A welcome from

Thank you for the opportunity to share The X Factor: How Generation X is quietly driving trillions in consumer spending with you. This report provides a global analysis of Gen X consumer behavior and spending trends, based on proprietary NIQ and World Data Lab (WDL) data, including WDL’s consumer spending forecasts. It follows our groundbreaking generational report, Spend Z, and continues our mission to decode and predict generational spending patterns worldwide, arming both manufacturers and retailers with the data they need to maximize growth.

While Gen X won’t hit its peak spend until the 2030s, retailers and manufacturers in the consumer packaged goods (CPG) and Tech & Durables (T&D) industries only have a few years to maximize Gen X spend before this cohort’s share of total spending starts to decline. The X Factor forecasts key areas of growth and underscores the differences in Gen X behavior by region and country so brands can better understand what motivates this generation today—and into the next decade.

Our team is passionate about seeing brands win with Gen X over the next five to 10 years. We’re certain that manufacturers and retailers will see measurable growth if they properly invest in Gen X. If you have questions about our research or how to engage with Gen X during this strategic window of time, we welcome the conversation. Together, we can help your business maximize the “Gen X decade.”

Register to watch the webinar in which NIQ’s Marta Cyhan-Bowles and WDL’s Wolfgang Fengler discuss The X Factor‘s key findings.

Want to make the most of the Gen X decade? Get a preview of what you’ll find in The X Factor—and then keep reading!

Want to read later?

Introduction

For years, Gen X has been dubbed “the forgotten generation” in media, policy, and even marketing campaigns. Skipped over or bundled in with Boomers or Millennials, this small but mighty generation has quietly become the engine of global consumer spending. This report will show why the next decade represents a once-in-a-lifetime opportunity for manufacturers and retailers to capture Gen X loyalty and lifetime value.

Gen X will be the spending leader globally through 2033, surpassing $20 trillion (USD). If you aren’t planning with them in mind, you’re missing your most profitable current customer.

Why you can’t afford to overlook Gen X

- Gen X will lead global consumer spending from 2021 through 2033. In high-income markets, Gen X will take the lead later but hold it longer—from 2026 through 2036.

- While Boomers still dominate in net worth, Gen X is second—and gaining.

- Gen Xers are currently in their peak expenditure years (ages 45–60).

- Gen X has emerged as the “caretaker consumers”—simultaneously caring for children, aging parents, and their households.

