The problem: When revenue growth masks shopper declines

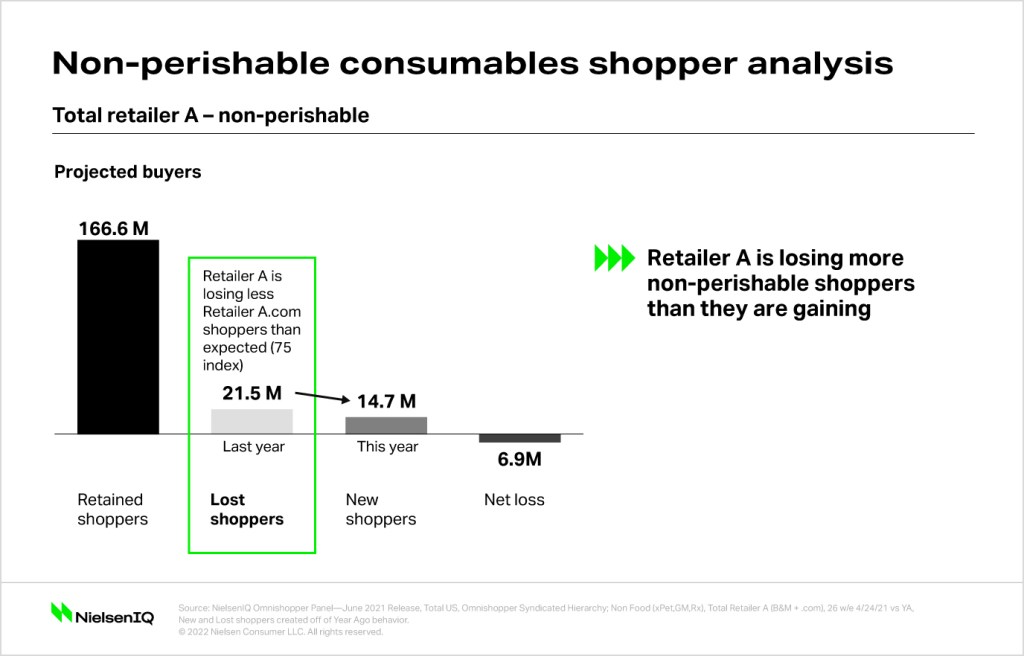

A large national retailer, referred to here as Retailer A, seemed to be performing well in non-perishables departments. Projected sales had grown to $125 million over the previous year. However, this growth obscured important shopper behavior. Using NielsenIQ Omnishopper panel, Retailer A discovered they had lost approximately 7 million shoppers.

To diagnose the cause of the decline and ultimately develop a targeted marketing strategy to win back shoppers, NielsenIQ consulted with Retailer A to answer three key questions:

- Who was the customer they were losing?

- Which competitors were the lost shoppers shifting to?

- Why were they leaving?

