In new GfK global study, US vehicle priorities closely track those across 17 countries

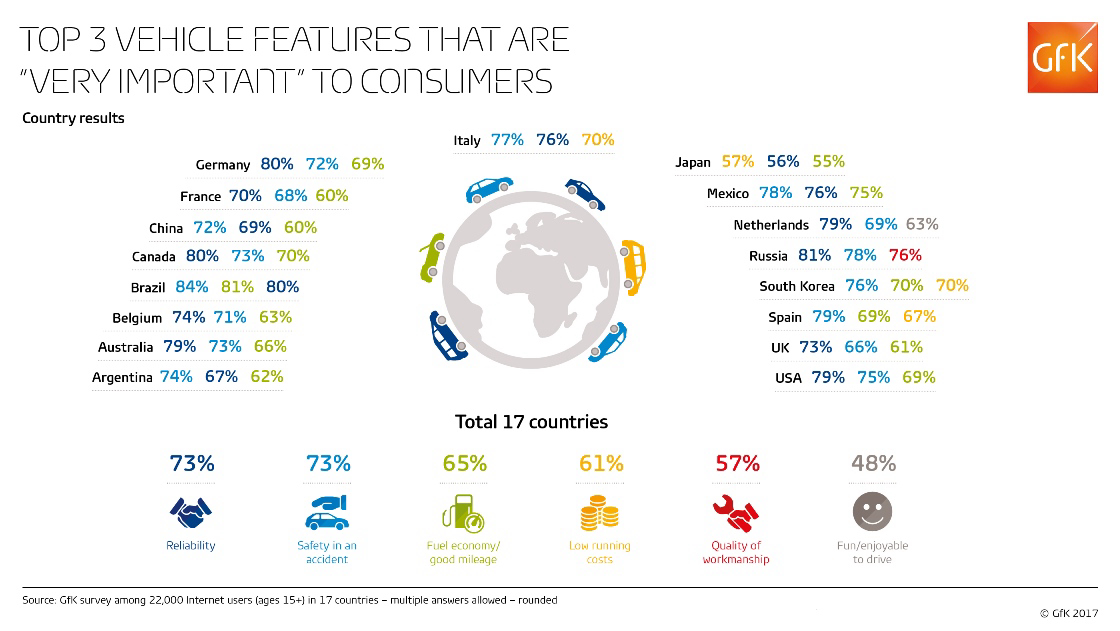

New GfK global research reveals that three quarters of US consumers find reliability (79%) and safety in an accident (75%) to be “very important” automobile features – more important than fuel economy (69%) and low running costs (63%).

In the study, GfK asked more than 22,000 people online in 17 countries to indicate how important they find a number of common vehicle features, covering cost savings, appearance, and driver experience. The US “top 5” features were identical – in slightly different order – to the overall global results.

The research also shows that more than half of US consumers find quality of workmanship (64%) and a smooth and quiet ride (52%) to be “very important” auto features.