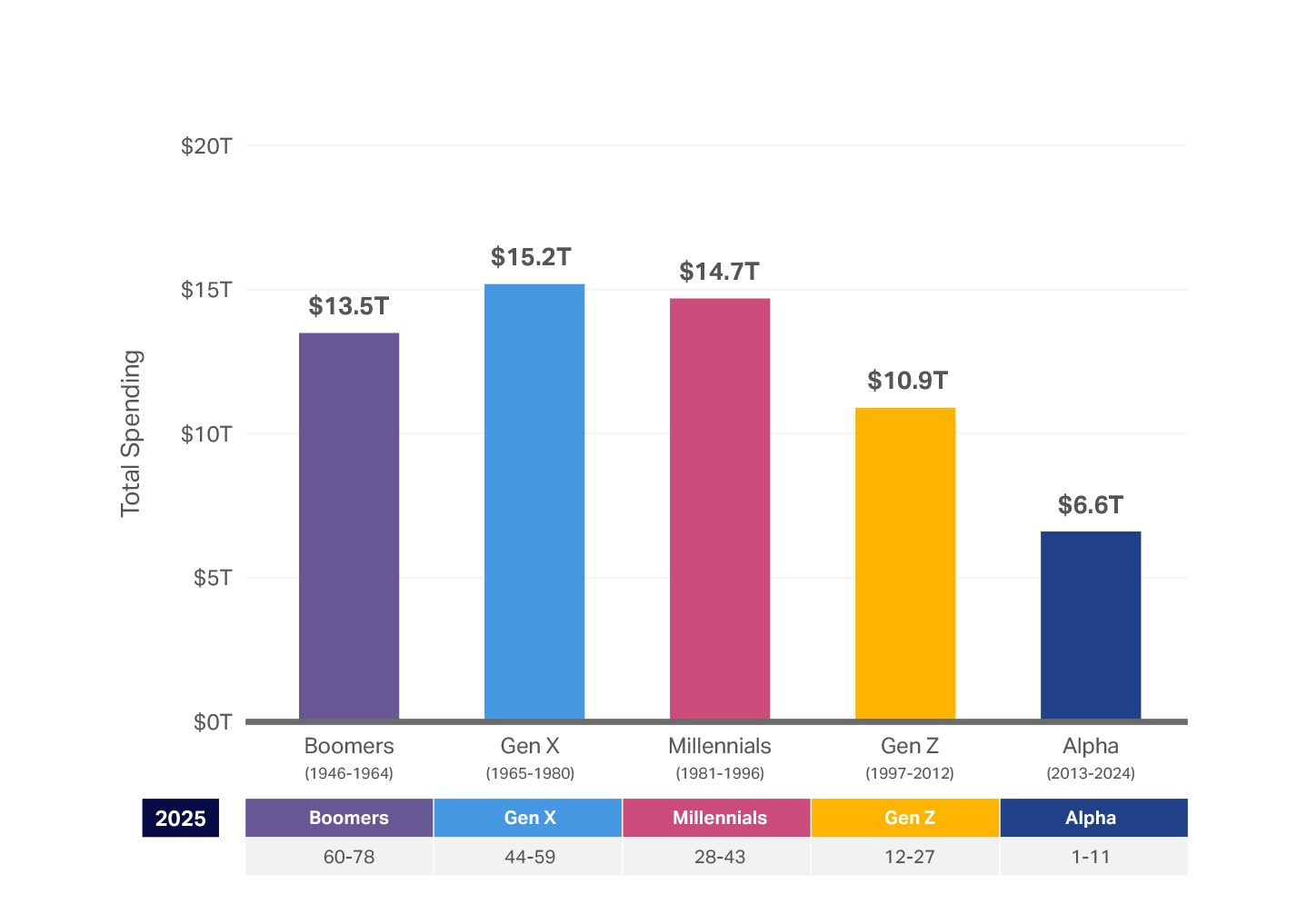

- Gen X will spend $15.2 trillion in 2025. If you treated them as their own “country,” they would form the world’s second-largest consumer market— second only to the US and roughly 2x the size of China’s current spending. And that number will only keep climbing: By 2035, global Gen X spending will reach $23 trillion.

The time to capture Gen X spend is now.

Taking action

Our goal is to make this report actionable, with insights specific to manufacturers and retailers. Unlike with other generations we’ll analyze, Gen X’s spend is peaking now, meaning immediate action is necessary. At the end of each section, you’ll find a summary of takeaways and actions to help you capture Gen X spend.

If you’re unsure which actions will provide the most incrementality, our team at NIQ is available to assist. We can help make sense of the data for your prioritized categories and identify new opportunities within your product portfolio.

What actions matter now?

Manufacturer actions: Strategically develop product portfolios that cater to Gen X’s binary role as provider and consumer. Focus on functional innovation, premiumization, and clear value communication.

Retailer actions: Focus innovation and premium product development on Gen X today. Unlike other generations, Gen X can and will spend on quality and convenience now—but only if you can clearly convey value.

Who is Gen X?

The 1.4 billion members of Gen X alive today were born between 1965 and 1980 (currently ages 45–60). The time of their birth means Gen Xers straddle the analog and digital domains. They were born primarily to Boomer parents, and their children are either Millennials or Gen Zers. Gen Xers pride themselves on their independent spirit, which can be attributed to many growing up as “latchkey kids” with both parents working. In their youth, they witnessed the rise of MTV, grunge culture, and personal computing. Most incomprehensibly for members of Gen Z and younger generations, most Gen Xers didn’t have a cell phone until college—or later. Instead, their early social lives depended on a landline phone attached to a wall.

Today, Gen Xers are far from the teens described above. These middle-aged adults now sit at the center of both their family and economic lives. They are well-educated global leaders at the peak of their careers, helping to usher in a new kind of technology revolution with the proliferation of new digital touchpoints like omnichannel shopping and AI-driven personalization. At the same time, they’re in their “double-dependent stage,” caring for their children and their aging parents.

Noteworthy consumer behaviors

- Digital adopters: Trust reviews, engage in omnichannel shopping, consider themselves “digital pioneers”

- Tech influencers: Often set household tech agenda

- Pragmatic buyers: Want quality and clarity over “flash”

The Gen X decade

Finally hitting its stride, Gen X is poised to exert dominance with its wallet. In 2025 alone, Gen X will spend an estimated $15.2 trillion. Over the next decade, this cohort will remain the highest-spending generation in the world.

