Brands desire clear and rapid measurement

The US retail media market remains on a strong upward trajectory, with 2023 spending expected to top $52 million in the US alone, a nearly 20% jump for the year.

That level of spending commitment comes with some serious concerns for brands. In a recent survey, 94% of brand advertisers said that in their upcoming budgets they plan to divert part of their planned marketing dollars from trade marketing to fund retail media.

That’s a meaningful decision with significant consequences. Brands need to have confidence that their retail media campaigns will deliver on their strategic and financial goals. This goes beyond basic metrics like audience scale or Return on Ad Spend (RoAS).

The report from Coresight Research, The US Retail Media Market: Understanding the Ad Buyer’s Perspective in CPG, commissioned by NIQ, shed light on how brands view this challenge. Respondents were asked how brands prefer to measure their retail media activities. Their answers may offer guidance to retailers as to what steps they should take to ensure these needs are met.

The findings confirm that CPG brands desire clear and rapid measurement of retail media performance to understand the effectiveness and pay-back on their campaigns and continue to improve. Many are committed to including retail media in their marketing mix, but they want things to work better. At the top of their list: superior ability to measure campaign effectiveness.

Timeliness is a top concern

Most brands (92%) say they are satisfied with retailers’ timeliness of providing data and insights regarding the performance of personalized promotions and coupons, but there is room for improvement in retail media.

The research revealed that brands perceive just 23% of retailers presently share campaign data and analysis with advertisers in real-time while 56% deliver data immediately following campaign completion. Another 21% take a week or more to provide this information.

Among brand advertisers who indicated they do not receive data in real time, 97% reported that real-time data sharing would prompt them to increase their advertising investments.

Why this is important: Look-back metrics document performance but they do not allow in-flight course corrections that should be possible, even routine, in the context of digitally enabled advertising.

Right now, fewer than one in four brands (23%) say they can access in-flight retail media campaign metrics, and 75% say improved real-time data sharing would influence them to increase their retail media advertising investments.

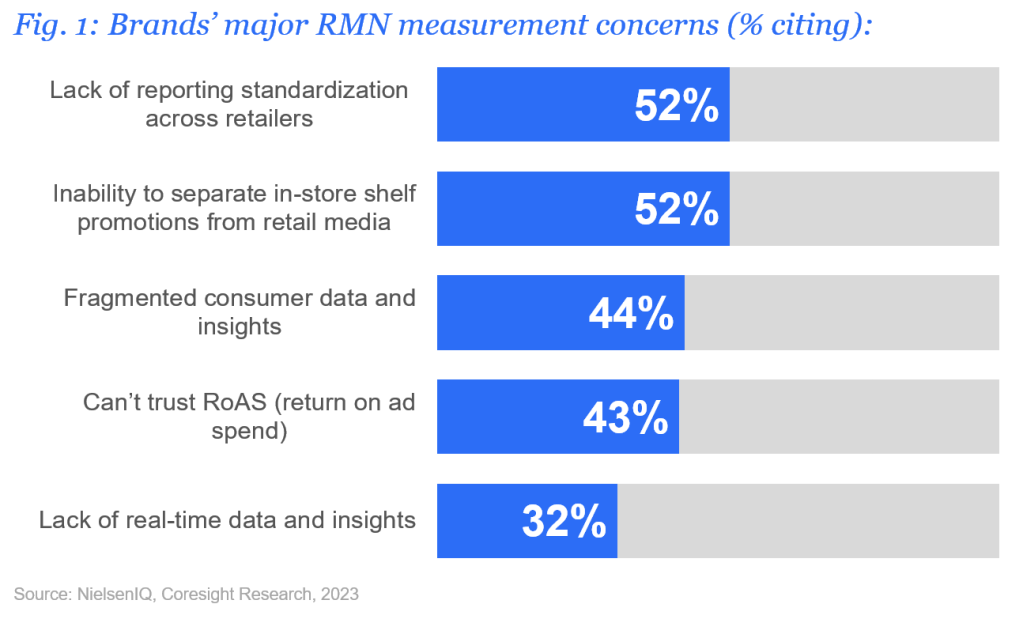

Asked to rank their top concerns regarding RMN measurements, lack of reporting standards rose to the top of the list, cited by 52% of respondents [Fig. 1]. They were equally concerned about the inability to distinguish between the impact of in-store promotions versus retail media campaigns. Data fragmentation – the need to hunt down and collate answers from disparate sources – was a top worry for 44% of brands.

Commenting on the findings, Xavier Facon, NIQ,Global SVP Retail Product said, “Brands are not going to bring many new dollars into the pot until retailers can properly explain what the impact is, what the efficacy is, what the performance is. It is super challenging to do that with simple, basic campaign KPIs like RoAS. That doesn’t tell the whole story.”

He continued, “If I put myself on the side of the media network, I’d be very concerned about what those few numbers are telling – or not telling – the brands. Concerned that it tells a negative story due to factors that I can or cannot control. This is a risk when you limit yourself to minimal metrics.”

Want to find out more?

In this report, NIQ and Coresight Research explore the US retail media market from the perspective of brand advertisers, to understand how retailers can improve their offerings and gain a competitive edge.