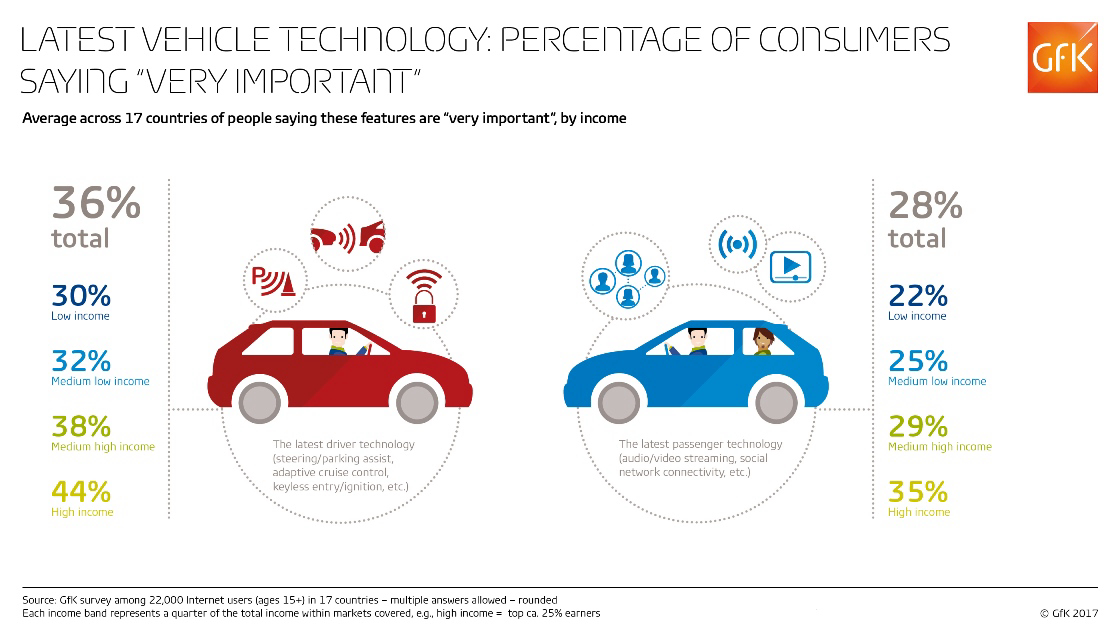

Importance of vehicle technology increases with income

The effect of income on what people see as important in their vehicles is clear across a range of features, especially new car technologies. GfK’s study shows that having “the latest driver technology” – such as steering or parking assist, adaptive cruise control, and keyless entry – is “very important” to over a third of high-income (41%) and medium-high-income (34%) US consumers, versus a quarter of low-income (24%) and medium-low-income (26%) Americans.

Similarly, newer passenger technologies – including audio or video streaming and social network connectivity – are “very important to more than one third of high-income (33%) and medium-income (30%) US consumers – almost double the levels for medium-low (18%) and low-income (17%) Americans.

Globally, on average, 44 percent of people in the high-income quartile see the latest driver tech as “very important,” compared to just 30 percent of people in the low income quartile. For the latest passenger technology, 35 percent of those in the high-income quartile say it is very important, versus 22 percent of those in the low-income quartile.

Income also affects prioritizing of car features such as quality of workmanship, a comfortable interior, a spacious interior, a powerful engine, the reputation of the manufacturer. In other areas, such as fuel economy or environmental friendliness, the results are much more even across all income bands.

Siegfried Hoegl, GfK’s Global Head of Automotive Research, comments, “The value of these findings for vehicle manufacturers lies in being able to assess precisely which features different consumer segments say appeal most to them – and adjust marketing content and product development to match those aspirations. By combining this attitudinal data with analysis of actual sales across different markets and consumer segments, or insights from running in-depth car clinics, we help our clients to fine-tune their customer insights to the maximum extent – both globally and at country-specific level.”

To download full findings for each of the 17 countries, visit www.gfk.com/global-studies/global-study-overview/

Latest vehicle technology: breakdown by income quartiles

Top 3 ‘very important’ vehicle features, by country

About the survey

GfK conducted the online survey with over 22,000 consumers aged 15 or older across 17 countries. Fieldwork was completed in summer 2016. Data are weighted to reflect the demographic composition of the online population aged 15+ in each market. Countries covered are Argentina, Australia, Belgium, Brazil, Canada, China, France, Germany, Italy, Japan, Mexico, Netherlands, Russia, South Korea, Spain, UK and USA.

About GfK

GfK is the trusted source of relevant market and consumer information that enables its clients to make smarter decisions. More than 13,000 market research experts combine their passion with GfK’s long-standing data science experience. This allows GfK to deliver vital global insights matched with local market intelligence from more than 100 countries. By using innovative technologies and data sciences, GfK turns big data into smart data, enabling its clients to improve their competitive edge and enrich consumers’ experiences and choices.

For more information, please visit www.gfk.com or follow GfK on Twitter.