This spending power is happening today because members of Gen X are now in their peak earning years. Gen Xers are also having to spend on their children (ages 17–32, world average) and their aging parents.

For retailers and manufacturers, this spending (on both themselves and their dependents) translates to big dollars, as Gen X represents the richest and most spend-ready generation in developed markets globally.

trillion (USD) in global spend in 2025 alone

By 2033, however, Gen X shifts into a new reality—and becomes the new Boomers in terms of spending impact . The top end of the generation moves into retirement, and Millennials will surpass them in spend. Gen X will still spend on their children, but it will be to help them financially with large purchases—like a house—rather than cost-of-living stipends. Many Gen Xers will also see their Boomer parents pass away during this time, eliminating the need to spend on elder care.

During the next eight to 10 years, while Gen X households still have children at home, Gen X women are incredibly important consumers. Women in general are increasing their dominance relative to economic decisions for their households and now influence 70–80% of all consumer spending. As it relates to direct spend, women now control 50% (a staggering $31.8 trillion) of worldwide spend. It should come as no surprise then that, in many countries, Gen X women are the most active CPG buyers and most influential family decision-makers.

Low-income vs. high-income countries

There’s one caveat that manufacturers and retailers can’t afford to overlook when considering Gen X: While Gen X dominates in high-income countries, it’s already on the decline in some low- and middle-income countries due to relatively low average life expectancy in those regions. In these countries, Gen X spend isn’t as meaningful as it is in high-income markets, where life expectancy is longer, incomes are higher, and families are smaller.

This trend of high-income country spend dominance continues to play out through 2030 and beyond, until Gen X hits its peak spending globally around 2033. In low- and middle-income countries, Millennials and Gen Z already spend more than Gen X.

When we look across regions and countries, we can easily see the low- vs. high-income reality bear out. Wealthier regions, including Europe and North America, help account for two-thirds of Gen X spend worldwide, while low-income regions, such as Sub-Saharan Africa, skew much younger relative to spend.

In the chart below, the horizontal line shows Gen X’s average share of total spending at 24%. Only a handful of countries meet or exceed that level. Those above the line—China, the US, and most EU nations—are also the world’s highest-spending markets, indicating that Gen X’s influence is strongest where overall consumer outlays are largest. The opposite holds true in Sub-Saharan Africa, large parts of Asia Pacific, Middle East & North Africa, and Latin America, where Millennials and Gen Zers won’t have as much impact on overall consumer spending.

With Gen Xers dominating in wealthy countries, they naturally reign supreme relative to the higher spending groups of rich and upper middle class consumers. Here, we’ll define “rich” as anyone who spends $120 per day (per person, in 2017 dollars, to control for cost-of-living differences) and “middle class” as anyone spending $12 per day (per person). For clarity, Gen X is currently not the wealthiest generation but will spend the most during this next decade. For the near term, younger generations will continue to dominate the lower spending groups. (In other words: More than one in every four people who are rich are Gen Xers.)

This distinction is paramount: While Gen X may not be the wealthiest generation (in terms of total assets)—a title that still largely belongs to Boomers—they dominate in daily discretionary spending, and they represent the greatest consumer ROI in large-basket, multi-category purchases (especially across the Grocery, Household, and Wellness categories). For companies looking to maximize incrementality, Gen X is comprised of the most dependable, active spenders across the most profitable consumer segments.

Manufacturer and retailer actions

1

In higher-income regions and countries

Fuel premium purchases across key categories by focusing on attributes we know are most valued by higher-income Gen X consumers.

2

Key attributes for higher-income Gen Xers

Reliability, functionality, product value (not simply price), health and wellness, efficiency and convenience, and authenticity

3

In lower-income regions and countries

Secure customer lifetime value (CLV) by earning Gen X trust via long-lasting, multi-use products and promotions that reflect the household finances of said country/region.

4

Key attributes for lower-income Gen Xers

Affordability and accessibility, durability and multi-use utility, availability (wide-scale distribution), and functional wellness at affordable prices

Small but mighty

Gen X is smaller in population than Generation Alpha , Millennials, and Gen Z, but it currently has more consolidated wealth, especially in developed markets like Canada, Germany, Japan, the UK, and the US. This generation also has incredible influence over technology, media, the workplace, and the political landscape because its members hold leadership positions in these areas.

