Today’s shoppers demand a frictionless journey.

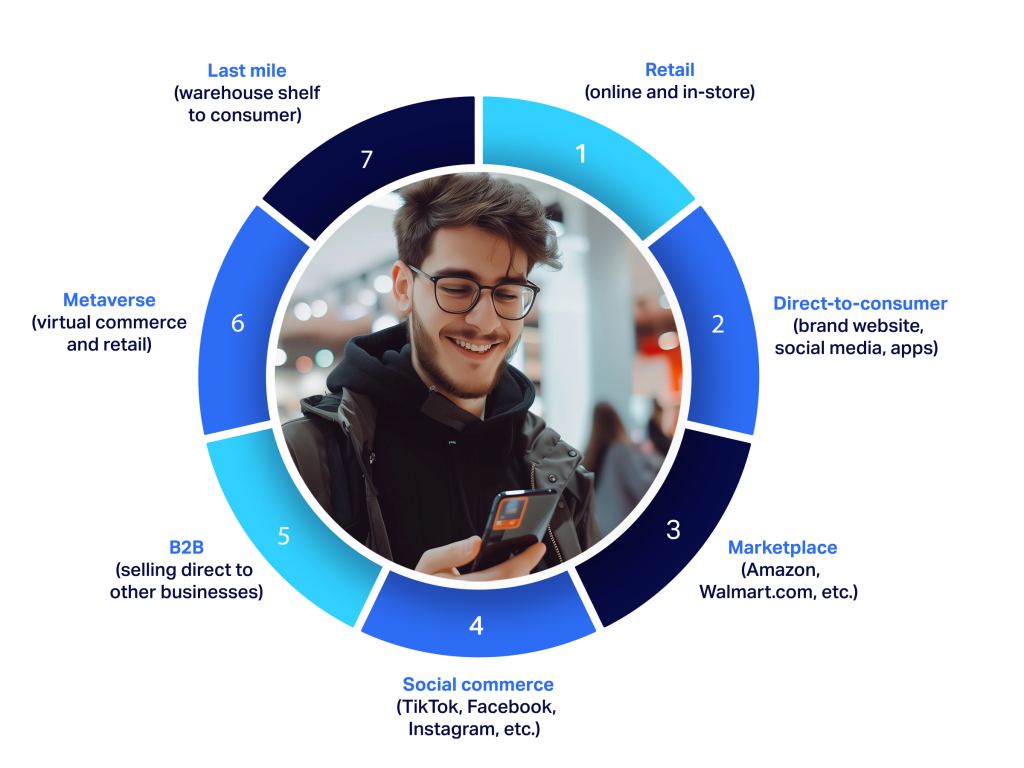

To earn consumers’ business, brands must deliver a seamless customer experience across seven omnichannel touchpoints.

This guide aims to equip manufacturers and retailers with the insights and strategies needed to succeed in today’s global omnichannel environment and help prepare them for the emerging trends of tomorrow.

Omnichannel market dynamics in the United States

$1.5 trillion

Value of the omni opportunity in the U.S.

80:20

Average in-store vs. online spend ratio

for U.S. consumers

U.S. trends brands and retailers should be aware of:

- Retail media networks are huge, and they’re growing.

- Categories are far from a monolith.

- Amazon will remain the commanding presence in both omnichannel sales and share.

- Availability is the top U.S. purchase driver online.

- U.S. online shoppers favor small trips.

1%

Year-over-year growth in

new online shoppers

4%

Year-over-year growth in purchase

frequency for online shoppers

Western European FMCG trends to watch:

- The Health & Beauty category is growing.

- Quick commerce is in decline.

- In-store shoppers prefer hypermarkets and supermarkets.

- Chinese platforms are delivering value in Western Europe.

- Convenience is a top purchase driver online.

Omnichannel market dynamics in Western Europe

The omni landscape across Asia Pacific

50%

Five of the top 10 e-commerce retail

share markets are in APAC

62.6%

Percentage of global e-commerce

that originates in APAC countries

Developing APAC trends for FMCG:

- There’s huge opportunity for e-commerce growth.

- Health & Beauty have dominant players.

- Quick commerce is booming in several markets.

- Social commerce is rapidly expanding here.

- Price is a top purchase driver.

From online and offline sales to consumer-sourced measurement, our Omni suite of solutions gives you the most exhaustive brand and merchant sales data available. This includes a complete, multichannel view of purchasing dynamics for better decision-making.

What brands should focus on to win

Think of your strategy like a three-legged stool: It needs all three legs—measurement, activation, and consumer—to stand on its own.

Here are the levers of growth brands can pull to drive success.

Measurement

New channels

Pack size optimization

Maximizing occasions

Activation

Focus on brand equity

Health and wellness

Consumer

Innovation

Sustainability and wellness

Your next steps

Opportunities abound for omnichannel growth. Awareness of these trends can keep you informed, but a comprehensive multichannel strategy will require data specific to your products and your consumers—across every country and region where your products are sold.

Discover the six actions to take today to shore up your omni strategy for tomorrow.

The fusion of online and offline retail in the Tech & Durables sector is not just a trend—it’s the future.

Learn more about omni trends in T&D in our companion article, Blurring boundaries in 2025: The online-offline fusion in Tech & Durables retail.