchase histories.

Role of solution providers and a common platform

The research highlighted several ways that solution providers can help facilitate the data exchange process.

“We asked about the challenges retailers and supplier face when attempting to share data,” Fenyo said. “The ones that jumped out were the lack of a centralized platform and a lack of support from data vendors, followed closely by lack of attention from top management.”

While data is often present, it can be hard to access, he said, adding that better tools and support are needed, including a centralized data collaboration platform with visibility to the supply chain, along with advanced analytics and data visualization.

Desired capabilities

Retailers and suppliers are looking for multiple capabilities from their supply chain solution providers, the research confirmed. Their responses indicated significant gaps between what they considered important compared with what they actually now possess.

“The biggest gaps are around root-cause analysis of out-of-stocks and the ability to look across at supply chain performance data about suppliers or retailers they are working with,” Fenyo said.

Among retailers, 73% said a view of supplier supply chain performance is “important,” but only 24% indicated that they have this capability. Similarly, 70% of suppliers said a view of retailer supply chain performance is important, but just 26% said it is available to them.

“We find there is a huge gap between importance of solving some of these problems and data that is available today,” he said. “That’s why newer data sharing platforms are so important.”

Monetization of supply chain data

While trading partners have some experience with the monetization (selling and buying) of shopper data, the Coresight study also highlighted an emerging opportunity to also derive added value from supply chain data.

“This is a newer area, partly driven by some of the external pressures and changes in business we’ve seen recently,” Fenyo said.

The survey found that about a third of retailers (33%) are selling data and about a third of suppliers (36%) are buying it, but both expect to do more. Within three years 50% of retailers and 51% of suppliers expect to be participating in this activity.

Objectives cited by respondents for data-sharing activities include optimizing inventory levels, reducing shipment delays and improving speed to market.

Innovation areas

Fenyo noted a high level of innovation is occurring, “in terms of how people can really run their businesses better and leverage data.”

Referencing on-shelf availability, he noted that there is a lot of effort to measure OSA as more of a “standard metric” in the industry. There is much interest also in aggregating data for better analytics of customers and supply chain all in one place.

“Retail Media is becoming a big play currently and that can have real implications for the supply chain and inventory availability,” he added.

On-shelf availability offers key path to success

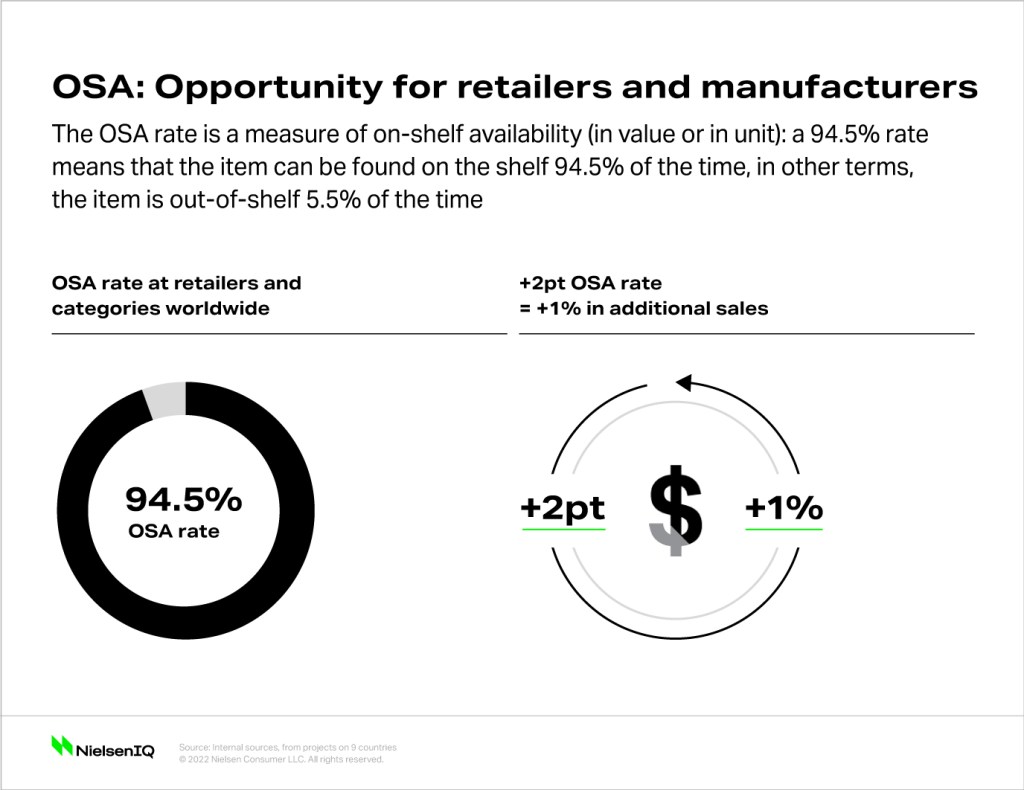

Improved capabilities in measuring and managing on-shelf availability have jumped to the forefront as a collaboration opportunity for retailers and manufacturers, said Chintan Mehta, VP of Product, NielsenIQ. In addition, having full on-shelf availability transparency is critical as a key path to success.