Though Gen X currently makes up just 17% of the global population, in developed nations like the US, it’s currently leading almost one-third of all households. This gives Gen X an outsized influence when it comes to CPG and T&D purchases. Gen X spending power is even more impressive because its wage growth over the past few years has been slower, when compared with younger generations.

Key insights

- Gen X consumers are open to new brands if the brands they’ve historically purchased fail to meet expectations or stop delivering clear value—especially in today’s inflationary climate.

- Gen X members reward brands that consistently deliver and save them time, money, or mental energy.

- Gen X’s loyalty is earned through positive brand experiences and reliability/consistency—not hype or social proof (e.g., influencers).

C-suite takeaways

- Fewer people, more value (if captured)

- Gen X conversion = higher ROI per shopper

The sandwich generation

In addition to being dubbed “the forgotten generation” (a misnomer we’ll continue to explore), Gen X is referred to as “the sandwich generation” because many of its members are financially supporting children while caring for aging parents. In emerging markets, Gen X may represent the first generation to achieve middle-class stability. In high-income countries, their status as “CFOs” of three generations means much of their wealth is being spent on others.

We’ve mentioned that Gen X’s children are on average ages 17–30 globally, but they do skew slightly younger in a few key regions.

Being sandwiched between aging parents and their children has led to both notable stress for Gen X and an effective decrease in discretionary spending. A recent study in the US found that finances are a big reason for Gen Xers’ stress, with 51% feeling stress in this area fairly or very often. Of the Gen X respondents, only 35% feel prepared to financially support their parents, and just 55% feel prepared to financially support their children over the next few years.

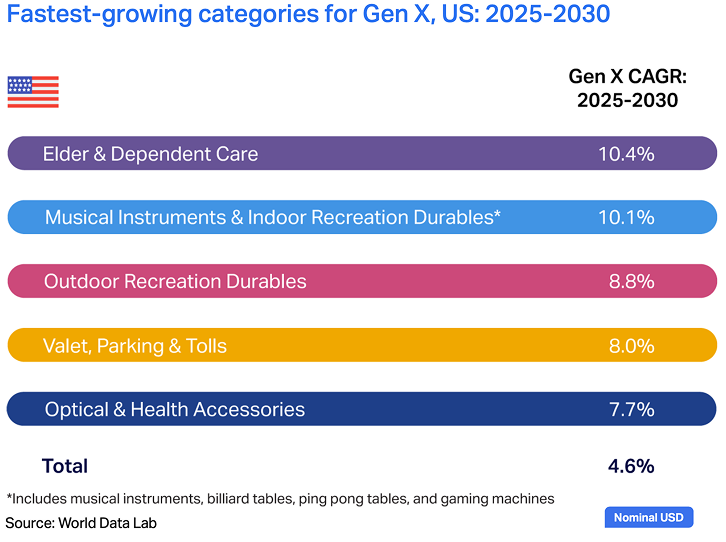

The weight of Gen X responsibilities shows in their spending. Elder & Dependent Care and Education are among the fastest-growing categories for this cohort—and will be for the next five years, leaving Gen Xers with less discretionary spending for themselves.

Gen Xers are feeling the crunch in their day-to-day choices too. For example, they are much more likely than Boomers, but less likely than Millennials, to stress significantly about choosing or preparing what to eat every day.[1] They are also much less likely than Millennials and Gen Z to splurge or treat themselves with more expensive purchases. This conservative purchase pattern holds true across low-, medium-, and high-income Gen Xers.

1 NIQ 2025 Private Label & Branded Products report global survey

Key insights

- Gen X often sets the standard for what modern-day consumption looks like: homeownership, education, brand aspirations, employment goals.

- Gen X consumers tend to be brand-trusting and loyal to purchases that help them actualize their goals relative to status.

- Gen X members are gatekeepers for their children’s mobility—heavily influencing what Gen Zers and Millennials consume.

- Gen X consumers look for value and convenience to help them juggle enormous responsibilities and financial priorities.

Manufacturer actions

Consider new formats and claims geared toward caregiving, longevity, and convenience in products across CPG and T&D portfolios.

Retailer actions

Position products and services as time savers and enablers of care. Dependent Care, Outdoor Recreation, and Household Tools are key categories of growth. Deliver omnichannel experiences that build trust first, then highlight convenience.