New Zealand’s fast-moving consumer goods (FMCG) sector continues to face disruption. Manufacturers are under pressure to manage this complex environment and address challenges such as bringing growth to categories, managing the in-store experience, and understanding what to do with e-commerce—all the while managing financials (doing more with less). Questions around assortment, price, and promotion are at the center of many of these challenges. With shoppers becoming more discerning, promotional strategies need to be shopper-led where price and promotions are expressed as a value equation that shoppers can connect with.

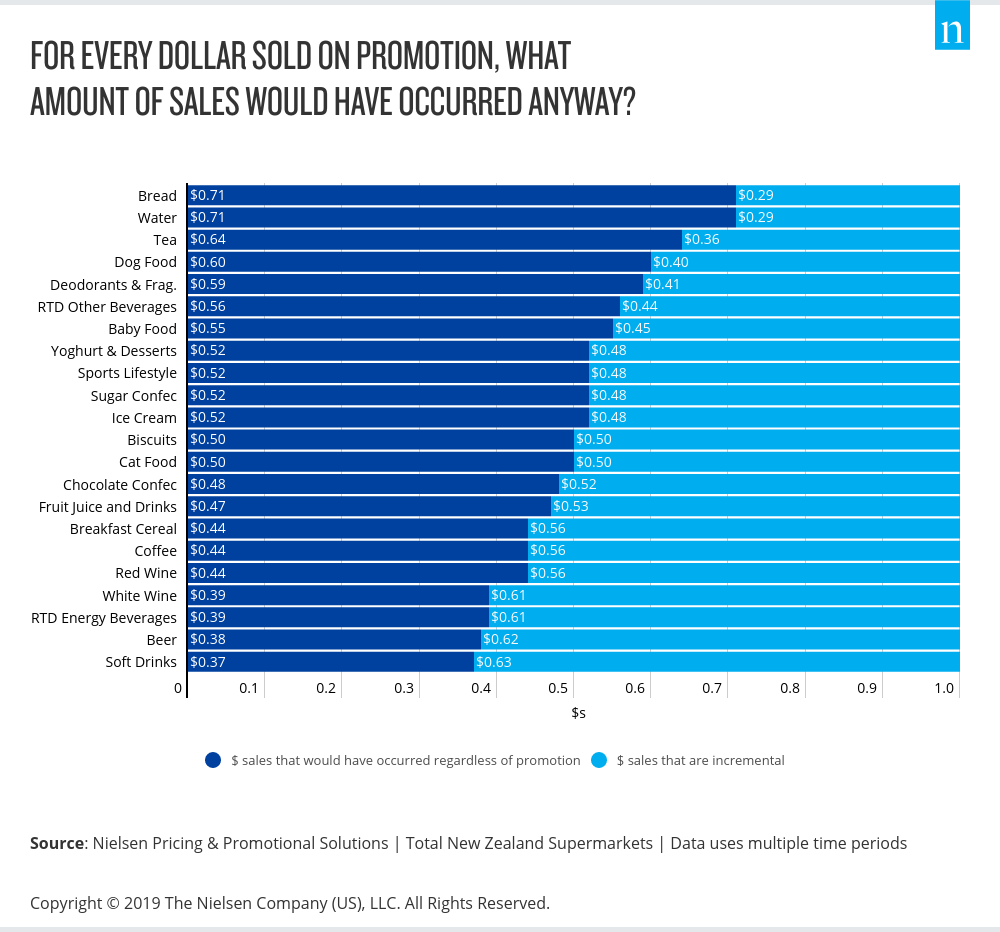

By placing the shopper at the center of decision making, manufacturers can better collaborate with their retailer partners to address the inefficiencies of trade spend—one of the largest costs of doing business. In New Zealand, for every dollar sold on promotion, approximately $0.50 is truly incremental. This varies across categories depending on the existing promotional dynamic and shopper responsiveness to promotions.

By placing the shopper at the center of decision making, manufacturers can better collaborate with their retailer partners to address the inefficiencies of trade spend—one of the largest costs of doing business. In New Zealand, for every dollar sold on promotion, approximately $0.50 is truly incremental. This varies across categories depending on the existing promotional dynamic and shopper responsiveness to promotions.

In New Zealand, for every dollar sold on promotion, approximately $0.50 is truly incremental. The remaining 50 cents would have occurred anyway, and at a higher non-promoted price point.

There’s no doubt that promotional planning can be run in a more efficient and shopper-centric way, but many find it challenging to know where to start when making improvements.

In the last six months, I’ve met with 30 FMCG companies to discuss ways they can boost their portfolio efficiency. These conversations included building on their shopper understanding, ensuring the right products are on-shelf for that shopper, optimising the use of the shelf space, and managing price and promotional tactics to increase their ROI specific to trade spend.

Status quo: sticking with ‘SALY’

When we look specifically at why existing promotional plans can have a low return on investment for both retailers and manufacturers, ‘SALY’ (same as last year) budgeting is a prime culprit.

Promotion plans are frequently built on a previous year’s plan with minimal change. In addition, manufacturers are often under pressure to invest at least the same amount of trade spend as they did the year before, if not more. The core challenge is that if you price or promote your products too expensive you could take a hit on share and impact velocity on shelf, risking being delisted. However, too cheap and you could miss out on profit and communicate a lower quality for your brand. Additional challenges in the promotional planning process below can lead to the development of strategies that aren’t shopper-centric, which run the risk of having a low return on investment.

- It’s a disconnected process: Often, businesses make price and promotional decisions, as well as designing assortment and space strategies, in isolation. This leads to inefficiency when these strategies are not aligned or planned together, despite being inextricably connected. The only way to truly deliver on revenue management and trade promotion optimisation objectives is to first get the right items and facings on shelf, which you then optimise.

- Doesn’t fully factor in category impacts: Businesses often don’t fully understand how individual promotions impact the whole category. As a result, they may develop strategies that steal share from other brands as opposed to driving category impact, which runs the risk of devaluing categories in the long term. Other times, promotions can encourage shoppers to switch to competing stores, which is great for the retailer but not necessarily good for the manufacturer. Understanding promotional strategies that drive shopper behaviour benefiting both manufacturers and retailers allows for the creation of win/win strategies in the planning process.

- Lack of alignment between promotions and shopper response: If shoppers respond more to promotional price changes in the market than shelf price changes for certain items, you could argue that those items are better suited to a ‘hi-lo’ strategy than an ‘everyday low price’ strategy. However, a large proportion of items in the market are inelastic where shoppers don’t respond significantly to either shelf or promo price, and yet they are still regularly placed on price promotion. In addition, there is a lack of science being applied to understanding promotional mechanics like being in a mailer or on display and how these activities impact shopper behaviour beyond the effect of a price change. A comprehensive understanding of all of this is critical to executing best-in-class price and promotional strategies.

New Zealand shoppers are some of the most sensitive to price and promo changes in the world. If shoppers are trained to be increasingly sensitive to shelf and promo price changes, categories will be devalued. NielsenIQ estimates that almost a half a billion dollars annually is eroded in lost value due to promotional activity today. The industry needs to take a shopper-centric view, where strategies are tailored to match how shoppers are behaving and responding to price in the market today.