Shining a light on lost shoppers

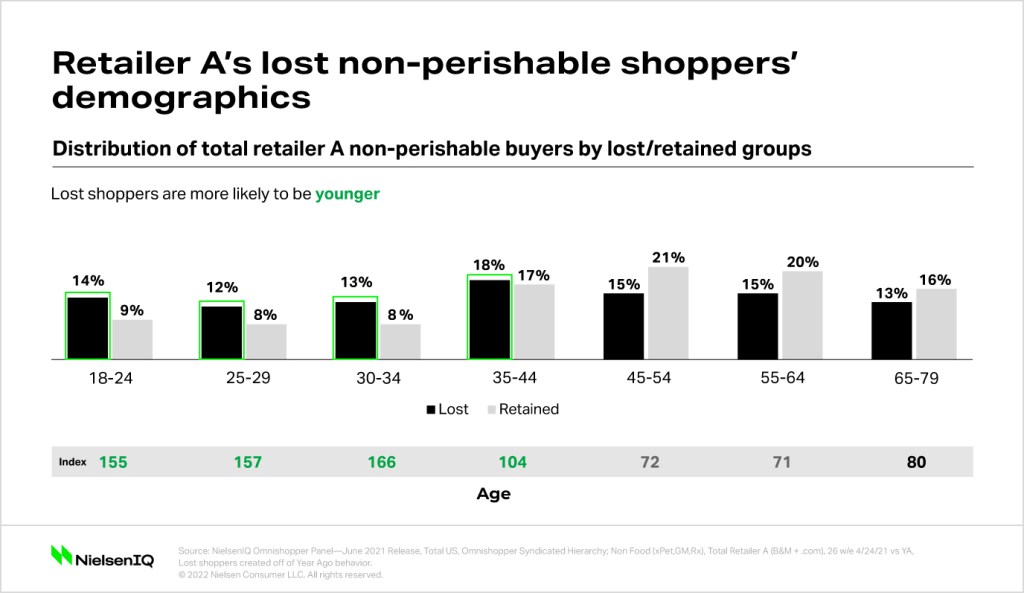

NielsenIQ Omnishopper data provided a clear demographic profile of shoppers leaving Retailer A. Lost shoppers were more likely to be young. The age ranges 18-24, 25-29, and 35-44 had the highest rates of lost shoppers compared to retained shoppers.

Omnishopper data also revealed that lost shoppers were also likely to be:

- Higher-income (earning over $75k annually)

- Male

- Living alone

- Hispanic

- Educated

- A professional or student

These findings informed important marketing strategy decisions for Retailer A, such as choosing digital advertising channels, since younger shoppers are more likely to be reached online.

New, lost, retained: The value of lost shoppers

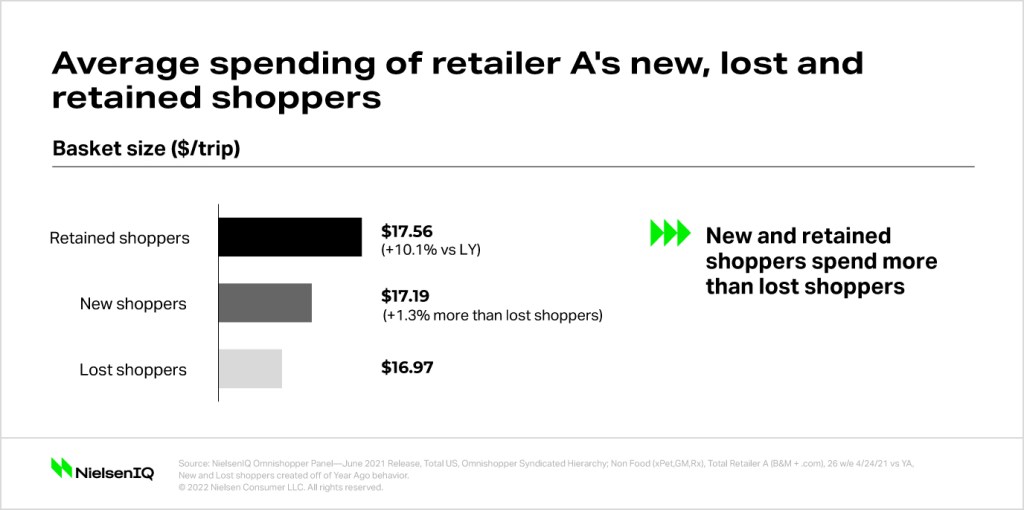

Now that Retailer A had a clear profile of its lost shoppers, it could identify the revenue created by each group of shoppers and strategize accordingly.

With detailed, accurate measurement, Retailer A could determine whether it was most profitable to drive larger basket sizes for retained shoppers, win back lost shoppers, or attract new shoppers.

On average, new shoppers spent 1.3% more ($17.19) at Retailer A than lost shoppers ($16.97). The higher spend from new shoppers, coupled with a 10% larger basket size from retained customers, offset revenue declines from lost shoppers, and drove a $125 million increase in sales.

Although Retailer A lost 6.9 million non-perishable shoppers, the new customers it gained are likely to spend more, so it will take fewer of these shoppers to recover the revenue that lost shoppers took to competitors.

