Marketplaces, forecasting, assortment and purpose ever more important to success

Consumer tech retailers in Latin America (LatAm) are operating in an environment of high consumer expectations and some tough economic realities.

Retail revolution: opportunities being harnessed in LatAm

Formats

Strong expectations for omnichannel, internet marketplaces and retail media networks

Technology

Artificial intelligence to help manage inventory, and high interest in Blockchain

Operational Excellence

Key investments in delivery, assortment, financial services, and workforce skills

Purpose

Industry split on investing in sustainability, repair hubs and second life

A new global survey by GfK shows that most have their eyes on targeted opportunities. In their efforts to maximize results, retailers across the region are making investments within four interconnected areas: formats, technology, operational excellence and purpose.

Retailers’ new emphases will fall partly upon finding fresh revenue streams, including through internet marketplaces, social commerce, and experience stores. Equally, companies will pursue process excellence and look to secure a competitive edge by enhancing their talent base. Behind the scenes, use of artificial intelligence and robotics will be increasingly advanced.

87%

of LatAm retail executives expect omnichannel to remain dominant

80%

say demand forecasting is core benefit of their AI investments

9 in 10

to improve delivery and assortment

Half

of retailers to invest in sustainability, marking a significant split in the industry

Source: GfK Retail (R)evolution 2023

The GfK survey, involving nearly 800 retail executives in 76 countries worldwide, highlights fascinating developments in what matters most to retailers in 2023.

In LatAm, omnichannel is clearly perceived as the most successful post-pandemic format. Click and collect services will remain an important element of ensuring seamless service, countering the often lengthy and expensive home delivery options.

Digital tools will be used in ever more varied ways, with retail media networks gaining popularity and Blockchain poised to unlock the potential of alternative forms of payment.

LatAm retailers are split on the value of investing in broader business purpose, an area increasingly important to consumers. Many do not perceive enough demand yet, though some will move ahead in pursuit of differentiation.

This report examines the current evolutions among LatAm retailers. By understanding these changes, and investing wisely, those retailers can build profitability and a sharp competitive edge.

LatAm: most successful formats expected

87%

omnichannel

74%

internet marketplace

74%

buy online, pick up in store

71%

shopping experience store

68%

mobile commerce

65%

social commerce

Source: GfK Retail (R)evolution 2023

Formats

Consumer tech retail formats are evolving rapidly across LatAm.

The dominance of traditional small stores has been eroded. Some 87% of retailers in the region have confidence in the prospects for omnichannel. This is a higher proportion than even the strong global average.

Notably, the option to buy online and pick up in store is particularly popular. Such services offer consumers convenience and speed, as well as reduced costs.

“Regional delivery and shipping are often quite pricey,” explains Santiago Barbaglia, LatAm retail director at GfK. “So buying online and picking up at a local store is a good option for people in almost every country in the region.” Increasingly, large store chains could offer this service to other companies to create an additional revenue stream.

Growth of marketplaces and social commerce

Newer formats are quickly growing in popularity. Chief among these is internet marketplaces. Three quarters of LatAm retailers expect strong growth here, well above the global average of 65%. During the pandemic, marketplaces boomed, and they continue to expand strongly.

Many of the largest LatAm retailers have launched marketplaces in recent years, and continue to invest in them. More and more omnichannel and online specialists are following suit.

“A key focus in the region is enabling a wider assortment of products,” explains Barbaglia. “Many physical stores don’t have a sufficient range. Online – and marketplaces in particular – allow for a much greater array of products.”

A key focus of LatAm retailers is improving product assortment. Creating internet marketplaces is a popular way to achieve this aim

“Brands and retailers have been working together, and with local influencers, to continue growing this channel,” notes Barbaglia.

Meanwhile, seven in 10 bricks and mortar store operators plan to invest in upgrading the shopping experiences they offer. These propositions will focus on events and catering, healthcare and education, as well as product tryouts.

Localization strategies also offer significant potential, and 59% of retailers expect them to remain a successful sales generator. Retailers across LatAm are also focusing on maximising revenues made through store and warehouse space. Some 58% plan to use these areas to offer fulfillment solutions, even if efforts are in the early stages.

