Measuring success for SMBs

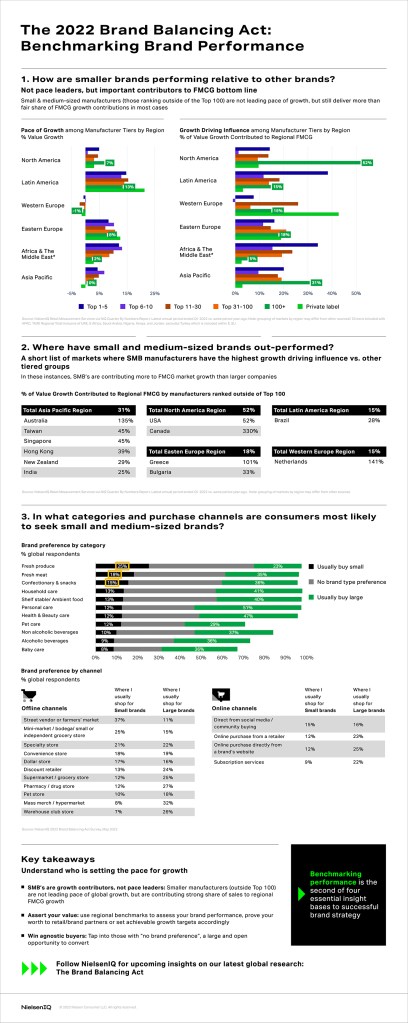

As larger manufacturers often do, continuous measurement and benchmarking of performance is a key step to assessing and seizing brand growth potential. For small and medium-sized businesses (SMBs), pace has not been the swiftest compared to larger companies, but growth driving influence, or contributions to regional sales growth, have been significant.

In fact, manufacturers outside of the top 100 have contributed 52% of their region’s annual FMCG growth in North America and 31% in the Asia-Pacific region.

To succeed, SMBs need to use regional benchmarks to assess their brand performance, prove their worth to retail/brand partners, and set their achievable growth targets accordingly.

The category and channel strengths of SMBs

Understanding where consumers seek smaller brands is as important as understanding which regions across the world are leading the pace of brand growth.

According to our global survey one of the top categories where consumers seek out SMBs when buying confectionary and snack products (15%).

Notably, 44% of consumers indicate they have no brand preference when shopping for these types of products. This further adds to the open opportunity for smaller brands to convert and build loyalty among category buyers.

Shoppers in search of SMBs tend to lean on smaller outlets, like street vendors/farmers markets (37%) and minimarkets/bodegas/independent grocery stores (25%).

Large brands have a distinct advantage online, but the playing field is nearly even among consumers buying direct from social media or community buying. In this case, 15% say they usually shop for SMBs through the social media and community buying channel, compared to 16% who usually seek the channel for large brands.

Putting it all together

These metrics demonstrate that in the current climate, SMBs are often leading as sales growth contributors, but are not the pace leaders.

Consumers, on the other hand, have distinct categories and channels to which they’re more likely to seek smaller brands for purchase. To thrive, SMB’s must lean into their brand advantages to extend their share of sales and increase their pace of performance in the long term.

Check out the infographic below to take a deeper dive into where the opportunities for SMBs exist and who is setting the pace for growth:

Stay ahead by staying in the loop

Don’t miss the latest NIQ intelligence—get The IQ Brief in your inbox.

By clicking on sign up, you agree to our privacy statement and terms of use.