Why lost shoppers left for competitors

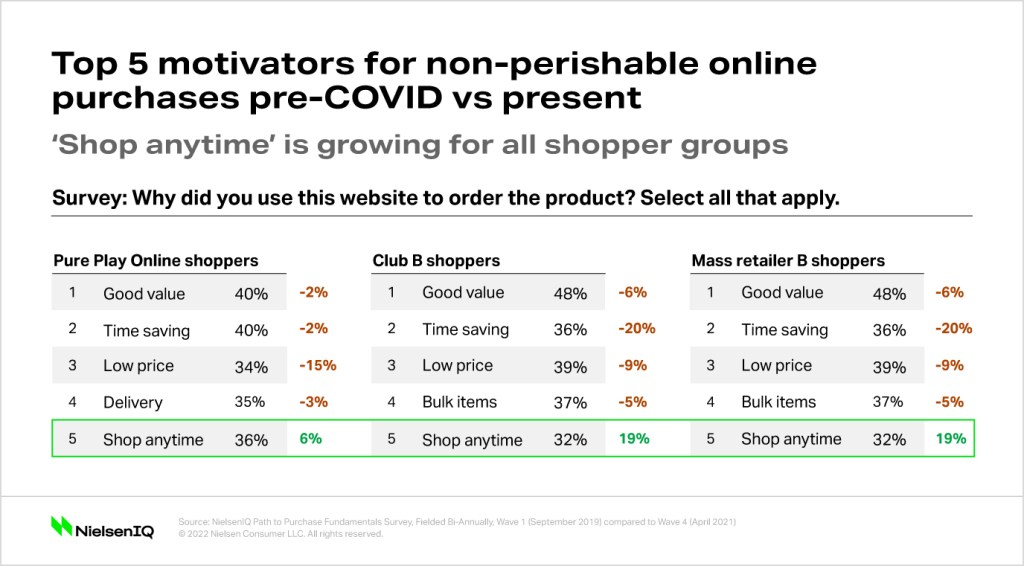

Competitors were taking a significant share of Retailer A’s shoppers: an online retailer (Pure Play Online), another mass retailer (Mass Retailer B.com), and a club retailer (Club B.com).

Equipped with a clear understanding of who lost shoppers were and where they were going, Retailer A used Omnishopper insights to discover the potential underlying reasons lost shoppers had shifted to competitors.

The primary reason shoppers chose to purchase from Pure Play Online was convenience. Rather than making a trip for a handful of non-perishable items, shoppers preferred to have them delivered, bolstered by options for free shipping. Another convenience factor was the ability to shop anywhere: at work, at home, and at any time of day.

In fact, “shop anytime” was the only motivator that grew for shoppers overall. Although low prices were a strong motivator two years ago, it appears that shoppers of non-perishable products now find convenience significantly more important.

Knowing that competitors are better at meeting shoppers’ need for convenience can position Retailer A to improve its customer experience and become a first choice for this segment of lost shoppers.

What retailers can learn from omnichannel analysis

Using tools designed to accurately measure omnishopper behavior, Retailer A uncovered the answer to key questions surrounding the motivations and behavior of lost shoppers. With these insights in hand, Retailer A had guidelines it could use to optimize marketing messaging and strategy to win back a profitable group of customers.

The omnichannel analysis revealed three key findings:

- Who are lost shoppers in the non-perishables market? Lost shoppers are more likely to be younger Hispanic males with high incomes who are living alone or in smaller households.

- What competitors are they shifting to? Lost shoppers are spending their online dollars at three primary competitors: Pure Play Online, Mass Retailer B.com, and Club B.com, with the largest growth in dollar spend occurring online.

- Why are they leaving? The key reason shoppers are shifting to competitors is convenience: the ability to shop anytime has grown significantly as a motivator for non-perishable purchases.

Winning customer loyalty and bigger baskets requires effective tracking of omnichannel performance, following shoppers’ habits in-store, online, and at competitors’ registers. Retailers that have a deep understanding of their shoppers’ core motivations and needs will stay ahead in today’s rapidly shifting markets.