Revenue streams that bring manufacturers closer

In a tough market, European retailers are clear that format innovation must include finding new revenue streams. At the same time, these new areas will help keep manufacturers on side, an important step as those businesses experiment with selling directly to consumers.

Equally, retailers are acting to generate revenues in ways that bring tech brands closer. Renting out space both in-store and online will be important for retailers in strengthening brand relationships. These efforts will be strongly in focus given manufacturers’ growing direct-to-consumer sales.

“Some tech brands are achieving rapid growth in direct sales, bypassing retailers to offer large discounts,” says Barbaglia. “Retailers are therefore looking to strategies that change the dynamics.

These include providing brands with unique sales routes and market insights.”

Renting out store space to brands is one such key area of focus for 56% of LatAm retailers. This space could be used for smart displays, kiosks and enhanced retail experiences, enabling brands to have engaging and powerful routes to customers in store.

Meanwhile, nearly six in 10 executives in the region are keen to develop retail media networks (RMNs). These will allow them to sell advertising space on their websites and apps. RMNs can raise brand awareness among consumers and capture quick sales, in a place where thousands of consumers may be browsing at any point. Brands can derive unique marketing metrics and insights, while the retailers find relatively quick return on investment as they sell online space.

LatAm: top tech focus areas

60%

AI/machine learning

37%

blockchain

33%

robotics

Source: GfK Retail (R)evolution 2023

Technology

LatAm retailers will for the main part introduce more artificial intelligence and machine learning (AI and ML), as per global trends. Notably, however, they will be ahead in investing in Blockchain.

Both these technology investment focuses will be critical in supporting developments across the other three pillars: formats, operations and purpose.

AI to manage inventory

As is the case globally, the main LatAm technology focus is on AI and ML. With six in 10 retailers set to invest here, there is strong potential for transformation.

Fluctuating sales mean AI-driven demand forecasting will be critical. In volatile economics, getting it right is a longer term effort

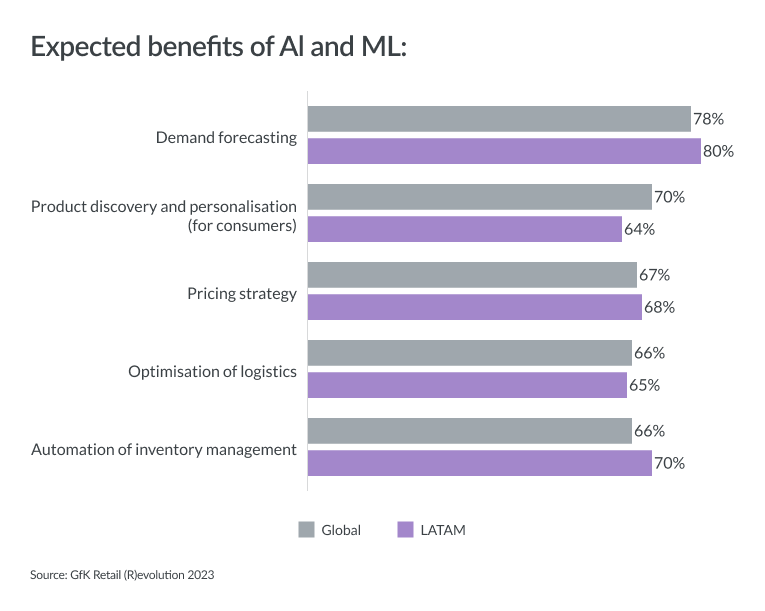

Key areas for AI and ML will include demand forecasting and managing inventory. Forecasting is now the focus of 80% of LatAm retailers investing in AI.

The automated management of inventory will also be critical to seven in 10 LatAm retailers, above the global average.

These areas will be critical to retailers as they face quickly fluctuating sales, given the changing macroeconomic effects on consumer incomes.

“When retailers here are short on inventory, or conversely end up holding stock, it can be very costly. Efficient inventory management and good insights into demand are vital,” explains Barbaglia. “Getting it right, however, will be a long term effort – particularly in volatile markets.”