The U.S. food retail industry had a measured on-shelf availability rate of 92.6% in the 52 weeks ending February 12, 2022, Mehta said. That translates to 7.4% of items out-of-shelf, which cost the industry at least $88 billion in lost sales over the year. During the last 13 weeks of that period, empty shelves cost U.S. retailers an average of at least $1.9 billion each week.

Addressing this challenge is crucial, Mehta said, since “an improvement of two percentage points in the OSA rate translates to a one percent increment in sales.”

OSA rates can be calculated by retailer, which enables them to benchmark their performance, he explained. “Across the geographies where we calculate OSA, we have noticed large ranges across categories, especially for beverages.”

During the fourth COVID wave from July to October 2021, the best-performing retailers managed 94.8% OSA in the beverage category, compared with worst performers at 88.5% – this is a 6.3-point difference in product availability at the shelf, showing that not all retailers exhibited the same level of operational excellence of having items on the shelf during the COVID waves.

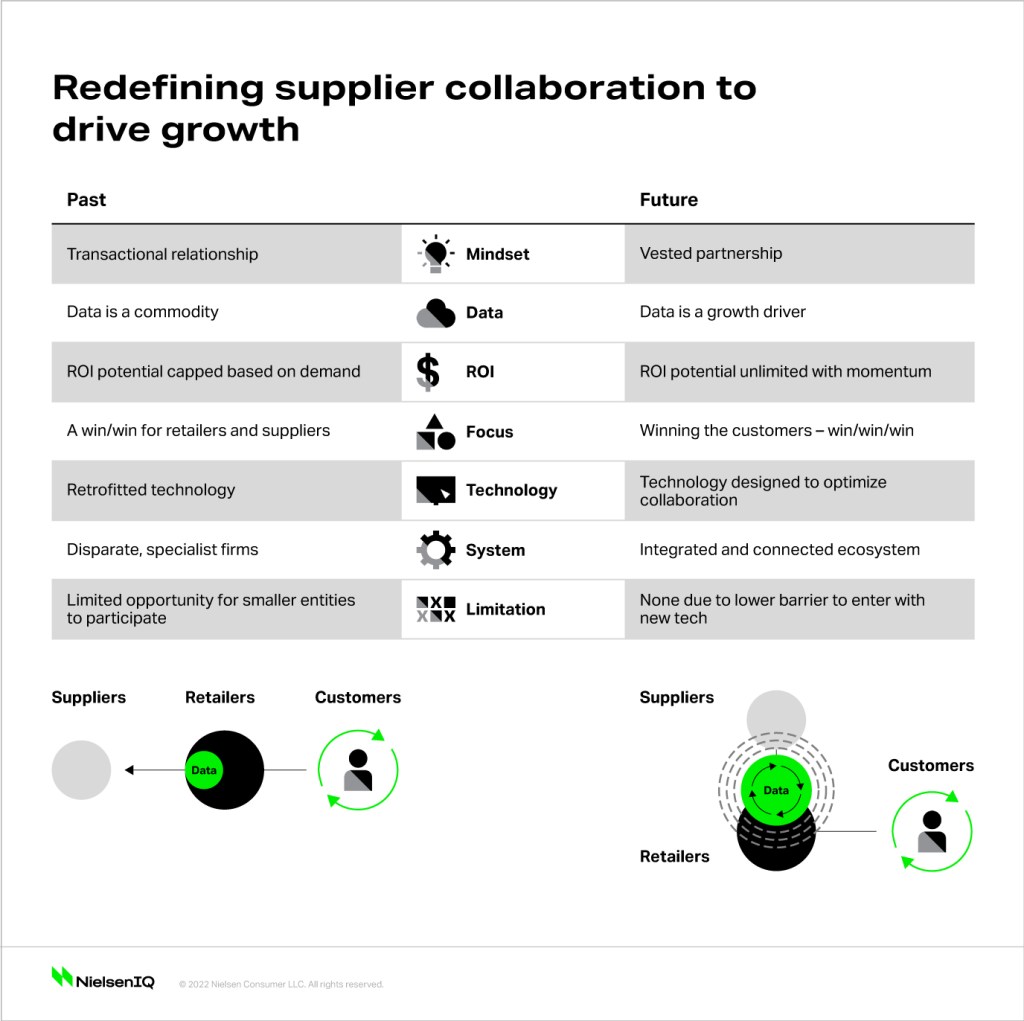

The new era of supplier collaboration

True collaboration is based on building and aligning with one version of the truth on a robust data platform—and one set of connected data sources. This means retailers and suppliers will have a comprehensive understanding of the customer in real time.