What retailers want to measure most

More than any other type of measurement, retailers want to know how well their campaigns perform. This is affirmed by findings from the 2024 Path to Purchase Institute Retailer Media Network Study, in which 51% of respondents ranked “proof of sales lift and ROI from campaigns” number one, and 88% in the top three.

Wrote the P2PI, “When it comes to retail media measurement, nearly 9-in-10 respondents said they wanted their retailer partner to provide proof of sales lift and ROI for campaigns. Nearly half [49%] also indicated they want their retailer partner to provide granular and customized reporting and more than 40% said they wanted standardized metrics and definitions, and offline and online attribution.”

Self-service is a key enabler

The Coresight research report commissioned by NielsenIQ, reveals that desire for real time and more comprehensive measurement presents an opportunity for retailers who want to make their networks more attractive to endemic advertisers. Self-service is key for enabling timely access.

Per the report authors, “The most widespread challenge among brand advertisers when it comes to RMNs is a lack of collaboration with retailers. Enhanced collaboration can positively impact revenues for retailers and suppliers, and improved data sharing can help solve challenges such as brand advertisers’ inability to understand RoAS (return on advertising spend) and limited visibility of target audience.”

Meaningful steps that retailers can take to build trust among brand advertisers include offering a shared collaboration platform to enable real-time communication and data sharing, they added.

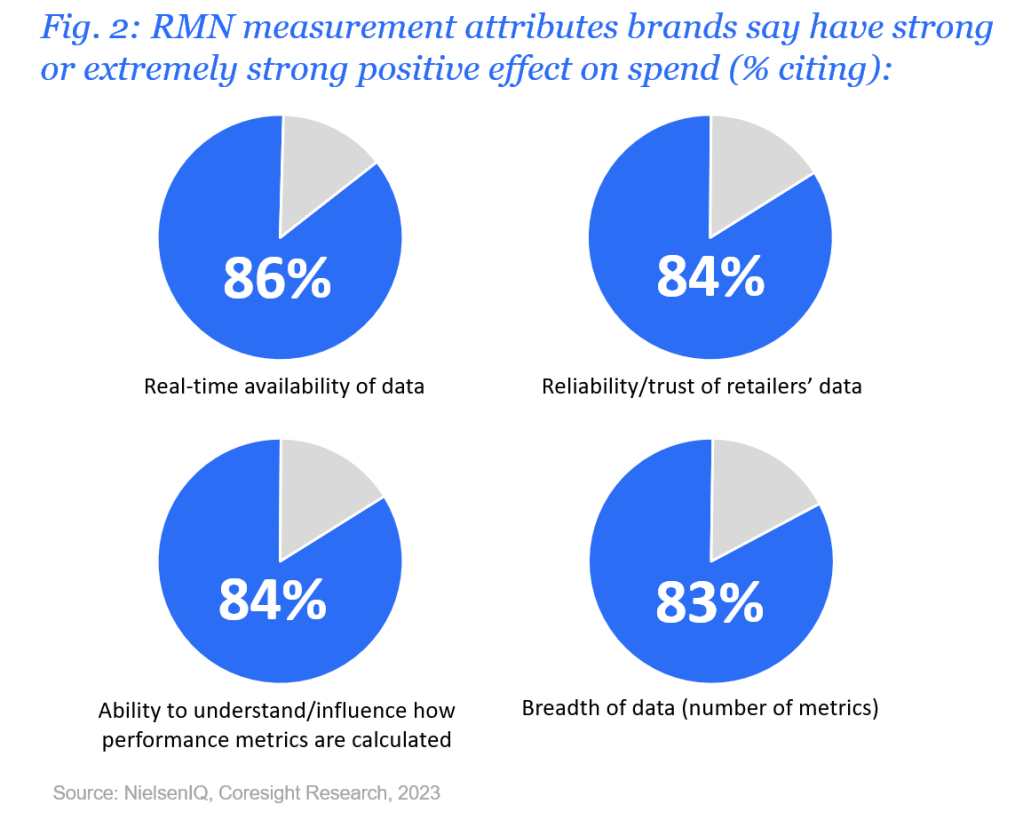

Survey respondents put real-time availability of data at the top of their list of desired measurement attributes, cited by 86% [Fig. 2], and they say this will strongly influence their likelihood to spend more with RMNs who can offer it. Data reliability and transparency of metrics are tied for next on the list, at 84%.

Facon insists that real-time data access should be paired with telling a complete analytic story – what NIQ calls The Full View®. That means access to all the metrics that matter, including customer and sales data. Rapid, reliable measurements may be used not only to optimize the next campaign but even to make planned adjustments while a campaign is running.

He warns against relying on outside services: “If you are asking a third party to create sales attribution showing true incrementality, those studies are not real-time.”

Measurement is the key that unlocks retail media potential

Facon advises that the next phase of retail media networks’ development must focus on enhanced measurement – on documenting results to bring in new dollars. “Retailers need to start showing the manufacturer or brand: This is how you are growing in our category.”

He advocates that retailers offer additional analytics derived from customer insights and sales insights. The goal is to help brands see that it works, understand where the performance comes from and what it does for their performance at this retailer. They should have no doubt they are actually reaching the right shoppers.”