Consumer-facing aspects will also motivate AI investment. Some 68% of LatAm retailers plan to use intelligent tech to help set the right product prices.

Two thirds will also use AI to support consumers discovering new products, including by showing them personalized options.

Leading in Blockchain

Investment plans linked to Blockchain are also strongly in evidence. With 37% of LatAm retailers investing in the technology, interest levels are well above the global average.

A key proposition with Blockchain is being able to accept alternative methods of payment, in the form of cryptocurrencies. While this is still in the early stages for retailers, it could become important, Barbaglia notes.

“It’s about finding a solution to a deep problem across the region – many people cannot access the traditional banking system,” he explains. “We have a lot of informal economic activity here, so retailers are looking to offer better and accessible methods of payment.”

Blockchain could also be valuable as a means of improving back-office operations, in the longer term. “Blockchain offers many benefits, including tracking products through the supply chain,” Barbaglia says. Such heightened transparency can also support drives towards sustainability and other purpose-led initiatives.

Robotics and warehouse automation

Other tech areas remain of slightly lower interest to the region’s retailers, despite strong backing from some large players. Among them is robotics. One third of LatAm retailers will invest in this area. Robots will be important in transforming warehouse processes, and checking inventory.

“Some of the big omnichannel players have pioneered in this area, automating all aspects of warehouses. Other retailers will surely follow,” Barbaglia says. Robots also have the potential for assisting customers in-store, he notes, though this is expected to be a much longer term focus, as in other regions.

The outlook around augmented and virtual reality (AR and VR) is somewhat mixed. Again, a third of LatAm retailers will invest here, on par with the global average. In time, the tech is expected to improve brand and shop experiences, including through immersive product tryouts and store navigation. As bricks and mortar customers grow accustomed to tech-driven experiences, there is the long term potential to bring together AR and VR with robotics to create powerfully engaging shopping venues.

LatAm: operational focus areas

92%

delivery times

86%

product assortment

84%

workforce

82%

supply chain

73%

payments

Source: GfK Retail (R)evolution 2023

Operational Excellence

Consumer tech retailers in LatAm are set to have a strong focus on operational excellence in the coming two to three years. This will be critical in meeting consumers’ growing expectations.

Supply and assortment

GfK research shows that consumers globally are more concerned about delivery times and product availability than before Covid.

For retailers in LatAm, improving delivery times is a crucial area of focus. Some 92% of retailers in the region, above even the high global average, will work on this area.

Substantial home delivery costs and lengthy transport times in the region mean improving outcomes will take time. As part of these long-term changes, over eight in 10 LatAm retailers plan to invest in the reliability of their supply chain so they can also get hold of products quickly in the first place.

Notably, LatAm retailers’ second highest operational priority is improving product assortment. Some 86% of the region’s retailers will focus on this, well ahead of the global average of 73%.

“Assortment has a lot of value for retailers here because in many countries their range of products is still quite lacking,” Barbaglia explains. “Consumers value a wide array of products to choose from, so it makes sense that retailers are so determined for improvement here.”

The new marketplace strategies are a crucial part of increasing assortment, he adds. “The retailers who create marketplaces can really broaden what’s available. They simply can’t have that variety in their stores.”

A competitive workforce

LatAm retailers will also focus extensively on their staffing in the coming two to three years, as they seek to tighten operations. A high 84%, above the global average, will look to improve their workforce.

Talent development will be critical to competitiveness, Barbaglia notes. Bringing in new skills is critical given the fierce competition for consumer attention.

“In the past, retail employees often stayed for decades, working their way up. They know their markets very well, but retailers now want more diversity within their workforces,” he notes. “People with degrees and from other industries are being hired into retail. This brings in new proficiencies and some fresh approaches.”

Ecosystem of change

LatAm consumer tech retailers also recognise the importance of expanding the range of their service offerings. Some 71% are focused on their ecosystem of services.

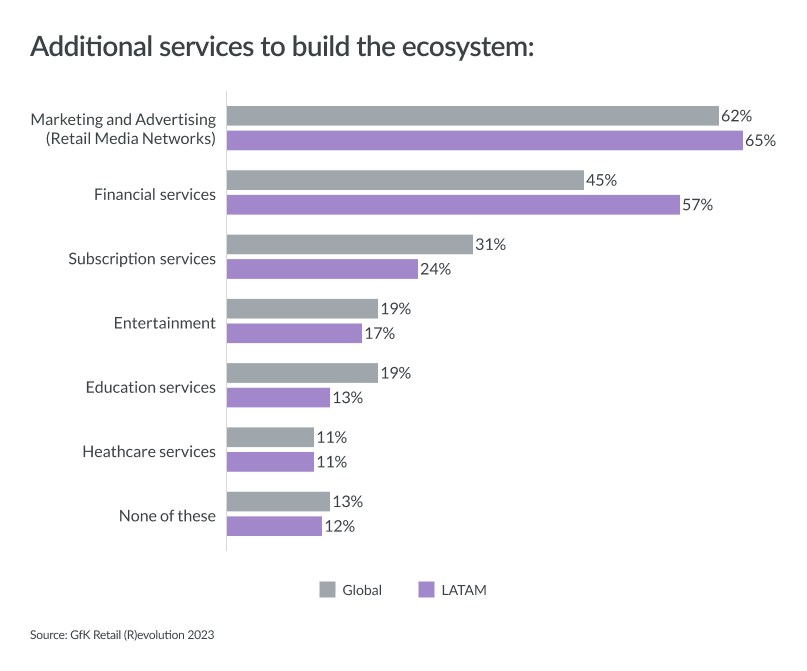

Retail media networks are the priority for most. Two thirds of retailers focusing on their ecosystems emphasize RMNs, given the financial returns and strengthened brand relationships on offer.

Meanwhile, retailers in the region will have an especially high focus on improving financial services. Some 57% will work in this area. This will be critical as they seek to make products more affordable and accessible.

“Getting financial services right will be a major differentiator,” Barbaglia explains. “It’s not just about people paying with one provider or another – but also paying in installments, potentially interest free. This will be particularly important for big ticket items that may otherwise be unaffordable.”

Other ecosystem aspects, such as offering subscriptions online, or entertainment and education in-store, are less popular. Fewer than a quarter of the LatAm retailers investing in their ecosystems will invest in creating and growing these revenue streams. For those that do, however, they could prove a powerful revenue generator.

LatAm: operational focus areas

56%

sustainable products and

services

53%

sustainable internal

practices

30%

repair hubs

24%

second-life products

Source: GfK Retail (R)evolution 2023

Purpose

Consumer expectations are constantly rising for retailers of all types. Among the most vocal demands is for retailers to have a clear high level purpose, including an emphasis on sustainability.

LatAm consumers now see purpose as a top 10 personal value, raising its importance for retailers.

Sustainability: long term differentiator

There remains, however, a gap between expectations and most retailers’ investment plans. This is even more stark in LatAm than in other regions. Among the retailers not investing in these areas, the key reason is a perceived lack of consumer demand, cited by 60%.

In four key areas – sustainable products, practices, repair hubs and second life – LatAm retailers are behind global averages.

“While sustainability does appear to matter a lot to consumers, many retailers don’t have the scope for raising prices to sell a more sustainable product. This has lowered the incentive for investing and focusing here,” Barbaglia notes.

The 56% of retailers acting on sustainable products and services marks a clear split in the industry. Among those businesses making changes, there is an opportunity for powerful differentiation. Efforts could focus on selling products made from more recycled and recyclable goods, extending the life of products, and minimizing packaging waste.

Meanwhile, half of LatAm retailers plan to invest in sustainable practices. This will involve reducing power and water usage in stores, warehouses and data centers, cutting waste, and using renewable energy sources.

Education, packaging and warranties in focus

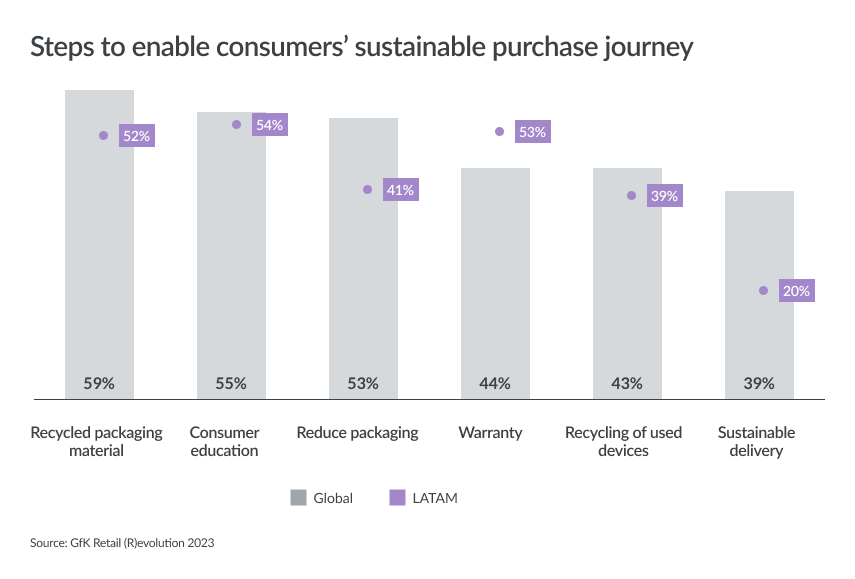

For the retailers looking to help consumers on a sustainable purchasing journey, a top priority will be education. Some 54% of them will invest in educating their customers around these issues, to help raise awareness and demand for greener products.

Packaging is another key focus. Just over half see recycled box material as important, while four in 10 will reduce the total quantity of packaging.

But greener delivery is a low priority, with only a third of retailers investing in sustainable transport given the deeper challenges in getting products quickly to consumer homes.

Some retailers are also paying close attention to extending device life. Warranties will be an important area here, with 53% of retailers investing. “Many consumers look for warranties in the first place because of the high outlay on certain products. They want to keep goods going,” Barbaglia says.

He adds: “When people buy products in installments, the retailers can also make the warranties even more attractive, by spreading that part of the cost.”

Repair hubs and second life products are also an important focus within device longevity. Repair hubs offer the opportunity for retailers to generate revenues by keeping devices working for longer. And second-life products mean the chance to sell to a key market looking to buy at a particularly low cost.

Over half of retailers will invest in education to improve demand for greener products

While only 30% of retailers will invest in repair hubs and 24% in selling second life products, each represents a significant and growing niche market.

“As economies get tougher for consumers, we expect these will become areas retailers are ready to explore more extensively,” Barbaglia explains. “Some retailers are already considering them for specific products, as a differentiator.”

Conclusion

Consumer tech retailers in LatAm face high consumer demands, amid macroeconomic challenges. Equally, they can see huge opportunities around revenues and customer loyalty by meeting these fast-changing expectations.

Consumers in the region are looking for more assorted and relevant products. At the same time, they want easy shopping experiences online and in-store, useful ways to pay, and faster and more affordable access to goods. Plus, more of them increasingly value sustainability.

GfK’s survey shows many LatAm retailers are responding assertively to the challenges and opportunities they face. They are investing in dramatically improving the customer experience, from supply speed and breadth of products, to new brand spaces and better forms of finance. And increasingly they are generating loyalty by responding to expectations around sustainability.

All of these improvements are being directly enabled by tech and by better workforces. Upskilled personnel, AI and Blockchain will play a vital part in unlocking better, more seamless experiences. These, in turn, will have a powerful effect on retailers’ revenues and their competitive edge.

The LatAm retailers investing wisely in the four pillars of formats, tech, operations and purpose will be those best placed to succeed. Many already rely on GfK insights and consulting services to understand the shifting local trends, and to make the right moves with confidence and clarity.

Authors

Namrata Gotarne

Global Strategic Insights

Ines Haaga

Global Strategic Insights

Contributers

Santiago Barbaglia

Retail Partner Leader

Endorsed by

Michael McLaughlin

President Global Retail

Wolfgang Wanders

VP MI Product

Vishal Bali

Global VP CSM

Jamie Clarke

Head of North America Retail NIQ